Key Takeaways

📈 Kroger offers a steady dividend yield of 1.87% with a 17-year streak of consecutive increases, backed by a low 33% payout ratio and consistent dividend growth in the 10–12% range.

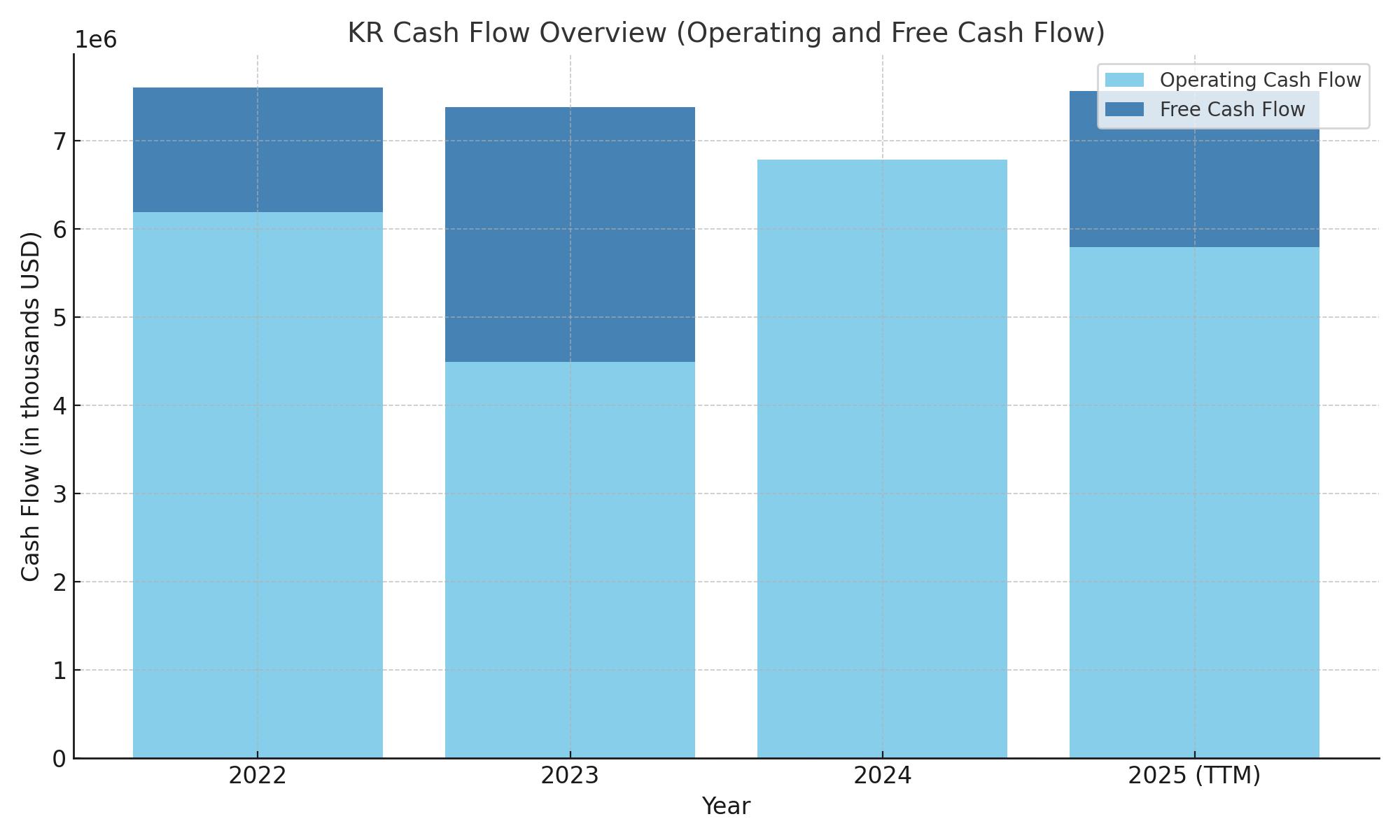

💰 Strong operating cash flow of $5.79 billion and free cash flow of $1.78 billion provide solid support for ongoing dividend payments and capital investments.

🔍 Analysts maintain a “Moderate Buy” consensus, with price targets ranging from $58 to $82, reflecting a balanced outlook and confidence in the company’s operational execution.

Last Update 5/27/25

Kroger has built a reputation on reliability, supported by consistent earnings, a shareholder-friendly dividend policy, and steady operational execution. With more than 2,700 stores across the country and a growing digital presence, it continues to evolve while staying rooted in essential consumer demand. Its scale, private-label strength, and disciplined approach to capital allocation make it a dependable income-generating stock.

Recent developments include a leadership transition, strong digital sales growth, and an upgraded outlook from several analysts. Even with modest yield, the dividend is backed by solid free cash flow and a conservative payout ratio, while valuation remains reasonable relative to the sector.

