Key Takeaways

📈 Mastercard offers a modest 0.53% dividend yield, but it has a strong track record of double-digit annual dividend growth supported by a low payout ratio and solid earnings coverage.

💰 Operating cash flow reached $15.49 billion over the last twelve months, with $14.32 billion in free cash flow—providing ample liquidity to fund dividends, buybacks, and innovation.

🧐 Analysts maintain a positive outlook with a consensus price target around $628, even after a recent downgrade citing limited near-term catalysts and international exposure concerns.

Updated 5/30/25

Mastercard has quietly built one of the most consistent and profitable business models in the financial world, driven by global transaction volumes and a growing suite of value-added services. With a presence in over 210 countries, the company benefits from the continued shift to digital payments, while maintaining industry-leading margins and a healthy balance sheet. Its revenue recently climbed 17% year-over-year, fueled by cross-border volume growth and strong consumer spending.

Supported by a management team focused on innovation and disciplined capital allocation, Mastercard continues to deliver steady dividend growth alongside robust share repurchases. The stock trades near all-time highs, reflecting investor confidence and the company’s ability to navigate regulation, competition, and global macro pressures while maintaining long-term momentum.

Recent Events

Mastercard’s latest quarterly results came in strong, reinforcing the stability investors have come to expect. Revenue grew over 14% year over year, fueled in large part by continued strength in its cross-border segment. With global travel rebounding, this part of the business is benefiting from rising transaction volumes—and these are among the highest-margin revenues Mastercard generates.

Earnings also moved in the right direction, rising nearly 9% compared to the same quarter last year. That kind of steady growth is exactly what dividend investors like to see. There’s no drama in these numbers—just a quiet consistency that points to a well-run operation.

Importantly, cash flow remains robust. Mastercard generated more than $14 billion in levered free cash flow over the past year, and it’s putting that cash to work. The dividend was paid out again this past May, and share buybacks continue at a steady clip. This is a company that knows how to return capital without compromising its growth potential.

Key Dividend Metrics

📈 Forward Dividend Yield: 0.53%

💵 Annual Dividend Rate: $3.04

📅 Most Recent Dividend Date: May 9, 2025

⏰ Ex-Dividend Date: April 25, 2025

📊 5-Year Average Yield: 0.52%

🔄 Dividend Growth: Steady increases year after year

🧮 Payout Ratio: 19.21%

📘 Earnings Coverage: More than 5x, with strong free cash flow support

Dividend Overview

Let’s be upfront—this isn’t a stock you buy for income today. The yield is just over half a percent, which isn’t going to turn heads. But the value here lies beneath the surface.

Mastercard’s dividend isn’t about short-term payouts. It’s about durability, long-term growth, and financial strength. That low payout ratio tells you everything you need to know. At just 19%, there’s a lot of room for this dividend to grow without putting a strain on operations.

And Mastercard’s approach is deliberate. It pays a modest dividend not because it has to, but because it can. It’s a reflection of a company that’s generating more cash than it needs and chooses to give some back to shareholders while keeping plenty of fuel in the tank for future growth.

Dividend Growth and Safety

Mastercard’s dividend history might not be flashy, but it’s impressively consistent. The company has been raising its payout every year since it first introduced a dividend back in 2006. Over the past five years, those hikes have averaged double-digit annual increases. That’s the kind of momentum that builds wealth over time—even if the starting yield is small.

From a safety perspective, this dividend looks rock solid. Mastercard runs one of the most profitable operations in the market. With a net margin over 45% and operating margins pushing 60%, it’s hard to find a more efficient business model.

Return on equity is sky-high, and while part of that’s due to a lean equity base, it still speaks to how effectively the company uses capital. Free cash flow remains strong, giving Mastercard the flexibility to continue paying and growing its dividend even if the business hits a bump in the road.

The balance sheet is clean. Debt levels are reasonable, and the company has more than enough liquidity to weather tough times. That stability is one of the things that makes this dividend so attractive—it’s not just about what Mastercard pays today, but how confidently you can expect it to keep paying in the years ahead.

