Updated 2/24/26

Leidos Holdings, Inc. operates at the intersection of defense, technology, and government services, generating over $17 billion in annual revenue with clients that include major U.S. federal agencies. Backed by consistent earnings, a growing backlog, and a low beta, it offers stability with a forward-looking growth strategy. The company’s focus spans cyber operations, digital modernization, energy infrastructure, and national security, aligning closely with current government spending priorities.

Recent Events

Leidos has continued to build on its financial momentum heading into 2026. Revenue for the trailing twelve months reached $17.17 billion, a meaningful step up from prior periods, and net income climbed to $1.45 billion. EPS came in at $11.15, reflecting strong operational execution across the company’s core segments. These aren’t flashy, speculative numbers — they’re the product of long-term contract execution and disciplined cost management.

Margins remain a bright spot. Profit margin is running at 8.43%, and the company is generating $1.75 billion in operating cash flow. Return on equity sits at a robust 31.03%, which speaks to how efficiently Leidos is deploying the capital it has available. These figures hold up well against peers in the defense and government IT services space.

The stock has had a wide range over the past year, trading between $123.62 and $205.77. At the current price of $174.13, shares are sitting comfortably above the 52-week low but meaningfully below the highs, which creates an interesting entry point given the analyst consensus. The stock’s beta of 0.62 continues to make it one of the more stable large-cap names in the sector, an attribute that income-focused investors tend to appreciate when broader market volatility picks up.

Key Dividend Metrics

📈 Forward Yield: 0.95%

💵 Annual Dividend (Forward): $1.66

📆 Last Dividend Payment: $0.43 per share

🧮 Payout Ratio: 14.63%

🔁 5-Year Average Yield: 1.34%

🔒 Cash Flow Coverage: Strong, with $1.75 billion in operating cash flow

📉 Free Cash Flow: $1.11 billion, providing ample dividend coverage

The headline yield is modest at under 1%, but the underlying picture is considerably more compelling. The payout ratio of 14.63% is among the most conservative in the sector, and the free cash flow generation leaves substantial room for continued dividend growth. This is a dividend being paid from a position of real strength, not necessity.

Dividend Overview

A yield of 0.95% won’t turn heads among investors hunting for high current income, but framing the Leidos dividend purely around yield misses the point. The more important story is how conservatively this dividend is funded and how much room exists for it to grow over time.

With a payout ratio below 15% and free cash flow exceeding $1.1 billion, the company is paying out a fraction of what it could theoretically afford. That gap between earnings and dividend obligation is a cushion that protects shareholders during periods of earnings pressure and supports future increases without requiring any meaningful sacrifice elsewhere in the capital allocation framework.

Leidos raised its quarterly dividend to $0.43 per share in December 2025, up from the $0.40 it had been paying since late 2024. That step-up, while measured, continues the company’s pattern of deliberate and consistent dividend growth. There are no sharp lurches upward, no cuts, and no drama — just a steady, disciplined cadence that long-term holders can depend on.

The current yield sitting below the five-year average of 1.34% reflects the stock’s price appreciation over time rather than any deterioration in the dividend itself. For investors focused on total return, this is a constructive signal about how the market views the company’s earnings quality and durability.

Dividend Growth and Safety

The dividend history tells a clean and consistent story. Leidos paid $0.36 per quarter through most of 2023, raised to $0.38 in December 2023, moved to $0.40 in December 2024, and then stepped up again to $0.43 in December 2025. That’s three consecutive annual increases, each one modest but meaningful, reflecting a management team that takes shareholder returns seriously without overextending the balance sheet.

Safety is not a concern here in any meaningful sense. A payout ratio of 14.63% against EPS of $11.15 gives the dividend an extraordinary degree of protection. Even if earnings were to decline sharply — a scenario that seems unlikely given the company’s contract backlog and recurring revenue model — the dividend would remain well-covered. That kind of structural safety is rare at any yield level.

Free cash flow of $1.11 billion provides an additional layer of confirmation. The company is generating real cash, not just accounting income, and that cash more than covers the dividend obligation many times over. Operating cash flow of $1.75 billion further reinforces how much internal capacity Leidos has to fund its capital return programs without leaning on external financing.