Recent Events

Over the past year, Kroger stock has climbed more than 30%, outpacing the broader market by a solid margin. That’s impressive, especially for a grocery chain operating in a sector often seen as defensive and low-growth. But this isn’t just a case of the market getting excited over nothing—there are some real fundamentals behind the move.

Despite a noticeable slowdown in year-over-year earnings growth—down around 88% recently—Kroger’s profitability metrics remain steady. Operating margins are still around 2%, typical for a grocer but telling of how tightly this company runs its ship. Profit margin is close to 1.8%, which isn’t glamorous but is more than enough given the company’s consistent revenue base of over $147 billion.

On the financial side, Kroger’s balance sheet is carrying some weight. Total debt is a bit high, with a debt-to-equity ratio over 229%, but it’s also producing significant returns on that capital. Return on equity sits just shy of 27%, which is a strong signal that the company knows how to put its capital to work.

Management hasn’t wavered on its dividend strategy. The next payout is scheduled for June 1, with an ex-dividend date of May 15. That kind of predictability is exactly what income investors look for.

Key Dividend Metrics

🧀 Forward Dividend Yield: 1.87%

🥩 Trailing Dividend Yield: 1.82%

🥦 5-Year Average Yield: 2.00%

🥖 Payout Ratio: 33.24%

🍷 Annual Dividend Rate: $1.28

🥕 Dividend Growth Streak: 17 years

Dividend Overview

Kroger’s dividend isn’t going to turn heads with a headline yield, but that doesn’t mean it’s not worth your attention. At just under 2%, the yield might seem modest, especially in today’s market. But it’s backed by consistent earnings, strong cash flow, and a management team that’s been methodical about raising the payout every year.

The current payout ratio is sitting comfortably around 33%, which leaves Kroger with more than enough breathing room to handle other priorities like reinvestment and debt reduction while still giving something back to shareholders. When you look at that in the context of $5.79 billion in operating cash flow, the dividend looks very well covered.

Kroger also shines with its consistency. For nearly two decades, it has been increasing the dividend year after year, building trust with long-term investors who value predictability. The annual dividend rate is currently $1.28, and with Kroger’s earnings power, there’s room for further increases down the line.

Even though the current yield is slightly below its five-year average, that’s more a reflection of the stock’s recent price gains than any weakness in the dividend. Investors who got in earlier are already seeing the benefits of that upward move—and even new buyers can take comfort knowing they’re stepping into a stable and mature dividend payer.

Dividend Growth and Safety

Dividend growth is where Kroger quietly stands out. With a streak of 17 consecutive years of raises, this company has proven time and again that it values returning capital to shareholders. The increases haven’t just been symbolic either—over the last five years, Kroger has been boosting its dividend at a healthy clip, often in the low double digits.

All of this is backed by a solid foundation. Levered free cash flow sits at $2.1 billion, and the company isn’t overextending itself to make payments. Even with elevated debt levels, Kroger’s ability to cover its interest and maintain healthy capital returns remains strong.

The conservative payout ratio gives management plenty of options. Whether it’s navigating inflationary cost pressures, investing in digital capabilities, or dealing with shifts in consumer behavior, Kroger has the flexibility to keep paying—and growing—the dividend. And with a beta of just 0.61, the stock tends to move less than the market, which is a welcome trait for income investors looking for stability.

There’s also meaningful insider ownership at just over 8%, while institutions hold more than 80% of the stock. That kind of backing suggests the people closest to the business believe in its long-term strategy, including its ability to keep delivering for shareholders.

In short, Kroger’s dividend is solid. It’s not the flashiest in the market, but it’s dependable, growing, and backed by a business that knows how to operate efficiently. For those looking for a steady source of income in their portfolio, it’s the kind of name that can offer peace of mind through market cycles.

Cash Flow Statement

Kroger’s trailing twelve-month cash flow reveals a business still generating strong internal capital, with $5.79 billion in operating cash flow. While this is slightly below the previous year’s $6.79 billion, it reflects stable performance in a mature and margin-tight industry. The consistency here is notable, especially considering broader cost pressures across retail. Capital expenditures ticked higher to $4.02 billion, showing Kroger is continuing to reinvest in store modernization and digital infrastructure.

On the financing side, the company leaned on new debt issuance, bringing in over $10.5 billion, though a large portion of that was balanced out by repayments totaling nearly $4.9 billion. Most notably, Kroger repurchased $5.16 billion worth of its own shares over the same period, signaling confidence in its long-term value. Free cash flow came in at $1.78 billion, a healthy figure that supports ongoing dividend payments and provides room for further strategic moves without putting undue pressure on the balance sheet. The cash position at the end of the period rose significantly to nearly $4 billion, more than double the level from the previous year.

