Key Takeaways

💰 Lowe’s offers a dividend yield of just over 2% with a strong 5-year dividend growth rate near 17%, supported by a conservative 38% payout ratio and decades-long consistency in increases.

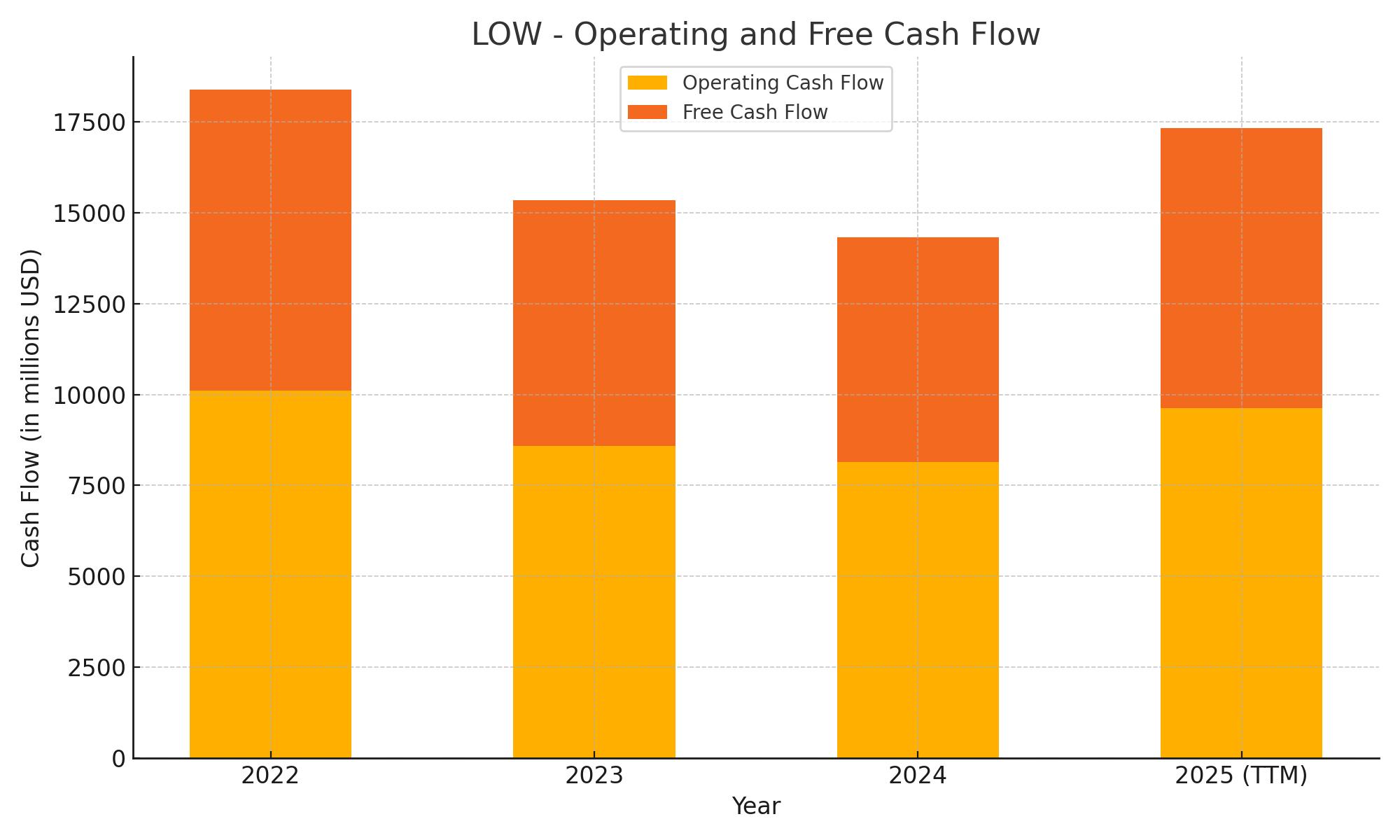

📊 Trailing twelve-month operating cash flow reached $9.63 billion, with free cash flow at $7.7 billion, providing a solid foundation for continued dividends, buybacks, and financial stability.

