Key Takeaways

💰 Humana’s dividend yield stands at 1.40%, supported by a low payout ratio of 24.98% and a consistent history of annual increases, reflecting a steady commitment to shareholder returns.

💵 Cash flow from operations reached $2.87 billion in the trailing twelve months, with free cash flow at $2.38 billion, indicating solid coverage for dividends and investments.

📊 Analyst sentiment is mixed with a consensus “Hold” rating and an average price target of $287.76, suggesting modest upside and a cautious but stable outlook.

Updated 5/13/25

Humana Inc. is a leading health insurance provider with a strong focus on the Medicare Advantage space. In 2025, the company has seen major developments, from leadership changes to a sharp shift in strategy that includes exiting underperforming markets. Despite a recent stock decline, earnings growth, efficient cost management, and a healthy balance sheet underscore Humana’s financial resilience.

The dividend, while modest at a 1.40% yield, is well covered and steadily growing. With a refreshed executive team, a clear path forward, and continued investment in operational efficiency and care delivery, Humana is positioning itself for more disciplined, focused growth in the years ahead.

Recent Events

Humana’s recent performance has been anything but smooth. The stock has taken a significant hit, down 26% over the last twelve months and over 8% just today. The sharp drop seems tied to mounting concerns about profit margins in Medicare Advantage, rising medical costs, and some policy uncertainty hovering over the sector. These pressures are making even the most stable names in healthcare feel the heat.

But dig beneath the surface, and things don’t look quite so bleak. Revenues are still rising, up 8.4% year-over-year. And earnings? Up nearly 68%. That’s not a sign of a struggling company. It’s generating more than $120 billion annually, with a modest but steady 1.42% profit margin — typical for a managed care provider.

Despite the market jitters, Humana continues to throw off solid numbers, especially in areas that matter to long-term investors. The business hasn’t lost its footing. And for those focused on dividends, the cash flow story is holding up well enough to keep paying and potentially even growing that dividend over time.

Key Dividend Metrics

📈 Dividend Yield: 1.40%

💵 Annual Dividend: $3.54 per share

📅 Next Ex-Dividend Date: June 27, 2025

📊 Payout Ratio: 24.98%

📈 5-Year Average Yield: 0.77%

🔁 Dividend Growth: Consistent upward trend

🔒 Dividend Safety: Supported by strong earnings and a solid balance sheet

Dividend Overview

Let’s not sugarcoat it — a 1.40% yield isn’t going to stop traffic. But that’s not the point. Humana’s appeal lies in its reliability. The dividend is well covered by earnings, with less than a quarter of profits being paid out. That gives the company room to breathe if it needs to hold steady during tougher quarters.

It’s also worth noting that the current yield is quite a bit higher than its five-year average. That’s partly a reflection of the recent dip in stock price — which, from a dividend perspective, makes the payout relatively more attractive.

Humana has more than $22 billion in cash and just under $14 billion in debt. That’s a strong balance sheet by any measure. A current ratio near 2 means the company has plenty of liquidity. These are good signs for anyone relying on regular dividends to pad their portfolio.

This isn’t a REIT or utility that’s built to pay high yields right out of the gate. Humana’s story is more about preserving capital, returning value over time, and doing it in a way that doesn’t stretch the business too thin. The fact that it’s managed to raise dividends consistently without letting debt pile up or burning cash is a solid vote of confidence in the payout’s future.

Dividend Growth and Safety

Where Humana really starts to shine is its approach to growing the dividend. It’s not making wild promises or trying to impress with sky-high increases. Instead, it’s played the long game — delivering slow, steady growth that’s built on sustainable earnings.

That low payout ratio gives it flexibility to maintain or even grow the dividend if earnings slow down. Operating cash flow remains strong, sitting at $2.87 billion, which easily covers its dividend obligations. Even in a quarter where free cash flow was negative — likely due to investment in systems, services, or regulatory timing issues — there’s enough breathing room to avoid any panic.

The business is also run with discipline. Return on equity is above 10%, and return on assets is nearly 5%. That’s solid efficiency for a company of this scale in a complicated industry.

There’s some comfort in the fact that nearly 98% of Humana’s shares are held by institutions. That tells you the big money sees value here, and they’re unlikely to tolerate dividend missteps. It also shows the stock is seen more as a stable investment than a speculative one.

Medicare Advantage, the core of Humana’s business, isn’t going away. While the company faces cost pressure and competitive challenges, it’s well positioned to adapt — and that’s key when you’re counting on a dividend to keep flowing for the next decade or more.

