Key Takeaways

📈 Kite Realty offers a forward dividend yield of 5.05%, with consistent annual growth and a strong track record of stable payouts supported by necessity-based retail tenants.

💰 Operating cash flow reached $439.5 million in the trailing twelve months, with free cash flow of $292.4 million, indicating strong coverage for dividends and reinvestment.

🔍 Analysts maintain a moderate buy consensus with a 12-month price target of $27.63, reflecting confidence in the company’s fundamentals and recent positive earnings momentum.

Last Update 5/27/25

Kite Realty Group Trust (NYSE: KRG) is a real estate investment trust focused on open-air shopping centers, particularly those anchored by essential retailers like grocers and daily needs tenants. With a portfolio spread across high-growth markets in the Sunbelt and coastal regions, Kite has positioned itself as a reliable generator of cash flow with consistent dividend payouts. The company recently reported a 6.9% year-over-year increase in revenue and raised its full-year FFO guidance, signaling solid operational momentum.

The stock currently trades around \$21.94 with a forward dividend yield of 5.05%, supported by steady free cash flow and a disciplined approach to capital allocation. Management’s recent acquisition of Legacy West in Dallas and leasing spreads above 13% reinforce a growth strategy built on quality assets and market demand. For income-focused investors, KRG offers a balance of yield, stability, and long-term potential.

Recent Events

Looking at recent developments, Kite Realty has had a rather eventful stretch—just not the kind that makes headlines. Revenue has been growing at a healthy clip, up nearly 7% year-over-year, and earnings surged by more than 67% over the same period. That kind of earnings growth for a REIT is impressive and hints at better operational efficiency or increased rent collection across its portfolio.

From a stock performance standpoint, the price has been relatively flat—up just under 2% over the past year. That might seem uninspiring at first glance, especially when the broader market has posted stronger gains. But for income-focused investors, this lack of price volatility is often a feature, not a bug. Flat price action paired with a consistent dividend yield creates a smoother ride, which is what many income investors are looking for.

On the balance sheet front, the company carries around $3 billion in total debt. That puts the debt-to-equity ratio close to 88%. It’s not low, but in the world of REITs where leverage is part of the business model, it’s not an outlier either. With nearly $440 million in operating cash flow and even higher levels of levered free cash flow, the company is not only covering its obligations—it’s also maintaining flexibility for future dividends.

Key Dividend Metrics

📈 Forward Yield: 5.05%

💰 Annual Dividend: $1.08 per share

🧮 Payout Ratio: 1,114.29% (based on net income)

📊 5-Year Average Yield: 4.50%

🗓 Ex-Dividend Date: July 9, 2025

📆 Next Dividend Date: July 16, 2025

The high payout ratio jumps out, but it’s worth taking a breath before drawing conclusions. For REITs, traditional earnings metrics don’t give the full picture.

Dividend Overview

Kite Realty’s dividend profile looks appealing on several fronts. The forward yield currently sits at a generous 5.05%, which is not only higher than its five-year average of 4.5%, but also well above the yield you’ll get from most fixed-income alternatives today.

With an annual dividend rate of $1.08, up from $1.05 previously, the company is clearly committed to maintaining a solid income stream for shareholders. That growth may not be eye-popping, but it reflects a thoughtful and sustainable pace. In this environment, that’s a welcome sign.

What really stands out is how consistent the dividend has been, even during periods of broader market stress. Kite’s payout hasn’t been flashy, but it has been dependable. And that consistency becomes even more attractive when coupled with a business model focused on high-traffic, essential retail locations.

Dividend Growth and Safety

On paper, the payout ratio looks sky-high—over 1,100% based on net income. But that’s not unusual for REITs. The trick is that net income under generally accepted accounting principles includes significant depreciation on real estate assets. It makes the business look less profitable than it really is from a cash perspective.

The real test of dividend safety for a REIT lies in its funds from operations (FFO) and adjusted funds from operations (AFFO). While those specific numbers aren’t listed here, the company’s robust operating cash flow—$439 million—and its strong EBITDA numbers suggest that the dividend is well-covered by recurring cash earnings.

