Updated 5/30/25

MarketAxess Holdings Inc. (MKTX) is a leading electronic trading platform specializing in fixed income, offering institutional investors streamlined access to U.S. credit, emerging market debt, and Eurobonds. With a strong focus on automation and platform innovation, the company has carved out a dominant position in its niche, underpinned by robust free cash flow, high operating margins, and a capital-light business model.

Led by CEO Christopher Concannon, the leadership team continues to prioritize strategic technology investments and international expansion. Despite recent earnings pressure from one-time tax-related items, MarketAxess maintains strong financial health, consistent dividend growth, and a solid cash position, making it a dependable name for long-term, income-focused investors.

Recent Events

The latest quarter ending March 2025 was a bit of a mixed bag. Revenues for the trailing twelve months landed at $815 million, which is slightly down from the year before. Not a huge drop, just under one percent, but enough to signal some softness. The bigger story came from the earnings side, where quarterly EPS took a sharp dive—down more than 79% year-over-year.

Now, that sounds jarring, and on paper, it is. But it’s important to keep it in context. Even with that earnings dip, MarketAxess kept its margins looking solid. Operating margin was over 42%, and profit margin came in at 26.6%. Those numbers show that despite some bumps, the core business is still very much intact.

What really stands out is their balance sheet. As of the most recent quarter, MarketAxess is sitting on $586 million in cash and carries only $70 million in debt. That kind of liquidity is a major comfort for long-term shareholders, especially dividend investors. Free cash flow is healthy too—over $500 million in the trailing twelve months. That gives the company room to maintain and potentially grow the dividend, even if earnings stay choppy for a while.

The stock price has certainly felt the weight of those recent results. It’s trading around $214, well below its 52-week high of $296. Still, for those watching from a dividend perspective, what matters most is what the company does with its cash—and on that front, MarketAxess continues to check the right boxes.

Key Dividend Metrics

💰 Forward Dividend Yield: 1.42%

📆 Dividend Date: June 4, 2025

📉 Payout Ratio: 51.74%

📈 5-Year Average Yield: 0.93%

🧾 Annual Dividend Rate: $3.04

📅 Ex-Dividend Date: May 21, 2025

🔒 Dividend Safety (Cash Coverage): Strong – backstopped by $586M in cash and $503M in free cash flow

📊 Dividend Growth: Steady, reliable increases over time

Dividend Overview

The current yield stands at 1.42%, which may not turn heads in high-yield circles, but it’s comfortably above the five-year average of 0.93%. That’s not because of any dividend cut, but more due to the stock price settling lower while the dividend keeps inching upward.

The payout ratio sits at 51.74%. That’s a sweet spot—high enough to give shareholders meaningful income, but low enough to suggest there’s plenty of buffer. In other words, they’re paying out less than they could, which leaves room for future increases and protects the payout if earnings stay volatile.

What really makes this dividend feel stable is how it’s backed. The company doesn’t just have healthy earnings. It has serious free cash flow and hardly any debt. When you see that kind of balance sheet strength paired with a moderate payout ratio, you’re looking at a dividend that’s not only safe but potentially set to grow.

The dividend payment schedule is also friendly for planners. Investors holding shares as of May 21, 2025, will receive their payout on June 4. It’s a clean, predictable setup.

Dividend Growth and Safety

When it comes to growing the dividend, MarketAxess has taken a careful approach. This isn’t a company that announces flashy 20% hikes. Instead, it raises the dividend slowly and steadily, reflecting the pace of its cash flow and overall earnings growth. That might not excite traders, but for long-term dividend investors, it’s exactly what you want.

This measured approach speaks to the company’s overall strategy. With $586 million in cash and only $70 million in total debt, it has the firepower to protect its dividend no matter what the market throws its way. And with more than $500 million in free cash flow over the last year, there’s plenty left over even after dividends are paid out.

From a valuation perspective, the forward P/E ratio has come down to around 28. That’s still on the higher end, but not outrageous for a company with strong margins and a defensible niche. The PEG ratio is hovering near 2.9, so you’re still paying a bit of a premium for growth—but the quality of that growth matters. And in the case of MarketAxess, the growth is real, albeit a little lumpy.

