Updated 5/29/25

Linde plc is a global leader in industrial gases, supporting a wide range of sectors from healthcare and energy to electronics and manufacturing. With a strong presence in over 100 countries, the company operates through a combination of on-site, merchant, and packaged gas solutions, alongside a robust engineering division that supports large-scale gas infrastructure projects. It’s a capital-efficient business built on high-margin, recurring revenue, and solid customer relationships.

Under the leadership of CEO Sanjiv Lamba, Linde continues to deliver consistent earnings growth and return capital to shareholders through a reliable and growing dividend. With a well-covered payout, strong cash flows, and a disciplined approach to capital allocation, the company remains a core holding for income-focused investors.

Recent Events

In the first quarter of 2025, Linde posted year-over-year revenue growth of just 0.10%. That number might seem underwhelming at first glance, but it actually reflects Linde’s disciplined approach. Even in a more sluggish industrial environment, the company keeps improving the quality of its earnings. Operating margins came in strong at 28.29%, and net profit margins are holding steady at a healthy 20.02%.

Earnings per share reached $13.78 on a trailing basis, with modest growth of 2.80% over the same quarter last year. The company’s ability to generate $12.82 billion in EBITDA while maintaining high margins speaks volumes about its operating efficiency.

Linde’s cash generation remains a key strength. It pulled in nearly $9.63 billion in operating cash flow over the past year, with $3.41 billion in levered free cash flow. That level of cash gives Linde plenty of breathing room to invest in future projects, pay down debt, and of course, keep rewarding shareholders.

Key Dividend Metrics

🪙 Forward Dividend Yield: 1.30%

📈 5-Year Average Yield: 1.36%

💵 Forward Annual Dividend: $6.00 per share

📆 Next Ex-Dividend Date: June 4, 2025

💰 Payout Ratio: 41.15%

📅 Next Dividend Payment: June 18, 2025

🔄 Dividend Growth Track Record: Over 30 years (including legacy firms)

Dividend Overview

While Linde’s dividend yield isn’t jaw-dropping at 1.30%, there’s a lot to like here if you’re focused on long-term stability. This is a company that backs its dividend with real earnings power and disciplined financial management.

With a payout ratio a touch over 41%, the dividend isn’t stretched thin. There’s enough room for Linde to reinvest in its operations, fund strategic growth projects, and still return cash to shareholders. That’s the kind of flexibility income investors should value.

Linde isn’t just throwing money at shareholders. It’s doing so in a way that shows clear intent to protect and grow the payout over time. In a sector that often deals with cyclical pressures and capital-intensive operations, the consistency of Linde’s dividend stands out.

With 87% of shares held by institutions, it’s clear that large investors see the company as a reliable performer. That type of vote of confidence doesn’t come easily and usually reflects a track record of earnings durability and capital discipline.

Dividend Growth and Safety

One of the most attractive qualities of Linde’s dividend is how reliably it grows. Investors have watched the payout steadily increase over time, often with mid-to-high single-digit hikes. That growth hasn’t been flashy, but it has been dependable—and in the world of income investing, that counts for a lot.

Over the past five years, Linde’s yield has hovered around 1.36%, even as the stock has climbed. That’s a sign that earnings have been growing in lockstep with payouts, keeping everything balanced.

What really makes the dividend feel secure is the company’s free cash flow coverage. Linde isn’t relying on debt to fund payouts. It’s generating enough cash organically to keep dividends flowing without compromising its ability to invest for the future. That’s backed up by nearly $5.3 billion in cash on the balance sheet.

Linde’s current ratio sits just under 1.0, which means it’s managing working capital efficiently. There’s no excess baggage on the books, but also no sign of cash flow strain.

With projects in hydrogen and decarbonization already underway, there’s a clear path for new revenue streams to support future dividend hikes. As those investments mature, the added cash flow could boost the payout without breaking a sweat.

