Key Takeaways

💰 Dividend yield has climbed to 2.93%, well above the 5-year average, with a steady growth history and a manageable 57% payout ratio.

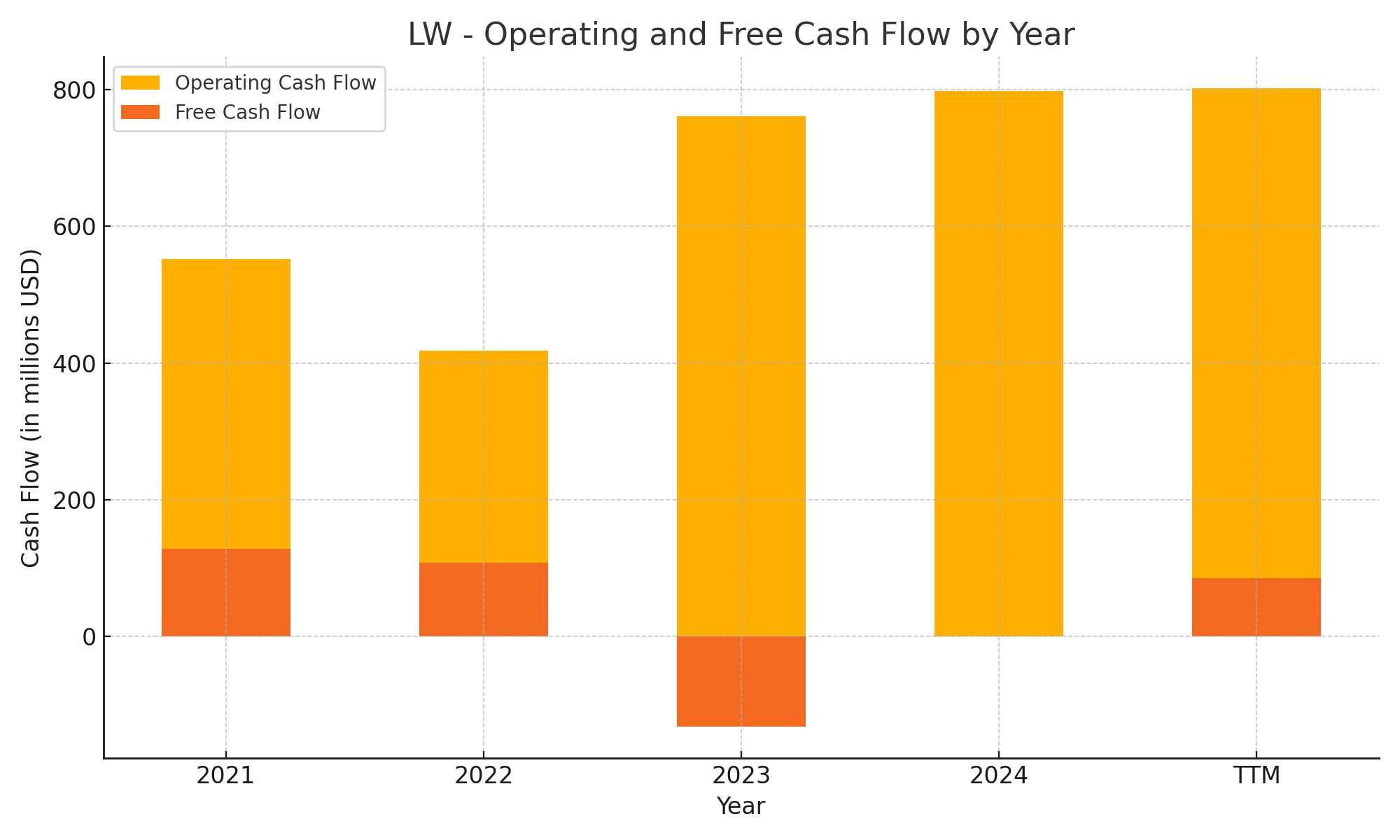

📈 Operating cash flow remains strong at $802 million TTM, supporting dividends and investment, though free cash flow is tighter due to high capital expenditures.