Another interesting point is institutional ownership, which is over 100%. That tells you a lot of the stock is in strong hands, likely long-term holders who are in this for stability and gradual appreciation—not short-term flips.

All in all, while the headline numbers from the recent quarter weren’t great, they haven’t changed the story for dividend-focused investors. The balance sheet remains fortress-like, the dividend is well-funded, and there’s a solid track record of consistent, if modest, growth. That combination might not scream excitement, but it does offer something better: reliability.

Cash Flow Statement

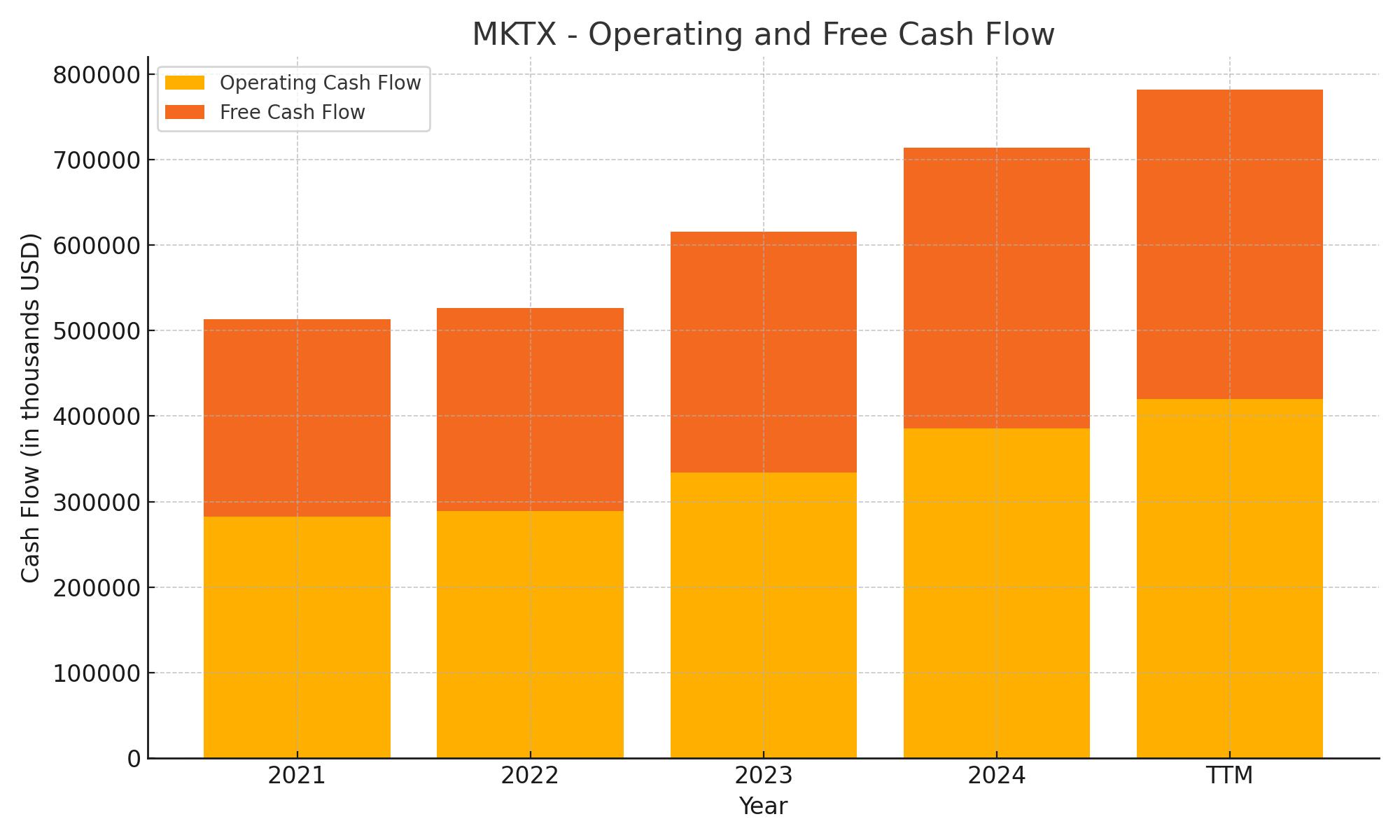

MarketAxess has maintained a strong cash-generating profile, with trailing twelve-month (TTM) operating cash flow rising to $419.8 million, up from $385.2 million in 2024. This consistent year-over-year growth highlights the efficiency of its business model, where revenue may show some fluctuation but core operations continue to generate robust cash. Free cash flow also improved notably, reaching $361.4 million in the TTM, providing ample flexibility for dividend payments, reinvestment, or strategic reserves.

