Last Update 5/27/25

Knight-Swift Transportation Holdings Inc. (KNX) stands as the largest full-truckload carrier in the United States, with expanding operations in less-than-truckload, logistics, and intermodal. Following a challenging period marked by freight market softness and acquisition integration, the company has shown early signs of recovery, returning to profitability in Q1 2025 and maintaining a consistent dividend policy along the way.

With a forward-looking leadership team and strategic investments in network efficiency and fleet modernization, Knight-Swift is positioning itself for resilience. Its current dividend yield of 1.68%, steady free cash flow, and operational scale make it a notable consideration for long-term income-focused investors.

Recent Events

Knight-Swift isn’t a company that usually steals headlines, but it plays a key role in the American economy as the biggest full-truckload carrier in the country. Lately though, the trucking giant has been rolling through some potholes. The stock has slid over the past year, down more than 10%, trailing the broader market. Freight demand is starting to stabilize, but pricing remains soft, and that’s weighed heavily on revenue growth and margins.

Revenue inched up just 0.1% over the past year. Profit margins are thin, sitting at 2.04%, and return on equity is barely over 2%. Those aren’t the kind of numbers you want to see from a company used to tighter, more efficient operations. A lot of the strain comes from integrating U.S. Xpress and dealing with a trucking market that’s still trying to find its footing.

But here’s something income-focused investors might appreciate: despite the pressure on earnings, Knight-Swift is sticking to its dividend plan. Not only have they kept it intact, but they’ve actually increased it. That’s the kind of move that shows where management’s priorities are—returning value to shareholders, even when it’s not easy to do so.

Key Dividend Metrics

📈 Forward Yield: 1.68%

💰 Annual Dividend Rate: $0.72

🧮 Payout Ratio: 70.21%

📅 Ex-Dividend Date: June 9, 2025

🎯 Five-Year Average Yield: 0.91%

🔁 Dividend Growth Trend: Positive

🔒 Dividend Safety (Cash Flow Coverage): Cautiously adequate

Dividend Overview

Let’s be upfront—Knight-Swift’s yield doesn’t scream income play. At 1.68%, it won’t stand out on a dividend screener. But there’s more going on beneath the surface. The company has historically kept a low payout profile, with a five-year average yield under 1%. So today’s yield, well above that historical level, signals something different—maybe a shift in philosophy.

The payout ratio is on the higher end, just over 70%. That’s something to keep an eye on. But cash generation hasn’t completely dried up. Operating cash flow is still healthy, north of $870 million, even if levered free cash flow has thinned out to under $5 million. That suggests they’re walking a tightrope—there’s enough room to keep the dividend going, but not a lot of cushion if conditions worsen.

This isn’t a bond-proxy type of dividend, but rather one that could grow into something more if the core business finds its rhythm again. It’s also worth noting that Knight-Swift isn’t overextending itself with massive repurchases or flashy deals. The capital return policy is measured and targeted, which gives the dividend some room to breathe.

Dividend Growth and Safety

Here’s where things get a little more interesting. The dividend has been rising, slowly but surely. The latest increase, from $0.66 to $0.72 annually, is part of a consistent pattern over the past few years. It’s not aggressive growth, but it’s steady—and in this sector, that says something about how management sees the future.

Now, on the safety side, there are a few wrinkles. The payout ratio being above 70% doesn’t leave a lot of room for error. It’s not in the danger zone, but it’s close enough that a weaker quarter or an unexpected cost could put stress on dividend coverage.

Debt levels are manageable, with total debt at $3.2 billion and a debt-to-equity ratio around 45%. Cash on hand is just over $200 million, so they’ve got a little flexibility, but not much. With a current ratio under 1, liquidity management will be important going forward.

What’s reassuring is how Knight-Swift allocates capital. They’ve made strategic moves like acquiring U.S. Xpress, but they haven’t gone overboard. There’s discipline in how they run the business, and that’s good news for income investors looking for reliability rather than explosive growth.

