Key Takeaways

📈 IDEX offers a forward dividend yield of 1.37% with over a decade of consistent annual increases, supported by a sustainable payout ratio of 43.99%.

💵 Strong free cash flow of $538.9 million and operating cash flow of $680.4 million reflect the company’s disciplined financial management and ample coverage for dividends and reinvestment.

🔍 Analysts maintain a positive outlook with a consensus buy rating and a mean price target of $223.54, citing consistent operational performance and strategic execution across IDEX’s diversified industrial portfolio.

Updated 2/24/26

IDEX Corporation, trading under the ticker IEX, is a global leader in fluid and metering technologies, precision instrumentation, and health and science solutions. With over 40 businesses in its portfolio, the company supports specialized sectors like fire and safety, water treatment, life sciences, and industrial manufacturing. Its strong order pipeline and consistent cash generation underscore its steady operational performance.

The leadership team, led by CEO Eric Ashleman, continues to prioritize disciplined growth, smart capital allocation, and innovation. Recent results showed stable revenue, continued investment in strategic acquisitions, and maintained dividend growth, all while keeping cost controls firmly in place.

Recent Events

IDEX has been navigating a constructive but measured industrial environment heading into early 2026. The company’s Health and Science Technologies segment has continued to generate notable order activity, including contributions from the Mott team’s clean water project pipeline that management highlighted in prior earnings commentary. On the acquisition front, IDEX has maintained its posture of targeting bolt-on deals that complement its core fluid and metering franchises, staying disciplined on price even as deal flow in the industrial space has remained competitive.

CEO Eric Ashleman has been vocal about the company’s approach to balancing organic investment with targeted inorganic growth, a message that has resonated with investors who have pushed the stock toward the upper end of its 52-week range of $153.36 to $217.16. The stock currently sits at $208.45, well above the cycle lows seen earlier in the trailing twelve-month period. Management also identified cost savings initiatives in the prior year that appear to be flowing through to margins, with profit margins now running at 13.98% on trailing revenue of $3.46 billion.

CFO Abhi Khandelwal has continued to emphasize the strength of IDEX’s balance sheet and its capacity to sustain both dividend growth and opportunistic capital deployment. Short interest stands at roughly 2.5 million shares, a modest figure relative to the float that suggests limited bearish conviction among institutional participants.

Key Dividend Metrics

💵 Forward Dividend Yield: 1.37%

📈 5-Year Average Yield: 1.13%

📅 Last Ex-Dividend Date: January 16, 2026

📊 Payout Ratio: 43.99%

🔄 Dividend Growth Streak: 10+ years

💲 Annual Dividend: $2.84 per share

💰 Last Quarterly Payment: $0.71 per share

Dividend Overview

IDEX isn’t a high-yielder, but the story here is quality and predictability. With a current yield of 1.37%, it may not jump off the page until you look a little deeper. This is a business that has grown its dividend year after year, and it does so without compromising the underlying strength of the company.

The payout ratio sits just under 44%, which offers plenty of breathing room. The company’s free cash flow of $538.9 million comfortably covers the dividend outlay, and management has proven disciplined with how it allocates capital across dividends, acquisitions, and organic reinvestment.

You get the sense that dividends aren’t an afterthought at IDEX — they’re part of the long-term value proposition. The company prefers measured, consistent increases over flashy jumps, which aligns well with a conservative dividend growth strategy.

For income-focused investors, especially those with a long horizon, this steady approach can be far more attractive than a higher yield that might not hold up in a downturn. The $0.71 quarterly payment that was reaffirmed in the January 2026 cycle reflects that ongoing commitment.

Dividend Growth and Safety

One of the standout aspects of IDEX is its history of dividend growth. Even during periods of economic turbulence, it has continued to raise payouts. The dividend moved from $0.64 per quarter in mid-2023 to $0.69 in May 2024 and then stepped up again to $0.71 in May 2025, where it has remained through the January 2026 payment. That progression represents a roughly 11% increase over a two-year window, a pace that meaningfully outpaces inflation without straining the balance sheet.

Looking at safety, there are no red flags. Cash generation is strong, with operating cash flow reaching $680.4 million on a trailing basis, an improvement over the prior year’s $617.2 million figure. Free cash flow of $538.9 million provides substantial coverage above the annual dividend obligation, and the payout ratio of 43.99% leaves ample room for continued growth even if earnings face modest pressure.

