Updated 2/24/26

KBR, Inc. has steadily transformed into a global leader in government services, space exploration, and sustainable technologies. With operations anchored in long-term, mission-critical contracts, the company delivers consistent earnings and cash flow, backed by a well-managed balance sheet and strong return on equity. Its pivot away from traditional engineering toward high-margin service segments has positioned it for reliable growth in key areas like defense and energy transition.

The stock offers a modest but growing dividend supported by a low payout ratio and healthy free cash flow. Management remains focused on disciplined capital allocation, strategic acquisitions, and digital transformation. For investors prioritizing stability, income, and long-term growth potential, KBR presents a well-rounded profile.

Recent Events

KBR has continued to execute on its long-term repositioning strategy, deepening its presence in defense, space, and sustainable technology while maintaining its reputation as a reliable government services partner. The company’s Mission Technology Solutions segment has remained a consistent source of contract wins, with KBR continuing to build on established relationships with the U.S. Space Force, Department of Defense, and allied international defense programs. These relationships reflect years of operational credibility that are difficult for competitors to replicate.

On the financial side, KBR reported full-year revenue of approximately $8.04 billion and net income of $416 million, representing a strong improvement in profitability on a base that continues to grow. EPS came in at $3.19, and return on equity remains an impressive 28.43%, demonstrating that management continues to deploy capital efficiently even as the business scales. These are not the numbers of a company losing its edge.

The share price, however, has drifted lower. At $40.40, KBR is trading near the bottom of its 52-week range of $39.43 to $56.78, which creates an interesting dynamic for income investors evaluating entry points. Operating cash flow of $515 million provides a strong foundation for continued dividends and opportunistic repurchases, even as the market has assigned a more skeptical near-term valuation to the stock.

Key Dividend Metrics

📈 Forward Dividend Yield: 1.60%

💵 Annual Dividend: $0.66

🧮 Payout Ratio: 20.22%

⏱ Most Recent Quarterly Payment: $0.165

📆 Most Recent Ex-Dividend Date: December 15, 2025

📊 Dividend Growth (2023 to 2025): From $0.135/quarter to $0.165/quarter

🪙 3-Year Dividend Increase: Approximately 22%

📊 Free Cash Flow: $282 million

These metrics reflect a dividend program that prioritizes sustainability and steady growth over headline yield, which is precisely what long-term income investors should want to see from a company in this sector.

Dividend Overview

KBR’s 1.60% forward dividend yield is modest in absolute terms, but it is supported by one of the most conservative payout ratios in the industrials space, sitting at just over 20%. For investors who have watched high-yield companies stumble under the weight of unsustainable payouts, that number is genuinely reassuring. With annual dividends of $0.66 against EPS of $3.19, the company is retaining the vast majority of its earnings to reinvest in growth, service debt, and return capital through buybacks.

The dividend has been moving upward in a quiet but deliberate fashion. Quarterly payments stood at $0.135 throughout 2023, stepped up to $0.15 in 2024, and moved again to $0.165 in 2025, representing a cumulative increase of approximately 22% over three years. That pace reflects a management team that views the dividend as a long-term commitment rather than a short-term signal.

At current prices near $40.40, the yield is running above the historical average for this stock, which has spent much of its recent trading history offering closer to 1% or slightly above. That context suggests current buyers are picking up a slightly richer income stream than those who purchased shares at higher price levels over the past year.

Dividend Growth and Safety

The safety profile for KBR’s dividend is strong, and the case for continued growth is well-supported by the underlying financials. A payout ratio of just 20.22% against EPS of $3.19 means the company is distributing only a small fraction of what it earns, leaving significant room to absorb earnings pressure without threatening the dividend.

Free cash flow came in at approximately $282 million for the trailing period, which comfortably covers the annual dividend obligation and leaves room for repurchases and reinvestment. Operating cash flow of $515 million adds further comfort, underscoring that the dividend is backed by real cash generation rather than accounting earnings alone.

KBR does carry meaningful debt, which is a consideration for any income investor doing proper due diligence. However, the company’s contract structure, anchored in long-term government and defense agreements, provides the kind of recurring, predictable cash flows that make elevated leverage more manageable than it would be in a cyclical business. Debt servicing has not constrained the dividend program, and there is no indication that it will in the near term.

The business model itself is one of the strongest structural supports for the dividend. Long-term government contracts do not evaporate overnight, and the visibility they provide allows management to plan capital returns with a degree of confidence that most industrial companies simply cannot match. That visibility matters a great deal when evaluating dividend safety.

The pace of dividend growth has been measured, moving in roughly 10% increments every year or so. With EPS of $3.19 and an extremely low payout ratio, there is no mathematical barrier to continuing that pace. If earnings continue their upward trajectory, acceleration is entirely plausible within the next few years.

