Key Takeaways

💸 IBM offers a forward dividend yield of 2.52% and has raised its dividend for 29 consecutive years, backed by consistent free cash flow to support ongoing growth.

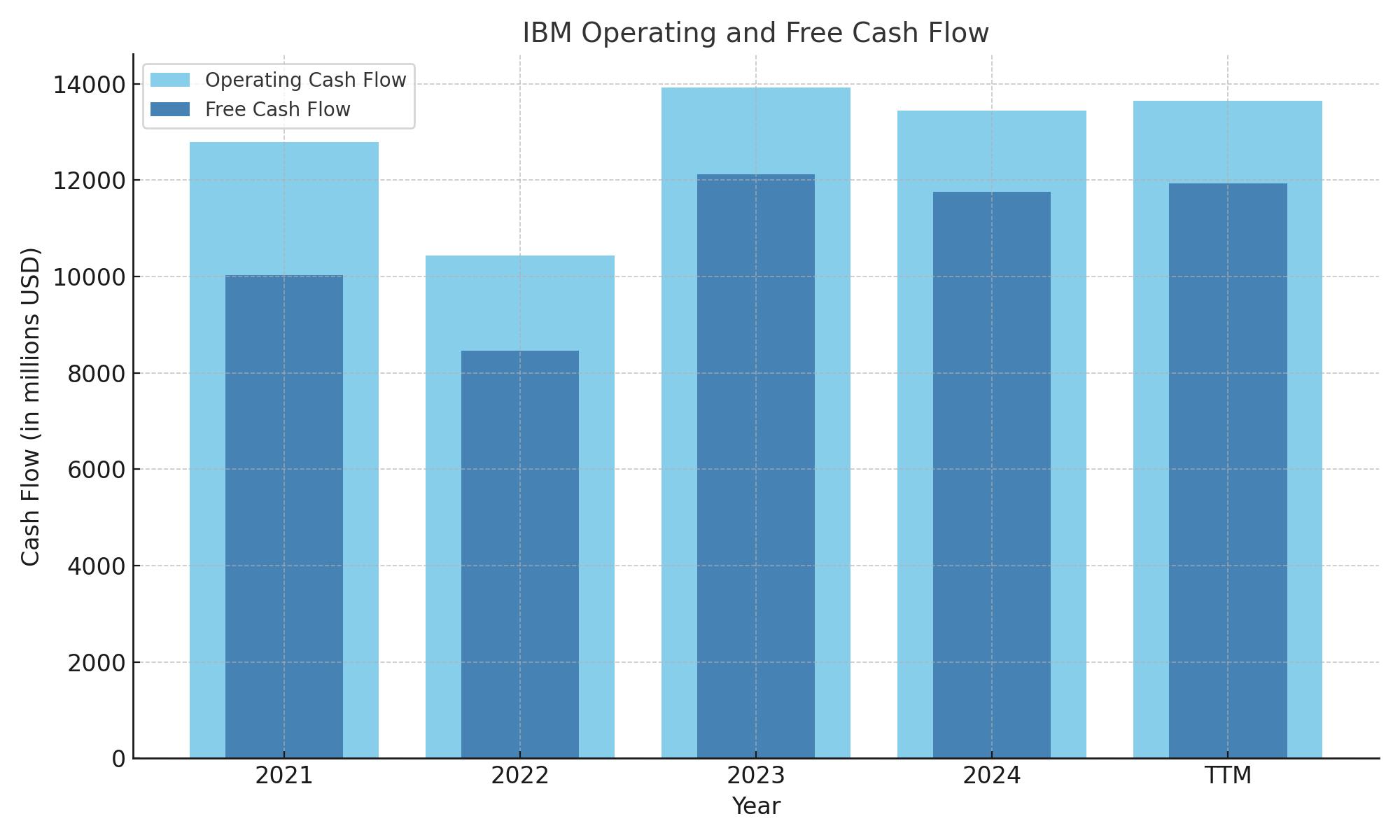

💼 The company generated $13.65 billion in operating cash flow and $11.94 billion in free cash flow over the trailing twelve months, maintaining strong liquidity despite investment-heavy quarters.

