Updated 5/29/25

LXP Industrial Trust (NYSE: LXP) is a real estate investment trust focused exclusively on single-tenant industrial properties across key U.S. logistics markets. With a 99.2% leased portfolio and a consistent quarterly dividend of \$0.13 per share, it offers a steady income stream supported by strong free cash flow and disciplined capital management.

Led by a veteran leadership team and centered on growth markets like the Sunbelt and Lower Midwest, LXP is executing a focused strategy aimed at long-term stability. A 6.26% dividend yield and reaffirmed guidance for 2025 position it as a dependable option for income-focused investors.

Recent Events

The first quarter of 2025 gave us a glimpse into how LXP is navigating the current landscape. Revenue rose about 3% year-over-year, a modest but respectable bump considering the broader challenges in commercial real estate. Total revenue over the trailing twelve months came in at $361 million.

More important for dividend investors, operating cash flow reached $211 million, and levered free cash flow pushed past $256 million. That’s a healthy surplus over what the company needs to keep its dividend commitments intact.

Debt sits at $1.54 billion, which isn’t unusual for a REIT, and with a debt-to-equity ratio of 73.2%, LXP appears to be managing its leverage well. Liquidity also looks solid with a current ratio of 1.54, which suggests short-term obligations are well covered.

Institutions seem to like what they see, with nearly 97% of shares held by large investors. And with short interest at just over 2%, there isn’t a lot of skepticism floating around either.

Key Dividend Metrics

📈 Dividend Yield: 6.26% (Forward)

📆 Payout Frequency: Quarterly

💸 Forward Annual Dividend: $0.53 per share

📊 Payout Ratio: 265% (based on net income)

📉 5-Year Average Yield: 4.59%

🔁 Recent Dividend Date: April 15, 2025

🚫 No Recent Dividend Cuts or Suspensions

Dividend Overview

Let’s start with the obvious—the 6.26% forward yield is a strong pull for anyone looking to build income. LXP hasn’t tinkered with its dividend rate in a while. It’s been sitting at $0.13 per quarter since 2019, and while that might not excite those seeking growth, it’s music to the ears of those who value stability.

On paper, the payout ratio based on net income—clocking in at 265%—would raise eyebrows in most sectors. But REITs are a different animal. They’re structured to return the bulk of their earnings to shareholders and typically measure dividend safety against cash flow instead of net earnings.

That’s where LXP shows its strength. With free cash flow over $250 million and annual dividends requiring just over $157 million, there’s breathing room. This is the kind of cash coverage that lets investors sleep at night.

Dividend Growth and Safety

If there’s one thing that might leave some investors wanting more, it’s the lack of dividend growth. The payout has been flat for several years, and LXP hasn’t signaled any near-term change. That said, it never cut—even during the turbulence of COVID or recent interest rate hikes. That consistency counts.

When you look at the five-year average dividend yield of 4.59%, today’s 6.26% stands out. The higher yield is more a reflection of share price pressure than sudden generosity, but for income investors, the result is the same: more income per dollar invested.

The safety profile still looks sound. Free cash flow covers the dividend with room to spare. The portfolio is made up of properties that serve essential logistical functions, and many are leased to tenants with strong financial profiles. Long-term lease structures add even more predictability to cash flow.

While the stock trades at 1.26 times book value—suggesting it isn’t exactly a bargain on an asset basis—this isn’t the type of investment where you’re hunting for discounts. It’s about reliability, not bargain hunting.