Return on equity of 12.34% and return on assets of 6.63% reflect a business generating respectable returns on the capital it deploys. Management has not been shy about reinvesting in the business through targeted acquisitions and continued innovation in core areas, and that balance between rewarding shareholders and building long-term franchise value is what gives IDEX’s dividend genuine durability.

If you’re building out a dividend portfolio that values consistency and careful stewardship over aggressive yield chasing, IDEX offers something solid. It’s the kind of name that can sit quietly in your portfolio, compounding year after year, and sometimes that’s exactly what a long-term income investor needs.

Chart Analysis

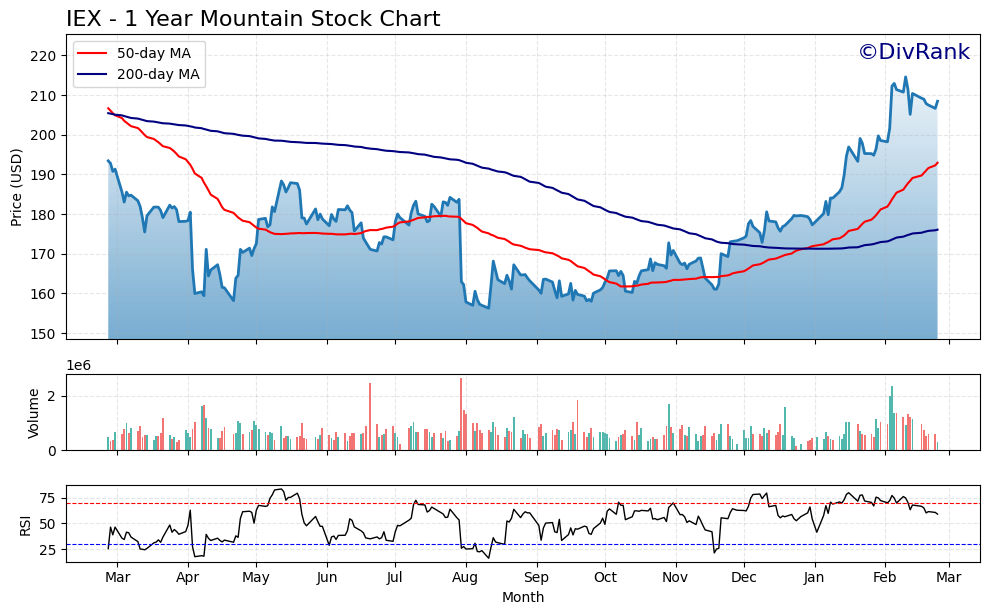

IDEX Corporation’s chart tells a compelling recovery story over the past twelve months. Shares bottomed near $156.29 at the 52-week low and have since climbed approximately 33% to the current price of $208.45, reflecting a sustained and broad-based rebound in investor confidence. That kind of range expansion, from trough to near the 52-week high of $214.58, suggests this was not a brief technical bounce but rather a genuine trend reversal with institutional participation behind it. At just 2.86% below the 52-week high, IEX is pressing against territory it hasn’t occupied in over a year, and the price action at this level will tell dividend investors a great deal about near-term conviction.

The moving average picture is unambiguously constructive. The 50-day moving average sits at $192.94 and the 200-day moving average at $176.08, and IEX is trading comfortably above both. More importantly, the 50-day has crossed above the 200-day to form what technicians call a golden cross, a configuration that historically signals the transition from a corrective phase to a more durable uptrend. The gap between the current price and the 200-day average is now more than $32, which means the long-term trend floor has moved substantially higher and provides a reasonable cushion for income investors who are less interested in timing a top and more focused on entry points with favorable risk-adjusted profiles.

The RSI reading of 59.09 occupies a particularly useful middle ground for dividend-focused buyers. The indicator is clearly in positive momentum territory, confirming that buying pressure remains dominant, yet it stops well short of the 70-plus readings that would flag an overbought condition and raise the probability of a short-term pullback. This is the kind of RSI profile that often accompanies stocks in a healthy, mid-cycle advance rather than a speculative blowoff, and it leaves room for continued price appreciation without the elevated mean-reversion risk that comes with extended momentum readings.