For income-focused investors looking for something they can hold through market cycles, Linde offers a rare combination: consistent dividend growth, strong balance sheet fundamentals, and a management team that knows how to deliver value over the long haul.

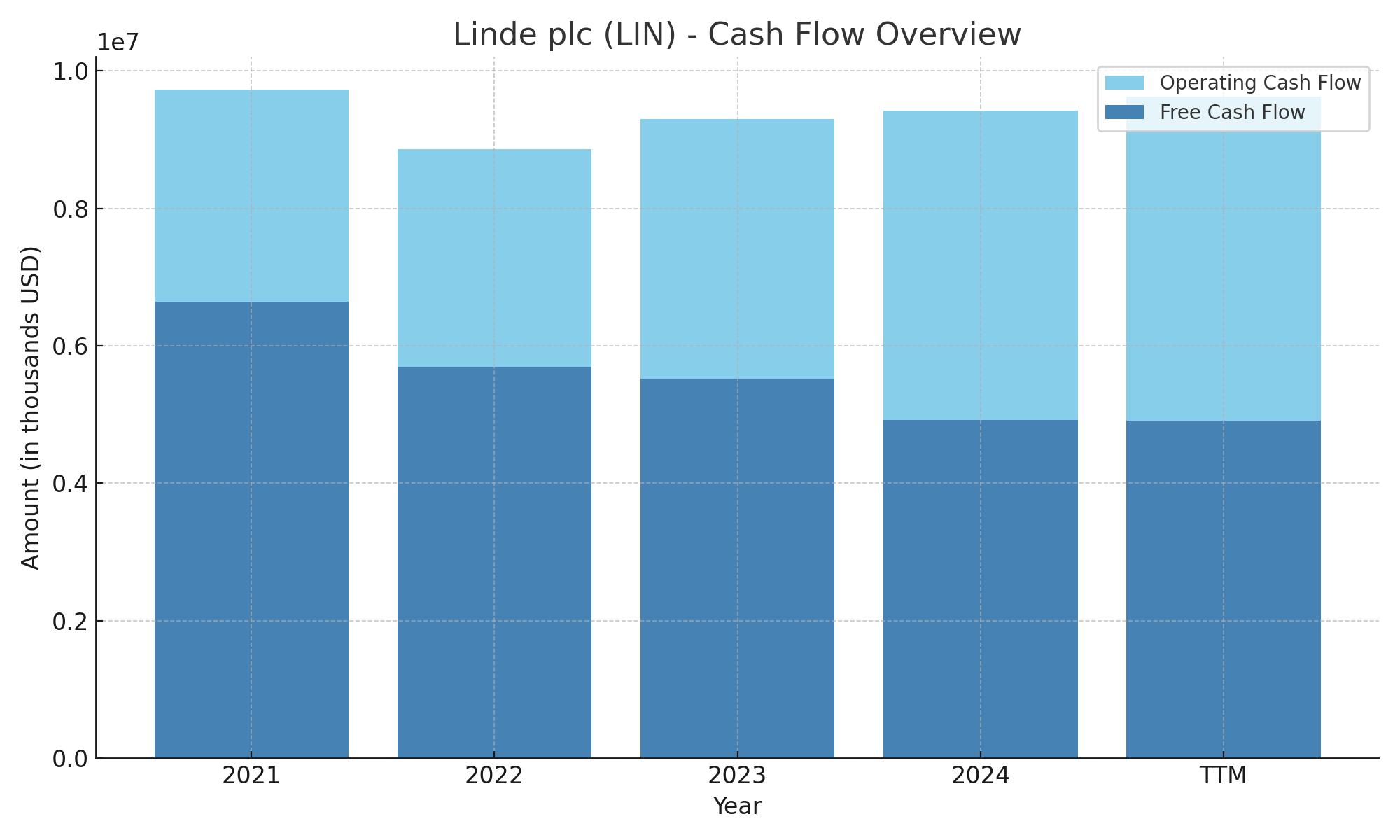

Cash Flow Statement

Linde generated $9.63 billion in operating cash flow over the trailing 12 months, slightly higher than the prior year. This level of consistency in cash generation points to the company’s operational strength and efficiency across varying industrial conditions. Capital expenditures for the same period came in at $4.72 billion, a modest increase year-over-year, signaling continued investment in infrastructure and long-term growth projects. After these investments, Linde retained $4.91 billion in free cash flow, which gives it plenty of flexibility to fund dividends, reduce debt, or support share buybacks.