🔍 Analysts maintain a generally positive outlook, with a consensus price target around $271, reflecting confidence in Lowe’s execution and future growth despite near-term macroeconomic challenges.

Updated 5/29/25

Lowe’s Companies, Inc. has long been a dependable player in the home improvement space, serving everyone from weekend DIYers to seasoned contractors. With over 60 years of uninterrupted dividend payments and a 5-year average dividend growth rate near 17%, it’s built a reputation for reliability and disciplined capital allocation. The current yield of just over 2% pairs well with strong free cash flow, consistent share repurchases, and a well-covered payout ratio around 38%.

Leadership under CEO Marvin Ellison has focused on tightening operations, boosting customer satisfaction, and driving digital upgrades. Despite some softness in consumer spending and macro headwinds, Lowe’s continues to deliver solid earnings and cash flow. Its long-term strategy balances steady income for shareholders with targeted growth through its professional segment and operational investments.

Recent Events

The last few quarters haven’t been blowout by any stretch, but they’ve held steady. Lowe’s reported a modest pullback in revenue—about 2% down year-over-year—which isn’t too surprising given the current economic environment. People are holding off on big-ticket spending, and the housing market has been sluggish thanks to elevated interest rates.

That said, Lowe’s has done a solid job of maintaining its margins. Operating margin sits near 12%, which is impressive given the headwinds. There’s a clear focus on cost control and making the business more efficient. Instead of trying to grow for growth’s sake, management is zeroed in on keeping the business lean and returning value to shareholders.

On the balance sheet side, there’s quite a bit of debt—just shy of $39 billion—but it’s being handled with care. The company’s generating over $8.7 billion in operating cash flow and more than $6 billion in free cash flow. That’s more than enough to cover dividends and still have room to reduce debt and buy back stock. The current ratio at 1.01 tells us they’ve got just enough cushion to manage short-term needs without overextending.

Key Dividend Metrics

🔁 Dividend Yield: 2.05%

📈 5-Year Dividend Growth Rate: ~17%

💸 Payout Ratio: 38%

📅 Most Recent Dividend Date: May 7, 2025

📆 Ex-Dividend Date: April 23, 2025

💵 Forward Annual Dividend: $4.60

🧱 Dividend Streak: Over 60 consecutive years

📊 5-Year Average Yield: 1.67%

Dividend Overview

For those seeking steady, growing income, Lowe’s is one of those names you keep in your portfolio and let it do its thing. The current yield sits at around 2.05%, a notch above its five-year average. That alone suggests the stock is fairly priced in terms of income potential, without needing to stretch valuation.

What really stands out is the payout ratio. Sitting at 38%, it shows Lowe’s isn’t stretching to maintain its dividend. There’s plenty of room to grow it, even if earnings take a short-term hit. This kind of financial breathing room is exactly what income investors should look for—it’s a sign the dividend isn’t just sustainable, it’s healthy.

Lowe’s doesn’t get flashy about its dividend, but the results speak volumes. This company has paid out a dividend every year since 1961 and has increased it annually for over five decades. That puts it in elite company, officially making it a Dividend King.

And this isn’t just about meeting a tradition—it’s a reflection of a disciplined capital strategy. Management keeps buybacks and dividends front and center. In fact, consistent share repurchases over the years have helped boost earnings per share and made each dividend dollar go even further.

Dividend Growth and Safety

When you look at the past five years, dividend growth at Lowe’s has been incredibly strong—around 17% annually. That kind of growth is rare in mature companies, especially in retail. And yet, Lowe’s continues to deliver.

