Key Takeaways

📈 Kellanova offers a forward dividend yield of 2.77% with a consistent track record of steady, moderate dividend growth supported by a sustainable 57% payout ratio.

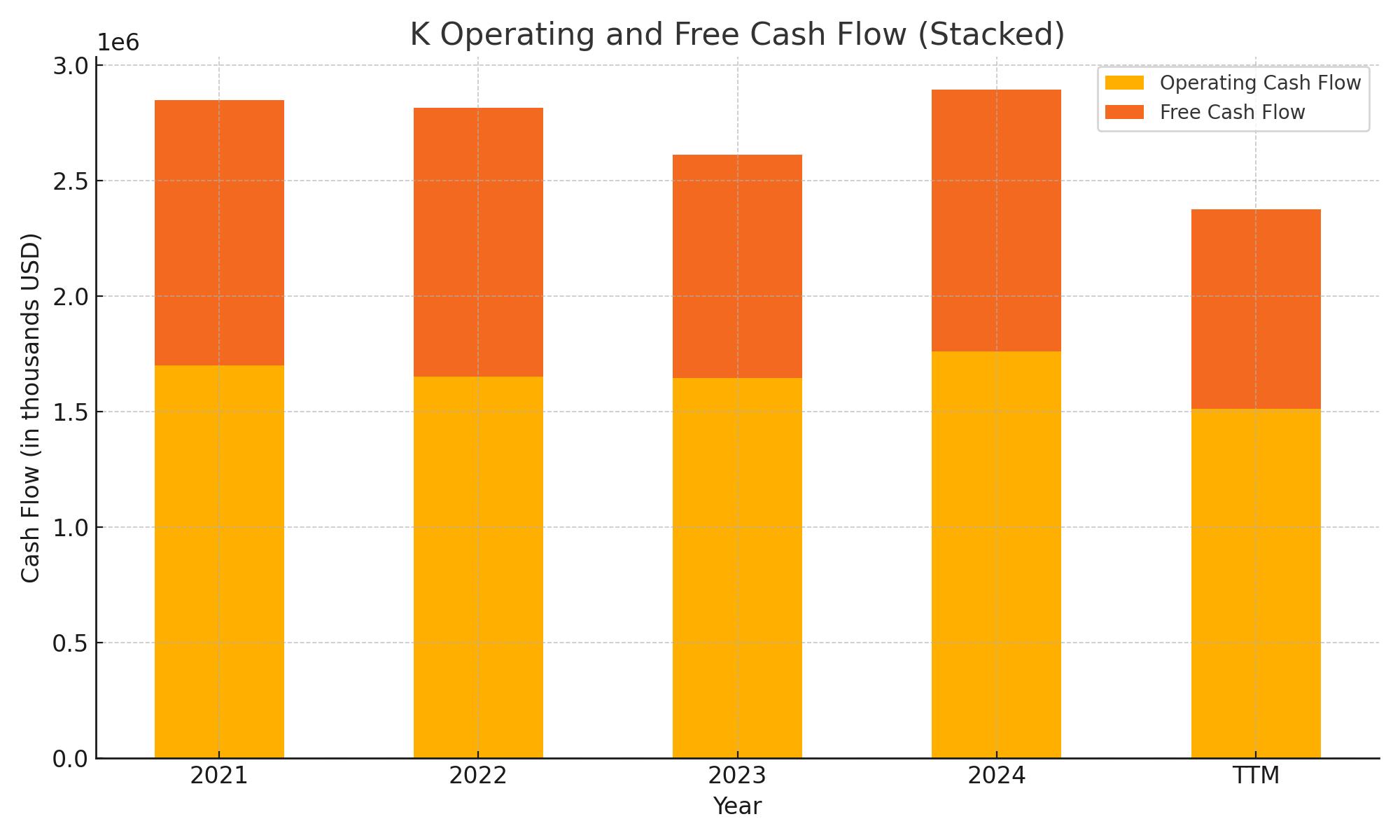

💵 The company generated $1.51 billion in operating cash flow over the trailing 12 months, with $863 million in free cash flow—providing solid coverage for its dividend and capital needs.