In terms of growth, Kite isn’t likely to be a name that doubles your income stream in five years. But that’s not really the point. What Kite does offer is a measured, reliable increase that can keep pace with inflation and help protect purchasing power over time. A 2.8% raise in the dividend, from $1.05 to $1.08, reflects a cautious but shareholder-friendly approach.

Cash Flow Statement

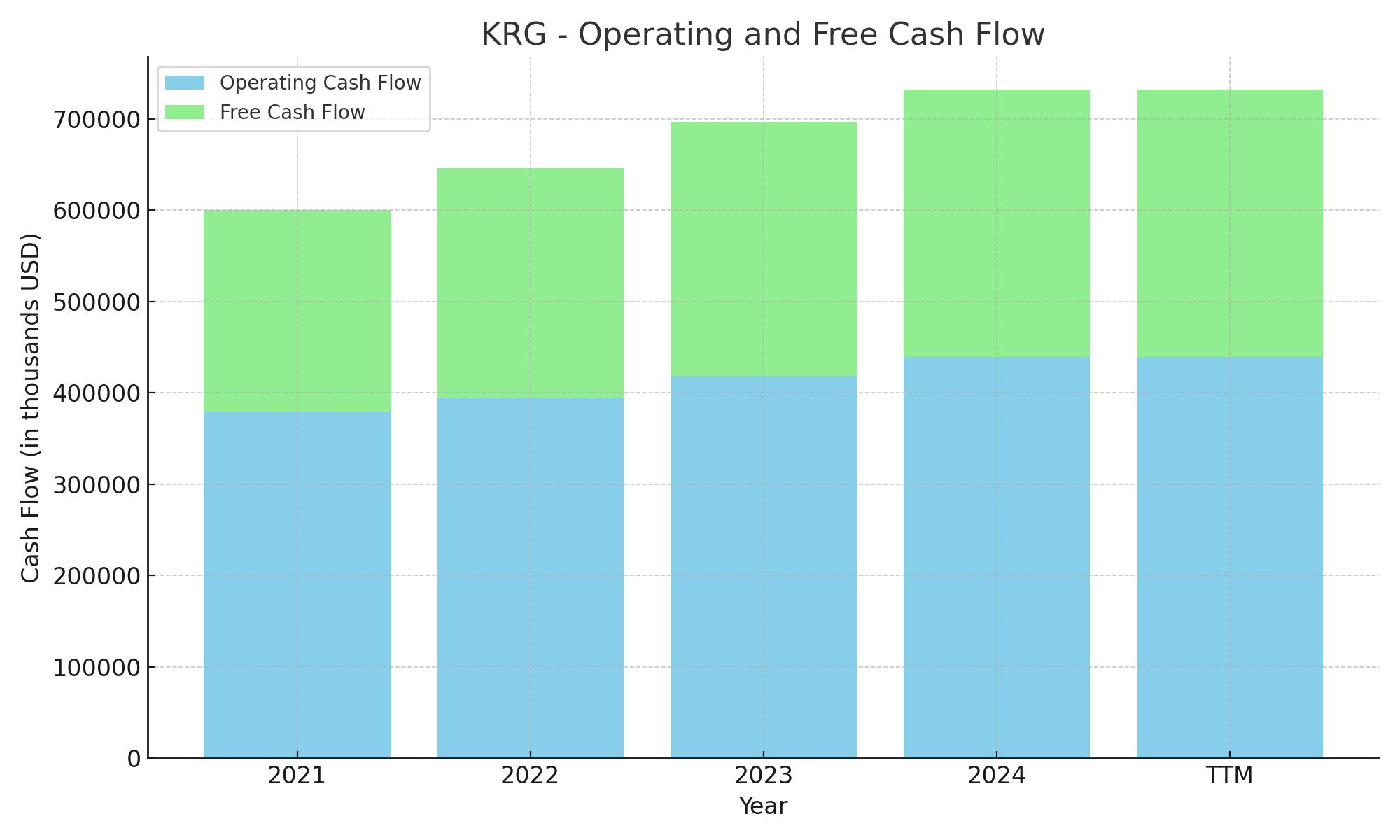

Kite Realty Group Trust has shown strong consistency in its cash-generating ability, with trailing twelve-month (TTM) operating cash flow reaching $439.5 million. This continues a steady upward trend over the last few years, climbing from $379.3 million in 2021 to $419 million by the end of 2024. That steady rise in operating cash flow underscores the stability of its core rental income and operational management, providing a solid foundation for sustaining dividends and covering capital expenses.

