Updated 2/24/26

IDACORP, Inc. (IDA), the parent company of Idaho Power, delivers electricity to more than 600,000 customers across Idaho and Oregon. With roots in regulated utility operations, the company has steadily grown its earnings and customer base while executing an ambitious infrastructure investment program. Under the leadership of CEO Lisa Grow, IDACORP has maintained its reputation as a disciplined, income-friendly utility with a consistent record of annual dividend increases and earnings growth.

Trading near its 52-week high at $143.26, the stock has climbed sharply over the past year as investors have rotated back into regulated utilities with strong regional growth profiles. With a current EPS of $5.81 and a payout ratio just under 60%, IDACORP continues to attract dividend growth investors who prioritize sustainability over yield maximization.

Recent Events

IDACORP has been active on the infrastructure and regulatory front heading into early 2026. The company has continued advancing its major transmission line construction projects, which represent some of the most significant capital commitments in the company’s history. These projects are central to Idaho Power’s long-range resource plan and are designed to accommodate the sustained customer growth the utility has experienced across southern Idaho, where commercial and residential demand continues to outpace regional averages.

On the dividend front, IDACORP raised its quarterly payout to $0.88 per share in the fourth quarter of 2025, up from $0.86 in the prior two quarters. That brings the annualized dividend to $3.52, continuing a streak of annual increases that stretches back more than a decade. The move reflected management’s confidence in the earnings outlook and its commitment to sharing gains with shareholders in a measured, sustainable way.

The stock itself has been one of the stronger performers in the regulated utility space over the trailing twelve months, rising from lows near $108 to its current level just below the 52-week high of $145.94. That kind of move in a low-beta utility underscores how much sentiment has shifted toward defensive income names as the broader interest rate environment has evolved.

Key Dividend Metrics

💸 Forward Dividend Yield: 2.41%

📈 5-Year Average Yield: ~2.99%

📆 Last Dividend Payment: $0.88 (February 5, 2026)

🪙 Payout Ratio: 59.21%

🔁 Dividend Growth: Annual increases for over a decade

📊 Cash Flow Coverage: Operating cash flow of $601.8M supports the payout

🧱 Balance Sheet: Price/Book at 2.20x, Book Value/Share $65.11

Dividend Overview

At a current yield of 2.41%, IDACORP’s dividend is trading at a modest discount to its five-year average yield of roughly 3%, which is a natural consequence of the stock’s strong price appreciation over the past year. Investors buying at today’s price are paying for that appreciation upfront, accepting a somewhat lower entry yield in exchange for a business that has demonstrated clear and consistent dividend growth over time.

The company currently pays a quarterly dividend of $0.88 per share, which amounts to $3.52 annualized. That compares to $3.32 just two years ago and $2.52 five years ago, reflecting a deliberate and well-executed growth trajectory. The November 2025 increase from $0.86 to $0.88 per quarter was the most recent step in that progression and aligns with management’s pattern of annual adjustments tied closely to earnings growth.

With a payout ratio of 59.21%, IDACORP retains a meaningful portion of its earnings for reinvestment and capital expenditure needs. That balance is especially important for a utility running an aggressive infrastructure buildout, where internal cash generation needs to be managed carefully alongside shareholder returns. A sub-60% payout ratio gives the company room to continue raising the dividend without overstretching.

Institutional ownership remains near 90% of the float, which speaks to the confidence professional investors have placed in both the income stream and the long-term operating model. That kind of backing tends to provide a measure of price stability even during broader market volatility.

Dividend Growth and Safety

IDACORP’s decade-plus streak of annual dividend increases is one of the more underappreciated attributes of the stock. The increases have not been flashy, but they have been remarkably consistent, moving from $0.79 per quarter in mid-2023 to $0.88 per quarter today. That represents cumulative quarterly growth of more than 11% over roughly two and a half years, a pace that comfortably outpaces inflation while keeping the payout ratio in a sustainable range.