On the financing side, cash outflows totaled $4.08 billion, mostly due to share repurchases and debt repayments, partially offset by new debt issuance of $4.73 billion. This balanced capital allocation reflects a disciplined approach, ensuring shareholder returns while managing leverage. The company ended the period with $5.43 billion in cash on hand, a solid cushion that reinforces its financial stability. Despite a dip in free cash flow from its peak in 2021, Linde continues to produce strong, consistent results that support its shareholder-friendly policies.

Analyst Ratings

📊 Linde plc has recently seen several shifts in analyst sentiment. On May 2, 2025, JPMorgan reiterated its Buy rating but made a small downward adjustment to its price target, trimming it from $480 to $470. The move wasn’t due to any red flags in the company’s fundamentals, but rather a more conservative outlook given current market dynamics. At the same time, Mizuho revised its target from $530 to $510, attributing the change to tempered expectations around short-term earnings momentum.

💡 Even with these adjustments, the overall tone remains constructive. Analysts continue to see Linde as a steady compounder with long-term upside. The company’s resilience and ability to generate consistent cash flow remain central to its appeal. It’s not immune to broader industrial slowdowns, but its diversification across sectors and regions softens the impact.

📈 The average 12-month price target for Linde now sits at $503.11, pointing to a potential upside of around 8.78% from the current price of $462.51. Targets range from a low of $475 to a high of $530, reflecting cautious optimism. In terms of consensus, the stock carries a “Moderate Buy” rating. Out of 12 analysts covering the name, 9 recommend buying, while 3 suggest holding. There are currently no sell recommendations.

Earnings Report Summary

Steady Revenue, Solid Execution

Linde’s first quarter of 2025 wasn’t about fireworks—it was about consistency. Revenue came in at $8.1 billion, holding steady from the same time last year. It might look flat at first glance, but when you peel it back, there’s a bit more to the story. Underneath that headline number, pricing increased by 2%, helping to offset a slight dip in volume. Some areas like manufacturing and metals saw a pullback, but pricing strength kept things balanced overall.

Operating profit hit $2.4 billion, up 4% from last year. That growth came down to smart execution—specifically, strong pricing strategies and productivity improvements. Margins improved too, climbing to just over 30%, which is no small feat in a mixed industrial environment. Earnings per share rose 5% to $3.95, and if you take out the currency impact, the increase was closer to 8%. On the cash side, Linde generated $2.2 billion in operating cash flow, with free cash flow coming in just shy of $900 million after capital spending.

Regional and Segment Highlights

In the Americas, Linde saw a 3% bump in revenue, with steady volume and pricing holding up well. Europe, the Middle East, and Africa didn’t fare as strongly revenue slipped 3% in that region, largely due to softness in chemicals and metals. The Asia-Pacific region also saw a 3% drop in sales, with manufacturing demand pulling back a bit.

One of the stronger areas was Linde’s engineering business. Revenue there came in at $565 million, up 5% from last year. Margins looked solid at just over 20%, and the real story was the backlog. The company is sitting on over $10 billion in future projects, the majority of which are long-term gas supply contracts. That pipeline sets them up nicely for future growth.

Looking Ahead

For the second quarter, Linde expects EPS between $3.95 and $4.05. That’s a modest gain over last year’s second quarter, but it’s still trending in the right direction. Full-year guidance was left unchanged, with the company projecting earnings per share to land between $16.20 and $16.50. If currency exchange rates stay stable, they’re targeting 6% to 8% growth for the year.

