Updated 5/30/25

Main Street Capital Corporation (MAIN) offers a compelling mix of reliable income and disciplined investment management. Operating as a business development company, it focuses on providing debt and equity financing to lower middle market companies, generating strong cash flows and monthly dividends backed by consistent net investment income. The company’s internally managed structure and conservative use of leverage have helped maintain stability through various market cycles.

With a 7.5% forward yield, monthly dividends, and supplemental payouts, MAIN continues to appeal to income-focused investors. A steady hand from its long-standing leadership team, paired with efficient capital allocation and careful credit selection, has supported total returns and net asset growth.

Recent Events

Main Street’s most recent earnings report delivered more of what long-time shareholders have come to expect. Net investment income per share remained solid, continuing to cover the dividend with room to spare. Revenue for the first quarter of 2025 grew 4.1% compared to the same period last year—a modest number on its face, but impressive when you factor in tighter credit conditions and elevated inflation.

Perhaps more importantly, earnings per share climbed 8.3% year-over-year. The reason? Much of MAIN’s debt portfolio is floating rate, which has worked to the company’s advantage with interest rates still sitting near multi-year highs.

The balance sheet remains sturdy, with a debt-to-equity ratio of just under 0.8x—conservative by BDC standards. MAIN also maintained its regular monthly dividend and announced the next ex-dividend date of June 6, 2025, so income investors know exactly when to have their positions set.

Key Dividend Metrics

📅 Dividend Frequency: Monthly

💸 Forward Annual Dividend Rate: $4.26

📈 Forward Yield: 7.52%

📊 5-Year Average Yield: 6.38%

📆 Ex-Dividend Date: June 6, 2025

📉 Payout Ratio: 70.34%

📅 Next Dividend Pay Date: September 15, 2025

🔁 Dividend Growth Track Record: Includes supplemental payouts

Dividend Overview

For income investors, MAIN checks a lot of boxes. At the moment, it’s offering a forward yield of 7.52%, which stands well above its own five-year average. But the dividend story here is about more than just the number. It’s about consistency and structure.

One of MAIN’s standout features is its monthly payout schedule. That steady rhythm can be a real asset for investors who rely on portfolio income for living expenses or simply prefer a smoother, more regular stream of cash flow.

Then there’s the bonus. MAIN has made a habit of paying supplemental dividends on top of the base monthly payout. These aren’t sporadic gifts—they’ve become a reliable piece of the total return puzzle. That kind of extra income can add meaningful yield over the course of a year and reflects the strength of MAIN’s investment portfolio, particularly on the equity side.

With a payout ratio hovering just over 70%, the dividend appears well-supported by ongoing income, not just accounting tricks or capital gains. This is especially important for investors who care about sustainability over hype.

Dividend Growth and Safety

While it might not grab attention with flashy dividend hikes, MAIN has built in its own form of dividend growth through those supplemental payments. It’s a practical, results-driven approach—letting the equity gains earned through long-term portfolio growth filter back to shareholders when the timing is right.

What stands out about MAIN’s dividend policy is how durable it’s been. During COVID-19, when plenty of firms were slashing payouts or going silent altogether, MAIN stayed on course. The monthly dividend never skipped a beat, and the supplemental payments came back not long after.

From a safety standpoint, this BDC is in good shape. The balance sheet shows total debt of $2.26 billion, but with solid earnings power and a conservative leverage profile, that doesn’t raise red flags. Liquidity looks strong, with over $100 million in cash and a current ratio of 2.64. Combine that with a management team that has a direct stake in the business and a long-term mindset, and you’ve got a setup that inspires confidence.

Also worth noting is MAIN’s profitability. Return on equity stands at 19.3%, and profit margins are sky-high, north of 94%. Those aren’t numbers you often see, and they underscore the efficiency of the business and the power of its internal management structure.

This is a company designed to keep the income flowing—not just today, but across market cycles. With consistent coverage, added bonus dividends, and smart capital management, MAIN has shown that it’s more than just another high-yield option—it’s a disciplined income engine.