The debt load deserves acknowledgment. Leidos carries meaningful leverage, which is not unusual for a company of its scale operating in the government services sector, where contract durations are long and cash flows are predictable. The key question with elevated debt is always whether the cash flow can service it comfortably, and in Leidos’ case, the answer is clearly yes.

With return on equity at 31.03% and return on assets at 9.90%, the business is generating impressive returns on what it has deployed. These metrics suggest that management is allocating capital productively and that the earnings base supporting the dividend is grounded in genuine business performance rather than financial engineering.

For dividend growth investors, Leidos offers something that’s genuinely underappreciated: a low-payout, cash-rich company with a stable government contract base that has both the means and the track record to keep raising its dividend year after year.

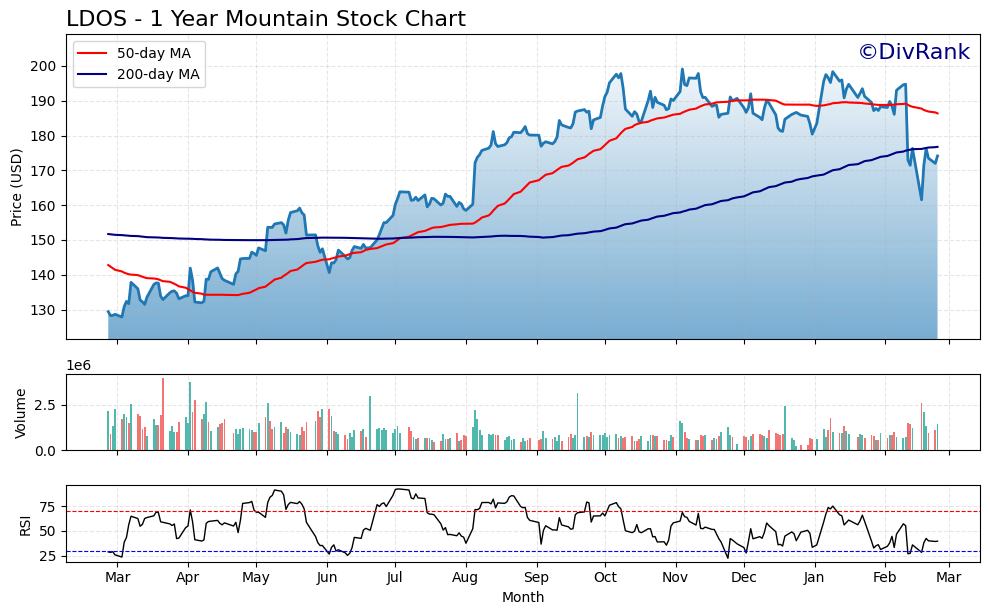

Chart Analysis

Leidos has had a volatile but ultimately constructive twelve months, climbing from a 52-week low of $127.90 before reaching a peak of $199.10, a range that reflects both the broader defense sector’s sensitivity to budget and contract news and the stock’s own execution momentum. The current price of $174.13 sits roughly 12.5% off that high, meaning the shares have given back a meaningful portion of the year’s gains but remain 36% above their lows. That context matters for dividend investors: the pullback has arrived from a position of strength rather than fundamental deterioration, and the price action suggests a stock consolidating after a strong run rather than one in structural decline.

The moving average picture is mixed but carries a bullish undertone. The 50-day moving average at $186.36 and the 200-day moving average at $176.75 are configured in a golden cross formation, meaning the 50-day sits above the 200-day, which is a classically constructive longer-term signal. However, the current price of $174.13 has slipped below both averages, putting LDOS in a position where it needs to reclaim the 200-day near $176.75 to restore near-term confidence. A clean hold and recovery above that level would indicate the recent weakness is a temporary dip into support rather than the beginning of a more sustained downtrend.

The RSI reading of 39.75 places LDOS close to technically oversold territory, which is generally the zone where income-oriented buyers begin to pay attention. The stock has not yet crossed the 30 threshold that would signal a classic oversold condition, but the direction of momentum is worth watching closely. Readings in the high 30s often precede either a stabilization and bounce or a final flush lower before buyers step in, and for patient dividend investors willing to average into positions, this range has historically offered better forward entry points than chasing strength at elevated RSI levels.