Capital expenditures remained in a tight range, totaling $147.1 million over the TTM period, slightly above the prior year. Free cash flow landed at $292.4 million, a healthy increase from previous years. On the financing side, there was a net cash outflow of $491.5 million, driven largely by aggressive debt repayments totaling $693.8 million, despite new debt issuance of $450.6 million. This reflects a clear focus on deleveraging and financial discipline. The company ended the TTM period with $55.1 million in cash on hand, a drop from $133.6 million the prior year, indicating the firm is putting its capital to work rather than letting it sit idle.

Analyst Ratings

📈 Kite Realty Group Trust (NYSE: KRG) has seen a mix of analyst activity recently, reflecting both optimism and recalibration. Raymond James updated their stance by lowering the price target from $28 to $26, but interestingly, they kept a “Strong Buy” rating. That suggests they still see meaningful upside, even if they’re adjusting expectations to better align with current market dynamics and valuation multiples.

🔄 On the other hand, Piper Sandler took a more cautious route, shifting their rating from “Buy” to “Hold” and reducing their target from $33 to $25. Their move likely stems from increased focus on near-term risks like leasing pressure or tenant retention challenges, both of which could impact growth over the next few quarters.

⚖️ Wells Fargo also revisited its view, trimming its price target from $26 to $24 while holding onto an “Equal Weight” rating. It’s a sign of neutrality—recognizing the company’s stability but holding back from making a more bullish call until there’s more visibility on growth catalysts or operational leverage.

📊 Across the board, analysts have settled on a consensus price target of $27.63 over the next 12 months. That represents a projected upside of roughly 29% from current levels and reinforces a “Moderate Buy” consensus rating from the broader analyst community.

Earnings Report Summary

A Strong Start to the Year

Kite Realty Group Trust opened 2025 on a strong note, with first-quarter numbers that came in ahead of expectations. Net income available to common shareholders landed at $23.7 million, or $0.11 per diluted share, reflecting healthy performance right out of the gate. Revenue climbed to $221.8 million, marking a nearly 7% increase over the same quarter last year. That kind of growth doesn’t happen by accident—it’s the result of a disciplined approach to property management and strategic growth.

One of the more eye-catching developments this quarter was the acquisition of Legacy West, a high-end mixed-use development in the Dallas area. It’s a trophy asset with impressive occupancy levels—over 98% leased on the office side and 95% for retail. That kind of asset doesn’t just add to the portfolio; it elevates it. And it’s expected to be immediately accretive to FFO per share, which helps support future dividend stability and growth.

Leasing Momentum and Guidance

Leasing activity was also a bright spot this quarter. The company signed 182 new and renewal leases covering about 844,000 square feet. The blended cash leasing spread came in at a strong 13.7%, and non-option renewals were even better at 20%. Those are healthy spreads that suggest strong demand across Kite’s retail footprint. What’s more, new shop leases averaged nearly $41 per square foot—well above the portfolio’s current average. That kind of pricing power points to well-located, in-demand assets.

Management responded to the quarter’s strength by raising its full-year guidance. NAREIT FFO per share is now expected to fall between $2.04 and $2.10, up from the previous range. Core FFO was also bumped up slightly, which shows confidence not just in what’s happened, but in what’s ahead. Same-property NOI growth came in at 3.1% for the quarter, helped by stronger base rent and solid recovery income.

Steady Vision from Leadership

CEO John Kite took a confident tone when reflecting on the quarter, emphasizing the team’s ability to execute well despite a complex economic backdrop. He pointed to the strength of the balance sheet and reiterated the company’s focus on long-term value creation. There’s a sense that Kite Realty is not just trying to grow for growth’s sake, but rather focusing on high-quality additions to the portfolio and maintaining operational discipline.