Analyst Ratings

🟢 Kroger has recently seen a mix of analyst opinions, reflecting both optimism and caution. On the positive side, JPMorgan reaffirmed its confidence in the company by maintaining an “Overweight” rating and raising the price target from $72 to $82. This adjustment suggests a belief in Kroger’s potential for growth and resilience in the competitive grocery sector. Similarly, Morgan Stanley maintained an “Equal-Weight” rating but increased its price target from $65 to $71, indicating a moderate level of confidence in the stock’s performance.

🔴 On the flip side, Melius Research downgraded Kroger to a “Sell” rating, setting a price target of $58. Their concerns center around challenges such as increased competition from other retailers, potential liabilities from legal disputes, and recent changes in executive leadership. These factors contribute to a more cautious outlook on the company’s near-term prospects.

🟡 Overall, the consensus among analysts leans towards a “Moderate Buy,” with an average price target of approximately $68.06. This suggests a balanced view, acknowledging both the company’s strengths and the challenges it faces in the current market environment.

Earning Report Summary

Solid but Mixed Performance

Kroger’s most recent earnings gave investors a mix of confidence and caution. The company posted adjusted earnings per share of $1.14, which came in a bit better than what most on Wall Street were expecting. Revenue for the quarter hit $34.3 billion, just a touch under estimates. That shortfall mostly had to do with the company stepping back from its specialty pharmacy business and a drop in fuel prices—both factors that weren’t a big surprise.

Still, there was good news in the core grocery business. Same-store sales, excluding fuel, grew by 2.4%, a sign that shoppers are still coming through the doors. That’s a steady performance in a challenging retail environment where price sensitivity is front and center for most households.

Digital and Private Label Growth

Kroger also made some solid strides on the digital side. Online sales climbed 11% compared to the same time last year. Their continued investment in online ordering and fulfillment seems to be gaining traction with shoppers looking for convenience. They also leaned in on private-label products, launching more than 900 new items, including a strong push in fresh foods. These products usually come with better margins, so that’s a smart play.

Leadership Transition

The quarter also brought some major changes at the top. Longtime CEO Rodney McMullen stepped down following an internal review, and Ronald Sargent has stepped in as interim CEO. He’s no stranger to the company and seems to be focused on keeping things steady while reinforcing Kroger’s customer-first approach. In statements following the earnings release, leadership emphasized their commitment to delivering value and continuing to improve the in-store and online experience.

Looking Ahead

As for the road ahead, Kroger gave guidance that points to slow but steady growth. The company expects same-store sales to rise between 2% and 3% in the coming year, with adjusted earnings per share in the range of $4.60 to $4.80. They’re also planning to spend between $3.6 and $3.8 billion on capital improvements, including updates to stores and more digital upgrades.

All in all, while the top-line results may have been slightly under expectations, the company is still showing it can adapt and deliver. Kroger is clearly focused on sharpening its competitive edge, especially through digital channels and private brands, while staying committed to its core mission of value and service.

Earnings Report Summary

Solid but Mixed Performance

Kroger’s most recent earnings gave investors a mix of confidence and caution. The company posted adjusted earnings per share of $1.14, which came in a bit better than what most on Wall Street were expecting. Revenue for the quarter hit $34.3 billion, just a touch under estimates. That shortfall mostly had to do with the company stepping back from its specialty pharmacy business and a drop in fuel prices—both factors that weren’t a big surprise.

Still, there was good news in the core grocery business. Same-store sales, excluding fuel, grew by 2.4%, a sign that shoppers are still coming through the doors. That’s a steady performance in a challenging retail environment where price sensitivity is front and center for most households.

Digital and Private Label Growth

Kroger also made some solid strides on the digital side. Online sales climbed 11% compared to the same time last year. Their continued investment in online ordering and fulfillment seems to be gaining traction with shoppers looking for convenience. They also leaned in on private-label products, launching more than 900 new items, including a strong push in fresh foods. These products usually come with better margins, so that’s a smart play.

Leadership Transition

The quarter also brought some major changes at the top. Longtime CEO Rodney McMullen stepped down following an internal review, and Ronald Sargent has stepped in as interim CEO. He’s no stranger to the company and seems to be focused on keeping things steady while reinforcing Kroger’s customer-first approach. In statements following the earnings release, leadership emphasized their commitment to delivering value and continuing to improve the in-store and online experience.

Looking Ahead

As for the road ahead, Kroger gave guidance that points to slow but steady growth. The company expects same-store sales to rise between 2% and 3% in the coming year, with adjusted earnings per share in the range of $4.60 to $4.80. They’re also planning to spend between $3.6 and $3.8 billion on capital improvements, including updates to stores and more digital upgrades.

All in all, while the top-line results may have been slightly under expectations, the company is still showing it can adapt and deliver. Kroger is clearly focused on sharpening its competitive edge, especially through digital channels and private brands, while staying committed to its core mission of value and service.