Key Takeaways

💰 Innospec’s forward dividend yield stands at 1.91%, recently increased by 10%, continuing a steady pattern of long-term dividend growth.

💵 Operating cash flow for the trailing twelve months was $132.2 million, with positive free cash flow of $68.7 million and nearly $300 million in cash reserves.

📊 Analyst sentiment is mixed, with a recent downgrade to hold and an upgrade to strong buy, and a consensus 12-month price target of $119 suggesting potential upside.

Updated 5/16/25

Innospec Inc. (NASDAQ: IOSP) is a specialty chemicals company with a global footprint across fuel additives, oilfield services, and performance chemicals. Its business model focuses on consistent, niche market execution and disciplined capital management, supported by a strong balance sheet and a seasoned leadership team. The company currently trades near \$88 per share, with a forward dividend yield of 1.91% and a recent dividend hike of 10%, reflecting management’s confidence in long-term cash flow strength.

While recent earnings showed a year-over-year decline in both revenue and net income, the Fuel Specialties segment delivered strong margin performance. The stock has pulled back over 30% in the past year, creating a more attractive yield and valuation profile. With nearly \$300 million in cash, minimal debt, and a new \$50 million buyback program, Innospec is positioned to weather market headwinds while continuing to reward shareholders.

Recent Events

Innospec’s latest quarterly results show some friction. Year-over-year revenue fell by almost 12%, and earnings dropped by over 20%. That kind of movement isn’t insignificant and points to broader pressures in the specialty chemicals sector—particularly in areas tied to fuel and energy markets, which have cooled in recent months.

Despite those bumps, the company remains on firm financial ground. Cash reserves are nearing $300 million, and debt is just over $44 million. That kind of cushion isn’t just comforting—it’s empowering. It allows the company to keep supporting its dividend, even when earnings aren’t peaking.

The stock price has definitely felt the squeeze. From a 52-week high of $133, shares have slid down to the high $80s. But that’s also pushed the yield higher, making the dividend look more attractive than it has in years. For investors focused on income rather than price swings, that shift matters.

Key Dividend Metrics

📈 Forward Dividend Yield: 1.91%

💸 Forward Annual Dividend Rate: $1.68

📆 Ex-Dividend Date: May 20, 2025

📊 Payout Ratio: 143.5% (trailing)

🔄 5-Year Average Dividend Yield: 1.27%

📉 Stock Price (as of May 15): $88.27

Dividend Overview

Innospec’s current yield doesn’t scream high income, but it sits noticeably above its historical average. That higher yield is a product of the recent price pullback and gives income investors a better starting point than usual.

The payout ratio looks high at first glance—over 140%—but context matters here. That number reflects a recent dip in earnings, not a shift in dividend policy. In other words, the dividend is temporarily outpacing net income, but not because the company is overextending itself.

Cash flow paints a more accurate picture of dividend sustainability. Operating cash flow remains solid at over $130 million in the trailing twelve months. Even though free cash flow is in the red, that’s more a result of short-term capital expenses and timing quirks than long-term structural issues. And with almost $300 million in cash, Innospec isn’t in a position where it needs to pull back.

There’s no indication the company is wavering on its dividend. Quite the opposite—the latest dividend, set to be paid in late May, reflects a continued commitment to incremental increases.

Dividend Growth and Safety

Innospec doesn’t go big on dividend headlines, but it plays the long game well. Over the past five years, it has steadily increased its payout, building trust with shareholders and reinforcing a pattern of conservative, dependable growth.

While the current payout ratio might look aggressive, it’s not a sign of danger. This company runs with almost no debt—less than 4% of equity—which gives it unusual flexibility in lean periods. That kind of balance sheet strength adds a safety net that many dividend payers simply can’t match.

The risk isn’t financial leverage—it’s earnings variability. Like many chemical producers, Innospec’s profits can ebb and flow with demand cycles and input costs. But the consistency of dividend hikes over the past decade says a lot about how management views its responsibility to income investors.

