Updated 5/29/25

Louisiana-Pacific Corporation (LPX) is a leading manufacturer of engineered wood building materials, with a strong footprint in both new residential construction and the repair and remodel markets. The company has strategically shifted toward value-added products like SmartSide siding and Structural Solutions, positioning itself for margin stability and long-term growth. Its financials are solid, with a strong balance sheet, consistent free cash flow, and disciplined capital returns through dividends and share buybacks.

The Siding segment continues to be a growth engine, driven by increasing volume and new product lines like the Naturals Collection. While the OSB segment has faced pricing headwinds, management remains focused on execution and operational efficiency. With a low payout ratio, improving order trends, and a clear strategic direction from a seasoned leadership team, LPX presents a compelling story for dividend-focused investors looking for steady fundamentals in the building materials space.

Recent Events

LPX’s stock took a bit of a dip recently, closing at $89.71 on May 28 with a 4.9% decline for the day. Not unusual for a company in the construction space, especially with interest rate concerns still looming and mixed housing data rolling in. But the bigger picture tells a more stable story.

Over the last twelve months, LPX brought in $2.94 billion in revenue, posted $403 million in net income, and kept margins surprisingly healthy. Operating margin sits just under 17%, while return on equity clocks in at an impressive 24.4%. Despite a year-over-year earnings decline of about 15.7%, these numbers suggest a business still running with a lot of efficiency.

The balance sheet backs that up. LPX holds $256 million in cash against just $379 million in debt. With a current ratio of over 3, there’s no liquidity concern here. The company is well-positioned to weather short-term turbulence while continuing to return capital through dividends and share repurchases.

Key Dividend Metrics

For investors eyeing income, LPX delivers a neat package of dividend fundamentals that balance yield with long-term growth potential.

💵 Forward Annual Dividend Rate: $1.12

📈 Forward Dividend Yield: 1.25%

📉 5-Year Average Yield: 1.33%

📊 Payout Ratio: 18.6%

📆 Next Dividend Date: June 3, 2025

⏳ Ex-Dividend Date: May 20, 2025

The current yield sits at 1.25%, which might not turn heads at first glance. But the quality of that dividend, supported by strong cash flows and low payout ratios, makes it a different kind of opportunity. LPX doesn’t chase yield for attention—it prioritizes sustainability.

Dividend Overview

There’s something refreshing about a company that keeps its dividend strategy simple. LPX doesn’t make big headlines with massive hikes or splashy yield announcements. Instead, it sticks to a strategy built on fundamentals. The result? A payout that’s steady, supported, and growing.

The dividend represents just 18.6% of earnings, which leaves plenty of room for future increases even if the company faces a softer revenue stretch. At the same time, it isn’t hoarding cash—LPX is actively returning capital to shareholders without putting pressure on its balance sheet.

With $564 million in operating cash flow and nearly $286 million in levered free cash flow over the last twelve months, there’s a strong foundation behind every dividend payment. LPX is clearly focused on rewarding investors in a sustainable way.

Dividend Growth and Safety

This is where LPX really stands out. Over the past five years, it has steadily grown its dividend from $0.64 to $1.12 per share. That translates to a compound annual growth rate of about 12.3%—a solid pace for a company in a cyclical industry.

There’s no hint of recklessness in those hikes. Every increase appears to be backed by actual performance, not just a desire to keep up appearances. Even during slower periods in the housing cycle, LPX has the flexibility to maintain and grow its payout thanks to its low payout ratio and modest debt levels.

Another shareholder-friendly move is the company’s ongoing stock buyback activity. It’s not a headline-grabber, but LPX has consistently used excess capital to reduce share count over time. That’s a quiet but powerful way to support long-term dividend growth.

If you’re searching for a flashy high-yield play, this might not be the stock for you. But if you appreciate consistent dividend increases backed by fundamentals, LPX is doing a lot of things right. It’s the kind of company that flies under the radar but rewards patience with reliable returns and a disciplined capital allocation strategy.