Institutional ownership remains high, which is consistent with the profile of a company that attracts long-horizon, quality-focused investors. That shareholder base tends to reinforce management’s preference for disciplined, incremental capital returns rather than dramatic moves in either direction.

Altogether, KBR’s dividend profile is one built for durability. The yield is not going to attract investors who need maximum current income, but for those who value a well-covered, growing payout anchored in a stable business, the picture is genuinely compelling. The combination of a low payout ratio, strong cash flow, and consistent growth history makes this one of the more defensible dividends in the industrials sector.

The opportunity here is not about income today. It is about building a position in a dividend that has the financial foundation and management discipline to grow meaningfully over the next decade.

Chart Analysis

KBR has endured a difficult twelve months on the price chart, surrendering roughly 27% from its 52-week high of $55.55 to the current price of $40.40. That kind of drawdown compresses valuation multiples and elevates the dividend yield, which is the silver lining for income-focused investors willing to step into a downtrend. The stock is now trading just 1.95% above its 52-week low of $39.63, which means the shares are effectively resting on the floor of their annual range with very little technical cushion beneath current levels.

The moving average picture reinforces the cautious tone. KBR is trading below both its 50-day moving average of $42.49 and its 200-day moving average of $46.17, and the 50-day has crossed beneath the 200-day to form what technicians call a death cross. That configuration signals that intermediate-term momentum has deteriorated faster than the long-term trend, and it tends to attract institutional selling pressure rather than buying interest. For a dividend investor establishing a position, the moving averages serve as a useful roadmap for what overhead resistance looks like on any recovery attempt, with the 50-day near $42.49 being the first meaningful hurdle and the 200-day near $46.17 representing a more substantial test of conviction.

The RSI reading of 45.37 places KBR in slightly oversold territory without yet reaching the deeply washed-out levels below 30 that often mark exhaustion points in a selloff. Momentum is neither confirming a bottom nor signaling imminent capitulation, which leaves the technical setup in an ambiguous middle ground. Buyers have not yet stepped in with enough conviction to push the RSI back above the neutral 50 threshold, and that hesitation suggests the path of least resistance remains to the downside in the near term.

For dividend investors, the chart tells a story of a stock that has repriced materially over the past year and now offers a more attractive entry yield as a result, but the technical evidence does not yet suggest the selling pressure has fully run its course. Investors who prioritize income over short-term price performance may find the current level compelling given the proximity to the 52-week low, but a more conservative approach would be to wait for the price to reclaim the 50-day moving average on a sustained basis before treating the downtrend as resolved. Averaging into a position gradually rather than committing all capital at once is a reasonable way to balance the income opportunity against the ongoing technical weakness.