For dividend growth investors, the technical setup here is about as clean as it gets in the current market environment. The trend is up on every meaningful timeframe, the golden cross is confirmed, momentum is positive without being excessive, and the stock is within striking distance of a new 52-week high. A clean break above $214.58 on meaningful volume would represent a multi-year breakout and could attract a fresh wave of momentum-oriented capital alongside the income crowd. Investors building or adding to a position at $208.45 are buying into a structurally improving chart, with the 50-day moving average near $193 serving as a logical reference point for defining risk on the trade.

Cash Flow Statement

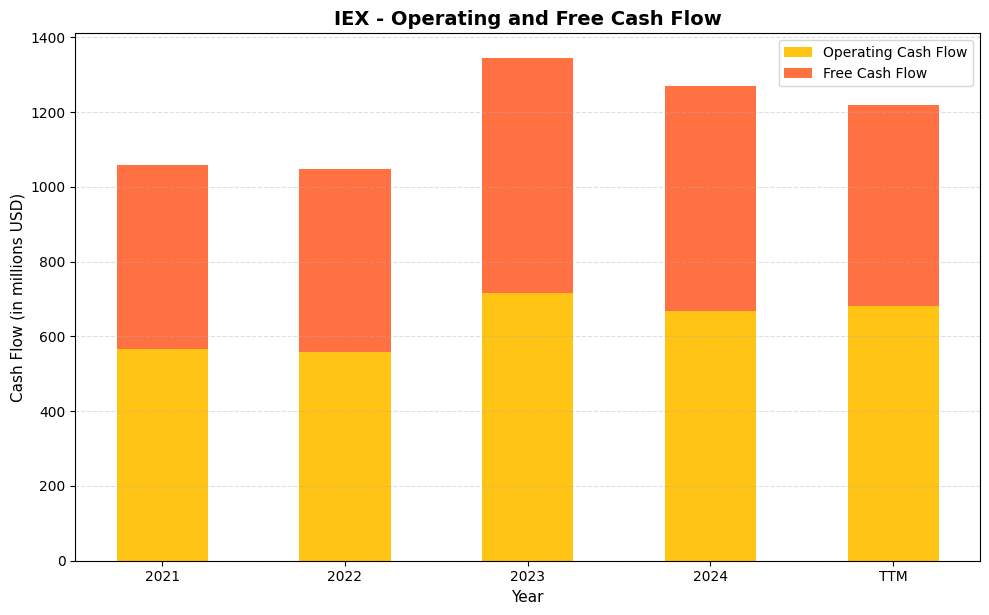

IDEX Corporation’s cash generation record is a cornerstone of its dividend investment case. Operating cash flow held steady in the $557 to $565 million range in 2021 and 2022, then surged to $716.7 million in 2023, a year that demonstrated the company’s ability to convert earnings into real cash at an elevated rate. The 2024 figure of $668.1 million represented a modest step back from that peak, and the trailing twelve months of $680.4 million suggest stabilization in a healthy range. Free cash flow tells a similar story, moving from $492.6 million in 2021 to a high of $626.8 million in 2023 before settling to $603.0 million in 2024 and $538.9 million on a TTM basis. Even at the lower TTM level, the company is generating well over half a billion dollars in free cash flow annually, which provides comfortable headroom to fund dividends, share repurchases, and bolt-on acquisitions simultaneously without straining the balance sheet.

The longer arc of this data reveals a business that has grown its cash generation capacity meaningfully over the four-year span while keeping capital expenditures disciplined. The gap between operating cash flow and free cash flow has remained relatively narrow throughout, typically running $70 to $90 million per year in capital spending, which reflects the asset-light characteristics of IDEX’s engineered fluid-handling model. That capital efficiency is a genuine advantage for dividend investors because it means a high proportion of operating cash is available for direct shareholder returns rather than being consumed by reinvestment demands. With the dividend payout consuming a fraction of annual free cash flow, IDEX carries substantial room to continue its tradition of annual dividend increases, and the consistency of this cash generation across different economic environments reinforces confidence in the sustainability of that commitment.

Analyst Ratings

The analyst community holds a consensus buy rating on IDEX, with 13 analysts covering the stock as of late February 2026. The mean price target of $223.54 sits roughly 7% above the current price of $208.45, suggesting measured but meaningful upside in the view of the covering analyst community. The range of targets is fairly wide, spanning from a low of $170.00 to a high of $250.00, which reflects differing views on how quickly IDEX can accelerate organic growth and whether the industrial demand environment will support multiple expansion from current levels.