All signs from this report suggest that Kite is staying focused on what it does best: managing high-performing retail centers, keeping tenants in place, and driving value for shareholders. The results speak for themselves, and the tone from leadership suggests more of the same going forward.

Management Team

Kite Realty Group Trust is led by a seasoned executive team with deep roots in the real estate sector. At the helm is John A. Kite, who has served as Chairman and CEO since the company’s inception in 2004. With a background in economics and a career that began at Harris Trust and Savings Bank, John brings strategic vision and a steady hand to the company’s growth and operations.

Supporting him is Thomas K. McGowan, President and Chief Operating Officer. Tom has been with Kite Realty since 2004, overseeing development, leasing, and property management. His extensive experience in real estate development ensures that the company’s projects are executed efficiently and effectively.

Heath R. Fear serves as Executive Vice President and Chief Financial Officer. Heath joined Kite Realty in 2018, bringing with him a wealth of experience from his previous roles at GGP Inc. and RPAI. He oversees the company’s financial strategy, accounting, and investor relations, ensuring fiscal responsibility and transparency.

Rounding out the leadership team is Mellissa Boggs, Executive Vice President of Employee Experience. Mellissa focuses on human capital initiatives, fostering a workplace culture that supports employee engagement and development.

This leadership team combines strategic foresight with operational expertise, positioning Kite Realty for continued success in the competitive real estate market.

Valuation and Stock Performance

As of late May 2025, Kite Realty Group Trust’s stock is trading around $21.94 per share. The company’s market capitalization stands at approximately $4.81 billion, with an enterprise value of $7.69 billion. These figures reflect the company’s substantial presence in the real estate investment trust sector.

In terms of valuation metrics, the stock’s price-to-sales ratio is 5.5, which is slightly below the peer average. The price-to-book ratio is 1.42, indicating that the stock is trading at a reasonable premium to its book value. The enterprise value to EBITDA ratio is 15.5, suggesting that investors are willing to pay a premium for the company’s earnings before interest, taxes, depreciation, and amortization.

Analysts have set a consensus 12-month price target of $27.63 for Kite Realty, implying a potential upside of approximately 29 percent from current levels. This target reflects confidence in the company’s ability to generate stable cash flows and maintain its dividend payouts.

Over the past year, the stock has experienced modest growth, with a 3 percent increase in share price. While this performance may not be as robust as some high-growth sectors, it aligns with the company’s focus on stability and income generation, which is appealing to dividend-focused investors.

Risks and Considerations

Investing in Kite Realty Group Trust involves several risks and considerations. One key concern is the company’s exposure to the retail sector, which has been undergoing significant changes due to the rise of e-commerce and shifting consumer preferences. While Kite Realty focuses on open-air shopping centers anchored by grocery stores and other necessity-based retailers, there is still a risk of tenant turnover and vacancies.

Another consideration is the company’s debt levels. With total debt of approximately $2.98 billion and a debt-to-equity ratio of 88.36 percent, Kite Realty carries a significant amount of leverage. While this is common in the REIT industry, it does expose the company to interest rate risk and potential refinancing challenges.

Economic conditions also play a role in the company’s performance. Factors such as rising interest rates, inflation, and changes in consumer spending can impact the demand for retail space and the company’s ability to maintain occupancy rates and rental income.

Additionally, the company’s geographic concentration in certain markets could pose risks if those areas experience economic downturns or natural disasters. Diversification across different regions can help mitigate this risk, but it’s still a factor to consider.

Final Thoughts

Kite Realty Group Trust presents a compelling option for investors seeking stable income through dividends. The company’s focus on necessity-based retail properties, combined with a strong management team and prudent financial practices, positions it well in the current market environment.

While there are risks associated with the retail sector and the company’s debt levels, Kite Realty’s strategic approach to property management and development, along with its commitment to maintaining a strong balance sheet, provides a level of confidence in its long-term prospects.

For dividend-focused investors, Kite Realty offers a reliable income stream with the potential for modest capital appreciation. As with any investment, it’s important to consider the associated risks and conduct thorough due diligence before making a decision.