For dividend investors focused on growth, safety, and quality, Mastercard might not be the most obvious choice. But dig a little deeper, and what you’ll find is a dividend that’s quietly compounding in the background—backed by one of the most dependable business models around.

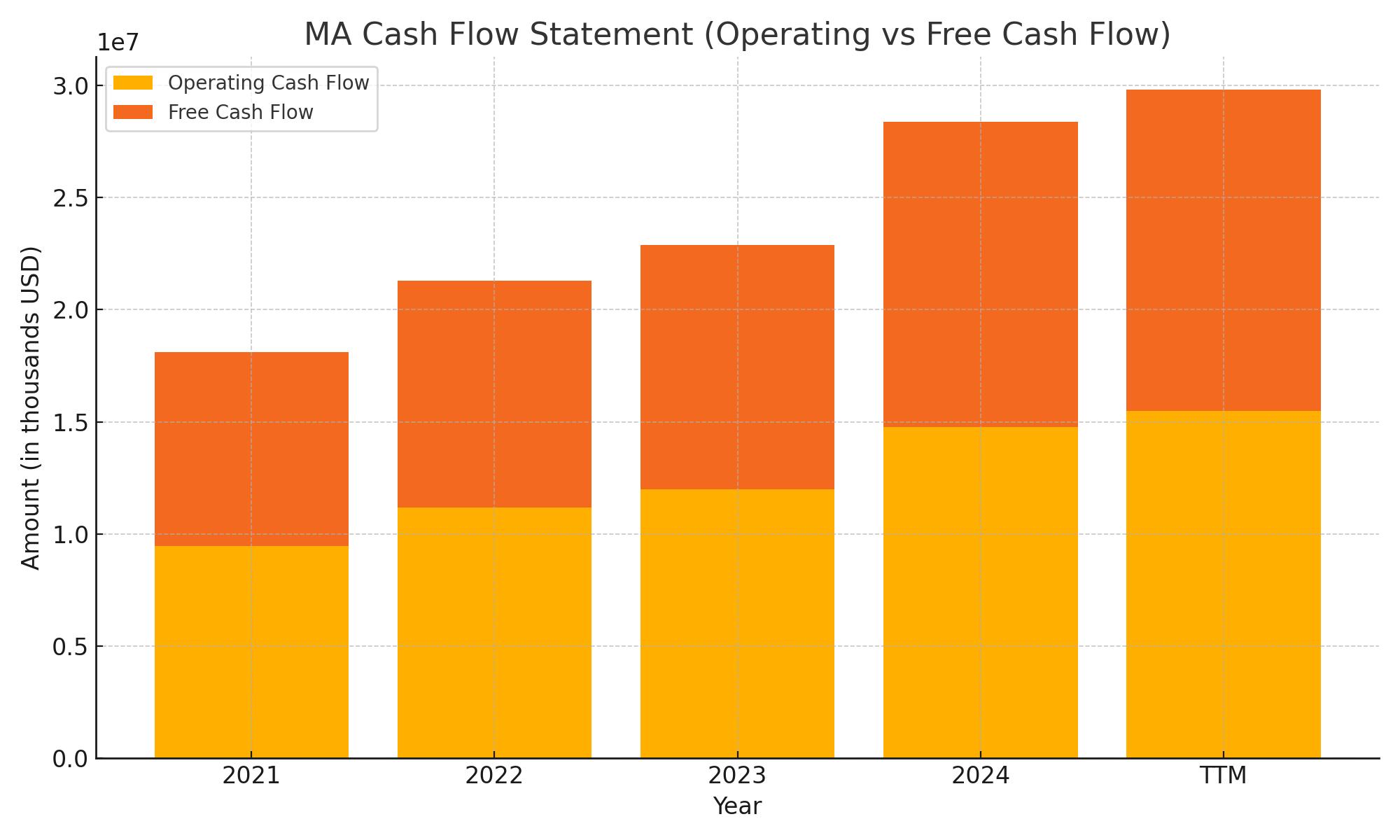

Cash Flow Statement

Mastercard’s trailing twelve-month (TTM) cash flow shows a strong and consistent ability to generate operating cash, with $15.49 billion in operating cash flow—a steady climb from $14.78 billion the year before. This continued strength reflects the company’s tight control over costs and healthy margins, underpinned by its transaction-based revenue model. Free cash flow also followed suit, rising to $14.32 billion, giving Mastercard ample flexibility to fund dividends, share repurchases, and strategic investments without straining its balance sheet.