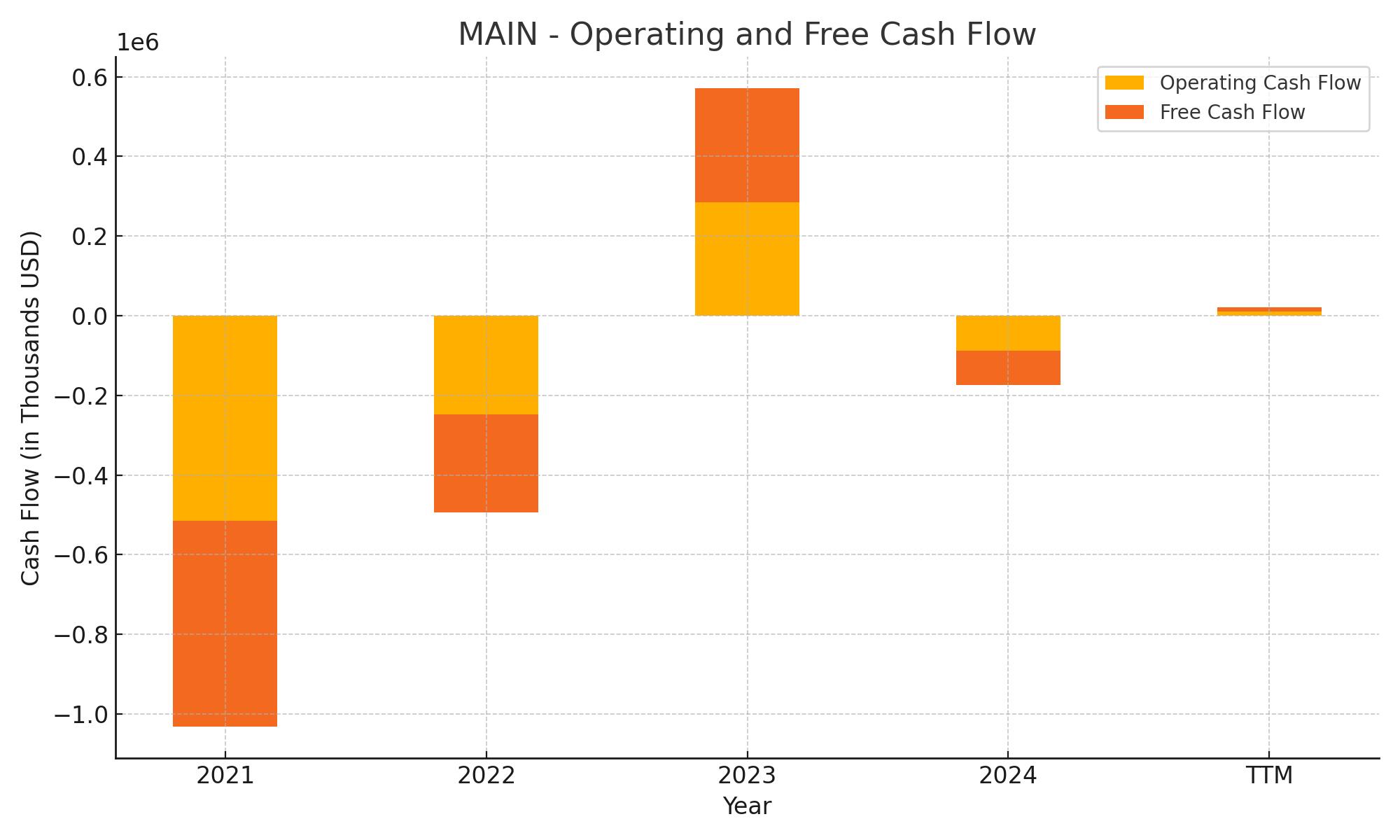

Cash Flow Statement

Main Street Capital’s cash flow activity over the trailing 12 months reflects a company maintaining disciplined control while navigating the needs of its investment strategy. Operating cash flow for the TTM is positive at $10.56 million, a sharp turnaround from the prior year’s significant outflow. Free cash flow follows the same path, landing at the same figure, which indicates a period of stabilized operations despite the volatility seen in past years.

On the financing side, cash movements continue to show active capital management. Over $2.1 billion in debt was issued during the trailing 12 months, offset by nearly $1.91 billion in repayments. Equity issuance added another $122 million in capital. While net financing cash flow was slightly negative at $16.36 million, the end cash position improved to $109 million—its highest level in five years. This suggests the company is preserving flexibility while supporting both investment and dividend strategies.

Analyst Ratings

📉 Main Street Capital Corporation (NYSE: MAIN) has recently seen a shift in sentiment among analysts, with a more cautious tone emerging. Oppenheimer kept its “Market Perform” rating intact but trimmed its price target from $58 to $53. The adjustment reflects concerns around potential earnings softness and a more demanding interest rate backdrop that could weigh on portfolio performance.

🔍 Truist Securities echoed that cautious view, maintaining a “Hold” rating while dialing back its price target from $62 to $54. Their note suggested a more conservative approach to valuation amid sector headwinds and a recalibration of expected returns. UBS also stayed neutral, slightly revising its target from $55 to $54—signaling a generally steady outlook with some guardedness.

📊 The current analyst consensus rating is “Hold,” with a 12-month average price target of around $52.80. That figure sits just below the current share price, implying analysts expect the stock to stay relatively range-bound in the near future. While MAIN continues to perform well operationally, analysts appear to be waiting for a more compelling entry point or clearer upside catalyst before turning more bullish.

Earnings Report Summary

Main Street Capital kicked off 2025 with a solid performance that stuck to its core strengths. Net investment income came in at $1.01 per share, a touch lower than the $1.05 posted last year, but still a strong showing. Total investment income ticked up to $137 million, driven by a notable jump in dividend income. That increase—$13.2 million more than last year—was largely thanks to stronger contributions from its lower middle market companies.

