Last Update 5/27/25

Kulicke and Soffa Industries (KLIC), a key player in the semiconductor equipment space, continues to show disciplined execution through a period of industry softness. With a solid balance sheet, $538 million in cash, and minimal debt, the company has maintained consistent free cash flow, supported shareholder returns, and invested in next-generation packaging technologies.

Despite a dip in revenue, gross margins have expanded and operating efficiency remains strong. The stock is trading near $32, well off its 52-week high, but analysts still hold a moderate buy consensus with a price target near $44.50, reflecting cautious optimism for a rebound.

Recent Events

This past quarter, the company reported continued softness in its top line. Revenue declined year-over-year by almost 6%, which tracks with broader trends in the chip equipment market. But Kulicke and Soffa didn’t panic. Instead, it continued doing what it does best—generating free cash, keeping costs in check, and distributing dividends.

The market may not be in love with the semiconductor story right now, but Kulicke and Soffa is clearly playing the long game. A 2.57% forward yield isn’t the flashiest in the market, but in a time when many peers aren’t offering anything at all, that kind of reliability is noteworthy.

Key Dividend Metrics

💰 Dividend Yield: 2.57% (Forward)

📈 5-Year Average Yield: 1.50%

📆 Dividend Frequency: Quarterly

🔒 Payout Ratio: 218.92%

📊 Free Cash Flow (ttm): $151.03M

💸 Cash per Share: $11.02

🧾 Debt/Equity: 4.20%

🧠 Return on Assets: 4.55%

💼 Return on Equity: 2.29%

Dividend Overview

Kulicke and Soffa has become a bit of a quiet achiever on the dividend front. It’s not a high-yielder, but the payout is steady and surprisingly well-supported. The forward dividend yield of 2.57% is a good step up from its historical average, and that alone could attract more income-focused investors over time.

At first glance, the payout ratio north of 200% might look like a red flag. But context matters. The company is generating strong cash flows—over $150 million in free cash flow during the last 12 months—and only needs a fraction of that to support its dividend. This isn’t a case of borrowing to pay shareholders. It’s just a business where earnings, due to industry volatility, can swing more than the actual ability to return capital.

The $11 per share in cash on the balance sheet provides a safety net. That’s a cushion many dividend-paying firms can only dream of, and it gives management the flexibility to stay consistent even if the operating environment gets worse before it gets better.

Dividend Growth and Safety

What’s especially appealing about KLIC is its approach to growing the dividend. Since initiating a payout in 2018, the company has steadily raised it—not at breakneck speed, but with the kind of measured confidence that long-term investors prefer.

The dividend isn’t just safe—it’s sitting on a rock-solid foundation. With a current ratio over 5 and minimal debt, there’s no need to worry about liquidity. And management has shown they’re not going to stretch themselves just to appease shareholders. They’re running a disciplined playbook.

Even with a high payout ratio, the dividend looks sustainable thanks to the strong cash flow. Book value is over $16 per share, and when you factor in the cash position, investors are looking at a company that’s not just distributing profits but preserving capital along the way.

It’s also worth noting the institutional ownership: more than 96% of the float is held by institutions. That’s usually a strong sign of confidence in the business and its ability to deliver consistent returns—including dividends.

While semiconductor cycles can be lumpy, Kulicke and Soffa has carved out a steady path. For those in it for the income, this is a name that rewards patience—not with massive yields, but with a track record of responsible stewardship and a payout that keeps showing up quarter after quarter.

