Updated 2/24/26

Lam Research is a vital player in the global semiconductor industry, providing etch and deposition tools that are central to chip manufacturing. With deep ties to top-tier chipmakers across Asia and North America, the company has positioned itself at the forefront of high-performance computing, AI, and advanced memory technologies. Its operations are supported by a stable management team and a disciplined financial strategy that prioritizes both innovation and shareholder returns.

The company has continued to deliver impressive financial results, with revenue surpassing $20.5 billion on a trailing basis and net income exceeding $6.2 billion. Backed by over $7.1 billion in operating cash flow and a dividend that has grown steadily over recent quarters, Lam offers a compelling mix of technology exposure and financial reliability. Analysts remain broadly constructive, with a consensus price target of $274.42 suggesting meaningful upside from current levels.

Recent Events

Lam Research has continued to build momentum heading into early 2026, with trailing revenue now exceeding $20.5 billion and net income above $6.2 billion. Profit margins have expanded to 30.22%, reflecting a combination of strong pricing power, favorable product mix, and disciplined cost management. The company’s return on equity of 65.56% and return on assets of 21.05% are standout figures, even by semiconductor equipment standards, and underscore how efficiently Lam deploys its capital base.

On the dividend front, Lam raised its quarterly payout from $0.23 to $0.26 in September 2025, representing a meaningful step-up for income-focused shareholders. That increase brought the annualized dividend to $1.04, continuing a pattern of deliberate, consistent growth that the company has established over recent years. The payout remains well-covered by both earnings and cash flow, giving investors confidence that this trajectory can continue.

The stock has traded as high as $251.87 over the past 52 weeks, reflecting sustained investor interest in semiconductor equipment names tied to AI infrastructure buildouts and advanced memory demand. With operating cash flow now topping $7.1 billion and free cash flow approaching $4.8 billion, Lam enters 2026 from a position of considerable financial strength.

Key Dividend Metrics

🧾 Forward Dividend Yield: 0.40%

💵 Annual Dividend: $1.04

📈 Most Recent Quarterly Dividend: $0.26 (raised from $0.23 in September 2025)

🛡️ Payout Ratio: 20.12%

📆 Last Ex-Dividend Date: December 3, 2025

💰 Dividend Coverage: Backed by $7.12B in operating cash flow

📊 Free Cash Flow: $4.82B

Dividend Overview

Lam’s dividend yield of 0.40% sits at the lower end of what income investors typically seek, and that’s largely a function of the stock’s strong price appreciation rather than any reluctance on the company’s part to distribute cash. At a quarterly rate of $0.26 per share, the annualized dividend of $1.04 is well-supported by a business generating over seven billion dollars in operating cash flow each year.

The payout ratio of just over 20% is notably conservative, which is precisely the point. Lam has structured its dividend policy to leave significant room for reinvestment, share repurchases, and future increases without putting any pressure on the balance sheet. This approach reflects a management team that treats the dividend as a commitment, not a marketing tool.

What makes Lam’s dividend story compelling isn’t the yield in isolation but rather the trajectory and the financial foundation beneath it. The company hasn’t chased income investors with an inflated payout. Instead, it has methodically grown its dividend in line with earnings and cash flow, ensuring every increase is durable rather than aspirational.

For investors who want exposure to the structural growth of AI and advanced chip manufacturing while still collecting a growing income stream, Lam represents a disciplined option. The yield may be modest today, but the combination of a low payout ratio and robust cash generation makes the case for continued dividend growth a persuasive one.

Dividend Growth and Safety

Lam’s recent dividend history tells a story of deliberate, consistent growth. The quarterly payout stood at $0.1725 as recently as early 2023, moved to $0.20 by mid-2023, climbed to $0.23 in September 2024, and took another step up to $0.26 in September 2025. That progression represents a cumulative increase of more than 50% over roughly two and a half years, which is a meaningful rate of dividend growth for a technology company of this scale.

The safety of that dividend is anchored by genuinely exceptional cash flow metrics. Operating cash flow of $7.12 billion and free cash flow of $4.82 billion give Lam considerable flexibility to maintain and grow the dividend even if business conditions moderate. The annual dividend obligation at the current rate represents only a small fraction of either figure, leaving a wide margin of safety that most income-focused investors would find reassuring.