Cash Flow Statement

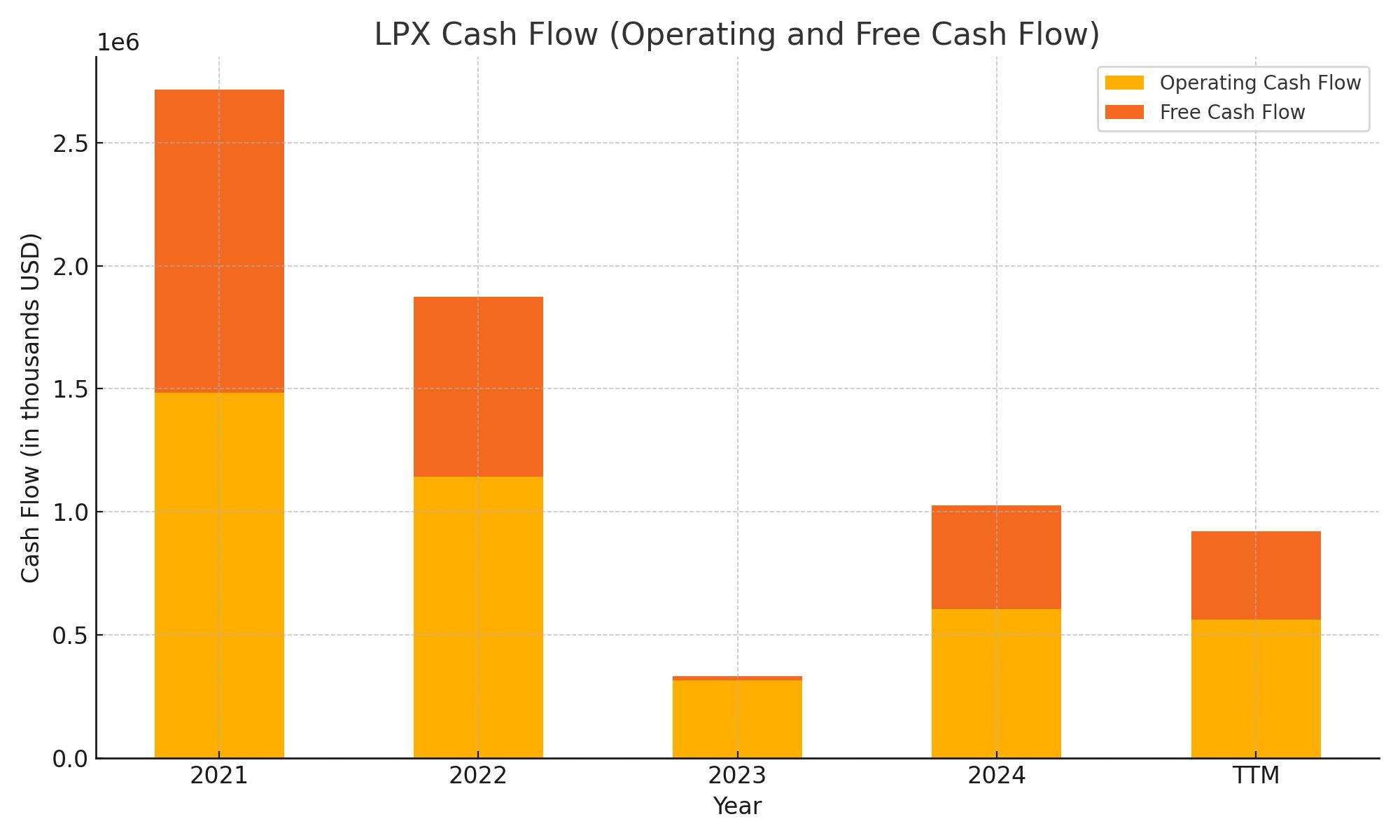

Louisiana-Pacific’s trailing twelve-month (TTM) cash flow shows a disciplined approach to capital management in a cooling market environment. The company generated $564 million in operating cash flow, a solid figure, though noticeably lower than the peak levels seen in 2021. Despite that moderation, LPX still converted a meaningful chunk of that into free cash flow—$358 million to be exact—after accounting for $206 million in capital expenditures.