📊 Analysts are divided with ratings ranging from Sell to Outperform, and the average consensus price target is $249.06, reflecting mixed views on IBM’s transition and AI strategy.

Updated 5/16/25

IBM has spent the past few years quietly repositioning itself, focusing heavily on hybrid cloud, artificial intelligence, and enterprise software. Under the leadership of CEO Arvind Krishna, the company has made significant strides with platforms like Red Hat and watsonx, while continuing to generate reliable free cash flow and maintain its nearly three-decade streak of dividend increases.

Backed by a strong cash position and solid operating metrics, IBM’s stock has climbed more than 50% over the past year. With a growing presence in generative AI, a stable dividend yield, and a strategic shift away from legacy hardware, IBM now sits at the intersection of innovation and income.

Recent Events

The last twelve months have been good to IBM shareholders. The stock has climbed to $266.68, up almost 58% over the past year. That’s a strong move, especially for a company often labeled as a slow mover. Compare that to the broader market’s 11% gain, and IBM starts to look more than just a dividend play.

What’s fueling that momentum? Some of it is certainly the excitement around AI. IBM’s pitch is that it offers enterprise-ready AI—something companies can actually implement and scale without the chaos of bleeding-edge startups. That’s resonating with investors.

Still, it hasn’t all been smooth. Revenue growth came in at just 0.5% year-over-year, and earnings dropped over 34% in the latest quarter. That kind of earnings volatility is a reminder that IBM is still very much in transition, and growing pains are part of the equation.

But despite some earnings softness, the dividend remains firmly in place. The company just went ex-dividend on May 9, with the next payout scheduled for June 10. It’s the 29th consecutive year that IBM has raised its dividend—an impressive feat that places it squarely among the elite Dividend Aristocrats.

Key Dividend Metrics

🧮 Forward Dividend Yield: 2.52%

📈 5-Year Average Yield: 4.50%

💰 Forward Annual Dividend: $6.72 per share

📆 Payout Ratio: 114.19%

🏆 Dividend Growth Streak: 29 consecutive years

📊 Ex-Dividend Date: May 9, 2025

📅 Next Payment Date: June 10, 2025

Dividend Overview

At first glance, IBM’s 2.52% yield might not turn heads. Especially when you compare it to the 4.5% average it’s posted over the past five years. But the reason for the lower yield is pretty simple—share price appreciation. When a stock rallies like IBM has, the yield naturally pulls back.

Dig a bit deeper, though, and that dividend starts to look very solid. The company is currently paying $6.72 per share each year. With nearly 930 million shares outstanding, that’s a sizable cash commitment.

Now, the payout ratio might raise some eyebrows. At over 114%, IBM is technically paying out more in dividends than it earned in net income over the last 12 months. But that doesn’t mean the dividend is in danger. IBM’s cash flow tells a more complete story.

Operating cash flow sits at $13.65 billion, and levered free cash flow is north of $10.5 billion. Those numbers give IBM plenty of breathing room. They cover the annual dividend cost comfortably, even with some margin for capital spending or debt service.

In short, IBM may be stretching its earnings a bit thin, but the dividend is being paid out of a strong and consistent stream of cash.

Dividend Growth and Safety

One of the more compelling parts of IBM’s dividend story is its consistency. Not only has the company raised its payout for 29 straight years, but it’s done so through all kinds of business cycles and tech upheavals. That track record alone speaks volumes about how seriously IBM takes its dividend.

Still, the high payout ratio isn’t something to ignore completely. If earnings don’t rebound soon, IBM will need to keep relying on cash flow to maintain and grow the dividend. The good news is that the company’s shift toward recurring revenue from software and AI services could start to ease that pressure.

As more of IBM’s business comes from predictable, high-margin segments, earnings should stabilize. That would go a long way in making the dividend feel even more secure. There’s also the fact that IBM isn’t shy about reinvesting in the business. Capital allocation continues to prioritize the dividend, even as new tech opportunities emerge.

One area worth watching is the balance sheet. IBM has $66.84 billion in total debt and a debt-to-equity ratio of nearly 248%. That’s high by most standards, and it does create some risk. But IBM’s cash cushion—$17.46 billion as of the last quarter—helps keep things in check. The company also generates enough cash to cover interest payments without breaking a sweat.