For long-term holders, that’s real money. If you had picked up shares five years ago and reinvested dividends along the way, your yield on cost could now be closing in on 4%. It’s a textbook example of how reliable dividend growth builds wealth.

Now, how safe is the dividend going forward? There are a few things to consider. First, the company’s cash generation is strong. Operating cash flow over the past year is north of $8.7 billion, and free cash flow is comfortably over $6 billion. With a dividend bill of just over $2.5 billion, the coverage is more than solid.

Second, even with a chunk of debt on the books, Lowe’s isn’t over-leveraged. They’ve shown time and again they can balance shareholder returns with smart debt management. And they’ve done this while navigating multiple economic cycles—recessions, housing slumps, even a pandemic.

Lastly, management continues to raise the dividend, even in more cautious environments. The latest bump, a 5% increase, may not be the largest in their history, but it’s a clear signal that they’re confident in the business and committed to shareholders. That kind of consistency builds trust.

There’s something comforting about a business that doesn’t need to shout. Lowe’s just goes about its work, generating cash, paying dividends, and gradually growing value. For income-focused investors, it’s one of those rare names where the income is steady, the growth is real, and the risk is low. It’s not just a stock—it’s a cornerstone.

Cash Flow Statement

Lowe’s continues to demonstrate its strong cash generation, with trailing twelve-month operating cash flow reaching $9.63 billion. This represents a noticeable increase from the prior year and reflects solid core profitability despite a softer retail environment. Free cash flow also improved to $7.7 billion, highlighting Lowe’s disciplined approach to capital expenditures, which came in at $1.93 billion. The company’s ability to convert earnings into free cash flow is a central reason why it maintains such a reliable dividend and active buyback program.

On the financing side, Lowe’s returned significant capital to shareholders, repurchasing over $4 billion in stock during the same period. Debt activity was muted, with no new issuances and just over half a billion repaid, showing a conservative stance on leverage. Despite these outflows, the company increased its ending cash position to $1.76 billion, the highest in recent years. This combination of healthy free cash flow, modest capex, and focused capital returns paints a picture of a company that knows how to balance growth, shareholder value, and financial stability.

Analyst Ratings

Lowe’s has been seeing a mix of updates from analysts lately, with sentiment reflecting both caution and confidence. 🧐 While a few firms have trimmed their price targets, the broader view still leans optimistic. The average 12-month price target sits around $271.12, which points to about 20% upside from where the stock is currently trading. 📈

Some analysts are reining in expectations due to macro pressures. Stifel Nicolaus, for example, lowered its price target from $250 to $240 and kept a “Hold” rating. The reasoning? Ongoing concerns about tighter consumer spending in the home improvement space. 🏠 Mizuho also pulled back, adjusting their target from $300 to $280, citing a more cautious stance given the uncertain economic outlook. 🕵️

But not all the news is tempered. KeyBanc Capital Markets turned more bullish, upgrading Lowe’s from “Sector Weight” to “Overweight” with a target of $266. They’re encouraged by Lowe’s continued push toward efficiency and its execution of strategic priorities. 💡 Morgan Stanley echoed that tone, reaffirming an “Overweight” rating with a target of $255. They pointed to strong management and a long-term growth path, even though higher interest rates could temporarily cool bigger renovation projects. 🔧

Earning Report Summary

Solid Performance Despite a Tough Backdrop

Lowe’s kicked off fiscal 2025 with a quarter that was steady, if not spectacular. Earnings per share landed at $2.92, a touch ahead of what most expected. Revenue came in at $20.93 billion, just a bit light, but still reflecting a solid performance given the circumstances. Comparable sales dipped by 1.7%, showing that consumers are being a little more careful with spending—especially on non-essential home projects.

The weather played a part in that, too. CEO Marvin Ellison pointed to an unusually cold and wet spring in some regions as one reason foot traffic and seasonal product demand softened. But despite these headwinds, he was upbeat about how the team handled things. He noted that customer satisfaction scores were up, thanks to a sharp focus on service and store execution.