Cash Flow Statement

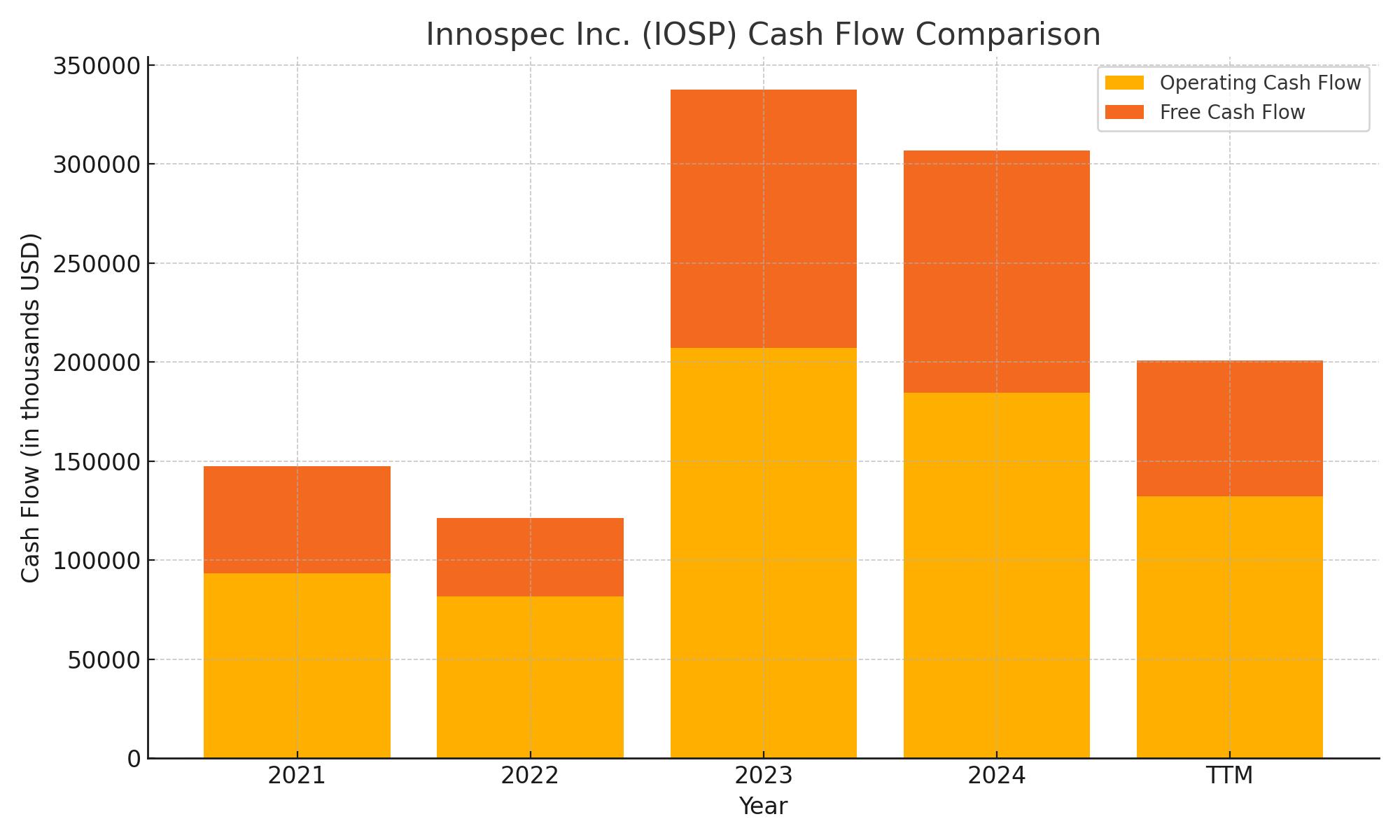

Innospec’s trailing twelve-month cash flow statement shows a solid base of operations, even amid some shifting capital needs. The company generated $132.2 million in operating cash flow, a drop from the previous year’s $184.5 million but still comfortably above pre-2022 levels. This decline reflects some tightening in earnings and working capital, but the business continues to produce steady cash from its core operations.