On the financing side, LPX continued returning capital aggressively. It spent $260 million on share repurchases over the past year while steering clear of new debt issuance or repayments, suggesting no pressing liquidity concerns. With investing cash flow at a manageable outflow of $206 million, mostly due to CapEx, the company closed the period with $262 million in cash. This balance underscores its ability to fund operations and shareholder returns without stretching the balance sheet.

Analyst Ratings

Louisiana-Pacific Corporation (LPX) has recently caught the attention of Wall Street analysts, resulting in a few notable rating shifts and price target updates. 🟢 On May 7, 2025, Loop Capital shifted its stance from “Hold” to “Buy,” pairing that upgrade with a fresh price target of $110. The move highlights growing confidence in LPX’s product positioning and its resilience in a still-uncertain housing market.

🏁 Also on May 7, RBC reiterated its “Outperform” rating and nudged its target from $114 to $115. While not a massive jump, the slight increase signals steady optimism in LPX’s ability to deliver value, particularly through its premium siding and engineered wood products.

📉 A few weeks earlier, Truist Securities trimmed its target from $126 to $112, though it maintained a “Buy” rating. That adjustment reflects a bit more caution on near-term earnings, likely tied to volume softness or pricing pressure, but it’s clear they still see upside over the long run.

🎯 Overall, LPX sits with a consensus rating of “Hold” and an average price target of $107.38. That suggests nearly 19% upside from current levels. Targets vary from $75 on the low end to $123 on the high end, capturing a broad range of sentiment depending on how analysts weigh housing cycle dynamics and demand recovery.

Earning Report Summary

Siding Holds Strong

Louisiana-Pacific’s latest earnings update was a bit of a mixed bag, but there’s no doubt the Siding business continues to carry the weight. In the first quarter of 2025, the Siding segment grew by 11% compared to the same period last year, bringing in $402 million. That bump came from more volume—about 9% more—and a modest 2% improvement in pricing. Products like ExpertFinish are pulling their weight, now making up 10% of siding volume and 15% of total siding sales. The Naturals Collection, with its softer, prefinished tones, is catching on too. It already accounted for 14% of siding volume in the quarter.

Leadership sounded confident about what’s ahead. CEO Brad Southern noted strong momentum in orders heading into Q2, pointing to a healthy pace in new home construction and signs of life returning in the shed market. He described the order file for siding as one of the strongest they’ve seen.

OSB Feels the Pressure

It wasn’t all smooth sailing, though. The OSB segment ran into some headwinds. Revenue there dropped 15% to $267 million, driven mostly by an 11% price decline and a slight 4% dip in volume. That hit profitability pretty directly—Adjusted EBITDA came in at $54 million, down 40% from last year. Margins also took a hit, sliding from 29% down to 20%. Management tied this to a slow start in the U.S. building season and continued softness in OSB pricing across the market.

The Big Picture

On the whole, LPX posted $724 million in net sales—about flat from a year ago. Net income slid 16% to $91 million, or $1.30 per share. Adjusted EBITDA was down slightly to $162 million, largely because of the dip in OSB performance. Still, the company’s financial foundation looks sturdy. LPX finished the quarter with $1 billion in available liquidity, including $256 million in cash. They spent $64 million on capital expenditures and returned $81 million to shareholders between dividends and buybacks.

Looking Ahead

As far as the rest of the year goes, LPX expects the siding momentum to continue. Second-quarter siding revenue is forecast to land between $445 million and $455 million. Full-year siding revenue is expected to top $1.7 billion, with EBITDA somewhere in the $425 to $435 million range. They also flagged a $12 million headwind from tariffs but are already working to offset the impact.