On the financing side, the company continues its disciplined approach, recording negative cash flow from financing activities at -$225.9 million in the TTM. This is in line with a history of outflows related to shareholder returns and debt repayments rather than raising capital. Notably, after issuing and repaying significant debt in prior years, no new debt has been issued in the latest period. The end cash position sits at a healthy $640.8 million, slightly down from 2024, but still reflecting a strong liquidity buffer that supports ongoing dividend reliability and operational resilience.

Analyst Ratings

MarketAxess Holdings Inc. (MKTX) has seen a range of analyst updates lately, and the overall tone has been cautiously optimistic. 🟡 The current consensus among analysts sits at a “Hold” rating, which essentially signals neutrality — not overly bullish, not particularly bearish either.

🔼 Morgan Stanley stuck with its “Overweight” rating and nudged its price target up from $263 to $283. Their confidence seems rooted in MarketAxess’s strong market presence and strategic direction. They see the company continuing to benefit from automation in fixed-income markets.

🔽 On the other hand, Piper Sandler trimmed its price target from $213 to $202 while reiterating a “Neutral” call. They pointed to recent revenue softness and competitive pressures as reasons to tread carefully in the near term.

🔼 Citigroup remained on the more upbeat side, lifting its price target from $250 to $265 and reaffirming a “Buy” rating. They’re clearly seeing potential for stronger performance down the line, likely based on the company’s cash flow strength and long-term growth story.

🔼 Barclays raised its target slightly from $232 to $240 while keeping an “Equal Weight” stance. That suggests they believe the stock is fairly priced given current fundamentals, neither undervalued nor overvalued.

🔼 Keefe, Bruyette & Woods bumped their target just a notch from $223 to $226, maintaining a “Market Perform” rating. Their outlook seems balanced—acknowledging the company’s strengths but also aware of industry headwinds.

📊 The average 12-month price target now stands at $241.78. With the stock recently trading around $214, that implies roughly 13% upside potential. Price targets range from a conservative low of $191 to a more bullish high of $295, reflecting the broad spectrum of views on how MKTX will navigate current market conditions.

Overall, analysts appear split but slightly leaning positive, especially where cash flow resilience and market leadership are concerned. The divergence in targets makes sense for a company in transition, balancing solid fundamentals against some short-term challenges.

Earning Report Summary

A Mixed Start to the Year

MarketAxess kicked off 2025 with a bit of a mixed bag. On the surface, things looked strong—record average daily volumes in key areas like emerging markets and Eurobonds showed that client activity remains high. But dig a little deeper, and some softer numbers start to show up.

Total revenue came in at $208.6 million, just a touch below the same time last year. The dip mostly came from lower commission revenue, especially in the credit segment. On the flip side, their rates business saw a healthy 34% boost in commissions, and services revenue also hit a record $27 million thanks to growth in data and post-trade offerings.

One-Time Hit to Net Income

The real head-turner in this quarter was net income. It dropped hard—down 79% from a year ago to $15.1 million. That sounds alarming at first glance, but there’s an important footnote: a one-time $54.9 million tax reserve tied to a decision from a New York tax court. Strip that out, and earnings per share only saw a slight dip, from $1.92 to $1.87.

Expenses were up a bit too, mainly due to ongoing investments in tech and talent. These are strategic moves, meant to support long-term growth, but they do put some pressure on margins in the short term.

Leadership’s Take and What’s Ahead

CEO Chris Concannon remains upbeat despite the earnings hit. He pointed to strong momentum in the company’s trading platform, especially in U.S. credit markets. A lot of the confidence stems from recent upgrades to their tech—features like targeted block trading and portfolio enhancements are designed to make trading smoother and more efficient.

The Open Trading platform also continues to be a bright spot, with average daily volume reaching $4.8 billion. Portfolio trading, in particular, is gaining serious traction, up 78% from last year. That kind of growth shows the demand for smarter, faster ways to move big positions in the bond market.