Profitability ratios reinforce the picture further. A return on equity of 65.56% and a net profit margin of 30.22% reflect a company that converts revenue into earnings with remarkable efficiency. These aren’t numbers that suggest a business struggling to fund its obligations; they suggest one with significant financial capacity that is choosing to grow its dividend at a measured pace.

With 31 analysts covering the stock and a broad buy consensus in place, institutional confidence in Lam’s financial direction remains high. Short interest of approximately 30.6 million shares is something to monitor, but it has not materially disrupted the company’s capital return strategy. All told, Lam’s dividend is among the safer and more growth-oriented payouts available in the semiconductor equipment space.

The combination of a low payout ratio, expanding free cash flow, and a demonstrated willingness to raise the dividend on a regular basis positions Lam as a name that can grow alongside an investor’s income needs over time. It may not be a headline yield today, but the underlying mechanics are sound and the direction is clear.

Chart Analysis

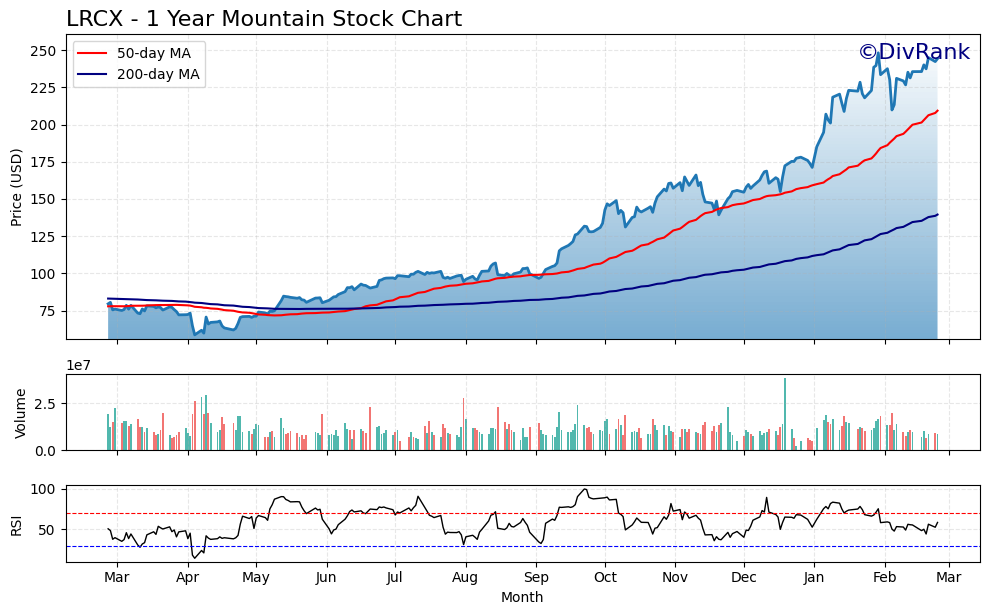

Lam Research has delivered a remarkable recovery over the past twelve months, surging from a 52-week low of $58.73 to its current price of $244.25, a gain of more than 315% from the trough. That kind of price appreciation in a single year reflects a dramatic reversal in sentiment toward semiconductor capital equipment names, and LRCX has been one of the clearest beneficiaries. The stock is now within striking distance of its 52-week high of $248.17, sitting just 1.58% below that level, which signals that buyers have maintained control of the tape through the entire recovery phase without any meaningful deterioration near the top of the range.

The moving average picture is unambiguously constructive. The 50-day moving average sits at $209.29 and the 200-day moving average at $139.52, both well below the current price of $244.25. The 50-day has crossed above the 200-day, forming what technicians refer to as a golden cross, a configuration that historically signals sustained intermediate-to-long-term upward momentum. For dividend investors, this kind of moving average alignment matters because it reduces the probability of a sharp, prolonged drawdown that could pressure management into reconsidering capital returns. When a stock is trading this cleanly above both major moving averages, the underlying trend is providing a stable foundation beneath the income thesis.

The relative strength index reading of 58.63 places LRCX in a constructive but not overheated zone. A reading in the upper-50s suggests the stock has meaningful momentum without flashing the kind of overbought warning that would concern a disciplined income investor approaching a new position. Stocks approaching or exceeding an RSI of 70 often invite short-term profit-taking, so the current reading near 59 leaves room for continued appreciation before the chart sends a caution signal. The combination of strong price action and a moderate RSI is a setup that dividend growth investors tend to appreciate, since it implies the market is adding to positions steadily rather than chasing the stock aggressively in a way that creates fragile entry points.