On the financing side, Mastercard remained active in managing its capital structure. While it issued $5.2 billion in debt over the last 12 months, repayments amounted to just over $2 billion, maintaining a cautious approach to leverage. The company continues to return a significant portion of its cash to shareholders, evident from its consistently negative financing cash flows, which totaled -$11.14 billion in the TTM period. Despite these outflows, Mastercard ended the period with nearly $10 billion in cash on hand, reinforcing the company’s financial resilience and ability to navigate future market cycles without liquidity concerns.

Analyst Ratings

📉 Mastercard has recently seen a shift in analyst sentiment. Seaport Global downgraded the stock from Buy to Neutral, pointing to concerns about its international exposure and a lack of clear catalysts heading into 2025. The firm’s analyst acknowledged that while Mastercard remains fundamentally strong, its heavier reliance on non-U.S. markets could limit near-term revenue momentum. Without any significant upcoming events or product launches to serve as a trigger, the stock was viewed as fairly valued at current levels.

📈 Despite this caution from Seaport, the broader analyst community continues to see upside. The consensus price target currently sits around $628.31, reflecting a healthy premium over recent trading levels. Several major firms have updated their targets in recent weeks, with UBS lifting its price objective to $660, Jefferies moving theirs to $655, and Citigroup setting a $652 target—all while maintaining Buy ratings. These upward revisions suggest confidence in Mastercard’s steady growth engine, driven by expanding digital payments and cross-border volumes.

💡 The mixed views underscore the dynamic Mastercard operates in—well-regarded for its consistency and dominance, but occasionally seen as priced for perfection. Still, most analysts appear comfortable with where the company is headed and expect performance to pick up as travel and international spending continue to grow.

Earning Report Summary

Strong Start to 2025

Mastercard came out of the gate strong this year, delivering a solid first quarter that beat expectations on multiple fronts. The company reported $7.25 billion in revenue, up 17% compared to the same time last year. That kind of growth doesn’t happen by accident—it reflects broad strength in consumer spending and Mastercard’s ability to monetize transactions at scale. Earnings also came in above forecast, with adjusted EPS hitting $3.73, a 13% bump from the previous year.

What really stood out this quarter was the continued rebound in cross-border volumes, which rose 15%. That’s a clear sign that global travel and international commerce are gaining momentum again. Gross dollar volume also saw a healthy 9% lift, and Mastercard’s value-added services—which include cybersecurity, analytics, and fraud prevention—grew 18%, now making up more than a third of the company’s revenue. These aren’t side businesses anymore—they’re a key part of the engine.

Leadership’s Take on the Quarter

CEO Michael Miebach sounded upbeat about the company’s performance and the road ahead. He pointed to Mastercard’s ability to stay flexible in a shifting environment while continuing to push innovation. One example is Mastercard Agent Pay, a product aimed at streamlining payments for call centers and service reps, showing how the company is finding new ways to deepen its footprint across industries.

Miebach also talked about new partnerships, including some big names like Microsoft and OpenAI, which could lead to more integrations and technology-driven payment solutions in the future. His tone wasn’t just optimistic—it was confident. Mastercard seems to be in a phase where it’s not only executing well but also thinking ahead.

CFO Sachin Mehra added more detail on what’s driving these results. He pointed out that consumer spending stayed strong across different income brackets, not just among the wealthier consumers. Low unemployment and relatively stable economic behavior are helping keep transaction volume healthy. Mehra also said they’re starting to see the benefits of investments made in recent years—particularly in digital and services areas.