Looking forward, the team at MarketAxess is sticking to its plan—leaning into electronic trading, scaling its newer protocols, and aiming to grab more share in core markets. With over $640 million in cash and a steady flow of free cash, they’ve got the resources to keep investing and rewarding shareholders along the way.

Management Team

MarketAxess is led by Christopher Concannon, who stepped into the CEO role in April 2023 after previously serving as President and COO. He brings years of experience from his time at Cboe Global Markets and Bats Global Markets, where he was instrumental in growing electronic trading operations. Since taking the top job at MarketAxess, Concannon has focused heavily on scaling the platform’s technology and expanding market reach.

Supporting him is a highly capable team. Ilene Bieler holds the CFO role, overseeing the company’s finances with a steady hand. Naineshkumar Panchal leads the tech side as CIO, helping ensure the company stays ahead of the curve in infrastructure and innovation. Revenue growth is managed by Kevin McPherson, the CRO, who keeps a pulse on client activity and business development. In the global arena, Dean Berry brings his expertise to the role of Group COO and CEO of EMEA & APAC, adding depth to international operations.

On the board, Carlos Hernandez took over as Chairman in January 2025. A former senior executive at JPMorgan Chase, he brings a strategic mindset and industry insight that help guide the company’s long-term vision.

Valuation and Stock Performance

The current share price of MarketAxess is $214.08, placing it well below its 52-week high of $296.68. The stock has seen a bit of a downturn in recent months, though it has remained above its 52-week low of $186.84. At these levels, it’s roughly 13 percent below the average analyst price target, suggesting some believe there’s room for upside if the company executes well.

Valuation-wise, the numbers reflect a premium. The trailing price-to-earnings ratio stands at 37.17, while the forward P/E is at 28.17. These figures suggest the market is still pricing in growth despite recent earnings softness. The PEG ratio is near 2.93, showing that earnings growth is not expected to accelerate sharply. Still, the company carries a strong track record, and investors may be willing to pay up for stability and consistency.

MarketAxess boasts strong profitability metrics. Its operating margin sits at over 42 percent, and net margin is around 26.5 percent. With a return on equity at 16.25 percent and return on assets above 11 percent, the company continues to deliver value on both fronts. That operational efficiency, paired with minimal debt and strong cash reserves, helps explain why the stock remains relatively expensive compared to peers.

Risks and Considerations

There are several headwinds that could impact MarketAxess moving forward. Competition in the electronic trading space is intense. More platforms are entering the space, and larger institutions continue to develop their own internal tools. That could pressure fees and erode market share over time if MarketAxess doesn’t continue to innovate.

Another consideration is regulation. The company operates across several jurisdictions, which means a patchwork of financial regulations to comply with. Any changes to these rules—especially those affecting how trades are reported or executed—could require costly system updates or impact revenue streams.

Technology is both a strength and a potential vulnerability. The company relies on its platforms running smoothly at all times. Any downtime, system bug, or cyber threat could pose real problems for client trust and daily operations. Moreover, as more competitors invest in technology, staying ahead of the curve becomes more challenging and expensive.

The macroeconomic environment also plays a role. MarketAxess is closely tied to fixed-income trading activity, which ebbs and flows with interest rate changes, central bank policy, and broader market sentiment. If bond market activity slows, so does their transaction-based revenue.

Internationally, the company faces additional complexities. Currency volatility, political instability, or slower economic growth in foreign markets could weigh on performance abroad. As they expand into EMEA and APAC, those risks become more material.

Final Thoughts

MarketAxess has carved out a unique and respected position in electronic bond trading. The leadership team is seasoned, with a clear focus on innovation and client service. Financially, the company is in solid shape—high margins, strong cash flow, and little debt give it plenty of room to maneuver.

Valuation is on the higher end, which speaks to the trust investors place in the business model. But that also raises expectations. Continued investment in technology, growing market share, and expanding into global markets are all necessary steps to justify the premium price.

As with any company, there are risks—both internal and external—that need to be watched. But if MarketAxess continues to execute the way it has historically, it remains an interesting name for those seeking stability, growth, and a shareholder-friendly capital return strategy.