🔍 Analysts have taken a more neutral stance recently, with a consensus hold rating and a price target of $79.41, reflecting tempered short-term expectations despite operational resilience.

Last Update 5/27/25

Kellanova, trading under the symbol K, has transitioned into a focused snacking powerhouse after spinning off its North American cereal business. Now home to brands like Pringles, Cheez-It, and Eggo, the company has shifted its energy toward higher-margin, global growth categories. Backed by a steady operating model and seasoned leadership, Kellanova continues to generate reliable cash flow and maintain a long-standing dividend commitment.

Over the past year, the stock has gained nearly 38%, driven by solid earnings growth and the company’s strategic repositioning. Despite short-term headwinds like currency fluctuations and cost pressures, management remains confident in its execution, while the market takes a more measured view. With a forward dividend yield of 2.77% and a payout ratio around 57%, Kellanova balances shareholder returns with reinvestment in its future.

Recent Events

Kellanova has been going through a bit of a transformation lately. After spinning off its North American cereal division into WK Kellogg Co back in 2023, the company started narrowing its focus on higher-growth segments—namely snacks, international cereal, and frozen foods. This wasn’t just a cosmetic shift. It marked a meaningful pivot away from slower-moving legacy products toward more global and fast-moving categories.

And that shift seems to be gaining traction. Over the last year, the stock has climbed over 38%, outpacing the broader market. Earnings are also trending in the right direction. While revenue dipped a touch year-over-year, earnings actually grew nearly 14%, suggesting better cost controls and improved product mix are taking effect.

Kellanova is leaning into categories where it can win—and doing so without skipping a beat when it comes to shareholder returns. That kind of balance between reinvention and consistency is what makes the story here particularly interesting, especially for those of us focused on dividends.

Key Dividend Metrics

📈 Forward Dividend Yield: 2.77%

💰 Annual Dividend Rate: $2.28

🔁 5-Year Average Dividend Yield: 3.51%

🧮 Payout Ratio: 57.18%

📅 Next Dividend Date: June 13, 2025

🔔 Ex-Dividend Date: June 2, 2025

📊 Dividend Growth (Trailing 5 Years): Steady, modest increases

🧱 Debt/Equity: 155.5%

These figures don’t scream high yield, but they speak volumes about stability and dependability. That forward yield near 2.8% might sit below its five-year average, but that’s more a reflection of a rising stock price than a change in payout strategy. The consistency here is what matters, and that shows through clearly.

Dividend Overview

When you look at Kellanova from a dividend perspective, the word that comes to mind is “durability.” This isn’t a stock that’s ever made headlines with jaw-dropping hikes or flashy shareholder moves. Instead, it just keeps delivering—year in, year out.

The current dividend sits at $2.28 annually, which gives it a forward yield that lands just under 2.8%. That won’t set income portfolios on fire, but it doesn’t need to. The payout ratio sits just over 57%, which is pretty comfortable. There’s still room to reinvest in the business, something that’s especially important as Kellanova continues to reposition itself globally.

Free cash flow coverage is healthy, too. Operating cash flow over the past year came in at $1.51 billion, with plenty of room to fund the dividend and maintain some breathing room for capital spending. That cushion is important—it gives management the ability to maintain or grow the payout even during a rocky quarter.

What also stands out is the company’s discipline. Even during its split, Kellanova kept things moving steadily on the dividend front. No surprises. No panic. Just a quiet continuation of shareholder returns.

Dividend Growth and Safety

Safety and predictability have always been part of the playbook here, and that hasn’t changed post-spin-off. The payout ratio is in a zone that feels sustainable, and the core business—anchored by strong, recognizable brands—delivers a kind of cash flow that’s easy to rely on.

Over the last five years, dividend increases have been slow and steady. No major jumps, but also no reversals or erratic patterns. It’s the kind of consistency that dividend investors tend to value over time. There’s comfort in knowing the company doesn’t need to rely on financial gymnastics to support its payout.