Cash Flow Statement

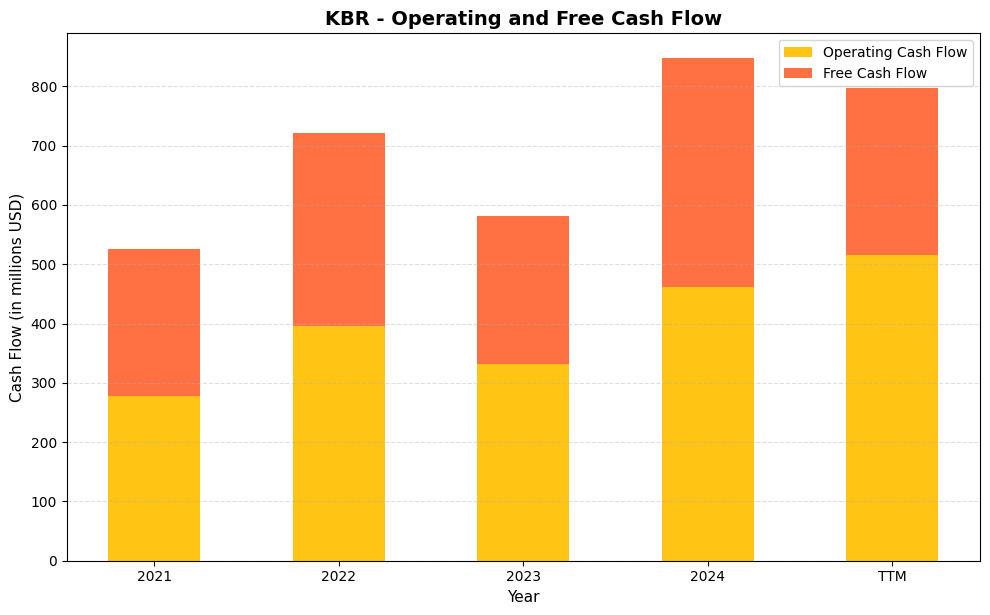

KBR’s cash flow profile has strengthened considerably over the past four years, and the 2024 figures make a compelling case for dividend sustainability. Operating cash flow climbed from $278.0M in 2021 to $462.0M in 2024, a gain of roughly 66% over that stretch, while the TTM figure of $515.0M suggests the momentum has not stalled heading into 2025. Free cash flow tells a similarly encouraging story, rising from $248.0M in 2021 to $385.0M in 2024 before pulling back to $282.4M on a trailing twelve-month basis. That TTM dip is worth understanding in context: operating cash flow is at a multi-year high, which means the gap is being driven by elevated capital expenditures rather than any deterioration in the underlying business. For dividend investors, the key takeaway is that KBR is generating free cash flow at a level that covers its current dividend obligation with substantial room to spare, leaving management plenty of flexibility to continue growing the payout.

Stepping back across the full data set, the 2022 operating cash flow reading of $396.0M and the corresponding free cash flow of $325.0M represented a meaningful step up from 2021, confirming that KBR’s shift toward higher-margin government services and sustainable technology businesses was translating into real cash generation rather than just reported earnings. The modest pullback in 2023, where operating cash flow eased to $331.0M and free cash flow to $251.0M, appears to have been a temporary pause rather than a structural reversal, given the sharp recovery that followed in 2024. Capital efficiency has generally improved alongside absolute cash generation, with free cash flow consistently representing roughly 80% to 90% of operating cash flow across most periods shown, a ratio that speaks to a relatively asset-light model with disciplined spending. For shareholders, this trajectory reinforces confidence that KBR’s dividend growth ambitions are grounded in genuine cash production rather than financial engineering.

Analyst Ratings

Analyst sentiment on KBR remains constructive, with a consensus rating of Buy across nine covering firms. The mean 12-month price target sits at $54.78, which represents upside of approximately 36% from the current price of $40.40. That is a meaningful gap between where the stock is trading and where analysts collectively believe fair value lies, and it has grown wider as the share price has drifted toward the lower end of its 52-week range.

The range of price targets spans from a low of $45.00 to a high of $65.00, with the low-end target alone implying roughly 11% upside from current levels. The distribution of targets suggests that even the most cautious analysts on the Street see the stock as undervalued at current prices, while the more bullish camp sees a path to $65 that would require meaningful multiple expansion alongside continued earnings growth.

The disconnect between the analyst consensus and the current share price, which is sitting near 52-week lows, likely reflects broader market sentiment toward defense and government services contractors in the current macro environment rather than any company-specific deterioration. With return on equity above 28%, a clean payout ratio, and strong operating cash flow, the underlying fundamentals do not justify a stock trading at 12.66 times earnings, at least not in the view of the analyst community covering this name.

Earning Report Summary

KBR delivered full-year revenue of approximately $8.04 billion, reflecting the scale the company has built across its two primary operating segments. Net income came in at $416 million, with EPS of $3.19 representing a solid result given the scope of operations and the continued investment the company is making in growth initiatives. The profitability profile, while modest at a 4.73% net margin, is consistent with the government services model, where revenue volumes are large and margins are more compressed than in pure technology or software businesses.

Operational Highlights

The Mission Technology Solutions segment continued to be a primary growth driver, supported by ongoing execution on large defense and space infrastructure contracts. KBR’s relationships with the U.S. Space Force and Department of Defense remain central to the revenue base, and the pipeline of potential awards in these areas continues to grow. The company has consistently demonstrated an ability to convert contract awards into recognizable revenue, which is not a given in a business where project complexity can delay start-up timelines.

The Sustainable Technology Solutions segment has also continued to mature as a contributor, with international project wins in regions including the Middle East, Australia, and Southeast Asia adding geographic diversification to a segment that historically leaned more heavily on domestic work. The margin profile in this segment tends to be stronger than the consolidated average, making its continued growth a positive development for overall profitability.

Cash Flow and Capital Allocation

Operating cash flow of $515 million was a standout figure in the most recent reporting period, reflecting improved working capital management and strong project execution. Free cash flow of approximately $282 million covered the annual dividend obligation multiple times over, reinforcing the safety and sustainability of the current payout level. Return on equity of 28.43% and return on assets of 5.17% both indicate that management is generating meaningful value from the capital deployed across the business.

Capital allocation priorities have remained consistent, with the company balancing dividend growth, share repurchases, and strategic acquisitions. The combination of a 20.22% payout ratio and strong operating cash flow gives management significant flexibility to accelerate any of these levers depending on market conditions and strategic opportunities as they arise.

Outlook and Management Commentary

CEO Stuart Bradie has consistently emphasized KBR’s focus on high-margin, long-cycle government and technology contracts as the foundation for sustainable earnings growth. The company’s realignment toward these segments over the past several years has improved the predictability of the revenue base and reduced the volatility that characterized KBR’s earlier incarnation as a traditional engineering and construction firm.