If their expansion into logistics and intermodal operations starts delivering better margins, there’s a chance for both cash flow and dividend capacity to improve. For now, this is a dividend you watch, not one you forget about. It’s quietly becoming a more meaningful part of the company’s identity. And that quiet confidence might be exactly what some portfolios need.

Cash Flow Statement

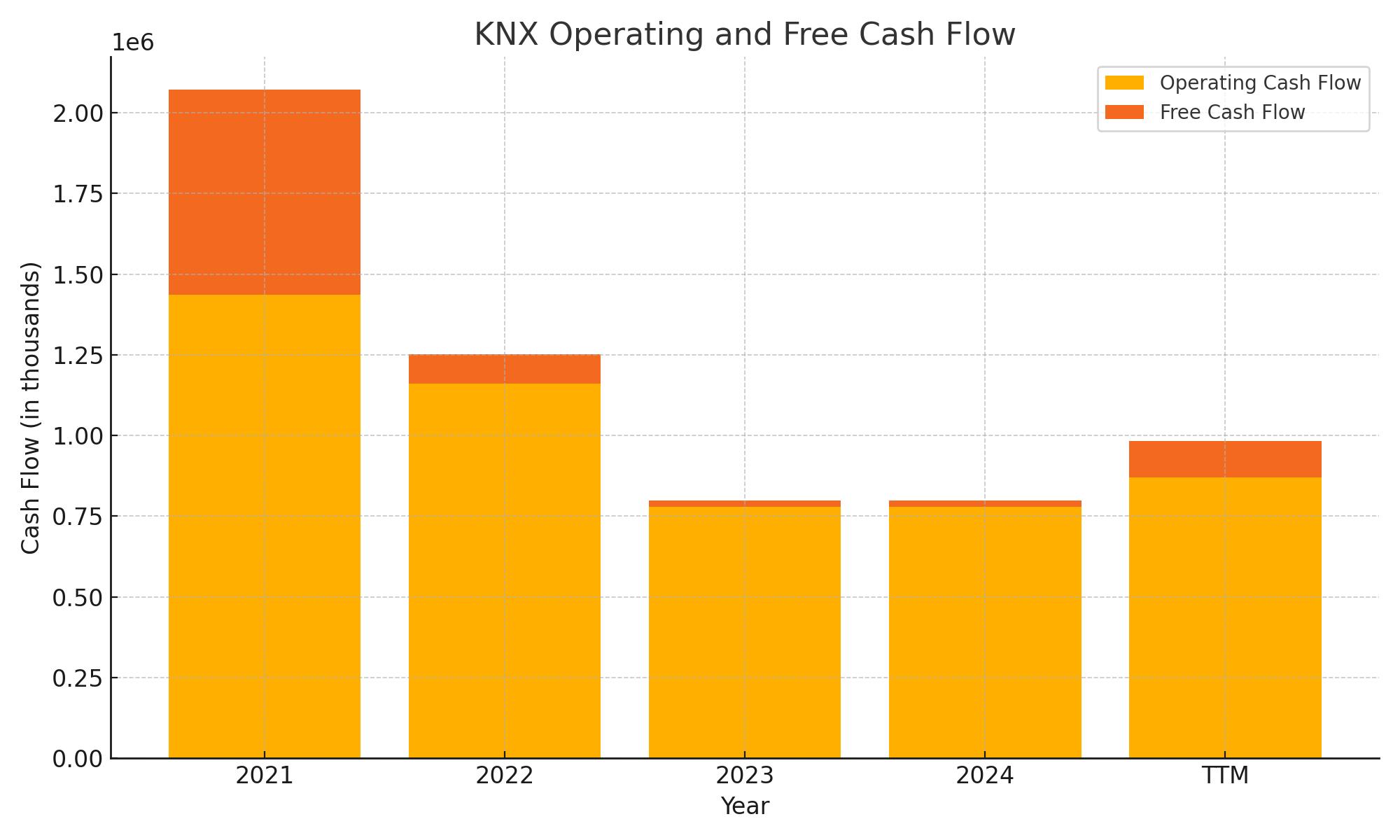

Knight-Swift’s trailing twelve-month (TTM) cash flow paints a picture of a company still generating solid operating income but under pressure from sustained investment outflows. Operating cash flow came in at $871 million, a respectable figure, though it’s notably down from previous years when it consistently surpassed the $1 billion mark. Free cash flow rebounded into positive territory at $111 million, after dipping into the red the year before. That rebound matters, especially for dividend sustainability, though it’s clear the company’s ability to generate excess cash has tightened.