For dividend investors evaluating LRCX, the technical backdrop is about as supportive as one could reasonably expect after a recovery of this magnitude. The trend is up, the moving averages confirm that trend with a golden cross, momentum is healthy without being stretched, and the proximity to the 52-week high suggests minimal overhead supply resistance. Investors who prioritize entry price for yield-on-cost purposes will want to weigh the fact that the stock has already repriced dramatically from its lows, compressing the starting yield relative to where it stood a year ago. That said, the chart does not present any near-term technical reasons for concern, and the overall structure supports the view that LRCX is in a durable uptrend that dividend growth investors can monitor with confidence.

Cash Flow Statement

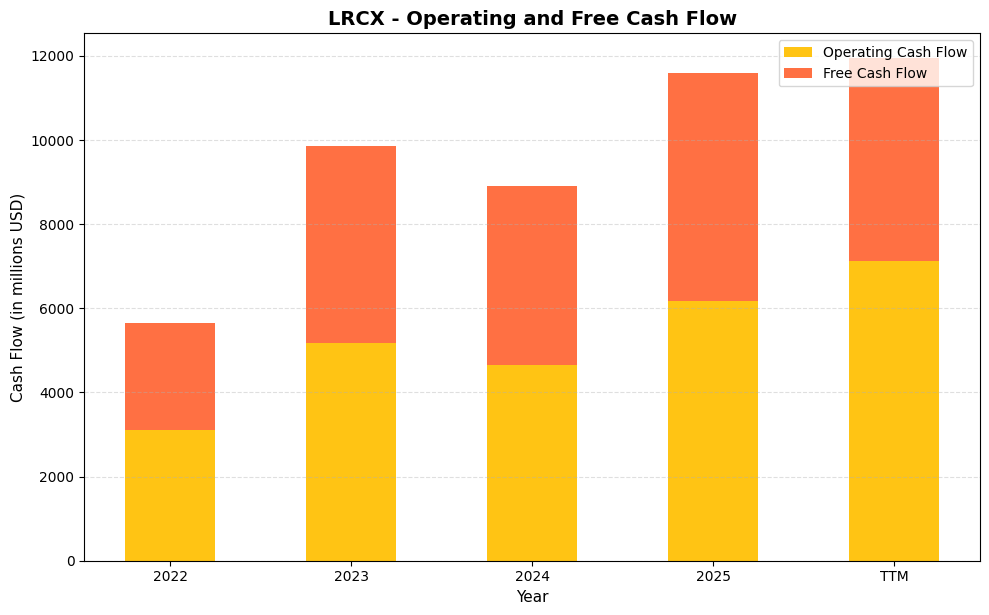

Lam Research’s cash generation profile is one of the most compelling aspects of its dividend story. Operating cash flow surged from $3,099.7 million in 2022 to $6,173.3 million in 2025, and the trailing twelve months figure pushes even higher to $7,121.9 million, signaling that the business is accelerating rather than plateauing. Free cash flow tells a similarly encouraging story, climbing from $2,553.6 million in 2022 to $5,414.1 million in 2025, which represents more than a doubling in three years. The TTM free cash flow figure of $4,816.9 million reflects elevated capital expenditures in the most recent period, but even at that level, LRCX generates far more free cash than it needs to sustain and grow its dividend. With annual dividend obligations consuming only a fraction of free cash flow, the payout sits on an exceptionally firm financial foundation.

The trajectory across this four-year window reveals a business that converts revenue into cash with increasing efficiency. The 2023 figures, where free cash flow reached $4,677.4 million on operating cash flow of $5,178.9 million, demonstrated that even in a year of semiconductor cycle softness, Lam’s cash generation remained robust. The spread between operating cash flow and free cash flow has stayed relatively narrow throughout this period, indicating that capital expenditure requirements are modest relative to the earnings power of the business. That capital efficiency gives management significant flexibility to pursue dividend growth, share repurchases, and strategic investment simultaneously rather than having to choose between them. For income investors, a company generating over $5 billion in annual free cash flow while carrying a manageable payout ratio represents exactly the kind of durable, self-funding dividend engine that compounds reliably over a full market cycle.

