Last update 5/27/25

Jefferies Financial Group Inc. (JEF) has emerged as a disciplined, income-friendly option in the financial sector. With a forward dividend yield of 3.30% and a payout ratio below 50%, it offers consistent shareholder returns backed by a focused, well-capitalized business. Its leadership, led by long-time CEO Richard Handler and President Brian Friedman, continues to steer the firm with a clear, long-term vision rooted in client service, risk management, and operational strength.

Recent earnings reflect the challenges of a volatile market, with revenues and earnings down year-over-year, but the company’s balance sheet remains strong, and its advisory pipeline continues to grow. Analysts maintain a moderately positive stance, with a consensus price target suggesting potential upside. For investors seeking a reliable mix of yield, value, and experienced leadership, Jefferies stands on solid ground.

Recent Events

In its latest quarter, Jefferies reported $6.87 billion in revenue over the trailing twelve months. That marked an 8.4% decline from the year before, while earnings came in at $635.87 million—down about 12.2%. At a glance, that may seem concerning. But dig a little deeper and it’s clear this dip is more about market timing than company-specific issues. The capital markets have been choppy lately, with unpredictable deal flow and sporadic trading volumes impacting everyone in the sector.

Even with those headwinds, Jefferies maintained a respectable 10.54% profit margin and a 9.48% operating margin. These numbers won’t light up the scoreboard, but they signal that the business remains healthy and disciplined. The balance sheet shows $55.46 billion in cash against $35.84 billion in debt, with a current ratio of 1.5—giving the company a solid liquidity base to manage through market cycles.

And while leverage is high at a debt-to-equity ratio of 349%, that’s par for the course in this space. Jefferies operates with a financial model that relies heavily on capital flexibility. It’s part of the playbook in investment banking, where access to liquidity matters more than traditional debt metrics.

The real headline for dividend investors, though, isn’t just about resilience—it’s the growing consistency of shareholder payouts.

Key Dividend Metrics

📈 Forward Dividend Yield: 3.30%

💰 Annual Dividend Rate: $1.60

📆 Dividend Growth: 14.3% YoY

🧮 Payout Ratio: 49.3%

📅 Next Dividend Date: May 29, 2025

📍 Ex-Dividend Date: May 19, 2025

🔁 5-Year Average Yield: 2.83%

These numbers set the tone. A 3.30% forward yield puts JEF well within the sweet spot for income investors, especially those who prefer a balanced combination of yield and growth potential. And the 14.3% hike in the dividend over the past year? That’s not just noise—it’s a real commitment.

Dividend Overview

Jefferies isn’t a classic dividend aristocrat, but it’s starting to show traits that income investors appreciate. With an annual dividend rate of $1.60, up from $1.40 last year, the company is clearly sending a message: rewarding shareholders is part of the long-term game plan.

The current payout ratio of 49.3% is healthy. It tells us the dividend isn’t being stretched to unsustainable levels. There’s room to maneuver if the economy hits a rough patch or if earnings soften. And the company still retains plenty of earnings to reinvest or allocate for strategic moves.

What makes Jefferies even more appealing at this point is valuation. The forward price-to-earnings ratio sits around 13.4, and its price-to-book is just below 1. That combination of a modest valuation and an improving dividend yield gives long-term investors some breathing room. You’re not overpaying to collect that check every quarter.

Dividend Growth and Safety

This is where Jefferies begins to separate itself from other mid-tier financial firms. That 14.3% year-over-year dividend boost wasn’t a one-off. The company has been steadily building a dividend track record over the last several years. Its five-year average yield sits at 2.83%, but the current yield comfortably exceeds that mark, suggesting an upward shift in capital return strategy.

Importantly, the dividend is well-supported by cash and earnings. Even with a dip in operating cash flow over the last twelve months, the company is flush with liquidity—$268.87 per share in cash, compared to a stock price around $48. That buffer provides strong downside protection for income investors who want to ensure their dividends don’t get interrupted in a downturn.