The buy consensus is grounded in IDEX’s consistent free cash flow generation, its demonstrated ability to grow the dividend sustainably, and the quality of its end markets across water, life sciences, and fire and safety. At a P/E of 32.52 and a price-to-book of 3.86, the stock is priced as a quality compounder rather than a deep value play, and analysts appear comfortable with that framing given the company’s track record of operational discipline. The mean target of $223.54 implies that the market is not yet fully pricing in the earnings recovery potential that several covering analysts appear to anticipate over the next twelve months.

Earning Report Summary

Solid Start to the Year with Some Mixed Signals

IDEX Corporation’s most recent full-year results show revenue of $3.46 billion and net income of $483.2 million, translating to EPS of $6.41. Operating cash flow improved to $680.4 million, and free cash flow of $538.9 million reflects the company’s continued ability to convert earnings into usable capital. Profit margins held at 13.98%, consistent with prior-year levels and reflective of management’s cost discipline in a mixed industrial demand environment.

Orders across the business have continued to trend constructively, with the Health and Science Technologies segment remaining a key driver of volume. The Mott team’s contributions to clean water infrastructure projects have supported backlog, and management has pointed to this segment as a source of durable long-term demand. Organic growth has been modest, consistent with broader industrial sector trends, but the quality of IDEX’s order book has remained a positive data point for investors watching the revenue trajectory.

CEO’s Take and Forward Strategy

CEO Eric Ashleman has maintained a steady tone in his public commentary, emphasizing that IDEX’s diversified business model provides resilience across different parts of the economic cycle. He has highlighted the company’s willingness to absorb near-term cost pressures through internal efficiency initiatives while preserving investment capacity for acquisitions and organic growth programs. The identification of cost savings initiatives in the prior year appears to be contributing to the improved operating cash flow figure, and management has signaled a continued focus on margin quality over volume-at-any-cost growth.

Ashleman has also been clear about the company’s approach to tariffs and supply chain dynamics, noting that IDEX’s pricing power in its specialized end markets provides a meaningful offset to input cost volatility. That pricing discipline, combined with the company’s strong customer relationships in niche industrial applications, underpins the confidence management has expressed about sustaining earnings quality through varying macro conditions.

Outlook Still Steady

Management’s forward guidance posture has remained consistent with prior cycles, projecting low-to-mid single-digit organic growth as the base case while acknowledging that customer decision timelines in some segments have lengthened. The company has not signaled any change to its capital allocation priorities, with the dividend, bolt-on acquisitions, and selective share repurchases remaining the primary uses of free cash flow. At $538.9 million in free cash flow against an annual dividend obligation well below that figure, the financial capacity to sustain and grow the dividend remains firmly intact.

Financial Discipline and Growth Focus

CFO Abhi Khandelwal has continued to articulate a clear and consistent message around capital discipline. The improvement in operating cash flow to $680.4 million from $617.2 million in the prior year reflects both earnings growth and working capital management, and Khandelwal has emphasized that IDEX’s balance sheet positioning gives it flexibility to act on acquisition opportunities that meet its return thresholds without compromising financial stability. Return on equity of 12.34% and return on assets of 6.63% reflect a business generating solid returns without excessive leverage, a profile that tends to support durable dividend growth over time.

Management Team

IDEX Corporation is guided by a leadership team that blends deep industry experience with a forward-thinking approach. At the helm is Eric Ashleman, who has served as CEO and President since 2020. With a tenure now exceeding five years, Ashleman brings a steady hand to the company’s strategic direction. His leadership emphasizes innovation and operational excellence, aligning with IDEX’s commitment to delivering high-quality engineered products across its specialized end markets.

Supporting Ashleman is Abhi Khandelwal, the Senior Vice President and Chief Financial Officer. Khandelwal, who joined the company in late 2023, plays a crucial role in managing IDEX’s financial health and capital allocation strategies. His financial acumen ensures that the company maintains its strong balance sheet and continues to invest in growth opportunities, as evidenced by the improvement in operating cash flow under his financial stewardship.