Analyst Ratings

Analyst sentiment on Lam Research is broadly constructive as of late February 2026. Among the 31 analysts currently covering the stock, the consensus stands at buy, reflecting confidence in the company’s positioning within the AI infrastructure buildout and advanced memory upgrade cycle. The mean price target of $274.42 sits above the current price of $244.25, implying upside of roughly 12% from current levels, which is a reasonable margin given where the stock has already run over the past year.

The range of analyst price targets is wide, spanning from a low of $200.00 to a high of $325.00. That spread reflects genuine differences in how analysts are modeling the pace of semiconductor equipment spending over the next several quarters, particularly with respect to China-related export restrictions and the timing of leading-edge memory and logic investment cycles. The more cautious targets cluster around the $200 level and generally assume some near-term headwinds, while the more bullish targets in the $300 range reflect assumptions of sustained AI-driven demand and strong operating leverage.

With the stock trading at $244.25 and the average target at $274.42, Lam currently sits below the midpoint of the analyst range in a way that leaves room for upside without requiring heroic assumptions. The buy consensus from a group of 31 analysts covering a widely followed name carries real signal, and the financial profile of the business, including its free cash flow yield and margin structure, provides a fundamental basis for that optimism. The overall tone from the analyst community is measured but positive, with most expecting Lam to benefit from multi-year secular tailwinds even if near-term results show some quarter-to-quarter variability.

Earning Report Summary

Lam Research’s most recent financial results reflect a business operating with considerable momentum. Revenue on a trailing twelve-month basis reached $20.56 billion, and net income came in at $6.21 billion, producing a net profit margin of 30.22%. Earnings per share of $4.87 demonstrate meaningful profitability on a per-share basis, supported by disciplined cost management and a favorable product mix skewed toward high-value etch and deposition systems used in advanced node manufacturing.

Market Strength and Regional Highlights

Lam’s revenue base remains geographically diverse, with significant contributions from Korea, Taiwan, and China. China continues to represent a meaningful portion of the business, which remains both a source of revenue strength and a point of ongoing scrutiny given the evolving U.S. export control environment. Korea and Taiwan have been particularly active as NAND and DRAM customers accelerate investments in high-bandwidth memory and next-generation storage, areas where Lam’s etch and deposition capabilities are essential. The Customer Support Business Group has also continued to contribute steadily, reflecting the recurring nature of service and parts revenue across the installed equipment base.

Margin Expansion and Profitability

Gross and operating margins have shown sustained strength, with the 30.22% net profit margin representing a strong outcome for a company at this stage of the cycle. Return on equity of 65.56% and return on assets of 21.05% are exceptional figures that reflect both Lam’s earnings power and the asset-light efficiency of its business model. Operating cash flow of $7.12 billion, well above net income, confirms that earnings quality is high and that cash conversion remains a core strength of the business.

Leadership Commentary and Forward Outlook

CEO Tim Archer has consistently emphasized Lam’s role as an enabling technology partner to the world’s leading chipmakers, and the financial results reflect that positioning. As chip architectures grow more complex, particularly in DRAM and advanced logic, the value of precision etch and deposition equipment increases, which supports both pricing and market share. Archer has pointed to AI infrastructure investment and the continued ramp of high-bandwidth memory as durable drivers that should sustain demand for Lam’s tools through the remainder of the decade.

Looking ahead, management has guided with cautious optimism, acknowledging macro uncertainty while pointing to strong backlog conditions and customer engagement levels. The company continues to invest aggressively in R&D to stay ahead of evolving process requirements, and its free cash flow generation gives it the resources to do so without compromising shareholder returns. The overall posture is one of a company confident in its competitive position and prepared to capitalize on what leadership views as a multi-year upgrade cycle in semiconductor manufacturing.

Management Team

Lam Research is led by a seasoned executive team with deep experience in the semiconductor industry. At the helm is Tim Archer, who has served as President and CEO since 2018. Archer joined Lam in 2012 following its acquisition of Novellus Systems, where he had spent nearly two decades. His background in engineering and operations has been key in guiding Lam through different industry phases with steady hands.

Doug Bettinger, the Executive Vice President and CFO, oversees the company’s financial strategy, including investor relations and corporate planning. With prior roles at Avago Technologies, Xilinx, and Intel, Bettinger brings a solid financial and operational understanding to the table. His role has been crucial in maintaining Lam’s balance sheet strength while also supporting shareholder returns.