Cash Flow Statement

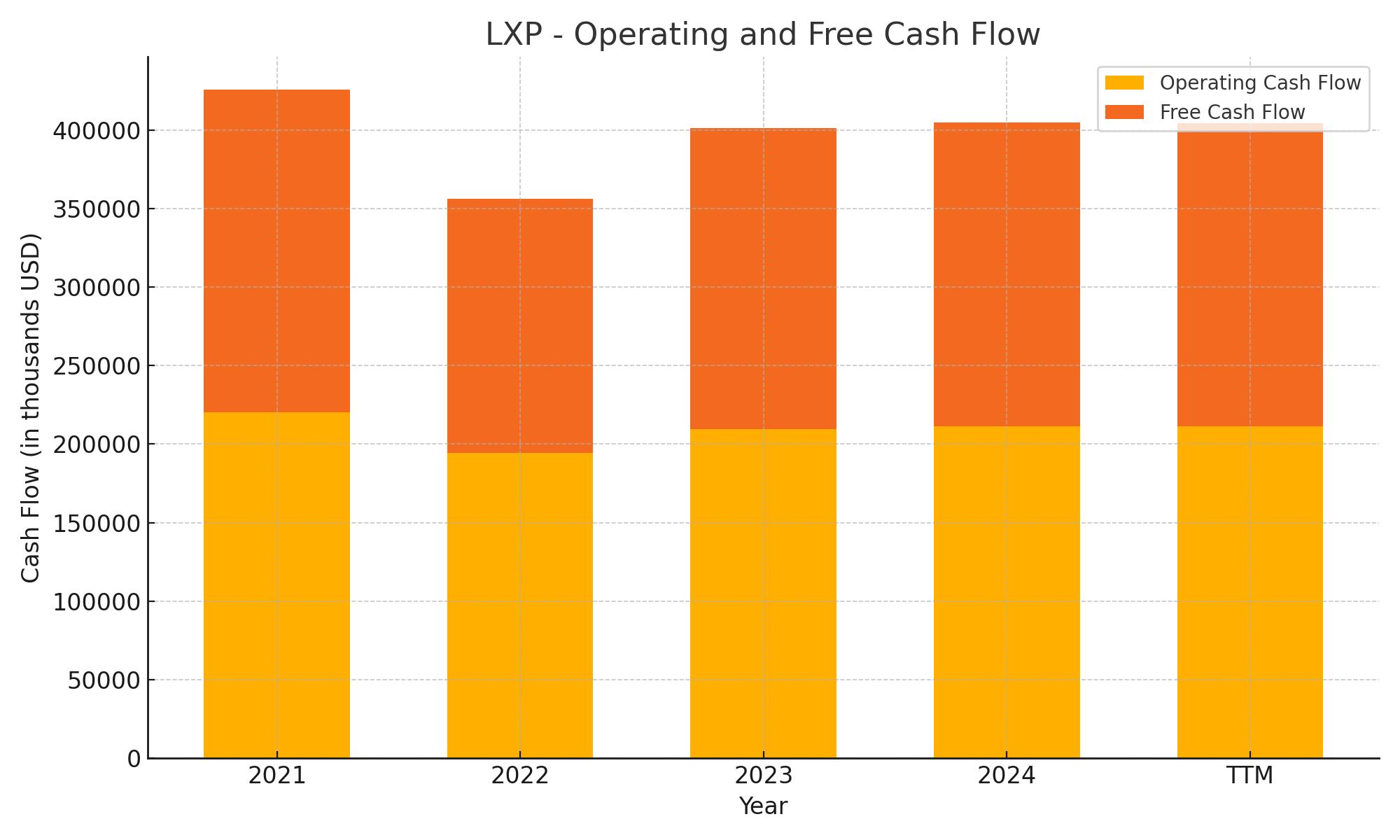

LXP Industrial Trust has maintained consistent operating cash flow, posting $211.3 million over the trailing twelve months. This figure has remained steady over the past few years, showing only minor variation—indicative of the stable income generated from its industrial property portfolio. Free cash flow also followed this pattern, landing at $193.1 million for the TTM, which comfortably covers its dividend obligations and suggests a strong buffer for ongoing distributions.

On the investing side, the company shifted to a positive cash flow of $137.3 million over the TTM, reversing the outflows seen in 2021 and 2022. This reflects a slowdown in aggressive property acquisitions, possibly a response to tighter capital markets. Financing cash flow, meanwhile, was negative $440.8 million, driven largely by significant debt repayments totaling over $333 million and a conservative stance on capital returns. The company’s ending cash position was $71.2 million, down from prior years but still sufficient given its consistent free cash generation and manageable capital expenditures.

Analyst Ratings

📈 LXP Industrial Trust has recently seen a blend of analyst actions that suggest a cautious but constructive outlook. On May 2, 2025, KeyBanc Capital Markets reiterated its “Overweight” stance while trimming the price target from $11 to $10. This move wasn’t about any missteps from LXP itself but rather a reflection of broader concerns around industrial REITs facing slower near-term leasing momentum.

🔄 Back in September 2024, Evercore ISI expressed a slightly more upbeat view, maintaining its “In-Line” rating and nudging the price target upward from $10 to $11. Analysts cited LXP’s portfolio strength and operational consistency as the basis for the modest upward revision.

🚀 Jefferies offered an even more optimistic take in June 2024, keeping its “Buy” rating and raising its target from $11 to $12. They pointed to the company’s strategic market focus and strong tenant quality as reasons for long-term confidence.

🌟 BNP Paribas Exane also entered the scene with a fresh “Outperform” rating and a price target of $11, highlighting LXP’s potential as a reliable income-generating REIT with room to rerate higher as macro pressures ease.

💰 The current consensus among analysts reflects a moderate buy, with an average price target sitting at $11. This suggests some upside from current levels and affirms LXP’s appeal as a dependable player in the industrial REIT space.

Earning Report Summary

A Strong Start to the Year

LXP Industrial Trust opened 2025 with a solid first-quarter performance, signaling that its steady approach to industrial real estate continues to pay off. The company posted net income of $17.3 million, or $0.06 per diluted share, swinging from a loss of $1.9 million during the same quarter last year. Revenues reached nearly $89 million, driven by rent bumps on existing leases, contributions from recently acquired properties, and the leasing of space that had previously been under development.