Another quiet strength is IBM’s lower volatility. With a five-year beta of just 0.63, the stock tends to move less dramatically than the broader market. For investors who value stability along with income, that’s a nice bonus.

In the end, IBM’s dividend isn’t just a relic of its past—it’s part of how the company defines its value to shareholders. Even as it reinvents itself for the AI era, IBM continues to reward investors who stick around for the long term.

Cash Flow Statement

IBM’s trailing twelve-month operating cash flow stands at $13.65 billion, showing stability in its core operations. This consistency has held up well year-over-year, and despite some fluctuations in reported earnings, cash flow generation remains one of IBM’s stronger financial pillars. Free cash flow for the same period came in at $11.94 billion, reflecting efficient capital spending, with capital expenditures at just $1.71 billion—well-contained for a company investing in AI and cloud infrastructure.

On the investing side, IBM spent heavily, with cash outflows of $13.71 billion. This sharp increase suggests deeper investment in long-term assets or acquisitions, which aligns with its push into next-gen technologies. Financing activities also pulled $3.51 billion in cash, a mix of debt repayments and share repurchases, although IBM did issue new debt worth $8.6 billion. The end result left the company with $11.19 billion in cash, down from last year but still a solid cushion. This combination of reliable cash inflow, strategic investment, and controlled financing suggests IBM is focused on transformation while still maintaining the liquidity needed to support its dividend and long-term plans.

Analyst Ratings

📈 IBM has recently experienced a mix of analyst opinions, reflecting both optimism and caution. 🧐 Wedbush Securities maintained its “Outperform” rating with a price target of $300, highlighting IBM’s strong position in AI and cloud services. They noted that AI spending now comprises about 12-15% of IT budgets, up from 10% in January, suggesting a significant opportunity for IBM to capitalize on this trend.

📉 On the other side, UBS maintained a “Sell” rating but slightly increased its price target from $160 to $170. This move indicates some recognition of IBM’s upside potential, even if the firm remains bearish. Morgan Stanley also maintained its “Equal-Weight” stance, trimming its price target modestly from $237 to $233, signaling a more reserved approach as IBM navigates its ongoing transition.

💵 The current consensus price target among analysts sits at approximately $249.06. The range is fairly wide, with the most optimistic estimate reaching $320 and the most conservative down at $170. This spread captures the divergent views on IBM’s performance outlook, driven by its evolving role in the AI landscape, steady cloud service traction, and the backdrop of broader tech sector volatility.

Earning Report Summary

A Solid Start to the Year

IBM kicked off 2025 with a decent performance that beat expectations in a few key areas. The company reported adjusted earnings of $1.60 per share on $14.54 billion in revenue. That’s a modest increase in revenue compared to last year, but earnings were slightly down, dipping about 5 percent. Even so, Wall Street had expected less, and IBM managed to come in ahead.

The software segment really carried the weight this quarter. It brought in $6.34 billion, which is up 7 percent year-over-year. Red Hat, a big piece of IBM’s hybrid cloud puzzle, continued to be a standout. Its revenue climbed 13 percent, and OpenShift, the cloud platform built on Kubernetes, surged 25 percent. That kind of growth gives IBM more momentum in its shift toward higher-margin services tied to hybrid cloud and AI.

Consulting Softens, AI Moves Forward

Not everything went IBM’s way. Consulting revenue came in lower at $5.07 billion, down 2 percent. There’s been a bit of a pullback from clients on discretionary projects—something that’s becoming a theme across the tech sector. Infrastructure revenue also dipped, down 6 percent to $2.89 billion, largely because IBM is coming off the z16 mainframe cycle and prepping for what’s next.

On the AI front, though, things are moving quickly. IBM added over a billion dollars in new AI business this quarter alone, bringing the total to more than $6 billion since it began tracking this category. With the z17 mainframe around the corner—designed with baked-in AI capabilities—there’s more excitement coming.

Looking Ahead

Despite some of the headwinds, IBM stuck with its full-year guidance. The company is still expecting at least 5 percent revenue growth in constant currency and around $13.5 billion in free cash flow for the year. For the next quarter, revenue projections are between $16.4 billion and $16.75 billion, which puts IBM slightly ahead of consensus estimates.