The balance sheet looks conservative enough, with more cash than debt and no red flags on near-term obligations. Management has also taken a measured approach—not overpromising, not overdistributing. That’s exactly what long-term investors want: steady increases backed by sustainable financials.

While the broader financial sector may experience its share of volatility, Jefferies seems to be positioning itself as a reliable income source for those willing to ride the cycle. For dividend-focused investors looking for a name that’s quietly building momentum, JEF offers a mix of stability and rising payouts that’s worth a closer look.

Cash Flow Statement

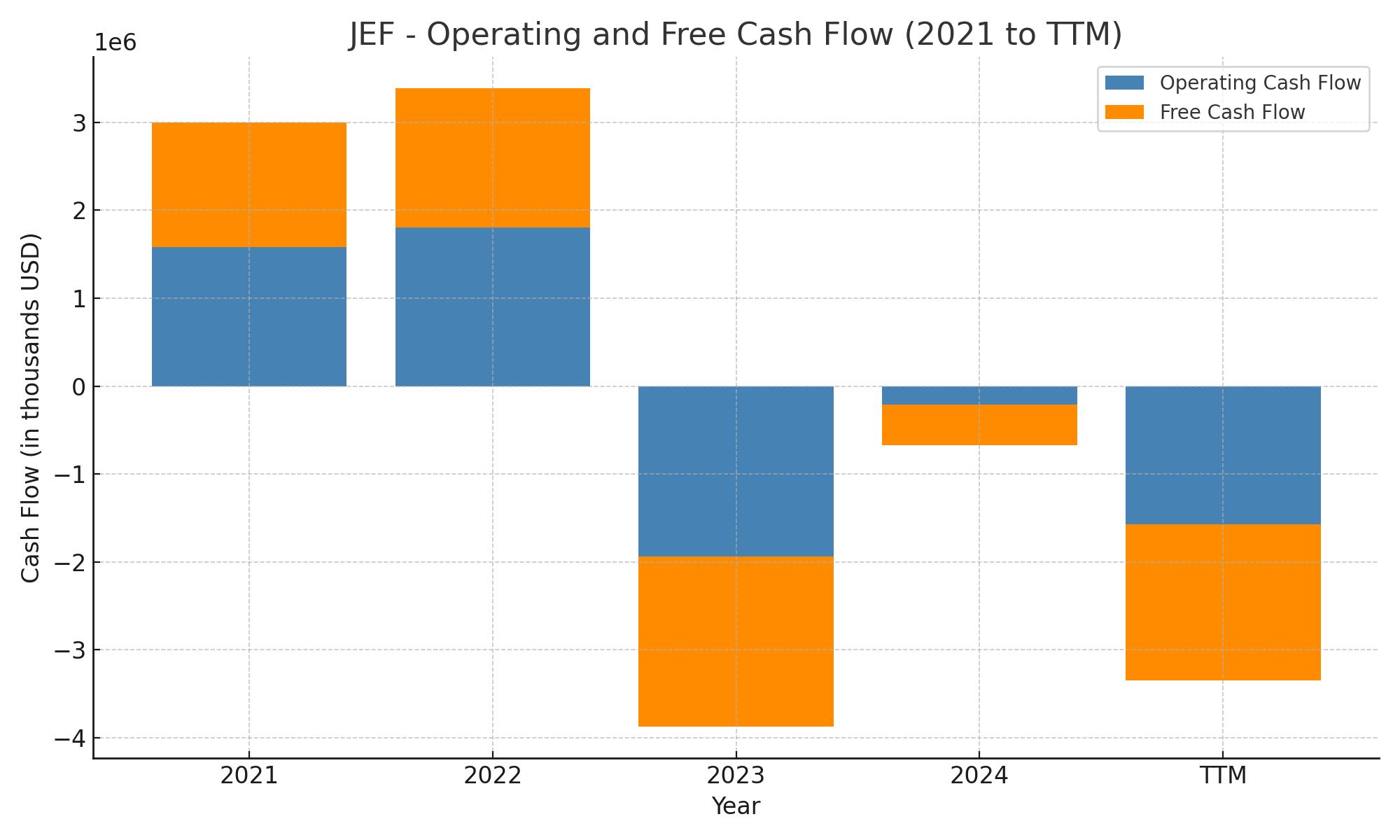

Jefferies’ trailing 12-month cash flow statement shows a company navigating an aggressive financial strategy with notable swings. Operating cash flow came in at negative $1.57 billion, a significant outflow that contrasts sharply with the positive results seen in 2021 and 2020. This decline can be linked to a tougher capital markets environment and changes in working capital tied to the firm’s business model, which naturally has more volatility in periods of market stress or repositioning.

Despite the negative operating cash flow, Jefferies generated over $5 billion in financing cash flow—primarily due to new debt issuance and capital management. However, with over $11 billion in debt repayments, it’s clear that a large chunk of those proceeds were used to refinance existing obligations rather than fund new growth. Free cash flow stood at negative $1.77 billion, underscoring that while dividends remain well covered in the near term, the company is spending significantly to maintain flexibility. Cash on hand remains robust at $12.47 billion, giving the firm a wide buffer to navigate short-term pressures.

Analyst Ratings

Jefferies Financial Group Inc. (NYSE: JEF) has seen mixed reactions from analysts recently, which isn’t surprising given the shifting tone in capital markets. The consensus rating stands at a moderate buy, with the average 12-month price target landing at $59.33. That implies a potential upside of about 22.5% from current trading levels, which could pique the interest of value-oriented investors watching the space.

📈 On May 15, 2025, Goldman Sachs reiterated its buy rating and nudged its price target up from $55 to $62. The upgrade was tied to increasing confidence in Jefferies’ ability to navigate the market with precision. Analysts highlighted the firm’s strategic focus, particularly its streamlining of operations and strong capital positioning, as key drivers for long-term earnings stability.