Looking forward, Mastercard is nudging its full-year growth expectations higher. The company now sees revenue increasing in the low-teens percentage range, slightly above its previous guidance. That kind of upward revision speaks volumes about how confident leadership feels, not just about consumer behavior, but also about the company’s broader positioning in the payments ecosystem.

Management Team

Mastercard’s leadership is anchored by CEO Michael Miebach, who took the helm in 2021. Since stepping into the role, he has placed a strong focus on expanding Mastercard’s influence in digital payments, AI-driven solutions, and cybersecurity. Miebach is known for pushing the company beyond traditional transaction processing, aiming to deepen Mastercard’s relevance in an increasingly digital global economy. His leadership reflects a forward-thinking approach that embraces both innovation and long-term growth.

Supporting him is CFO Sachin Mehra, who has been instrumental in maintaining Mastercard’s financial discipline and capital return strategies. Mehra’s oversight has helped the company maintain its strong free cash flow and efficient capital structure. Ed McLaughlin serves as President and Chief Technology Officer, playing a key role in the design and deployment of Mastercard’s technology stack. His work in secure payment solutions keeps the company on the cutting edge. Other key executives, including Linda Kirkpatrick for the Americas and Ari Sarker for Asia Pacific, ensure Mastercard maintains strong regional leadership and local adaptability in major global markets.

Valuation and Stock Performance

As of the end of May 2025, Mastercard shares were trading just under $578, showing roughly 30% growth over the past year. The company’s market cap has swelled to around $523 billion, supported by steady earnings growth and continued optimism about the broader digital payments sector. The forward price-to-earnings ratio is in the mid-30s, reflecting the premium investors are willing to pay for Mastercard’s profitability and global reach.

Valuation metrics like a trailing P/E around 40 and a price-to-book ratio near 79 suggest a business that is not cheap by conventional standards, but the premium seems warranted given its consistent revenue expansion and margin strength. The stock’s 52-week high of $588 and steady climb reflect both a favorable macro backdrop and investor confidence in Mastercard’s execution. With a return on equity approaching 188%—driven by high margins and share buybacks—the company continues to show that it can deploy capital effectively, even in a competitive and rapidly changing environment.

Risks and Considerations

While Mastercard’s position in the payment industry is formidable, it is not without its risks. Regulatory pressure, especially from Europe, remains a concern. Antitrust authorities have been increasingly vocal about interchange fees and network dominance, and any new restrictions could impact revenue, particularly in cross-border transactions. Mastercard has been through regulatory scrutiny before and has shown an ability to adapt, but the pace and tone of global regulation is worth watching.

Cybersecurity is another pressing risk. As more payments go digital, the threat landscape evolves. Mastercard invests heavily in securing its systems, but no organization is immune. A large-scale breach could hurt customer trust and damage the brand. On top of that, the fintech space is moving fast. New competitors and payment alternatives, especially those embedded in super apps or blockchain-based networks, continue to chip away at traditional card networks. While Mastercard has responded with its own innovation, the challenge of staying ahead remains ongoing.

Macro factors like interest rates, inflation, and consumer confidence also play a role. Any slowdown in spending or tighter financial conditions could pressure transaction volumes. Though Mastercard is diversified globally, economic shocks in key markets could affect its performance.

Final Thoughts

Mastercard stands out not just for what it does today, but for how it’s preparing for tomorrow. The leadership team is deeply focused on innovation, the financials are sound, and the brand continues to be one of the most trusted names in payments. Its stock might trade at a premium, but that premium is underpinned by real strength—earnings power, free cash flow, and a long runway for growth in digital and cross-border payments.

The path forward isn’t free of risks. Regulation, competition, and cybersecurity are always on the radar. But Mastercard has shown an ability to manage these pressures while continuing to return capital and invest in the future. For long-term investors looking for a stable, high-quality business in the financial technology space, Mastercard remains a compelling story to follow.