Looking ahead, there’s room for measured growth in the dividend. Management likely won’t push the payout ratio much higher, but with earnings moving in the right direction and cost efficiencies kicking in, there could be a little more headroom than in years past.

One thing to keep an eye on is the debt load. At $6.26 billion and with a debt-to-equity ratio above 155%, leverage isn’t low. But the business is built on stable demand, and cash flows remain solid. It’s not the kind of debt profile that typically raises red flags for a consumer staples name, but it’s something that could limit big dividend jumps in the near term.

In the end, Kellanova offers a story that dividend investors can feel good about. It’s not about chasing the highest yield or betting on explosive growth. It’s about showing up, quarter after quarter, and doing what needs to be done to keep shareholders rewarded. And that’s exactly what Kellanova has been doing.

Cash Flow Statement

Kellanova generated $1.51 billion in operating cash flow over the trailing 12 months, a slight dip from the $1.76 billion recorded in 2023. Despite the year-over-year pullback, the company continues to produce reliable core cash generation, supported by resilient demand across its snack and frozen food segments. Free cash flow came in at $863 million, which is comfortably above its annual dividend obligation, reflecting adequate room to manage debt and reinvest in the business.

On the investing side, Kellanova spent $649 million in capital expenditures over the last year, slightly up from the prior year but consistent with its operational footprint. Financing cash flow was negative $862 million, driven primarily by $1.31 billion in debt repayments. Notably, there were no new debt issuances or share buybacks in the period, suggesting a more cautious capital deployment strategy. The end cash position decreased to $323 million, down from $694 million the prior year, which reflects the combination of debt reduction efforts and steady investment in growth areas.

Analyst Ratings

📉 Kellanova has recently seen a wave of analyst downgrades, reflecting a shift toward a more cautious stance from Wall Street. In March 2025, Royal Bank of Canada adjusted its rating from moderate buy to hold, citing concerns around slowing near-term growth and lingering macroeconomic pressures. The sentiment was echoed by Argus Research, which moved the stock from buy to hold back in October 2024. Their change stemmed from a re-evaluation of the company’s valuation after its recent run-up in share price and uncertainty tied to input costs.

🔍 These adjustments indicate that analysts are dialing back expectations for aggressive gains in the near term. While the company continues to show solid execution post-spin-off, analysts appear to be waiting for clearer signs of sustained earnings momentum before turning more optimistic.

💼 Even with the downgrade activity, the stock maintains a consensus rating of hold, and analysts currently have a consensus price target of $79.41. That figure sits a few points below Kellanova’s recent trading level around $82.50, suggesting most see the stock as fairly valued for now. The muted outlook appears driven by near-term margin pressures and broader sector headwinds, despite the company’s strong brand portfolio and operational stability.

Earning Report Summary

Topline and Profit Snapshot

Kellanova kicked off 2025 with results that were a bit of a mixed bag. Net sales came in at $3.08 billion for the quarter, which was down 3.6% compared to the same period last year. Still, when you peel back the currency noise, organic net sales actually nudged higher by 0.7%. That shows there’s still some solid demand holding up the core parts of the business, despite the broader slowdown.

Operating profit landed at $430 million, which was a noticeable step up—just over 9% higher than last year. That bump came largely because the company didn’t have to deal with the restructuring costs that weighed down last year’s results. But on an adjusted basis, things looked a little softer. Adjusted operating profit fell more than 13%, and around 10.5% lower when stripping out currency swings, showing that higher costs and product mix are still pressuring margins.

Earnings and Regional Trends

Earnings per share reached $0.87, up 12% from the year prior, helped by that stronger operating profit and a lower tax bill. Adjusted EPS told a slightly different story, coming in at $0.90, down from $1.01. So while headline earnings looked better, the underlying picture was a bit more restrained.