For dividend investors, the current setup presents a measured opportunity rather than an urgent call to action. The yield has expanded as the price has pulled back, improving the income proposition relative to where it stood near the 52-week high. The golden cross structure suggests the longer-term trend remains intact, but reclaiming the 200-day moving average around $176.75 would provide a more confident signal that the dip has run its course. Investors already holding LDOS for its dividend growth profile have little reason for alarm at current levels, while those building a position may find the RSI compression and proximity to the 200-day a reasonable starting point for initiating or adding to exposure.

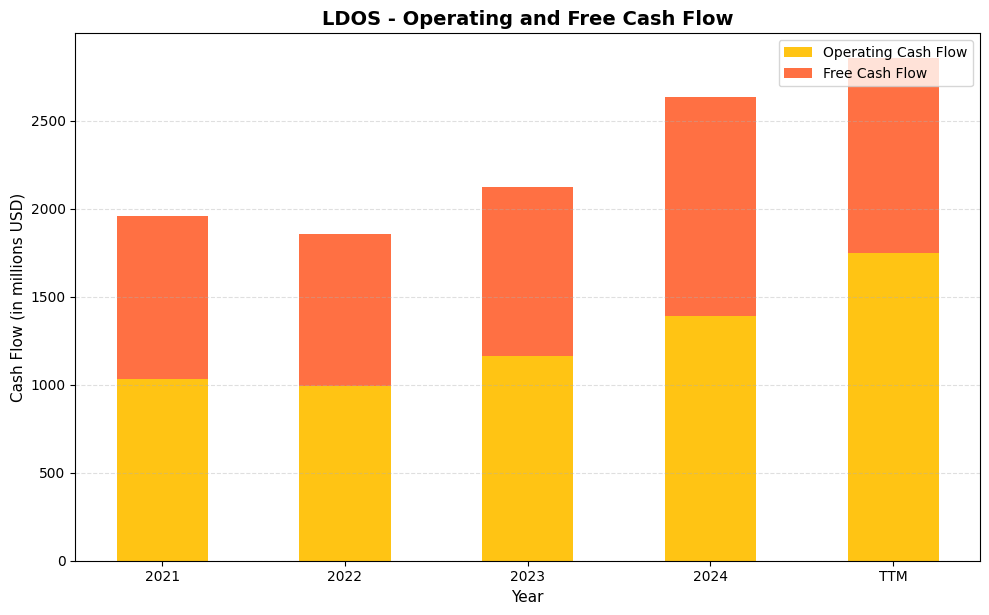

Cash Flow Statement

Leidos has built a genuinely impressive cash generation track record over the past four years, and the numbers make a strong case for dividend sustainability. Operating cash flow climbed from $1,033.0 million in 2021 to $1,392.0 million in 2024, a gain of roughly 35% over that span, with the TTM figure surging to $1,750.0 million. Free cash flow followed a similar trajectory, rising from $929.0 million in 2021 to $1,243.0 million in 2024 before settling at $1,105.6 million on a TTM basis. Even at the more conservative TTM free cash flow figure, Leidos is generating well over a billion dollars annually after capital expenditures, which provides substantial headroom above the dividend obligation. For income investors, that kind of coverage is exactly what you want to see underneath a growing payout.

The broader trend here speaks to a business that is converting revenue into cash with increasing efficiency. The one dip in 2022, when operating cash flow slipped to $992.0 million and free cash flow fell to $863.0 million, proved to be temporary and was followed by two consecutive years of meaningful acceleration. The spread between operating cash flow and free cash flow has remained relatively tight throughout the period, which indicates that capital expenditure requirements are modest relative to the size of the business, a characteristic typical of government services and technology firms. The jump in TTM operating cash flow to $1,750.0 million is particularly encouraging, as it suggests the underlying earnings quality is strengthening. Shareholders are effectively backed by a cash engine that has shown both resilience and growth, which is a combination that supports continued dividend increases and opportunistic capital returns going forward.