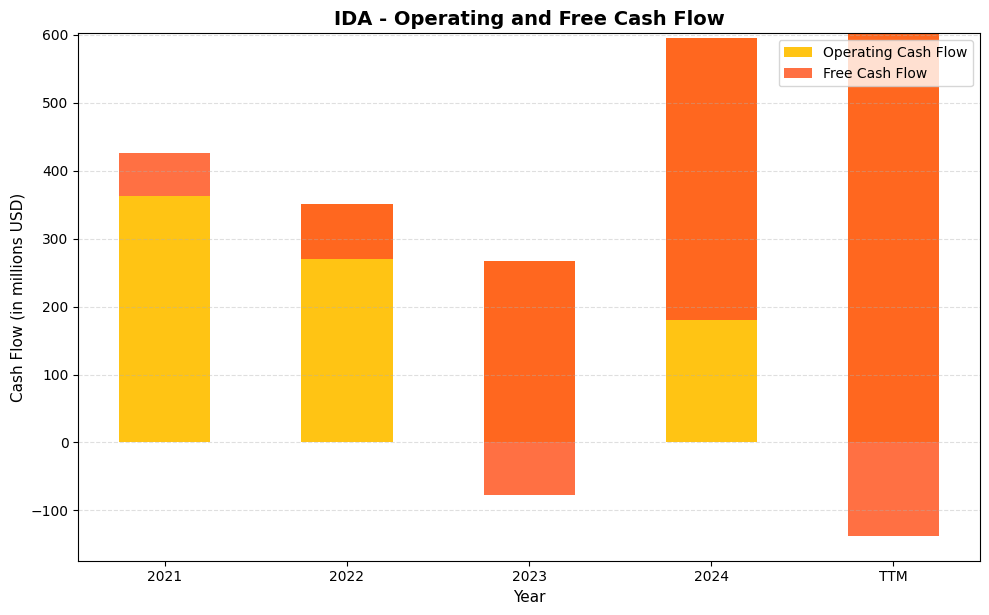

The one area that continues to require monitoring is free cash flow. Operating cash flow of $601.8 million is healthy and well above what is needed to fund the dividend, but capital expenditures remain elevated, resulting in negative free cash flow of approximately $738.8 million over the trailing twelve months. This is not unusual for a utility in the middle of a major transmission and generation investment cycle, but it does mean the company relies on external financing to bridge the gap between operating cash and total investment needs.

As long as IDACORP maintains access to capital markets at reasonable rates and the regulatory environment in Idaho and Oregon continues to support timely cost recovery, the dividend remains on a secure footing. The regulated utility model provides a level of earnings visibility that most sectors cannot match, which is precisely what makes these negative free cash flow periods manageable rather than alarming.

Debt levels are elevated relative to equity, as is common across the utility sector, but the company’s earnings stability and regulated revenue base provide a sufficient cushion. Return on equity of 9.37% and a profit margin of 17.84% suggest the business is generating adequate returns on its asset base, even as it invests aggressively for future growth. The dividend safety profile looks solid, and continued modest annual increases appear likely given the current earnings and payout trajectory.