Management’s commitment to operational discipline, cost control, and selective capital deployment has been a theme throughout recent commentary, and the financial results bear that out. With a P/E ratio of 12.66 at current prices, the market appears to be pricing in more skepticism than the operational results would seem to warrant, which is a dynamic that patient investors may find worth monitoring closely.

Management Team

KBR’s leadership is guided by Stuart J. B. Bradie, who has held the CEO role since 2014. He brings more than 30 years of industry experience and has been the architect behind much of the company’s transformation into a leader in government services and high-tech engineering. Under his leadership, KBR has prioritized strategic acquisitions and disciplined execution, helping reposition the business toward higher-margin, longer-term service contracts.

Byron Bright serves as the Chief Operating Officer and plays a pivotal role in overseeing both of KBR’s primary business segments. With a background in the U.S. Air Force and a deep understanding of defense programs, Bright has been instrumental in helping KBR maintain its operational edge while aligning execution with strategy.

Greg Conlon leads as the Chief Digital and Development Officer. His responsibilities focus on modernizing KBR’s internal systems and advancing its digital transformation, especially in project delivery and engineering design. Rounding out the leadership team is Sonia Galindo, General Counsel, whose legal expertise ensures the company navigates the regulatory landscape with care while supporting ethical governance practices across the board.

Valuation and Stock Performance

KBR’s stock has experienced a significant pullback from its highs, now trading at $40.40 against a 52-week range of $39.43 to $56.78. The current price is sitting just above the 52-week low, which means the stock has shed a substantial portion of its value from where it was trading less than a year ago. For investors evaluating entry points, this is a meaningfully different setup than existed at prior reporting periods when the stock was trading well into the $50s and $60s.

On a valuation basis, the P/E ratio of 12.66 is quite low for a business generating 28% return on equity with a clean balance sheet and a growing government contract book. The price-to-book ratio of 3.50, while not bargain-basement, is considerably more reasonable than where the stock was trading at higher price levels earlier in the 52-week range. Book value per share stands at $11.53, and the market cap has compressed to approximately $5.2 billion.

The analyst community’s mean price target of $54.78, against a current price of $40.40, implies roughly 36% upside. That is a wide gap, and while analyst targets should always be taken with appropriate skepticism, the unanimity of the Buy consensus across nine firms does suggest that the current price level is viewed as an overreaction rather than a reflection of fundamental deterioration. Beta of 0.51 confirms that this is a lower-volatility name, which makes the current discount to consensus targets stand out even more for patient income investors.

Risks and Considerations

KBR’s heavy reliance on U.S. government contracts is both a strength and a source of concentration risk. While these contracts provide the long-term visibility that underpins the dividend and the earnings base, they are also subject to shifts in federal spending priorities, budget sequestration, and changes in administration policy. Any meaningful reduction in defense or government services spending could pressure the revenue outlook more rapidly than KBR’s diversification into international markets could offset.

Project execution risk is an inherent feature of KBR’s business model. The company operates on complex, large-scale infrastructure and technology contracts where cost overruns, scheduling delays, or scope changes can compress margins and affect earnings in ways that are difficult to predict in advance. While management has generally handled execution well, the nature of the work means this risk is never fully eliminated and warrants ongoing attention.

International operations add another layer of complexity. KBR generates a meaningful portion of its revenue from projects in geopolitically sensitive regions, and exposure to currency fluctuations, local regulatory environments, and geopolitical instability can introduce earnings volatility that does not show up in the domestic contract base. The Middle East and parts of Asia Pacific, where the company is active, carry risks that are inherently difficult to model with precision.

Finally, the stock’s current proximity to its 52-week low, despite solid underlying fundamentals, suggests that broader market sentiment toward defense and government services contractors has been a headwind. Investors should consider that sentiment-driven multiple compression can persist longer than fundamentals alone would suggest, and that a re-rating to more normalized valuation levels may require either a catalyst or a broader improvement in risk appetite toward the sector.

Final Thoughts

KBR presents an interesting case at current prices. The stock is trading near multi-year lows while the underlying business continues to generate strong returns on equity, growing cash flow, and a dividend that has increased every year in recent memory. The gap between the $40.40 share price and the analyst consensus target of $54.78 is wide enough to merit serious attention from investors who are willing to look past near-term sentiment and focus on the longer-term earnings trajectory.

The dividend, while not a headline yield, is exceptionally well-covered at a 20.22% payout ratio and has compounded at a steady pace from $0.135 per quarter in 2023 to $0.165 today. That kind of disciplined, sustainable growth in the payout is exactly what income investors should want to see, and the financial foundation suggests it can continue. Risks around government contract concentration, project execution, and macro sentiment are real, but they are not new, and KBR’s track record of navigating them is a meaningful data point in the investment case.