Analyst Ratings

The analyst community remains constructive on Leidos, with a consensus buy rating across 13 covering analysts. The average price target of $214.00 implies upside of roughly 23% from the current price of $174.13, which is a meaningful gap and suggests the street sees the recent pullback from the 52-week high as an opportunity rather than a warning sign.

The price target range spans from $185.00 on the low end to $235.00 at the top, indicating a fairly wide spread of views but with even the most cautious analysts seeing upside from current levels. The low target of $185.00 still represents more than 6% above where the stock trades today, which means there is no analyst in the coverage universe currently pricing in further downside from here.

The broader consensus picture, combining the buy rating with a mean target that sits well above the current price, reflects confidence in Leidos’ contract backlog, earnings trajectory, and free cash flow profile. The stock’s current position near the lower end of its 52-week range, combined with this level of analyst support, makes a reasonable case that the risk-reward is skewed favorably for patient investors at the $174 level.

Earnings Report Summary

Leidos closed out its most recent fiscal period with full-year revenue of $17.17 billion, net income of $1.45 billion, and EPS of $11.15. Those headline numbers reflect a company that has continued to grow its top line while simultaneously expanding its profit margins, a combination that speaks to both market positioning and operational discipline. Revenue growth has been broad-based across the company’s key segments, with national security, health, and digital modernization all contributing to the overall advance.

Strong Margins and Backlog

Profit margin of 8.43% represents a strong showing for a government IT services business operating in a competitive contracting environment. Return on equity of 31.03% is particularly notable, indicating that the company is generating exceptional returns on shareholder capital relative to the asset base it’s working with. The backlog position remains a key differentiator, providing multi-year revenue visibility that underpins both earnings estimates and dividend confidence among investors.

CEO Insights and Strategy

CEO Thomas Bell has maintained a clear and consistent strategic message centered on the company’s NorthStar 2030 framework. That strategy prioritizes five growth areas: space and maritime systems, energy infrastructure, digital modernization and cyber, customized critical mission software, and managed health services. Bell’s emphasis on aligning these focus areas with documented national security priorities gives the strategy credibility beyond standard corporate planning, as it ties Leidos directly to where government clients are actively allocating budget.

Strategic Moves and Segment Highlights

The company has continued to pursue targeted acquisitions to deepen its capabilities in high-value areas, particularly in the cyber domain where demand from federal clients is accelerating. These strategic moves reflect a management team that is willing to invest for the long term while maintaining the financial discipline that investors in this sector expect. Integration execution remains a focus, with leadership emphasizing cultural alignment and revenue synergy capture as priorities in any deal framework.

Across segments, the pattern of broad-based growth continues. Digital and national security operations remain the largest contributor to overall revenue, while health and civil services and the commercial and international unit have both demonstrated above-average growth rates. The diversification across these segments reduces single-program concentration risk and gives the company multiple levers for growth even in periods where one area faces headwinds.

Capital Allocation and Outlook

Capital allocation remains disciplined. Operating cash flow of $1.75 billion gives management substantial flexibility, and the company has demonstrated a consistent preference for balancing debt management, share repurchases, and dividend growth rather than concentrating resources in any single area. Full-year free cash flow of $1.11 billion reinforces the view that shareholder return programs are well-funded and sustainable at current levels, with room to grow alongside earnings.

Management Team

The leadership team at Leidos continues to be a meaningful part of the investment case. CEO Thomas Bell, who brought deep aerospace and defense experience to the role, has maintained a sharp strategic focus on the five pillars of the NorthStar 2030 plan while keeping financial discipline front and center. His ability to articulate a coherent long-term vision while delivering consistent near-term results has built credibility with both institutional investors and the analyst community.

Bell’s background has helped shape a culture that is operationally rigorous but open to strategic investment when the opportunity merits it. The broader executive team combines long-tenured Leidos veterans with experienced professionals drawn from across the defense, technology, and government services industries. That blend of institutional knowledge and outside perspective has contributed to a management dynamic that is both steady and adaptive.

The financial results visible in the most recent period, particularly the return on equity of 31.03% and the operating cash flow of $1.75 billion, are a reflection of management’s focus on efficiency and margin discipline. Employee development and talent retention have also become more prominent priorities within the organization, with leadership recognizing that the company’s ability to win and execute complex government contracts depends heavily on the depth of its human capital bench.