Chart Analysis

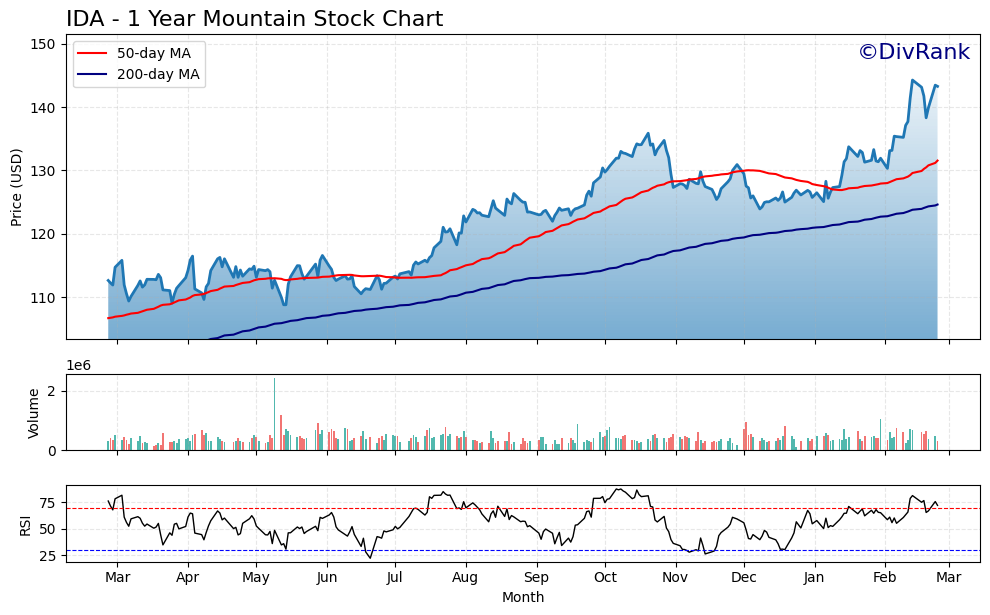

IDACORP has staged an impressive recovery over the past twelve months, climbing from a 52-week low of $108.79 to its current price of $143.26, a gain of nearly 32% from trough to present. That kind of price appreciation is well above what most income investors expect from a regulated utility, and it reflects a meaningful re-rating of the stock as interest rate sentiment shifted and investors rotated back into defensive yield plays. At $143.26, the stock is sitting just 0.69% below its 52-week high of $144.26, which tells you the majority of the buying pressure from this recovery cycle remains intact with very little overhead distribution to work through.

The moving average picture reinforces the bullish technical case. The 50-day moving average currently sits at $131.54 and the 200-day moving average at $124.61, meaning the stock trades comfortably above both trend lines by meaningful margins. Importantly, the 50-day has crossed above the 200-day, forming what technicians refer to as a golden cross, a configuration that historically signals sustained intermediate-term upward momentum rather than a short-lived bounce. For dividend investors, a price trading well above both moving averages reduces the near-term risk of a sharp drawdown back to cost basis, though it also means the margin of safety on price alone is thinner today than it was six to twelve months ago.

Momentum, as measured by the Relative Strength Index, is running hot. A current RSI reading of 72.23 places IDA in overbought territory, which is defined by the conventional threshold of 70. This does not mean the stock is poised for an immediate reversal, as utilities in strong uptrends can sustain elevated RSI readings for extended periods, but it does suggest that short-term buyers are chasing the move and that a consolidation or modest pullback would be a healthy and expected development from here. Investors initiating a new position at current levels should be prepared for that possibility.

For dividend-focused investors, the overall technical picture is one of strength with a caution flag on near-term entry timing. The trend is unambiguously positive, the moving average structure is constructive, and the stock’s proximity to a 52-week high reflects genuine investor confidence in IDACORP’s regulated earnings profile. The elevated RSI is the only meaningful technical concern, and it argues for patience rather than urgency. Investors already holding shares have little reason for concern, while those looking to build or initiate a position may find a better risk-adjusted entry point if the stock pulls back toward the $135 to $138 range, where the rising 50-day moving average would provide a logical area of support.

Cash Flow Statement

IDACORP’s operating cash flow has shown meaningful improvement in recent years, climbing from $351.3 million in 2022 to $594.4 million in 2024 and reaching $601.8 million on a trailing twelve-month basis. That operating cash generation is genuinely encouraging for dividend sustainability on its surface. Free cash flow tells a sharply different story, however. After accounting for capital expenditures, free cash flow has deteriorated from a modest positive $63.3 million in 2021 to deeply negative territory, sitting at negative $414.9 million in 2024 and negative $738.8 million on a TTM basis. For a regulated utility like IDA, a negative free cash flow figure does not automatically signal distress, since the dividend is effectively supported by operating cash flow and the company’s regulated rate base funding model. Still, the scale of the shortfall reflects an aggressive infrastructure investment cycle that requires ongoing external financing to bridge the gap between what the business earns and what it spends.