Looking around the world, North America saw a dip in net sales, down about 4%, with softer demand hitting the snacking and frozen categories. Europe’s numbers also slid slightly—down 3% overall and 2% organically. The good news is, cost cuts helped boost profit in that region. Latin America had a rougher go, with net sales tumbling 15% mostly due to currency hits, though profits looked better once you back out those effects. On the flip side, the Asia Pacific, Middle East, and Africa segment saw 3% sales growth and an impressive 17% jump in organic sales, with emerging markets doing much of the heavy lifting.

Leadership Perspective

CEO Steve Cahillane acknowledged that things remain unpredictable out there. Inflation, shifting demand, and foreign exchange pressures continue to cloud the near-term view. Still, he expressed confidence in Kellanova’s ability to hit its targets. He noted that the company is staying focused on execution and making gains in market share where it matters.

One of the bigger themes coming out of this quarter is the groundwork being laid for the merger with Mars. Cahillane made it clear that the leadership team sees this deal as a way to transform Kellanova into an even stronger global snacking leader. The focus now is on navigating near-term challenges while staying on course for the long-term reshaping of the business.

Management Team

Kellanova’s leadership is guided by Steve Cahillane, who serves as Chairman, President, and CEO. Cahillane has been steering the company since 2017 and brings prior experience from The Nature’s Bounty Co. and The Coca-Cola Company. Under his direction, Kellanova has undertaken significant changes, most notably the separation from its legacy cereal division and its shift toward becoming a global snacking business.

Alongside Cahillane is a team of seasoned executives. Nicolas Amaya leads the North American segment and has been with the company since 2001. Shumit Kapoor oversees the Asia Pacific, Middle East, and Africa region, contributing deep international operational experience. David Lawlor runs the European side of the business, while Victor Marroquín is responsible for Latin America. Other key figures include Charisse Hughes as Chief Growth Officer, Melissa Howell as Chief Human Resources Officer, and Lesley Salmon as Chief Digital and Information Officer. Each member plays a critical role in delivering on strategy and executing across regions.

Valuation and Stock Performance

As of late May 2025, Kellanova’s stock trades around $82.43, reflecting solid performance over the past year. The company holds a market cap near $28.6 billion with a forward price-to-earnings ratio of 21.01. These numbers place the stock in line with other consumer staples names, pointing to the market’s view of Kellanova as a reliable, steady player in the space.

The past 12 months have been kind to shareholders, with the stock up roughly 38% over that time. Much of this move is tied to optimism around its transformation strategy and continued strength in global snack brands. That said, analyst sentiment remains cautious in the short term. The average price target sits at $79.41, just under where shares are currently trading. This signals a more neutral view for the near future as markets assess execution and macroeconomic dynamics.

Risks and Considerations

There are a few risks that investors should keep an eye on. One of the most immediate is leverage. Kellanova’s debt-to-equity ratio stands at 155.5%, a level that suggests limited financial wiggle room if cash flow were to tighten or interest rates were to climb further. While the business model is cash-generative, high debt can create pressure when navigating growth or external shocks.

The planned acquisition by Mars also introduces a new set of unknowns. Integrating two large businesses isn’t always straightforward. There are questions around systems, cultures, and leadership alignment that can create friction. Plus, regulatory approval isn’t always a given and could introduce delays or modifications to the original terms.

From an operational standpoint, cost pressures remain front and center. Commodity volatility, freight costs, and evolving consumer trends can all affect margins and demand. While the company’s brand portfolio is a strength, a heavy dependence on a few key names means there’s little room for underperformance in those categories. Global operations also bring exposure to currency swings and geopolitical issues, which can quickly shift earnings expectations.

Final Thoughts

Kellanova is in the middle of an important chapter in its corporate story. The spin-off and sharpened focus on snacks have helped carve out a clear identity, and the results so far suggest the company is heading in the right direction. The leadership team has experience and a track record of navigating complexity, which is reassuring as the company moves through its next phase of growth.

At the same time, there are reasons to stay alert. Debt levels, market uncertainty, and the upcoming integration with Mars all introduce moving parts that will require execution discipline. For long-term investors who value consistency with some upside potential, Kellanova offers a blend of stability and strategic change. How well it manages that balance in the coming quarters will shape its place in dividend-focused portfolios.