On the investment side, outflows remain heavy, with nearly $674 million spent over the past year. Capital expenditures make up the bulk of that, totaling about $760 million—showing Knight-Swift continues to reinvest significantly in its fleet and infrastructure. Meanwhile, the company issued over $618 million in new debt, but that was more than offset by repayments of roughly $746 million. The end cash balance of $349 million is slightly below last year’s figure, reflecting both cautious cash management and the weight of ongoing capital requirements. The financing section also shows a pullback from prior years’ more aggressive capital moves.

Analyst Ratings

📉 Knight-Swift Transportation Holdings Inc. (KNX) recently saw a shift in sentiment among analysts. On April 1, 2025, one major bank pulled back its rating, moving KNX from “Buy” to “Neutral.” The reasoning? Lingering macroeconomic uncertainty and softer freight demand outlooks made them less confident in near-term upside. Along with the downgrade, the firm trimmed its price target from $66 down to $46, suggesting a more conservative view of the company’s earnings potential in the months ahead.

📈 Just a week later, sentiment improved from another corner. On April 8, 2025, a separate institution moved in the opposite direction, upgrading KNX from “Neutral” to “Buy.” Their price target came down slightly, from $53 to $48, but they highlighted improving operational execution and the early signs of freight volume stabilization as reasons for their more constructive outlook. While the upgrade was modest, it indicated a growing belief that the company may be better positioned than peers to weather the current cycle.

🎯 Across the board, analyst sentiment remains cautiously optimistic. The average consensus price target is $52.20, with a spread that stretches from a low of $42.42 to a high of $71.40. The range reflects different views on how quickly the freight environment will rebound—and how well Knight-Swift can capitalize when it does.

Earning Report Summary

A Better Quarter Than Expected

Knight-Swift’s first quarter of 2025 came with a few positive surprises. After struggling with losses this time last year, the company managed to swing back into the black. They posted net income of $30.6 million, or $0.19 per share. When adjusting for certain one-time items, earnings landed at $0.28 per share, which came in ahead of what many expected. Revenue for the quarter held steady at $1.82 billion. While that might not sound exciting, it’s worth noting that underlying revenue actually ticked up slightly when you strip out fuel surcharges and internal transactions.

Even more encouraging was the jump in operating income. Adjusted figures showed a 68% increase year-over-year, hitting $86.6 million. That signals real progress in how efficiently the company is running despite the freight market still being a bit unpredictable.

Segments at a Glance

Truckload operations faced a small drop in revenue, down about 4% compared to last year. Still, the team managed to improve their adjusted operating ratio, which means they were doing more with less. A key bright spot here was U.S. Xpress. Since being acquired last summer, it just posted its first profitable quarter under the Knight-Swift umbrella—something that didn’t go unnoticed.

The LTL (less-than-truckload) segment delivered strong volume growth, with shipments per day jumping over 24%. That helped push revenue up by nearly 27%. Pricing was strong too, but the gains were partially offset by integration costs related to Dependable Highway Express, which the company is still folding into the larger business. As a result, operating income took a bit of a hit, but the growth trajectory remains solid.

In logistics, revenue climbed nearly 12% with better rates per load and tight management on costs. Margins improved nicely, which gave the segment a solid contribution to overall performance. The intermodal business, meanwhile, is still finding its footing. Revenue edged up just slightly and the operating ratio stayed on the wrong side of breakeven.

What Leadership Had to Say

CEO Adam Miller struck a calm and focused tone during the earnings call. He acknowledged some of the headwinds out there—things like unpredictable weather and broader economic crosswinds—but emphasized the company’s ability to control its own levers. That includes being smart about equipment, managing expenses, and staying nimble as the freight market shifts.