Distributable net investment income reached nearly $95 million, slightly higher than the previous year. Operating costs were up, with total expenses hitting $47.2 million, mainly due to higher interest and administrative costs. Even so, the company turned in a healthy $116.1 million increase in net assets from operations. That’s up from $107 million a year ago and shows MAIN’s underlying business remains efficient. The net asset value per share edged higher too, now at $32.03.

Portfolio Activity and Dividends

MAIN stayed active with its investments. During the quarter, it committed over $86 million to its lower middle market portfolio and another $138 million to private loans. These moves weren’t just about putting cash to work—they were calculated decisions that helped grow the overall cost basis of the portfolio in a disciplined way.

On the income side, the board declared monthly dividends totaling $0.75 per share for Q2, a 4.2% boost compared to this time last year. Investors also received a supplemental dividend of $0.30 per share—marking the fifteenth straight quarter MAIN has delivered this extra income.

Leadership’s View

CEO Dwayne Hyzak described the quarter as another step forward for the company. He pointed out the healthy income stream, portfolio growth, and the successful public listing of MSC Income Fund as highlights. More importantly, he reaffirmed confidence in MAIN’s conservative approach to leverage and strong balance sheet—two things that have given the company flexibility to keep making moves even when markets feel tight.

All in all, the tone from leadership was optimistic but grounded. They see strength in the core portfolio, steady dividend coverage, and enough dry powder to keep capitalizing on opportunities as they arise.

Management Team

Main Street Capital is guided by a leadership team that’s been in place for years, bringing both stability and a long-term mindset. CEO Dwayne Hyzak has been with the firm since 2002 and became chief executive in 2018. Under his direction, the company has remained focused on disciplined capital allocation and conservative leverage, weathering market cycles without veering off course.

David Magdol, serving as President and Chief Investment Officer, also joined the firm in 2002 and plays a crucial role in shaping the firm’s investment strategy. His experience in both investment banking and private equity gives him the insight to identify quality middle market and private debt opportunities that align with Main Street’s income-generating goals.

Supporting them is Jesse Morris, Executive Vice President and Chief Operating Officer. Since joining the team in 2019, Morris has handled the firm’s financial and operational backbone, helping maintain efficient internal controls while keeping growth aligned with shareholder value. This trio, along with a strong bench of experienced professionals, creates a reliable foundation for continued stability and strategic execution.

Valuation and Stock Performance

Main Street Capital’s share price has held up well over time, appealing to investors who favor consistency and steady income. As of late May 2025, the stock trades around $56.67, putting it close to its recent highs. The past year has been kind to MAIN shareholders, with a total return near 28%, well ahead of broader equity markets.

The valuation remains reasonable for a dividend-focused investment. With a trailing price-to-earnings ratio of 9.61 and a forward P/E closer to 14.35, the stock doesn’t appear overly stretched. For investors measuring potential downside and income stability, these multiples reflect a balanced picture. MAIN also trades at roughly 1.78 times book value, suggesting that the market is placing a premium on its quality portfolio and operational track record.

Volatility has remained relatively low, with a beta under 0.9. That’s another checkbox for investors seeking income without the drama of high-beta, growth-focused names. The average analyst target sits around $52.80, slightly below the current price, suggesting a neutral outlook from the sell-side. Still, the long-term story for MAIN tends to play out more in dividends and stability than big price moves.

Risks and Considerations

Even with its strengths, Main Street isn’t without risks. As a business development company, it’s heavily regulated and must distribute at least 90% of its taxable income to maintain pass-through tax status. That can limit flexibility in retaining earnings or reinvesting in operations.

Another area to watch is the interest rate environment. MAIN holds a mix of floating and fixed-rate assets, so shifts in rates can impact both earnings and valuations. Rising rates can benefit income in the short term, but they can also pressure portfolio companies, particularly smaller firms that may face higher borrowing costs.

Credit risk is always a factor. MAIN’s lower middle market investments offer higher yields, but they also bring exposure to companies that may not have the same resilience or access to capital as larger corporations. A prolonged economic slowdown could strain these businesses, leading to write-downs or reduced income.

Dividend investors should also keep in mind that while MAIN has a strong track record of monthly and supplemental payments, future dividends depend on performance. Supplemental payouts, in particular, are based on realized gains, which aren’t guaranteed.

Final Thoughts

Main Street Capital has built a reputation for being one of the more consistent players in the BDC space. Its combination of monthly dividends, supplemental payments, and a conservatively managed investment book makes it a favored name among income-oriented investors.

The leadership team’s long tenure and alignment with shareholder interests offer an added layer of confidence. At a time when many companies are struggling to balance growth and income, MAIN continues to lean into what it does best—generating returns from small and mid-sized business lending while keeping risk in check.

It’s not a flashy stock and doesn’t aim to be. But for those seeking durable income backed by a thoughtful investment approach, Main Street continues to deliver what it promises: consistency, yield, and a strong hand on the wheel.