Last update 5/27/25

International Bancshares Corporation (NASDAQ: IBOC) is a Texas-based regional bank delivering consistent performance through disciplined management and a strong balance sheet. With over \$16 billion in total assets and operations centered across Texas and Oklahoma, IBOC focuses on traditional banking services with an emphasis on commercial lending and wealth management.

The company posted solid first-quarter 2025 earnings of \$96.9 million and maintains a trailing P/E of 9.5, paired with a 2.23% forward dividend yield supported by a conservative 20.7% payout ratio. Backed by long-term leadership, stable free cash flow, and prudent capital allocation, IBOC continues to reward patient, income-focused investors.

Recent Events

As of late May 2025, IBOC shares were trading at $62.65—a minor dip on the day, but up over 9% from the same time last year. That performance lines up closely with the broader market, but what’s more notable is how quietly and consistently it’s gotten there.

The bank’s most recent quarterly report showed revenue growth of just 1% year over year. Earnings per share came in at $6.57, slightly down from the prior year. But despite these modest numbers, margins remain strong. The profit margin is holding firm at over 50%, and operating margin is north of 63%. That’s not something you see every day in the banking space.

Return on equity sits at 15.2%, and return on assets at 2.58%—both solid numbers that point to efficient capital use. While many regional banks are still figuring out how to deal with shifting interest rates, IBOC is staying the course with a trailing P/E around 9.5 and a price-to-book ratio just above 1.3. Those valuations suggest a bank that’s neither overvalued nor underappreciated—just doing its job and doing it well.

Key Dividend Metrics 📊

💵 Forward Annual Dividend Rate: $1.40

📈 Forward Dividend Yield: 2.23%

📉 Trailing Dividend Yield: 2.16%

🕰 5-Year Average Dividend Yield: 2.68%

📊 Payout Ratio: 20.7%

🗓 Ex-Dividend Date: February 14, 2025

📆 Dividend Date: February 28, 2025

Dividend Overview

IBOC isn’t a headline-grabbing income play, but what it does offer is stability. With a forward dividend yield of 2.23% and a payout ratio of just over 20%, the company leaves itself plenty of room to maneuver. It’s not overextending or trying to impress with an outsized yield. Instead, it’s quietly delivering consistent income with the kind of coverage that leaves room for future growth—or flexibility during tougher times.

The dividend is clearly well-supported by earnings. Management seems intent on keeping things conservative, which has worked well for them so far. With cash on hand of nearly $590 million and modest total debt around $729 million, there’s no real strain on the balance sheet. The latest dividend was paid out in late February, following the ex-dividend date earlier that month. No drama, no surprises—just business as usual.

Dividend Growth and Safety

When you look at IBOC’s dividend through a long-term lens, it paints a picture of slow and steady growth. While the current yield is a bit below the five-year average, that’s largely due to share price appreciation. The actual dollar amount of the dividend has gradually moved up, and the fundamentals suggest there’s room for more.

With only about a fifth of its earnings going out the door as dividends, IBOC isn’t putting itself in a risky spot. There’s a strong cushion there. Operating cash flow over the past year was just shy of $480 million, which more than covers the dividend obligations. And because the bank isn’t over-leveraged, there’s no financial juggling required to keep shareholders happy.

The company also enjoys solid institutional backing, with nearly 70% of shares held by funds and other institutions. Insiders hold another 13%, which means leadership has skin in the game. That kind of alignment often leads to smart, long-term decisions rather than chasing short-term stock movements.

One other point worth noting: IBOC hasn’t done a stock split since 2007. That tells you something about how management views share structure—it’s not interested in window dressing. Instead, the focus is on steady growth and delivering value through fundamentals, not optics.

If you’re an investor looking for a company that approaches dividends the same way it approaches banking—methodically, carefully, and with a long-term mindset—then IBOC offers a compelling case. It’s not the flashiest name out there, but it gets the job done.