There was also strength in one of the more important measures for REITs—funds from operations. Adjusted company FFO came in at $46.4 million, translating to $0.16 per diluted share, essentially on par with the same time last year. It’s a sign of stability in an environment where not every REIT can say the same. On the operational side, same-store net operating income rose 5.2%, supported by a portfolio that’s now 99.2% leased. That kind of occupancy rate is impressive in any market, especially one still adjusting to shifting supply chain and industrial demand dynamics.

Leadership Commentary and What’s Next

Management’s tone was confident without sounding overoptimistic. CEO T. Wilson Eglin pointed to the quality of LXP’s tenant base and the resilience of its industrial properties as key reasons why the company has held up well. He also emphasized the benefit of focusing on supply-constrained markets, particularly across the Sunbelt and Lower Midwest regions. These areas now account for a large portion of the company’s real estate footprint and are central to its investment strategy.

One standout moment in the quarter was the extension of a lease on a 540,000 square foot facility. That deal didn’t just secure a long-term tenant—it also came with a significant rent reset: a 52.5% jump in base rent and nearly 59% increase in cash rent. Those are numbers any landlord would be happy with.

On the balance sheet side, the company paid down $50 million from its $300 million term loan, a move that shows it’s serious about keeping leverage in check. While that kind of discipline might not grab headlines, it does build long-term confidence among income-focused investors.

Looking forward, the company reaffirmed its full-year 2025 guidance. Management expects to deliver between $0.61 and $0.65 per share in adjusted FFO, with same-store NOI projected to grow in the 3% to 4% range. That’s not explosive, but it’s dependable—and for many investors, especially those eyeing the dividend, that’s exactly what matters.

Management Team

LXP Industrial Trust is led by a deeply experienced executive team that has played a central role in its evolution into a focused industrial REIT. At the top is T. Wilson Eglin, who has served as Chairman, CEO, and President since 2003. His long tenure with the company has provided continuity and strategic direction through market shifts and the company’s significant portfolio transformation.

Joseph Bonventre serves as Executive Vice President, Chief Operating Officer, General Counsel, and Secretary. He brings valuable legal and operational experience, helping guide LXP’s day-to-day structure. Nathan Brunner, who stepped in as CFO and Treasurer in March 2025, brings a fresh perspective with a strong financial background, having previously worked as a Managing Director in the Real Estate Investment Banking group at J.P. Morgan.

Rounding out the leadership team are Brendan Mullinix, Chief Investment Officer, and James Dudley, Director of Asset Management. Both play key roles in shaping investment strategies and overseeing property performance across the portfolio.

Valuation and Stock Performance

As of late May 2025, shares of LXP Industrial Trust trade around $8.47, giving the company a market capitalization in the ballpark of $2.5 billion. The stock has moved between a low of $6.85 and a high of $10.57 over the past year, showing a moderate trading range that reflects investor caution and selective optimism in the industrial REIT space.

LXP’s current P/E ratio stands at 42.05, which may seem high on a surface level, but this figure needs to be considered in the context of REIT accounting and the non-cash charges that often suppress reported earnings. Its price-to-book ratio sits near 1.24, suggesting that investors are paying a slight premium for access to its quality asset base and consistent income profile.

The company’s dividend yield is one of its standout features, currently sitting at 6.26% based on an annual payout of $0.53 per share. That’s well-supported by a strong free cash flow position, which over the trailing twelve months came in at $193.1 million. The stability of both cash generation and the dividend is a key draw for long-term income-focused investors.

Risks and Considerations

Despite LXP’s strengths, there are a few risks that investors should keep in mind. One of the biggest is its single-tenant property model. While this approach can offer long-term stability, it also exposes the company to risks if any major tenant fails to renew a lease or defaults altogether. These events can have an outsized impact on income when compared to multi-tenant properties.

Interest rates remain a broader industry concern. LXP has about $1.54 billion in debt and a debt-to-equity ratio of roughly 73%, which is reasonable for a REIT, but still needs close attention if borrowing costs continue to rise. Debt management and refinancing will be key in maintaining balance sheet strength and dividend consistency.

The company is heavily invested in the Sunbelt and Lower Midwest regions, which have seen strong demand but could face their own regional headwinds over time. That concentration makes geographic diversification an area to watch. Also, with a new CFO stepping in recently, there’s always a period of adjustment, even when the incoming executive brings solid credentials.

Final Thoughts

LXP Industrial Trust is a company that has quietly and consistently carved out a niche in the industrial REIT space. Its approach—focusing on well-located, single-tenant properties with long lease terms—has delivered dependable income even when broader markets have been unsettled.

Led by an experienced management team and bolstered by stable operations, LXP’s appeal lies in its consistency. The dividend is supported by strong cash flows, the balance sheet is solid, and its properties are well-leased. The stock may not be the flashiest in the REIT universe, but it has a profile that income investors tend to appreciate: slow and steady, with a yield that stands out.

The stock’s valuation remains within reason given the quality of its assets and its operational track record. There are risks, to be sure—tenant concentration, geographic exposure, and sensitivity to economic shifts among them. But for those seeking income reliability with a measured growth outlook, LXP continues to be a name worth knowing.