Tracing the trajectory from 2021 through the TTM period, the widening free cash flow deficit is almost entirely a function of accelerating capital expenditure rather than deteriorating operations. Operating cash flow has actually grown by roughly 66% over that span, which speaks to solid underlying earnings quality and the strength of the regulated utility framework that allows cost recovery through customer rates. The capital intensity reflects IDA’s investment in grid modernization, generation capacity, and infrastructure serving one of the faster-growing service territories in the Pacific Northwest. For shareholders, the practical implication is that the dividend, currently funded through operating cash flow and supported by a predictable regulatory compact, remains defensible in the near term, but continued reliance on debt and equity markets to fund the capital program introduces balance sheet risk that warrants monitoring as interest rates remain elevated and the investment cycle shows no signs of slowing.

Analyst Ratings

The analyst community has grown increasingly constructive on IDACORP as the stock has moved toward the upper end of its historical valuation range. With a consensus rating of Buy across nine covering analysts, the professional view is that the company’s earnings stability, regional growth profile, and disciplined management team justify continued ownership even at current elevated prices.

The mean 12-month price target stands at $146.22, which is essentially in line with where the stock is trading today at $143.26, suggesting analysts see the shares as fairly valued rather than deeply discounted at current levels. The high end of the target range reaches $158.00, implying roughly 10% upside in the most optimistic scenario, while the low target of $118.00 represents the more cautious view that the stock has run ahead of near-term fundamentals. Given how close the mean target is to the current price, investors should not expect analyst upgrades alone to drive meaningful near-term appreciation. The investment case at this level rests more on the income stream and dividend growth trajectory than on price target expansion.

Earning Report Summary

Full-Year 2025 Wraps Up Strong

IDACORP closed out fiscal year 2025 with full-year EPS of $5.81, placing the result squarely within the guidance range the company had maintained throughout the year and representing continued progress from prior periods. Net income came in at $323.5 million on revenue of $1.81 billion, with a profit margin of 17.84% reflecting the company’s ongoing focus on cost discipline alongside infrastructure investment.

Customer growth remained a meaningful contributor to results. Idaho Power’s service territory continues to attract both residential and commercial customers at above-average rates compared to the broader utility industry, driven by regional economic activity and business relocations into southern Idaho. That demand tailwind has provided a consistent lift to retail kilowatt-hour sales over multiple consecutive reporting periods.

Cost Pressures Continue but Are Being Managed

Operations and maintenance costs remained elevated through 2025, reflecting ongoing wildfire mitigation spending, inflationary labor pressures, and the increased complexity of running a system undergoing significant capital investment. Depreciation also continued to climb as new assets were placed into service, which is a natural consequence of the company’s capital program but does weigh on near-term earnings growth rates.

Despite those headwinds, IDACORP’s regulated rate structure and the use of Idaho’s deferred investment tax credit mechanisms helped smooth the path from revenues to net income. Management has shown a consistent ability to navigate the regulatory process in a way that balances customer rate stability with investor return requirements.

Looking Ahead

With EPS of $5.81 now in the books for 2025, the focus shifts to what the company can deliver in 2026. The major transmission construction projects that have been discussed throughout the past year are now underway, which means capital expenditures are unlikely to ease significantly in the near term. However, the completion of these projects over the coming years should translate into additional rate base growth and, by extension, earnings growth that supports continued dividend increases. Leadership has consistently communicated a long-term orientation around reliability and sustainable growth, and the 2025 results reinforce that the operational execution behind those statements is genuine.