Capital expenditures remained consistent, with $63.5 million spent, which aligns closely with recent years. Free cash flow, after these investments, came in at $68.7 million—down from the prior year but still firmly in positive territory. On the financing side, Innospec continues to run lean, with minimal debt activity and modest shareholder returns through buybacks and dividends. The company’s cash position has steadily grown, now sitting at nearly $300 million. This kind of liquidity supports its dividend profile and adds resilience in a lower-growth environment.

Analyst Ratings

🔄 In early May, Innospec experienced a shift in analyst sentiment. StockNews.com revised its outlook, moving the stock from a “buy” to a “hold” rating. This adjustment followed a quarterly report that showed a nearly 12% year-over-year revenue decline and a 20% drop in earnings. The downgrade reflects a more cautious perspective, likely tied to concerns about slowing demand in key segments like fuel and oilfield services.

🚀 On the flip side, Seaport Research Partners offered a more optimistic view in late April, upgrading Innospec from “hold” to “strong buy.” That call appeared to stem from confidence in the company’s ability to manage its balance sheet and execute in niche markets, despite the broader sector headwinds. The upgrade signals belief in a longer-term rebound that may not yet be priced into shares.

📊 Analysts currently place a consensus 12-month price target at $126, which would represent an upside of roughly 40% from current levels. Price targets vary from a low of $115 to a high of $138, showing a mix of caution and bullishness in the outlook. This spread of opinions captures the balancing act between short-term earnings pressure and long-term business stability.

Earning Report Summary

A Mixed Quarter with Clear Highlights

Innospec kicked off 2025 with a quarter that had its ups and downs. Revenue came in at $440.8 million, which was a step down from where things stood a year ago. The drop, just over 12%, reflected some softness in parts of the business. Net income landed at $32.8 million, or $1.31 per diluted share. That’s off last year’s pace, but adjusted earnings of $1.42 per share actually came in a bit better than what many expected.

Not everything moved in the same direction. Fuel Specialties turned in a strong performance, with operating income growing solidly year over year. Margins improved across all regions, and that helped offset some of the pressure felt elsewhere. On the other hand, Oilfield Services took a noticeable hit. Revenue in that segment fell 37% from last year, with much of that tied to weaker activity in Latin America and softer-than-hoped results in the U.S.

Performance Chemicals also faced its own headwinds. Operating income dipped about 5%, partly due to currency pressures and some pricing challenges that crept into the picture.

Staying Financially Nimble

Even with some softness in top-line results, the company kept its balance sheet in excellent shape. Innospec wrapped the quarter with just under $300 million in cash and no net debt. It also generated $28.3 million in operating cash flow during the period. That kind of financial strength gives the company room to maneuver, even when parts of the business are facing short-term challenges.

In line with its steady approach to shareholder returns, Innospec bumped up its semi-annual dividend by 10%, now paying $0.84 per share. They also kicked off a new $50 million stock buyback program, which signals confidence in their long-term outlook.

What Leadership Had to Say

CEO Patrick Williams acknowledged the uneven results but kept the focus on what’s working. He pointed to the performance in Fuel Specialties as a sign of the company’s core strengths and expressed optimism about what’s ahead. While he didn’t shy away from the fact that Performance Chemicals and Oilfield Services had a tough quarter, he made it clear that the business remains well-positioned.

Williams also reiterated that the company’s diversified portfolio helps it weather volatility. He sees opportunities for improvement as market dynamics shift and believes the groundwork is in place for margin growth and operational gains down the road.

Management Team

Innospec’s leadership is anchored by CEO Patrick S. Williams, who has led the company since 2009. Over more than 15 years at the top, Williams has overseen consistent operational progress and maintained a steady focus on capital discipline and strategic positioning. His long tenure adds a layer of predictability that investors often value, especially in a sector as specialized as chemicals.