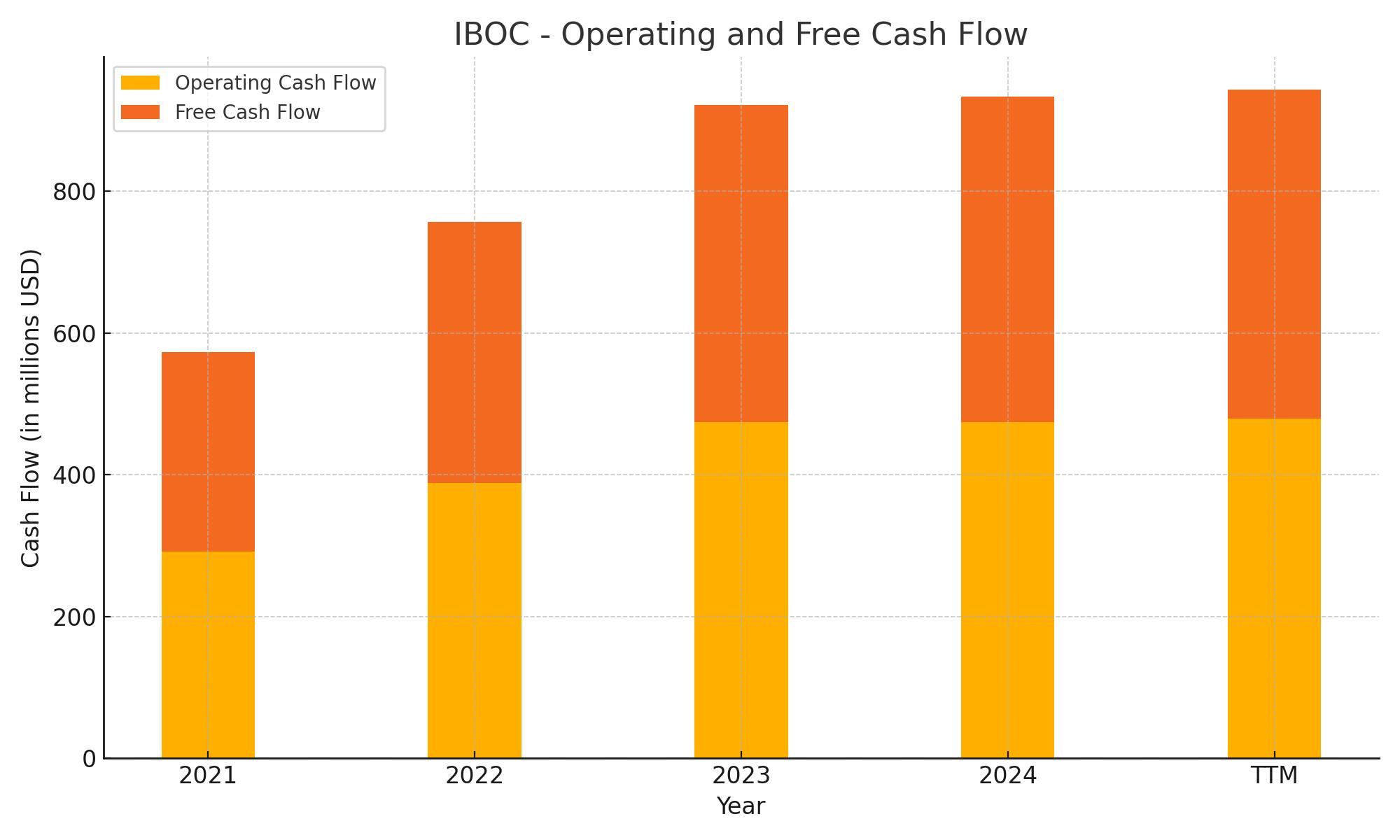

Cash Flow Statement

International Bancshares Corporation has maintained a consistently strong cash generation profile, with trailing twelve-month operating cash flow reaching $479 million. This marks a steady increase from prior years, reflecting the bank’s disciplined approach to managing its core banking operations. The resulting free cash flow stands at $464 million, giving the company ample financial flexibility to support dividends, reinvestment, and capital preservation. Capital expenditures have remained modest, under $15 million for the period, indicating a conservative approach to expansion or infrastructure investment.

On the investing side, the company continues to deploy significant capital, with TTM investing cash flow at a negative $1.18 billion. This reflects a pattern of consistent long-term investment, typical of a bank allocating capital across securities and loan portfolios. Financing activities have swung positive over the last year to $378 million, following several years of outflows, driven in part by adjustments in debt and capital stock activity. Despite this, the end cash position has improved significantly to nearly $590 million, up from $353 million at the end of 2024, offering a solid liquidity buffer. This robust cash position paired with strong free cash flow underlines the company’s financial strength and dividend-paying capacity.

Analyst Ratings

📈 International Bancshares Corporation (IBOC) has recently had its consensus price target raised to $69. This adjustment reflects growing confidence in the bank’s financial foundation and operational consistency. With a profit margin holding strong above 50% and return on equity sitting at 15.2%, analysts are taking note of IBOC’s efficient and disciplined execution. These metrics point to a well-managed institution that continues to deliver reliable earnings without overextending itself.

💼 The rating remains a “Hold,” which suggests that while IBOC is on solid footing, analysts are waiting for a more compelling catalyst before moving to a more bullish stance. This could be due to broader uncertainties in the regional banking landscape or the lack of a near-term growth trigger. Even so, the upward revision in the price target is a positive signal. It shows that the fundamentals are strong enough to justify higher valuation expectations over time, even if the market isn’t ready to fully reflect them just yet. Investors watching for slow-and-steady compounders will likely keep IBOC on their radar thanks to its consistent performance and clean balance sheet.

Earning Report Summary

Steady Start to the Year

International Bancshares Corporation kicked off 2025 with a first-quarter net income of about $96.9 million, or $1.56 per diluted share. That’s pretty much in line with where things stood a year ago, which speaks to the bank’s ability to deliver consistent results even as interest rate pressures continue to hang over the sector.