Looking ahead, Knight-Swift offered some measured optimism. They expect earnings per share in the next quarter to fall somewhere between $0.30 and $0.38. The LTL segment is set to keep growing, with projections of a 25% to 30% revenue increase year-over-year. Truckload might grow more modestly, but margins are expected to hold up. Investments will remain focused on modernizing the fleet and strengthening the terminal network, which should help the business stay competitive across all segments.

Management Team

Knight-Swift Transportation Holdings Inc. is led by a deeply experienced team with a long history in the trucking and logistics space. At the top is CEO Adam Miller, who took over the reins in early 2024 after serving in key roles including CFO and President of Swift Transportation. He’s been with the company for more than two decades, so his leadership style reflects an intimate understanding of its operations, culture, and challenges.

Working alongside Miller is CFO Andrew Hess, who stepped into the finance leadership role around the same time. Hess brings strong internal experience and has held several financial roles within the organization before his promotion. The executive team is rounded out by Executive Chairman Kevin P. Knight and Vice Chairman Gary J. Knight, both of whom played instrumental roles in shaping the strategic path that has brought Knight-Swift to where it is today. Their continued involvement ensures that long-term vision remains at the heart of day-to-day decisions.

This mix of continuity, deep industry knowledge, and operational insight gives the leadership team a steady hand as they guide the company through industry shifts and economic cycles.

Valuation and Stock Performance

Knight-Swift’s stock is currently trading at $43.84, rebounding somewhat from its 52-week low of $36.69 but still well off its high of $61.51. That tells a story of a stock trying to regain footing after a tough stretch in the freight industry.

Valuation metrics show a forward price-to-earnings ratio of 29.50, suggesting investors still expect the company to grow earnings. However, the trailing P/E of 45.55 reflects the current pressure on profitability, and the market isn’t ignoring that. Analysts on average have a price target of $50.29, with projections ranging from $44.00 on the low end to $63.00 at the high end. That wide spread shows how divided sentiment is—some see solid upside potential if the freight market improves, while others are waiting to see more concrete signs of recovery.

Performance over the past year has been influenced by the same macroeconomic currents hitting the rest of the trucking sector. Freight demand has been uneven, pricing has been competitive, and costs are always a factor. Still, Knight-Swift’s broad operational footprint and recent investments give it a platform for recovery that many smaller peers may not have.

Risks and Considerations

Knight-Swift is not immune to the volatility of the broader economy. Freight volumes tend to ebb and flow with economic activity, and when demand softens, revenues can take a hit. In recent quarters, trade uncertainties have also had an impact. Some customers have pulled back or delayed shipments, waiting for clearer signals on tariffs and regulations.

There’s also the complexity of integrating acquisitions. U.S. Xpress, which Knight-Swift acquired in 2023, holds long-term promise but also brings with it operational and cultural integration hurdles. Getting that acquisition to perform well financially will be key to unlocking value in the coming quarters.

Another long-term factor is regulation. Environmental standards are evolving, and with them comes pressure to modernize fleets and reduce emissions. That can mean higher upfront costs and tighter compliance frameworks. There’s also ongoing exposure to fuel price swings, labor shortages, and equipment delays—all of which can squeeze margins if not managed carefully.

These aren’t unique risks to Knight-Swift, but they are worth weighing when evaluating how the company is positioned for both short-term pressures and long-term shifts in the industry.

Final Thoughts

Knight-Swift remains one of the most recognized names in U.S. trucking. Its scale, asset base, and diversified offerings across truckload, LTL, logistics, and intermodal give it a range of levers to pull as the economy evolves. Leadership has proven to be steady, disciplined, and focused on driving performance while managing through the inevitable cycles that come with this business.

There’s no denying the challenges it faces, from macroeconomic headwinds to operational costs and evolving industry standards. But the company’s approach—rooted in efficiency, smart capital deployment, and consistent strategy—provides a level of resilience that makes it worth keeping on the radar. Whether the freight market bounces back this year or next, Knight-Swift is positioning itself to be ready when it does.