Capital spending is expected to fall between $5.0 billion and $5.5 billion in 2025, much of which will go toward expanding their gas supply network and maintaining existing infrastructure.

CEO Sanjiv Lamba summed up the quarter by emphasizing Linde’s resilience. Despite a few economic headwinds, he noted that the company managed to expand margins, grow earnings, and maintain its momentum. His message was clear: Linde has the playbook to keep delivering, no matter what the broader environment throws at them.

Management Team

Linde plc’s leadership is headed by CEO Sanjiv Lamba, who stepped into the role in March 2022. With over 30 years of experience in the industrial gases industry, Lamba has a reputation for steady leadership and a deep understanding of Linde’s operations. Since taking the reins, he’s emphasized operational discipline and a strong focus on execution, keeping the company agile and forward-thinking amid global economic shifts.

The executive team working alongside him includes Matt White, Executive Vice President and Chief Financial Officer, who oversees the company’s financial health and strategic planning. Guillermo Bichara serves as Executive Vice President and Chief Legal Officer, playing a key role in risk management and corporate governance. Jürgen Nowicki, CEO of Linde Engineering, leads the company’s engineering arm with a sharp focus on efficiency and technical innovation. Collectively, this management team continues to reinforce a culture of accountability and long-term value creation.

Valuation and Stock Performance

Linde’s share price is hovering around $462 as of the end of May 2025. The stock has climbed roughly 10% year-to-date, outpacing broader market indices and reflecting investors’ ongoing confidence in the company’s stable cash flow and strategic vision. That kind of steady appreciation is exactly what long-term dividend and value investors look for in a mature, well-managed business.

Valuation metrics show that Linde trades at a premium to some of its industrial peers. With a trailing price-to-earnings ratio of 33.56 and a forward P/E of 28.17, the market clearly values Linde’s consistency and potential for continued growth. These multiples suggest that investors are paying up for quality—and based on performance trends, many seem to believe that premium is well justified.

Analyst sentiment is generally positive. The average 12-month price target sits around $503, implying an 8.8% upside from current levels. Targets range from $475 to $530, reflecting a mix of cautious and more bullish outlooks depending on economic expectations and Linde’s ability to keep executing on its long-term growth initiatives.

Risks and Considerations

No investment is without its risks, and Linde is no exception. Legal exposure is one of the key areas to watch. Like many global industrial companies, Linde could be impacted by product liability claims, especially in more litigious regions such as the U.S. These types of issues are part of the territory when operating across diverse sectors and regulatory environments.

Operationally, Linde must guard against disruptions in its production facilities and supply chain. Accidents, equipment failures, or cybersecurity incidents could have real consequences on both output and reputation. These are low-frequency but high-impact risks that management works continuously to mitigate.

On the geopolitical front, international tensions and disputes can unexpectedly surface. A recent case in Russia, where a court froze over a billion dollars in assets tied to a Linde subsidiary, underscores how international exposure can sometimes create legal and financial complications.

Environmental and social governance is another layer to consider. Linde has earned praise for its ESG practices, but it still faces a medium level of exposure due to the nature of its operations. Maintaining high standards in sustainability and compliance will remain essential as investors and regulators continue to elevate their expectations.

Final Thoughts

Linde stands out in the industrial space for its consistent performance, global reach, and strong leadership. The management team has kept the company on solid footing through economic ups and downs, and the stock’s steady climb reflects that trust from investors. Valuation may be on the higher side, but it’s backed by solid earnings, strong margins, and a disciplined capital strategy.

While risks are present—ranging from legal liabilities to geopolitical and operational uncertainties—the company’s track record suggests it’s well-prepared to navigate them. For investors who value stability, efficient capital allocation, and reliable income growth, Linde continues to be a compelling name worth keeping on the radar.