Management Team

At the helm of IDACORP is Lisa A. Grow, who has served as President and CEO since June 2020. Her journey with the company began in 1987 as Idaho Power’s first female engineer. Over the years, she has held various leadership roles, including Senior Vice President of Operations and Chief Operating Officer. Her extensive experience across engineering and operations provides her with a comprehensive understanding of the utility’s inner workings. Beyond her corporate responsibilities, Grow contributes to the broader community through board roles in healthcare and regional economic institutions.

Under Grow’s leadership, IDACORP has maintained a steady course, focusing on operational excellence and strategic investments to meet the evolving energy needs of its customers. Her commitment to reliability and sustainability has positioned the company to navigate the challenges of a rapidly changing energy landscape, and the consistent earnings delivery and dividend growth record of recent years reflect well on the management team she has assembled.

Valuation and Stock Performance

As of February 24, 2026, IDACORP trades at $143.26, just below its 52-week high of $145.94 and well above the 52-week low of $108.15. That represents a substantial recovery and advance over the trailing year, and it has pushed the stock’s valuation metrics toward the higher end of their historical ranges. The current P/E ratio of 24.66x is above where the stock has typically traded, reflecting a combination of improved earnings sentiment and the broader re-rating of regulated utilities as a defensive asset class.

Price-to-book stands at 2.20x against a book value per share of $65.11, which is elevated for a regulated utility but not unreasonable given IDACORP’s consistent earnings growth and dividend track record. The mean analyst price target of $146.22 sits just above the current price, suggesting the market has largely priced in the near-term fundamental outlook. For investors entering at these levels, the total return thesis rests primarily on dividend income and modest earnings-driven price appreciation over a multi-year horizon rather than near-term multiple expansion. The stock’s beta of 0.60 reinforces its character as a low-volatility income holding that tends to hold up well when broader markets encounter turbulence.

Risks and Considerations

IDACORP’s capital expenditure program is one of the most significant risk factors to monitor over the next several years. With free cash flow running at negative $738.8 million over the trailing twelve months, the company is heavily dependent on external financing to fund its infrastructure buildout. If interest rates remain elevated or credit market conditions tighten, the cost of that financing could weigh on earnings and, over time, on the company’s flexibility to grow the dividend at its historical pace.

The regulatory environment in Idaho and Oregon represents both a source of stability and a potential source of risk. IDACORP’s earnings depend on constructive rate case outcomes and the timely recovery of infrastructure investments through customer rates. Any shift in the regulatory posture of state commissions, including pushback on rate increases or delays in cost recovery mechanisms, could compress returns on the company’s growing rate base and put pressure on earnings growth projections.

Wildfire risk remains an ongoing operational and financial concern for Idaho Power, given the geography of its service territory and the broader trend of increasing wildfire frequency and severity across the western United States. Mitigation spending has already pushed operations and maintenance costs higher, and a major wildfire event could result in significant uninsured liabilities or reputational damage that complicates the regulatory relationship.

Finally, at a P/E ratio of 24.66x and a stock price near its 52-week high, valuation itself is a consideration. Investors buying at current levels have less margin of safety than those who purchased during the lows of the past year, and any disappointment in earnings, guidance, or the dividend growth trajectory could lead to a meaningful price correction given how much optimism is already embedded in the current multiple.

Final Thoughts

IDACORP has earned its place as one of the more reliable dividend growth stories in the regulated utility space. The company’s track record of annual dividend increases, disciplined management, and consistent earnings delivery within a regulated framework gives income investors a level of predictability that is genuinely rare. The November 2025 increase to $0.88 per quarter, bringing the annualized payout to $3.52, is the latest in a long line of steps that demonstrate management’s commitment to sharing earnings growth with shareholders.

The stock is not cheap at current levels, and the yield of 2.41% will not satisfy investors seeking maximum current income. But for those with a longer time horizon who value dividend growth, operational stability, and low portfolio volatility, IDACORP continues to offer a compelling combination of attributes. The infrastructure investment cycle underway today is laying the groundwork for rate base growth and earnings expansion that should support continued dividend increases well into the latter part of this decade. It is a company built for patient investors, and patient investors have been well rewarded.