Management Team

Louisiana-Pacific Corporation (LPX) is guided by a leadership group with deep experience in building materials and a strong track record of execution. Brad Southern, Chair and CEO, has been with the company since 1999 and stepped into the CEO role in 2017. His background spans operations and strategic planning, and under his leadership, LPX has continued its pivot toward higher-margin, value-added products.

Alan Haughie, the Executive Vice President and CFO, brings decades of financial leadership to the table. Since joining LPX in 2019, he’s helped steer the company through volatile market cycles with a steady hand, relying on prior experience from companies like ServiceMaster and Federal-Mogul.

Jason Ringblom, who became President in April 2025, has been with LPX for over two decades. He has played a major role in growing the siding business, and his promotion reflects the company’s emphasis on building out this segment. Nicole Daniel, serving as SVP, General Counsel, and Corporate Secretary, leads LPX’s legal and governance efforts. Her experience across manufacturing industries adds a practical edge to LPX’s compliance and legal framework.

Leslie Davis, the VP, Controller, and Chief Accounting Officer, oversees the financial reporting and accounting functions. She joined in 2020 and brings strong internal controls and audit oversight, critical for keeping LPX’s financials tight and transparent.

Valuation and Stock Performance

At the end of May 2025, LPX shares were trading around $90.02, reflecting a modest uptick from the previous session. Over the past year, the stock has seen both highs and lows, ranging between $78.82 and $122.87. This reflects the broader volatility in housing-related equities and sentiment tied closely to construction trends.

The company is currently valued at roughly $6.24 billion. Analysts tracking the stock have placed a consensus 12-month price target of $108.13, suggesting some potential upside from where it stands today. That target aligns with cautious optimism about the siding business, while factoring in continued softness in the OSB segment.

From a valuation perspective, LPX trades at a forward P/E ratio of 19.46 and holds a price-to-book multiple of 3.69. These numbers are well within reason for the sector and show that the market hasn’t priced in aggressive growth expectations, but there’s recognition of the quality in earnings, especially from the more stable siding segment. Recent market sentiment reflects a balance between near-term caution and long-term potential.

Risks and Considerations

LPX, like any company tied to construction and housing, carries a set of macro risks. Demand for its products is tied closely to the health of residential building, renovations, and repair work. If interest rates rise or housing starts slow down, revenue and margins can feel the squeeze. These cycles aren’t new to LPX, but they remain a constant variable.

Volatility in raw material pricing, especially in wood products, can also make forecasting margins a challenge. When commodity costs spike, the company may not always be able to pass those through to customers right away. That dynamic has played a role in the softer OSB performance of late.

LPX also operates in a space with a fair amount of competitive pressure. Domestic and global players are all vying for contractor loyalty, shelf space, and builder preference. The company needs to continue investing in product innovation and service to maintain its edge. Environmental regulations add another layer of complexity. Compliance with both federal and state-level rules around sustainability and emissions requires ongoing attention and investment.

Final Thoughts

LPX is navigating through a transitional period. The Siding business is clearly the standout right now—driving growth, margin strength, and investor confidence. OSB, on the other hand, is facing a tougher backdrop, and how quickly that stabilizes will influence sentiment moving forward.

The management team has shown it can steer the company through cyclical challenges while still investing for the future. With a solid balance sheet, ongoing buybacks, and a growing dividend, LPX continues to position itself as a reliable, long-term holding in the building materials space.

For those following the company, attention will stay focused on housing market data, pricing dynamics in the OSB segment, and the company’s ability to maintain momentum in siding. The core of LPX’s story hasn’t changed: strong products, thoughtful leadership, and a deliberate approach to capital allocation. Those fundamentals provide a sturdy base for whatever market conditions come next.