Pat Lord, serving as Executive Vice President and COO, focuses on global operations and the customer support division. His leadership ensures that Lam’s manufacturing and service arms remain aligned with broader strategic goals. Also on the executive team is Vahid Vahedi, Senior Vice President and Chief Technology and Sustainability Officer, who heads up innovation and long-term sustainability initiatives. Audrey Charles, Senior Vice President of Corporate Strategy and Advanced Packaging, leads efforts on strategic direction and future growth areas like advanced packaging.

Altogether, the leadership team blends deep technical knowledge with strategic focus, putting Lam in a strong position to manage both innovation and execution.

Valuation and Stock Performance

As of February 24, 2026, Lam Research trades at $244.25, giving it a market capitalization of approximately $306.8 billion. The stock’s trailing price-to-earnings ratio of 50.15 is elevated by conventional standards, reflecting the premium the market assigns to Lam’s growth profile and its centrality to the AI and advanced memory investment cycle. Over the past 52 weeks, the stock has traded between a low of $56.32 and a high of $251.87, a range that captures significant appreciation alongside the broader semiconductor equipment rally.

The price-to-book ratio of 30.12 on a book value of $8.11 per share reflects how much of Lam’s value resides in its intangible assets, competitive positioning, and earnings power rather than its balance sheet in the traditional sense. That kind of premium is common among best-in-class semiconductor names with high returns on equity, and Lam’s 65.56% ROE provides a rational basis for it. The analyst consensus price target of $274.42 implies approximately 12% upside from current levels, with the range extending to $325.00 on the high end.

From a valuation standpoint, the stock is not cheap, and the beta of 1.78 signals that it will continue to move with amplified volatility relative to the broader market. Investors entering at current levels are paying for quality and growth expectations, which means any guidance shortfall or macro deterioration could produce meaningful downside. That said, for investors with a long-term view on semiconductor infrastructure spending, the current price reflects a company at the top of its game rather than one that has run ahead of its fundamentals.

Risks and Considerations

The semiconductor equipment industry is inherently cyclical, and Lam is not immune to the spending rhythms of its customers. When chipmakers pull back on capital expenditure plans during periods of oversupply or economic weakness, Lam’s order volumes and revenue can decline quickly. The current environment has been favorable, but investors should be prepared for the possibility that equipment spending moderates, particularly if AI infrastructure investment slows or memory customers delay capacity additions.

Geopolitical exposure is a persistent and meaningful risk for Lam. China has historically represented a significant portion of annual revenue, and ongoing U.S. export restrictions on advanced semiconductor equipment have created real uncertainty around how that business evolves. Any tightening of export controls, retaliatory trade measures, or escalation of U.S.-China technology tensions could reduce Lam’s addressable market in the region and pressure near-term results in ways that are difficult to predict or hedge.

The pace of technological change in semiconductor manufacturing is relentless, and Lam must continue investing heavily in R&D to stay ahead of evolving process requirements. A competitor that develops superior etch or deposition technology could erode Lam’s market share in specific segments, particularly as chipmakers push to ever-smaller nodes and more complex three-dimensional architectures. Maintaining the innovation edge is not optional; it is a continuous requirement for staying relevant in this industry.

The stock’s elevated valuation also introduces a risk that is specific to current entry points. A trailing P/E of 50.15 and a price-to-book of 30.12 leave little room for disappointment. Even a modestly weaker quarter or a reduction in forward guidance could trigger a sharp derating, particularly given the stock’s beta of 1.78. Investors who understand and accept that volatility are better positioned to hold through such episodes, but those who need stability in their portfolio should weigh the valuation premium carefully before committing capital.

Final Thoughts

Lam Research holds a solid and strategically vital spot in the semiconductor ecosystem. Its etch and deposition tools are essential for enabling the advanced chip architectures that underpin AI, high-bandwidth memory, and next-generation computing, and that positioning gives the company a durable competitive advantage that is not easily replicated. The financial results confirm that Lam is executing well, with revenue above $20.5 billion, operating cash flow exceeding $7.1 billion, and a dividend that has grown more than 50% since early 2023.

The risks are real and worth taking seriously. Cyclicality, China exposure, and an elevated valuation all deserve a place in any honest assessment of this stock. But Lam has demonstrated over multiple cycles that it can navigate uncertainty while maintaining financial discipline and continuing to invest in the technologies that keep it indispensable to its customers. For investors with a long-term perspective and an appreciation for the structural tailwinds driving semiconductor manufacturing, Lam Research remains one of the more compelling combinations of growth, cash generation, and rising income available in the technology sector today.