Strength in the Pro Segment

One bright spot in the report was the continued growth in Lowe’s professional customer business. While DIY spending is down, pro customers—contractors, remodelers, and tradespeople—delivered mid-single-digit growth. That’s a good sign that the backbone of Lowe’s revenue remains steady, even if the average weekend warrior is tightening the belt a bit.

Lowe’s leadership continues to see long-term value in catering to this group, with plans to invest more in inventory, tools, and technology that help pros get in and out quickly.

Looking Forward

Lowe’s stuck with its full-year guidance, which seems to suggest confidence about where things are headed. They’re forecasting earnings per share to land somewhere between $12.15 and $12.40 and are still aiming for flat to slightly positive comp sales for the year. Not overly ambitious, but measured—and realistic.

The company also reiterated its push toward operational improvements. That means more investment in digital, store layouts, and supply chain efficiencies. There’s also a big focus on diversifying where products come from—about 60% of the inventory is now sourced domestically, which helps reduce some of the volatility that tariffs and shipping disruptions can bring.

Management Team

Lowe’s leadership is anchored by Marvin Ellison, who serves as Chairman, President, and CEO. With a background that includes executive roles at both Home Depot and J.C. Penney, Ellison brings a wealth of retail experience to the table. Since taking the helm, he’s been instrumental in streamlining operations and focusing on core competencies.

Supporting Ellison is Brandon Sink, the Executive Vice President and Chief Financial Officer. Sink oversees the company’s financial strategies, ensuring fiscal responsibility and sustainable growth. Seemantini Godbole, as the Chief Digital and Information Officer, leads Lowe’s digital transformation efforts, enhancing the online shopping experience and integrating technology into store operations. William Boltz, the Executive Vice President of Merchandising, is responsible for product assortment and vendor relationships, ensuring that Lowe’s shelves are stocked with what customers need. Janice Dupré, serving as Executive Vice President of Human Resources, focuses on talent development and fostering an inclusive workplace culture.

This cohesive leadership team is committed to driving Lowe’s forward, balancing innovation with the company’s longstanding commitment to customer service.

Valuation and Stock Performance

As of late May 2025, Lowe’s stock is trading around $225 per share. This places it approximately 21 percent below its 52-week high of $287, indicating a potential opportunity for investors considering entry points. The company’s price-to-earnings (P/E) ratio stands at 18.3, aligning closely with industry averages, suggesting that the stock is fairly valued relative to its earnings.

Analyst sentiment remains positive, with a consensus price target of approximately $264.04, implying a potential upside of around 17 percent. Recent earnings reports have shown resilience, with the company maintaining its full-year guidance despite challenges in the housing market and consumer spending patterns. The stock’s performance reflects both the headwinds facing the retail sector and the confidence in Lowe’s strategic direction.

Risks and Considerations

Investing in Lowe’s comes with its set of risks. The home improvement sector is closely tied to the housing market, which has been experiencing volatility due to fluctuating interest rates and economic uncertainties. A slowdown in housing starts or renovations can directly impact Lowe’s sales.

Competition is another factor to consider. Lowe’s faces stiff competition from other big-box retailers and online platforms, which can pressure margins and market share. Additionally, supply chain disruptions and increasing costs of goods can affect profitability. While the company has made strides in digital transformation, the pace of technological change requires continuous investment to stay ahead.

Operational risks, such as managing a vast network of stores and employees, also pose challenges. Ensuring consistent customer service and inventory management across all locations is critical to maintaining brand reputation and customer loyalty.

Final Thoughts

Lowe’s stands as a stalwart in the home improvement retail space, backed by a seasoned management team and a clear strategic vision. While the company faces industry-specific challenges, its proactive approach to digital integration, supply chain management, and customer engagement positions it well for sustained performance. For investors seeking exposure to the retail sector with a focus on home improvement, Lowe’s offers a blend of stability and growth potential.