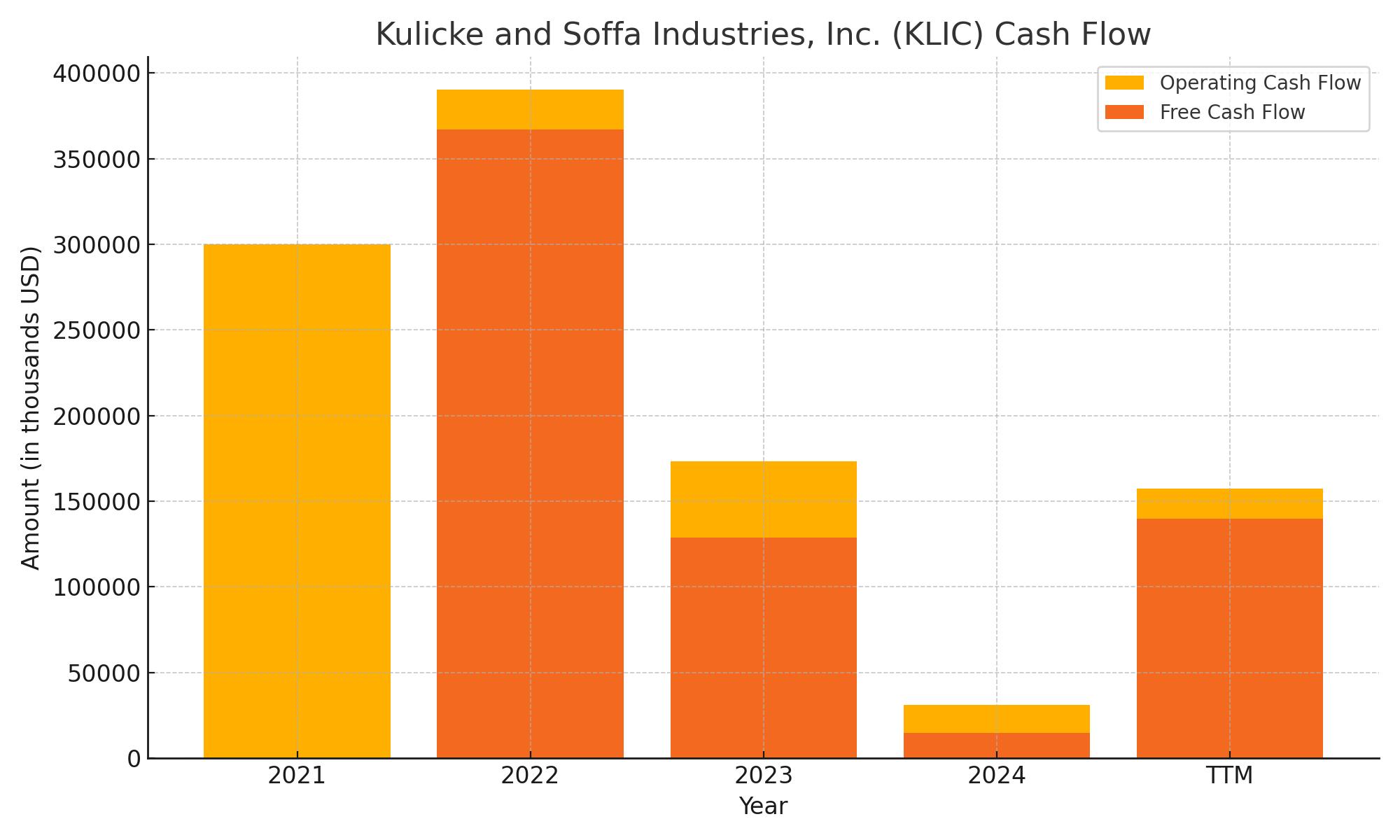

Cash Flow Statement

Kulicke and Soffa’s cash flow position remains one of its strongest attributes. Over the trailing twelve months, the company generated $157.3 million in operating cash flow—an impressive figure that reflects steady internal efficiency despite softer revenue. That strong performance allowed KLIC to produce $140 million in free cash flow even after capital expenditures. This speaks volumes about its ability to generate real cash earnings, not just accounting profits.

On the financing side, the company spent heavily, with $192 million flowing out—most of it used for share repurchases, continuing a trend from prior years. KLIC returned a substantial amount of capital to shareholders while avoiding new debt issuance. The balance sheet remained debt-light, with only minimal repayments made. Although investing activities showed a net outflow of nearly $38 million, this largely reflects disciplined reinvestment rather than aggressive expansion. Overall, the end cash position stands at $287 million, down from prior years but still robust.