📊 Analysts hold a consensus “Hold” rating with a $71.08 price target, citing margin pressure and ERP-related issues, but acknowledging long-term potential.

Last Update 5/27/25

Lamb Weston Holdings (NYSE: LW) is a global leader in frozen potato products, serving restaurants, retailers, and distributors across more than 100 countries. The company has a strong operational backbone and a long-standing presence in the foodservice industry, bolstered by consistent cash flow and a disciplined dividend strategy. Despite facing recent operational setbacks and margin pressures, it continues to generate solid earnings from its core business.

Shares have fallen significantly from their highs, pulling the dividend yield up to nearly 3% – well above the five-year average. Management is actively addressing customer service disruptions tied to a recent ERP system rollout, while also taking steps to rebuild volumes and defend margins. With a new CEO at the helm and a renewed focus on execution, Lamb Weston is positioning itself for a steadier path forward.

Recent Events

Lamb Weston Holdings (LW) has been in an interesting spot lately. The company’s well-known for its frozen potato products—think French fries, hash browns, and other comfort food staples that stock freezers across restaurants and grocery stores. While it’s not the kind of business that makes headlines, it’s one that quietly powers through, churning out dependable revenue from a steady customer base.

But recent months haven’t been entirely smooth sailing. Margins are showing some signs of pressure. Net income margin is sitting at 5.75%, which is lower than what many investors have come to expect from a company that usually enjoys strong pricing leverage. Operating margins, though, are still a healthy 17%, showing the core business remains efficient.

Debt is something that’s caught attention. Total debt is up at $4.27 billion, with a debt-to-equity ratio that’s well over 260%. That might sound hefty, but the bigger picture offers some calm—Lamb Weston has a current ratio of 1.35, so near-term liabilities aren’t a red flag. More importantly, the company generated over $800 million in operating cash flow over the past year, which gives it breathing room to manage both its dividend and its debt commitments.

There’s also been some earnings softness. The most recent quarter saw a year-over-year dip of about 0.1% in earnings, a small slip, but something to monitor. It’s not an indication of deep trouble, just a sign the business is recalibrating in a post-pandemic environment where supply chains, input costs, and consumer patterns are still shifting.

Key Dividend Metrics

📈 Forward Yield: 2.93%

💵 Annual Dividend: $1.48

📊 Payout Ratio: 56.86%

⏳ 5-Year Average Yield: 1.43%

🔁 Dividend Growth Trend: Positive

🧾 Dividend Date: May 30, 2025

🚫 Ex-Dividend Date: May 2, 2025

Dividend Overview

For investors focused on income, Lamb Weston’s dividend story is becoming a lot more compelling. The yield has climbed to nearly 3%—a significant jump from its five-year average of just over 1.4%. This uptick isn’t because the company suddenly got more generous. It’s the result of the share price falling, which naturally pushes the yield higher. That makes now an interesting time to look at the stock from a yield perspective.

At $1.48 per share annually, the dividend payout isn’t huge, but it’s solid—and importantly, it’s sustainable. The payout ratio stands at about 57%, which gives Lamb Weston enough flexibility to keep paying shareholders while also reinvesting in the business or weathering any temporary downturns.

This isn’t a company chasing attention with flashy special payouts or unpredictable dividend changes. Instead, they’ve steadily nudged the dividend upward over time, rewarding long-term holders with consistent increases. That sort of discipline speaks volumes about management’s priorities.

Dividend Growth and Safety

Stability and consistency are the themes here. Lamb Weston’s dividend growth over the past few years has been methodical. No wild swings, just a steady upward trend that reflects a company with confidence in its cash flow and a clear long-term view.

The fundamentals backing the dividend are sound. Operating cash flow is strong, which gives the company room to invest, pay down debt, and still return cash to shareholders. Free cash flow is on the lower side, but that’s mainly due to capital investments and servicing debt—both manageable, given the company’s size and the cash it continues to pull in.