Backing him is a leadership team with deep institutional knowledge. Ian Cleminson, Executive Vice President and CFO, has played a critical role in guiding Innospec’s financial strategy. His steady hand has helped keep the balance sheet in excellent shape. Phil Boon, who has served as Executive Vice President and COO, will be retiring in early 2025 after more than 25 years with the company, marking a significant transition point. Meanwhile, Ian McRobbie, the Chief Technology Officer, continues to drive innovation and R&D efforts, which are key to staying competitive in the performance chemicals space. Corbin Barnes, as Senior Vice President of Corporate Development and Investor Relations, remains instrumental in aligning growth opportunities with shareholder communication and market positioning.

At the board level, Chairman Milton C. Blackmore brings decades of energy and chemical industry experience. The board’s composition reflects a healthy mix of technical, financial, and operational backgrounds, helping the company stay agile yet grounded in sound governance.

Valuation and Stock Performance

Innospec is currently trading near $88 per share, giving it a market cap around $2.2 billion. Over the past year, shares have declined by more than 30%, as weaker results and shifting sector dynamics weighed on investor sentiment. That being said, many of the company’s core fundamentals remain intact.

The stock’s forward price-to-earnings ratio sits just under 16, which is fairly reasonable given the current environment and aligns with broader industry averages. Analysts following the stock see room for recovery, with the average 12-month price target set at $119, representing a notable upside from where it trades today.

Despite the decline in share price, Innospec has maintained a steady capital return program. The semi-annual dividend was recently raised by 10% to $0.84 per share, signaling continued confidence from leadership in the company’s long-term cash generation. The new $50 million stock buyback program also shows that management believes in the intrinsic value of the shares, even amid current volatility.

The company’s cash-rich balance sheet, with almost $300 million in cash and minimal debt, adds an additional margin of safety. This financial flexibility puts Innospec in a solid position to navigate through challenging periods and capitalize on strategic growth opportunities when they arise.

Risks and Considerations

As with any business, Innospec faces a number of risks that are worth keeping in mind. Its operations are tied closely to sectors like energy, personal care, and industrial manufacturing. Demand in these areas can be cyclical and influenced by broader economic trends. When macroeconomic conditions soften or input costs rise sharply, margins can come under pressure.

Leadership changes are another factor to watch. With COO Phil Boon stepping down in 2025, there will be some inevitable transition. While continuity at the top remains with CEO Williams and other long-serving executives, any shift in operational leadership can introduce uncertainty, especially for a company that places a premium on experience.

Geopolitical and currency risks also come into play, particularly with Innospec’s global footprint. Fluctuations in exchange rates and regional regulatory differences can affect both revenue and cost structures. Additionally, while the company has moved past prior compliance issues, operating in multiple jurisdictions requires ongoing diligence.

The chemical industry itself is highly competitive, and customer demand can shift quickly with innovation or new formulations. Maintaining an edge in performance chemicals, where product differentiation is key, will be critical to Innospec’s continued success.

Final Thoughts

Innospec may not command the attention of some of its larger industry peers, but its steady execution and focus on niche markets give it a different kind of appeal. It doesn’t try to be the biggest player—it aims to be one of the most dependable. And for income-oriented investors, that approach holds real value.

The company’s recent softness in earnings is part of a broader sector narrative, not an isolated misstep. Management’s decision to raise the dividend and repurchase shares, even during a slower quarter, speaks to its confidence in the long-term trajectory. The balance sheet is strong, the leadership team remains experienced, and the dividend growth track record continues to develop.

While risks tied to market demand and leadership transitions exist, Innospec’s consistent financial discipline and focus on long-term shareholder value make it a stock that still deserves attention. As markets evolve and the company adapts to new dynamics, investors will be watching to see how this quiet performer continues to deliver.