Valuation and Stock Performance

At $174.13, Leidos trades at a P/E ratio of 15.62 against trailing EPS of $11.15. That is a modest multiple for a company delivering 31% return on equity, consistent free cash flow above $1 billion, and a defensible market position in government IT services. The stock is currently sitting roughly 15% below its 52-week high of $205.77, which creates a more attractive entry point than existed for much of the past year.

Price-to-book of 4.48 against a book value per share of $38.90 reflects the premium the market assigns to Leidos’ earnings power and contract base rather than its tangible assets alone. This is appropriate for a services-oriented business where the real value lies in recurring revenue streams, customer relationships, and intellectual capital rather than physical plant and equipment. The market cap of approximately $22.3 billion is well-supported by the company’s cash generation profile.

With a beta of 0.62, Leidos continues to offer lower volatility than the broader market, a characteristic that resonates with income-focused investors who prioritize capital stability alongside dividend income. The analyst consensus price target of $214.00 implies meaningful upside from current levels, and even the most conservative target in the coverage universe sits above where the stock trades today. For investors comfortable with a patient, multi-year holding horizon, the current valuation looks attractive relative to the earnings and cash flow the business is generating.

Risks and Considerations

Leidos derives the vast majority of its revenue from U.S. federal government clients, which means the company’s growth trajectory is meaningfully tied to government spending cycles and budget priorities. Continuing resolution environments, debt ceiling negotiations, or shifts in defense and health agency appropriations can create delays in contract awards and constrain the pace of new work entering the backlog. The company’s broad exposure across multiple agencies provides some diversification, but the underlying dependency on federal spending is a structural feature of the business that investors should understand clearly.

The debt load on the balance sheet warrants ongoing attention. While operating cash flow of $1.75 billion provides comfortable coverage of interest obligations, elevated leverage does create sensitivity to interest rate movements and limits financial flexibility in scenarios where earnings come under pressure. The company has managed its debt profile responsibly, but the absolute level of obligations remains a factor that could become more consequential in a stressed environment.

Acquisition integration is a recurring execution risk given the company’s appetite for strategic deals, particularly in the cyber and digital modernization space. Each acquisition brings the potential for cultural misalignment, unexpected costs, or revenue synergies that take longer to materialize than initially anticipated. Management has a reasonable track record here, but the risk is real and compounds as the pace of deal activity increases.

The competitive landscape in government IT services continues to intensify. Firms including Booz Allen Hamilton, SAIC, Raytheon Technologies, and large commercial technology providers are all competing for a similar universe of federal contracts. As agencies push for more integrated digital solutions, the definition of who qualifies as a capable partner is broadening, which introduces new competitive pressure from firms that historically operated in adjacent spaces. Leidos is well-positioned, but maintaining that position requires continuous investment in capabilities, clearances, and talent.

Final Thoughts

Leidos occupies a durable position in one of the more resilient corners of the market. Government IT services, defense technology, and managed health infrastructure are not sectors that tend to disappear when economic conditions soften, and that defensive revenue profile is a meaningful asset for long-term investors. With annual revenue now exceeding $17 billion and free cash flow above $1.1 billion, the company has the scale and cash generation to sustain and grow its capital return programs for years to come.

The dividend, while modest in yield terms, is among the most conservatively funded in the sector. A payout ratio below 15% and operating cash flow of $1.75 billion create a margin of safety that few dividend payers can match. The consistent pattern of annual increases, most recently to $0.43 per quarter in December 2025, reflects a management team that takes dividend growth seriously while keeping financial flexibility intact.

The stock’s current valuation, with a P/E of 15.62 and a meaningful discount to the analyst consensus price target of $214.00, suggests that the market is not fully pricing in the company’s earnings power or cash flow trajectory. For investors who can look past the modest headline yield and appreciate the combination of earnings quality, cash flow strength, and strategic positioning, the current setup is compelling.

Leidos is not built for investors chasing maximum yield or explosive short-term price appreciation. It is built for investors who value consistency, capital preservation, and the kind of steady compounding that comes from owning a well-run business in a sector with durable demand. On those dimensions, it continues to make a very strong case.