Analyst Ratings

📉 Kulicke and Soffa Industries (KLIC) has recently experienced a wave of analyst revisions, reflecting the shifting dynamics in the semiconductor equipment sector. 🛠️ DA Davidson kept its buy rating intact but trimmed its price target from $60 to $55, citing short-term softness in demand. Similarly, Needham reiterated its buy stance but revised the target down to $37 from $53, pointing to broader macroeconomic pressure affecting capex across the industry. 🧭 TD Cowen held a neutral view, maintaining a hold rating while reducing its price target from $50 to $36, a move driven by cautious sentiment following recent earnings data.

📊 Despite the downward adjustments, the overall analyst tone remains moderately upbeat. The average consensus price target sits around $44.50, which offers meaningful upside from current levels. 💡 Analysts continue to highlight KLIC’s rock-solid balance sheet, robust free cash flow, and disciplined capital allocation as key strengths that give the company staying power. The general consensus is “Moderate Buy,” as analysts weigh the cyclical pressures against long-term fundamentals.

🔍 While short-term headwinds have prompted a more conservative tone, many in the analyst community still see KLIC as a steady hand in a volatile industry. The focus now shifts to how quickly the broader chip equipment market can stabilize and if KLIC can leverage its financial strength when demand returns.

Earning Report Summary

Financial Performance

Kulicke and Soffa’s latest earnings report offered a mixed bag, but there’s more strength under the surface than the top-line numbers suggest. Revenue for the first quarter of fiscal 2025 landed at $166.1 million, slightly down from the same time last year and a bit softer than the prior quarter. But what caught attention wasn’t the revenue—it was the earnings.

The company posted a GAAP net income of $81.6 million, which translates to $1.51 per diluted share. A major part of that came from a one-time $71 million gain tied to a customer settlement. Stripping that out, non-GAAP net income still came in at a respectable $20.2 million, or $0.37 per share. Gross margin improved to 52.4%, up nicely from a year ago, thanks to a more favorable product mix and some efficiencies on the cost side.

Operational Highlights

Kulicke and Soffa kept its balance sheet rock-solid. The company closed the quarter with over $538 million in cash and equivalents, giving it more than enough flexibility to keep investing in growth and returning capital to shareholders. During the quarter, it repurchased about 800,000 shares for roughly $37 million, a move that shows management’s confidence in the long-term picture.

Operating margins saw a healthy jump as well, reaching over 52%. That number got a little help from previously shipped systems that were recognized this quarter, but it also reflects disciplined expense management and a focus on maintaining profitability even when the revenue environment is choppy.

Leadership Outlook

CEO Fusen Chen struck a cautiously optimistic tone about the future. He pointed to continued investment in advanced packaging technologies like Fluxless Thermo-Compression and Vertical Fan-Out. These are areas that are becoming increasingly important as computing demands shift towards AI, cloud, and edge applications. Chen made it clear that while the current environment is a bit muted, the company is staying focused on innovation to be ready for what comes next.

CFO Lester Wong added some detail around the quarter’s financials, noting that expense discipline and some favorable foreign exchange impacts helped keep things on track. He also reiterated the company’s commitment to capital discipline—balancing R&D investment with shareholder returns through buybacks.

Looking Ahead

For the next quarter, management is guiding revenue to come in around $165 million, give or take $10 million. GAAP earnings per share are expected to be modest at around $0.03, with non-GAAP EPS closer to $0.19. The outlook suggests continued stability as the company navigates a market that’s still in a bit of a holding pattern.

All things considered, while revenue is still adjusting to the broader industry slowdown, Kulicke and Soffa is clearly focused on long-term execution. With a strong cash position, efficient operations, and a strategic eye on future tech needs, the foundation is there for when momentum picks back up.

Management Team

Kulicke and Soffa’s leadership is anchored by a team with deep experience in the semiconductor and technology sectors. At the helm is Dr. Fusen Chen, who has been serving as President and CEO since 2016. Dr. Chen brings a wealth of experience from his previous roles at Mattson Technology and Novellus Systems, where he held executive positions that focused on technology strategy and business unit leadership. His background in materials science and engineering provides a strong technical foundation for guiding the company’s strategic direction.