The broader executive team includes Lisa Anderson, Senior Vice President and General Counsel; Melissa Flores, Senior Vice President and Chief Human Resources Officer; and Roopa Unnikrishnan, Senior Vice President and Chief Strategy and Innovation Officer. Each brings a wealth of experience in their respective fields, contributing to a well-rounded leadership team that prioritizes ethical governance, talent development, and strategic innovation.

This cohesive management structure has been instrumental in navigating the complexities of the industrial sector, allowing IDEX to adapt to market changes while maintaining a focus on long-term value creation for shareholders.

Valuation and Stock Performance

As of February 24, 2026, IDEX’s stock is trading at $208.45, sitting near the upper end of its 52-week range of $153.36 to $217.16. The stock has recovered substantially from its cycle lows and is trading within reach of its 52-week high, reflecting improved investor sentiment toward the company’s earnings trajectory and cash flow quality. The market cap stands at approximately $15.7 billion, a recovery from the sub-$15 billion levels seen earlier in the trailing twelve-month period.

From a valuation standpoint, IDEX’s metrics reflect a company priced for quality. The trailing P/E ratio of 32.52 is on the higher end for an industrial name, but it is consistent with the premium that the market has historically assigned to IDEX’s niche positioning, consistent free cash flow generation, and dividend growth track record. The price-to-book ratio of 3.86 against a book value per share of $53.99 reinforces the quality premium embedded in the current price. Beta of 0.98 suggests the stock moves broadly in line with the market, offering neither outsized protection nor amplified volatility for portfolio construction purposes.

The analyst consensus mean price target of $223.54 implies approximately 7% upside from current levels, with the range spanning $170.00 on the low end to $250.00 on the high end. That spread reflects genuine disagreement about the pace of organic growth recovery and the sustainability of the current multiple, but the buy consensus suggests that the preponderance of covering analysts view the risk-reward as favorable at current prices. For dividend growth investors, the combination of a 1.37% yield, a sub-44% payout ratio, and a decade-plus growth streak makes the valuation conversation somewhat secondary to the income compounding story.

Risks and Considerations

IDEX’s exposure to cyclical end markets including agriculture, chemicals, and semiconductors means that macroeconomic slowdowns can translate into meaningful demand softness across portions of its portfolio. Organic growth has been modest in recent periods, and a more pronounced industrial downturn could put pressure on revenue and earnings growth assumptions that are currently embedded in the stock’s 32.52 P/E multiple.

The integration of acquired businesses presents ongoing execution risk. IDEX has built much of its portfolio through disciplined bolt-on acquisitions, and while its track record is strong, each new deal requires effective cultural and operational integration to contribute to shareholder value. A misstep on a larger transaction could weigh on returns and distract management attention from organic priorities.

Tariffs and trade policy uncertainty remain relevant considerations for a company with global manufacturing and customer exposure. IDEX has demonstrated pricing power in its specialized markets, but sustained cost inflation from trade disruptions could compress margins if pass-through pricing reaches customer resistance levels.

The competitive landscape in specialty industrial machinery is intensifying, with both established players and newer entrants investing heavily in differentiated solutions for water treatment, life sciences, and precision fluid management. IDEX must continue to invest in innovation and customer relationships to protect the pricing premiums and switching costs that underpin its margins.

Finally, the stock’s current valuation at a trailing P/E of 32.52 leaves limited room for earnings disappointment. Any guidance reduction or miss relative to analyst expectations could result in meaningful multiple compression, particularly if broader market sentiment toward industrial names softens in tandem.

Final Thoughts

IDEX Corporation presents a compelling narrative of steady leadership, strategic growth, and financial discipline heading into 2026. The improvement in operating cash flow to $680.4 million, the continued progression of the quarterly dividend to $0.71 per share, and the recovery in the stock price toward the upper end of its 52-week range all reflect a business that is executing on its long-term plan without cutting corners on financial quality.

The 1.37% yield won’t attract investors seeking immediate income maximization, but for dividend growth investors focused on compounding over a multi-year horizon, IDEX’s combination of a sustainable 43.99% payout ratio, strong free cash flow coverage, and a decade-plus growth streak makes it a credible core holding. The analyst community’s buy consensus and mean target of $223.54 suggest that the investment case remains intact at current prices, even as the valuation demands continued earnings delivery. For patient investors who value consistency and stewardship over headline yield, IDEX continues to earn its place in a quality dividend growth portfolio.