Return on equity stands at 21.64%, a strong signal that management knows how to put investor capital to work. Return on assets is lower at 7.37%, but that’s expected in a capital-heavy industry like food production. What matters is that Lamb Weston continues to generate returns without overextending itself.

What’s also worth noting is the low beta—just 0.46. That means this stock doesn’t whip around like some of the more volatile names out there. For dividend investors, that’s a plus. You want stability, especially when your focus is on income, and Lamb Weston fits that profile.

Institutional ownership sits above 97%, another quiet but meaningful signal. When large money managers stay invested, it usually reflects confidence in the company’s ability to keep delivering on shareholder value, including dividends.

Cash Flow Statement

Lamb Weston’s trailing twelve-month cash flow paints a picture of a business still generating healthy cash from its core operations, with $802 million in operating cash flow. That number has grown steadily over the past few years, showing resilience even as the company deals with macro pressures. But while the top line of the cash flow statement looks strong, the story shifts when you move down to investing activities. Capital expenditures surged to $716.5 million, keeping free cash flow at a relatively modest $85.5 million. It’s clear they’ve been pouring money back into the business—likely for expansion and efficiency upgrades.

On the financing side, debt plays a central role. The company issued nearly $1.7 billion in debt while also repaying over $1.27 billion, showing an active approach to managing its capital structure. Share repurchases remain part of the mix as well, with $254 million returned through buybacks. That level of activity, coupled with a sharp drop in cash reserves—from $304.8 million a year ago to just $67.3 million—reflects a company that’s staying aggressive with its growth strategy while still finding room to support shareholders. The cash flow foundation is solid, but the investment and financing activity suggests a business in motion, not one resting on past gains.

Analyst Ratings

Lamb Weston Holdings (NYSE: LW) has seen a few analyst rating changes recently, reflecting a mixed but measured outlook. The current consensus from analysts is a “Hold,” with an average 12-month price target sitting at around $69.91 📊. That suggests a potential upside of roughly 35% from where shares are trading now.

In May 2025, Barclays kept its “Overweight” stance but lowered the price target from $69 to $61 📉. Their reasoning pointed to lingering margin pressures and continued volatility in input costs, which could weigh on earnings in the short term. Stifel also held firm on a “Hold” rating but trimmed its price target from $63 to $56 ⚖️, taking a more cautious approach in light of broader market uncertainties.

On a more upbeat note, Jefferies reiterated its “Buy” rating, although they revised the target from $80 down to $75 💵. While they acknowledged the current headwinds, they still see strong long-term potential in Lamb Weston’s business model and market position.

Altogether, the tone among analysts isn’t overly bearish—it’s more about acknowledging the challenges ahead while still seeing value if the company executes well. The stock seems to be in a wait-and-see zone, with upside potential tied closely to how well it can manage costs and protect its margins.

Earning Report Summary

Mixed Results in a Challenging Quarter

Lamb Weston wrapped up its fiscal fourth quarter with results that left a few things to unpack. Sales dropped about 5% year over year, coming in at $1.61 billion. That decline wasn’t totally unexpected, given the operational hiccups and market headwinds the company has been facing. Earnings took a harder hit, though—net income slid 74% to $130 million, or $0.89 a share. Adjusted EPS came in at $0.78, down around 40% from last year’s mark.

Still, it wasn’t all downside. Operating income actually moved higher, up 14% to $213 million. That suggests the company is finding ways to keep costs under control or drive efficiency in other parts of the business. But it’s also clear that not everything went smoothly. The rollout of a new ERP system led to some customer service issues, and the impact showed up in lost business, especially from some of their higher-margin accounts. Meanwhile, competitors weren’t standing still—they undercut pricing, adding even more pressure.

Leadership Responds With Strategy and Adjustments

CEO Mike Smith acknowledged the challenges and didn’t sugarcoat it. He pointed out that rebuilding customer trust and tightening up operations are top priorities moving forward. That includes practical steps like improving logistics, refining how they manage railcars, and making better use of cold storage facilities. It’s all part of a broader plan to lift margins and deliver stronger value to shareholders.