🔻 On the flip side, Morgan Stanley took a more cautious approach. On April 7, 2025, they downgraded JEF from overweight to equal weight and dropped the price target from $75 down to $41. Their concern was centered on slowing revenue growth, coupled with macroeconomic headwinds that could weigh on deal volume and market activity.

⚖️ Back in March, Oppenheimer also adjusted its stance, shifting from outperform to perform. While not a dramatic shift, it reflected more tempered expectations given the current market cycle and a desire to see more consistent top-line performance before reaffirming a bullish outlook.

Altogether, analyst sentiment remains divided but cautiously optimistic. Price targets suggest room for upside, but with enough red flags to keep expectations grounded.

Earning Report Summary

Jefferies kicked off fiscal 2025 with results that reflected the reality of doing business in a complex, uncertain market. Revenue and earnings were down compared to last year, but management seems more focused on the bigger picture—building a stronger, more resilient firm while continuing to serve clients with consistency.

Numbers That Tell the Story

In the first quarter, Jefferies brought in $1.59 billion in net revenue. That’s a step down from $1.74 billion a year earlier. Net earnings available to common shareholders came in at $127.8 million, or $0.57 per share, down from $0.69 per share last year. While the topline and bottom-line numbers declined, they still reflect solid performance in a tough environment.

Investment banking brought in $700.7 million, down slightly from last year. Capital markets also saw a bit of slippage, pulling in $698.3 million versus $724.3 million. Asset management took the biggest hit, falling to $191.7 million from $273.4 million. Even so, Jefferies continued to strengthen its balance sheet. Book value per common share rose to $49.48, and tangible book value hit $32.57—both healthy improvements.

Leadership’s Take on the Quarter

CEO Rich Handler and President Brian Friedman didn’t sugarcoat things. They openly acknowledged that capital markets were difficult and that activity was muted, particularly on the equity underwriting side. But they were quick to highlight areas of strength, especially in advisory and debt underwriting, where Jefferies continues to hold its ground.