Supporting Dr. Chen is Lester Wong, the Executive Vice President of Finance and IT and Chief Financial Officer. Mr. Wong joined the company in 2011 and has a robust background in legal and financial leadership, having served as General Counsel and Senior Vice President of Legal Affairs before assuming his current role. His expertise in corporate law and finance plays a crucial role in maintaining the company’s fiscal health and compliance.

Chan Pin Chong serves as the Executive Vice President and General Manager of Products and Solutions. Since joining Kulicke and Soffa in 2014, Mr. Chong has been instrumental in diversifying the company’s product offerings, particularly in the battery bonding market. His extensive experience in engineering and operations within the semiconductor industry has been vital in driving product innovation and operational efficiency.

Nelson Wong, the Senior Vice President of Global Sales and Global Supply Chain, has been with the company since 1997. His long tenure and deep understanding of the company’s operations have been key in managing the complexities of global sales and supply chain logistics, ensuring that the company’s products reach their markets efficiently.

This leadership team combines technical expertise, financial acumen, and operational experience, positioning Kulicke and Soffa to navigate the challenges and opportunities within the semiconductor industry effectively.

Valuation and Stock Performance

Kulicke and Soffa’s stock has experienced fluctuations over the past year, reflecting the broader volatility in the semiconductor sector. Currently trading at approximately $32.69, the stock has seen a decline from its 52-week high of $53.71. This decrease aligns with the industry’s cyclical nature and recent market headwinds.

From a valuation perspective, the company’s trailing twelve-month price-to-earnings ratio stands at 96.63, which is significantly higher than the industry average. This elevated P/E ratio suggests that investors may be pricing in expectations of future growth or that the stock is currently overvalued relative to its earnings. The price-to-sales ratio is 2.58, and the price-to-book ratio is 2.07, indicating a moderate valuation when considering the company’s assets and sales.

Analyst sentiment remains cautiously optimistic, with a consensus rating of moderate buy and an average price target of $48.00, suggesting potential upside from current levels. However, investors should consider the company’s valuation metrics in the context of its earnings performance and industry trends.

Risks and Considerations

Investing in Kulicke and Soffa involves several risks that potential investors should consider. The semiconductor industry is known for its cyclical nature, and the company is susceptible to fluctuations in demand, which can impact revenue and profitability. Recent market conditions have shown a slowdown in semiconductor equipment spending, which could affect the company’s short-term performance.

Additionally, the company faces risks associated with global supply chain disruptions, which have been prevalent in the industry. Such disruptions can lead to delays in product delivery and increased costs. Furthermore, geopolitical tensions and trade policies can impact the company’s operations, especially given its global footprint.

Another consideration is the company’s recent decision to exit its Electronics Assembly business, which resulted in a significant pre-tax charge. While this move aligns with a strategic focus on high-margin semiconductor markets, it also introduces transitional risks as the company reallocates resources and adjusts its operations.

Investors should also be aware of cybersecurity risks, as the company has disclosed incidents of attempted cyber intrusions. While no significant data breaches have been reported, the potential for future cyber threats remains a concern.

Lastly, the company’s high payout ratio for dividends, exceeding 200 percent, may not be sustainable in the long term if earnings do not grow to support these distributions. Investors relying on dividend income should monitor the company’s financial health and dividend policy closely.

Final Thoughts

Kulicke and Soffa Industries presents a complex investment profile characterized by strong leadership, a solid balance sheet, and a strategic focus on high-growth areas within the semiconductor industry. The company’s efforts to streamline operations and concentrate on advanced packaging technologies position it well for future opportunities.

However, investors must weigh these strengths against the inherent risks, including industry cyclicality, supply chain challenges, and the sustainability of its dividend policy. The current valuation metrics suggest that the stock may be priced for growth, which adds another layer of consideration.

As with any investment, due diligence and a clear understanding of the company’s strategic direction and market dynamics are essential. Kulicke and Soffa’s trajectory will largely depend on its ability to navigate industry challenges and capitalize on emerging opportunities in the semiconductor space.