Loan activity remained solid, and the investment portfolio expanded, pushing total assets up to $16.3 billion. On the flip side, like many banks right now, IBOC felt the pinch of rising deposit costs. The higher interest expenses did eat into some of the gains from asset growth, but not enough to knock the bottom line off course. One encouraging sign was a drop in the provision for credit losses—down to $6.5 million from $8.9 million—suggesting that credit quality is holding steady.

Focused on the Fundamentals

CEO Dennis E. Nixon shared a tone of quiet confidence during the report. He pointed to strong customer service, tight financial controls, and a well-managed balance sheet as the reasons the bank continues to perform in a rocky environment. He also reaffirmed the company’s commitment to conservative lending standards, which have long been a hallmark of IBOC’s operating style.

Looking ahead, the bank isn’t changing course. The focus remains on organic growth, especially in commercial lending and wealth management. Operational efficiency and cost control are staying front and center, with no indication that the bank plans to stretch beyond its comfort zone. In a time when many regional banks are trying to figure out how to adapt to new market dynamics, IBOC is sticking to what it knows—and for now, it seems to be working.

Management Team

The leadership at International Bancshares Corporation has quietly built one of the most stable banking operations in the region. Dennis E. Nixon, the long-serving CEO, continues to steer the company with a focus on long-term strategy rather than short-term noise. His leadership style leans conservative, with an emphasis on sustainable growth, capital discipline, and shareholder value. He’s not just overseeing operations; he’s deeply connected to the business and its community roots.

The executive team around him has remained largely intact over the years, which speaks to the strength and continuity of the bank’s culture. They’ve guided IBOC through economic highs and lows without overreacting or chasing trends. Decisions are thoughtful, measured, and grounded in the company’s strengths—core lending, customer service, and maintaining a solid balance sheet. The high level of insider ownership also reflects a clear alignment between management and shareholders, with leadership acting more like stewards than risk-takers.

Valuation and Stock Performance

Over the past year, IBOC has quietly delivered a respectable stock performance, gaining a little over 9 percent. That’s right in line with the broader market, but achieved with much less volatility. The current share price of $62.65 places the stock at a trailing P/E ratio of 9.5, which is lower than many peers in the regional banking space. It’s not a flashy number, but it reflects the solid, predictable nature of the business.

The price-to-book ratio is about 1.34, which suggests investors are paying a modest premium for quality. When you factor in the bank’s earnings consistency, strong return on equity, and well-managed risk profile, it becomes clear why that valuation makes sense. The market isn’t overhyping this stock, but it’s also not overlooking the dependable performance.

The forward dividend yield of 2.23 percent adds to the investment case, especially with a payout ratio just above 20 percent. There’s plenty of room for dividend growth or capital redeployment. Institutional investors hold roughly 70 percent of the float, indicating that larger players see this as a stable, long-term hold. While daily trading volume isn’t high, it’s steady enough to keep the stock accessible without being overly reactive.

Risks and Considerations

Even well-managed banks like IBOC face real challenges. The interest rate environment remains a concern, as prolonged high rates could continue to pressure deposit costs and compress margins. While the company has shown it can handle this environment effectively so far, that could change if rates stay elevated longer than expected.

Credit risk is another area to monitor. IBOC has historically maintained high asset quality, but any economic downturn could affect borrowers, particularly in the commercial segment. A slowdown in loan growth or an increase in delinquencies could create headwinds.

There’s also a growing sensitivity among depositors to higher yields. This trend forces banks to compete more aggressively for funds, which can eat into profitability. If this continues, IBOC will have to remain nimble to protect its margins without compromising on service or credit standards.

Liquidity is another consideration. While the company’s stock generally trades smoothly, lower daily volume can sometimes lead to larger price moves on days when sentiment shifts abruptly. Investors need to be aware that in certain market conditions, the stock may not behave as predictably as its fundamentals suggest.

Final Thoughts

International Bancshares Corporation doesn’t make big promises or chase headlines. Instead, it focuses on delivering results that are reliable, repeatable, and aligned with the interests of long-term investors. The management team continues to show discipline, and the financials back up that approach—strong earnings, controlled expenses, and a balance sheet built for resilience.

Valuation remains in a comfortable range, offering a solid entry point for those looking to add a bank with consistent performance and dependable dividends. The modest yield is backed by a low payout ratio, giving plenty of room for growth or flexibility should the economic landscape shift.

There are risks, and they shouldn’t be ignored. But IBOC has earned the benefit of the doubt by showing it can manage through challenges without compromising its principles. This is a bank that knows what it is and leans into its strengths.

For investors looking for a company that prioritizes longevity and stability over speculation, International Bancshares offers a compelling story. It may not be the loudest voice in the room, but it has built a track record of strength that’s hard to overlook.