CEO Arvind Krishna kept the focus on IBM’s broader mix of services and its long-term direction. He pointed out that even as some customers take a more cautious stance—especially in consulting—demand for cloud and AI remains strong. CFO James Kavanaugh also reassured that IBM is watching supply chains and tariffs closely and has steps in place to avoid any surprises.

All in all, this quarter showed a company leaning on its strengths while still navigating some tricky terrain. The transition to AI and software-heavy business continues, and leadership sounds confident that they’re headed in the right direction.

Management Team

IBM’s leadership is anchored by Arvind Krishna, who serves as Chairman and Chief Executive Officer. Since taking the helm in 2020, Krishna has played a central role in driving the company’s evolution toward hybrid cloud infrastructure and AI-driven solutions. His focus has been on reshaping IBM to better align with the future of enterprise technology, including automation, cybersecurity, and data platforms.

Working alongside him is James Kavanaugh, IBM’s Senior Vice President and Chief Financial Officer. Kavanaugh has been pivotal in executing the company’s financial strategy while supporting innovation-led investment. He brings a pragmatic approach to managing IBM’s balance sheet and cash flow, ensuring that even during periods of transformation, shareholder returns and financial stability remain priorities.

Together, Krishna and Kavanaugh form a leadership team that emphasizes long-term vision while staying grounded in operational discipline. Their efforts to revitalize IBM’s business mix—moving away from legacy hardware dependency and deeper into cloud services and AI—reflect a leadership mindset that’s keen on relevance and reinvention.

Valuation and Stock Performance

IBM stock has quietly been one of the stronger performers in the past year, recently trading near $266.68. It’s up significantly over the past 12 months, reflecting renewed investor confidence as the company gains traction in AI and hybrid cloud. This performance has outpaced the broader market, something not typically expected from a legacy tech name like IBM.

From a valuation perspective, the stock carries a forward price-to-earnings ratio of around 24.33 and a trailing P/E closer to 45. Those numbers are elevated when compared to IBM’s historical norms, suggesting that the market is now pricing in future growth from its AI and cloud ventures. The premium valuation also implies that investors are seeing more than just a dividend play—they’re betting on transformation.

Free cash flow continues to be a cornerstone of IBM’s investment thesis. With over $13 billion in free cash flow expected this year, the company retains flexibility for dividends, share buybacks, and reinvestment. Despite its debt load, the cash-generating ability provides a cushion and positions IBM to continue rewarding shareholders while still investing in innovation.

Risks and Considerations

Even with the positive momentum, IBM faces its share of challenges. The technology landscape is unforgiving, and IBM must contend with fast-moving rivals in cloud services and AI. Maintaining competitiveness will require ongoing investment, talent retention, and a clear product vision that resonates with enterprise customers.

There’s also execution risk. As IBM transitions further into high-value segments, any missteps—whether in integrating acquisitions, scaling new offerings, or managing expenses—could undercut investor confidence. Consulting softness seen in recent quarters is another area to watch, especially as companies scrutinize tech budgets.

Macroeconomic risks loom as well. Currency fluctuations, inflation, and global trade dynamics can all affect IBM’s revenue, particularly given its international reach. Additionally, the company’s heavy debt load—over $66 billion—means interest rate shifts and refinancing pressures must be carefully managed.

Final Thoughts

IBM is no longer the old-guard tech company it once was. Under new leadership and with a clear emphasis on AI and cloud solutions, it has repositioned itself to be more relevant in today’s digital-first world. That transformation is being noticed by investors, reflected in both share price appreciation and a more favorable view of future earnings potential.

What remains encouraging is the steady hand at the top. Krishna and Kavanaugh have consistently communicated their strategy, delivering on key milestones without overpromising. The dividend remains a pillar of IBM’s shareholder return story, backed by robust cash flow and a disciplined capital allocation strategy.

For investors focused on a blend of income and innovation, IBM continues to present a compelling mix. Its direction is clearer than it’s been in years, and while challenges remain, the company appears to be moving with more purpose than ever.