Looking ahead, Lamb Weston is setting expectations with a clear range. For fiscal 2025, they’re projecting sales between $6.6 billion and $6.8 billion. On the earnings side, they’re aiming for somewhere between $4.35 and $4.85 per share. They’re expecting better volume in the back half of the year, thanks to some recent wins with new customer contracts and what sounds like a healthy sales pipeline.

That said, they’re still keeping an eye on restaurant traffic, which has softened in some markets. If that trend continues, it could drag on volumes and make it harder to hit their targets. Leadership also mentioned they might tweak asset usage or spread out some capital projects to stay nimble if the market stays rocky.

Overall, while the fourth quarter brought some bumps, the company seems focused on addressing its missteps and putting the right pieces in place for a better year ahead. The tone from management was one of accountability but also determination—there’s a sense they know what needs to get fixed and are already working on it.

Management Team

Lamb Weston has made some notable changes to its leadership in recent months as it works through operational and market-related challenges. In January 2025, Mike Smith was appointed President and Chief Executive Officer. Smith has been with Lamb Weston since 2007, holding several key leadership roles over the years, including Chief Operating Officer. His long tenure gives him a deep understanding of the company’s internal mechanics and customer relationships, which is especially valuable as the company seeks to rebuild trust and improve execution.

Bernadette Madarieta continues in her role as Chief Financial Officer. She’s been part of Lamb Weston since its spin-off and has played a central role in building out the finance organization and driving its strategic financial planning. Other notable executives include Eryk Spytek, General Counsel; Steve Younes, Chief Human Resources Officer; and Benjamin Heselton, who joined recently as Chief Information Officer. Together, this team brings a blend of continuity and fresh insight as they aim to steady the ship and drive long-term value.

Valuation and Stock Performance

Lamb Weston’s stock has had a rough stretch, reflecting broader industry pressure and internal growing pains. As of May 27, 2025, the stock closed at $53.19, a 5.2% gain on the day. Still, that price is a long way from the 52-week high of $89.23, highlighting just how much investor sentiment has shifted over the past year. The market has been reacting to missed expectations, softer volumes, and implementation issues around new systems.

Analyst sentiment has become more neutral. The average 12-month price target is about $71.08, which would represent a gain of around 34% from current levels. That target signals that analysts aren’t giving up on the company, but they’re waiting to see stronger execution. Lamb Weston’s market cap sits at roughly $7.13 billion, and the stock offers a dividend yield near 2.93%. That yield is above its five-year average and adds a layer of income for long-term investors who believe in the company’s recovery strategy.

Risks and Considerations

There are several risks that investors need to be mindful of. The ERP system rollout is a big one. It’s not just a technical issue—it’s had a real impact on customer relationships and contributed to lost business. While management is actively addressing these problems, there’s still execution risk if the fixes take longer or cost more than anticipated.

Debt is another concern. The company’s debt-to-equity ratio is above 260%, putting Lamb Weston on the higher end of the spectrum in its peer group. Cash flow remains solid, which provides some cushion, but the elevated leverage means there’s less room for error if market conditions worsen or if costs creep higher. On top of that, global restaurant traffic remains soft in some regions, and competitors are aggressively pricing to win share, which could weigh on margins further.

Final Thoughts

Lamb Weston is navigating through a difficult stretch, but it’s not standing still. New leadership has taken over with a clear plan to reset customer relationships, clean up operational processes, and deliver stronger results in the future. The market has taken a cautious stance, but the fundamentals of the business—strong brands, consistent demand for its products, and meaningful cash flow—remain in place.

If the company executes well on its recovery plan, there’s reason to believe it can stabilize and rebuild shareholder confidence. Until then, investors will be watching closely to see if the improvements in leadership and operations start to show up in the numbers. The next few quarters could be telling as Lamb Weston works to turn the page and write a more stable chapter.