They also pointed out that the firm’s backlog in equity underwriting is growing—an encouraging sign for the quarters ahead. Rather than reacting to short-term volatility, Jefferies seems intent on playing the long game. The leadership emphasized risk management, strong client relationships, and maintaining high levels of liquidity as central pillars of their strategy.

One message came through clearly: while the current quarter didn’t blow anyone away, Jefferies is positioning itself to thrive when the market turns. Handler and Friedman sounded confident that the firm’s steady approach and broad platform put it in a good place to gain share as opportunities open up.

Jefferies isn’t trying to chase headlines or overextend. Instead, it’s working to stay consistent, deepen relationships, and quietly build strength where it counts. For investors looking beyond the noise, that strategy might hold more value than it first appears.

Management Team

Jefferies Financial Group is guided by a leadership team with deep experience and a steady hand. Richard Handler, the CEO, has been with the company for over thirty years. His approach is pragmatic and grounded, favoring sustainable growth over short-term plays. He’s known for building long-term relationships and keeping the firm focused on what it does best—serving clients and managing risk.

President Brian Friedman works closely alongside Handler and brings a sharp strategic mind to the table. He’s played a pivotal role in reshaping Jefferies into a more streamlined and focused organization. Together, they’ve led the company through major transitions, including divestitures of non-core businesses and a renewed focus on its core banking and capital markets operations.

What stands out is the continuity. There’s no revolving door at the top. This team has been in place for years, which helps reinforce stability and vision. They understand the cyclical nature of the business and plan with a long-term lens rather than chasing headlines or market trends.

Valuation and Stock Performance

Jefferies trades at a forward P/E around 13.4, which is on the lower end for financial firms of its kind. The price-to-book ratio sits just under 1, making it look undervalued by traditional measures. This suggests the market hasn’t fully priced in the company’s long-term potential or the value of its cleaner, more focused business model.

Looking at the past year, the stock has moved within a relatively narrow band. It’s up from its lows but still not near its highs, which mirrors the cautious tone across the financial sector more broadly. The 50-day moving average has leveled off a bit, which could signal some stability returning after a choppy stretch.

Dividend investors have reason to pay attention. The yield is currently around 3.30%, and the payout ratio is under 50%, giving the company room to boost distributions if earnings remain steady. Management has used share buybacks tactically rather than aggressively, adding another layer of support for the stock when conditions are right.

Overall, the stock doesn’t look expensive by most conventional metrics. For those willing to wait out the cycles, Jefferies offers a mix of income and potential upside at a reasonable entry point.

Risks and Considerations

Jefferies faces its fair share of risks. The most immediate one is its exposure to the ups and downs of capital markets. If deal volume dries up or trading activity slows, revenue can drop quickly. Investment banking, by nature, isn’t the steadiest business in a storm.

Leverage is also something to watch. The debt-to-equity ratio is high, as is typical for investment banks, but it adds a layer of risk in periods of stress. While liquidity is strong, with significant cash reserves, heavy debt always adds complexity when the market turns.

The competitive landscape is another challenge. Jefferies is going up against much larger firms with more resources. It succeeds by being nimble and client-focused, but in certain environments, scale can be an advantage.

Interest rates and regulatory shifts are also in play. Higher rates can both help and hurt, depending on the activity mix. And new regulations—whether domestic or global—can introduce friction into operations, even if they’re well-intentioned.

Final Thoughts

Jefferies has built a reputation on consistency, not hype. The firm knows what it’s good at and sticks to it. There’s something to be said for that, especially in a space where volatility and overreach are common.

The leadership team has a clear plan. They’re not chasing trends or scrambling to reinvent the wheel. They’re refining what works and shedding what doesn’t. That kind of discipline tends to appeal to investors who think beyond the next quarter.

For those seeking a mix of dividend income, reasonable valuation, and steady management, Jefferies might check the right boxes. The business is tied to the rhythms of the market, which brings risk, but with risk comes opportunity. And Jefferies, more often than not, seems ready to meet the moment.