Cash Flow Statement

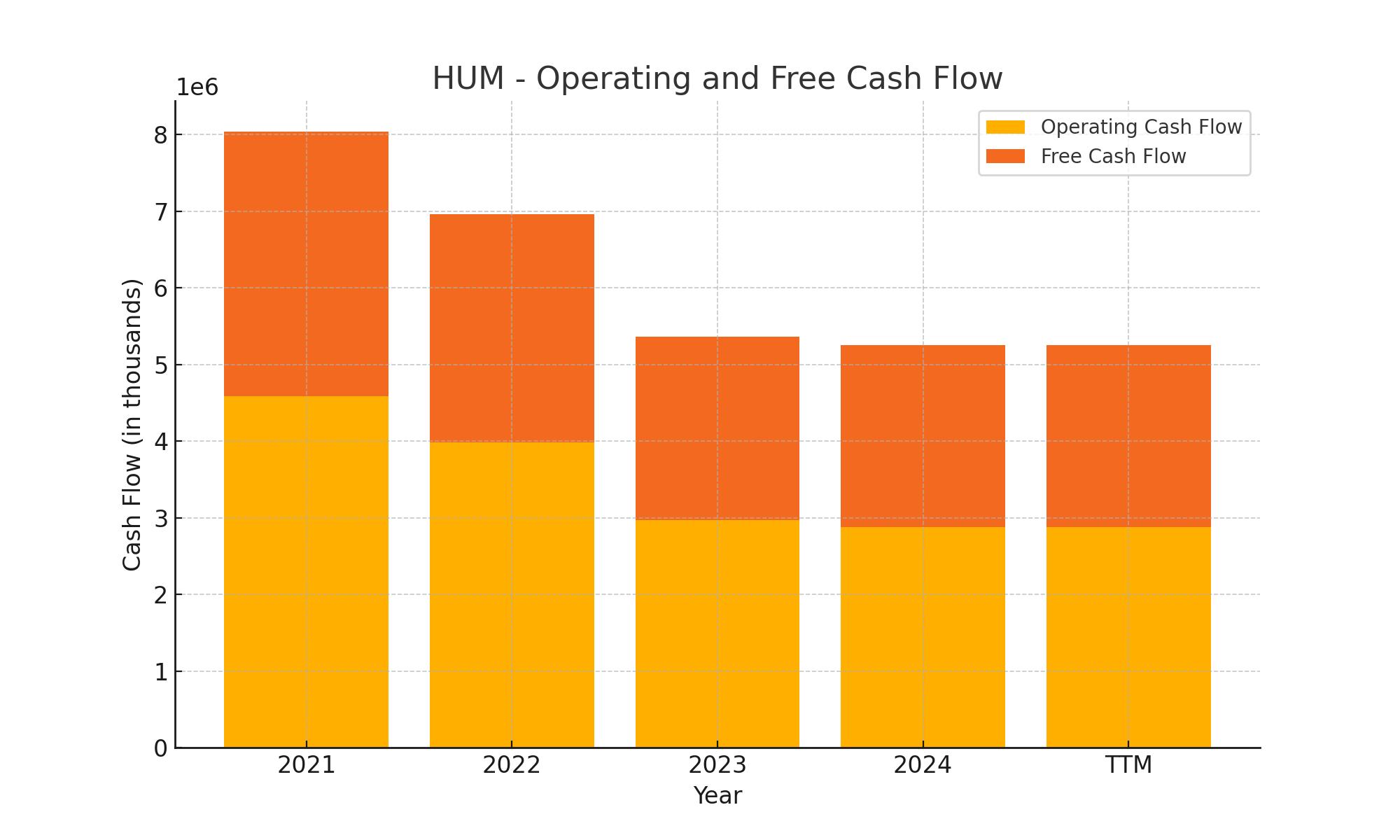

Humana’s trailing 12-month cash flow shows a business that continues to generate solid cash from operations, pulling in $2.87 billion. While that figure has come down from recent years — it peaked at $4.59 billion in 2021 — it still comfortably supports both the company’s capital expenditures and dividend obligations. Free cash flow sits at $2.38 billion, reflecting Humana’s efficiency in converting its operational strength into accessible capital. The decline in operating cash flow over the past couple of years is notable, though it aligns with broader margin pressures and increased medical costs across the healthcare industry.

On the investing side, Humana spent $2.22 billion, primarily through capital expenditures and other strategic investments. Financing activities resulted in a $2.31 billion outflow, driven by debt repayments and modest stock buybacks. Debt issuance did provide some support, adding $1.48 billion back into the mix, but repayments and past commitments outweighed it. Despite the cash outflows, Humana’s cash position grew to $4.25 billion — nearly doubling from the end of 2023. This rebound in liquidity suggests prudent financial management, ensuring the company maintains flexibility even in a tighter operating environment.

Analyst Ratings

📊 Humana’s stock has seen a mix of analyst actions recently, reflecting both cautious optimism and some concern over sector dynamics. 💼 The consensus among analysts is a “Hold” rating, with an average 12-month price target hovering around $287.76. 📈 This suggests a moderate upside from current levels, indicating that while the stock isn’t expected to surge, it’s also not anticipated to decline significantly.

💬 Several firms have adjusted their price targets in response to Humana’s performance and broader industry trends. 🧭 Oppenheimer raised its target to $310, maintaining an “Outperform” rating, citing confidence in the company’s strategic initiatives. 🚀 Barclays increased its target to $322, reflecting a positive outlook on Humana’s market position. However, 🏛️ JP Morgan slightly lowered its target to $256, keeping a “Neutral” stance, possibly due to concerns about regulatory pressures and competitive challenges in the healthcare sector.

🔍 These varied perspectives highlight the complexities facing Humana and the healthcare industry at large. 🧩 While some analysts see potential for growth, others urge caution, emphasizing the need to monitor ongoing developments closely.

Earning Report Summary

Strong Start to 2025

Humana kicked off 2025 with a solid performance that surprised to the upside. The company posted adjusted earnings per share of $11.58, comfortably beating expectations. That kind of jump—roughly 67% higher than last year—didn’t happen by accident. It came from some bold choices, including stepping away from Medicare Advantage plans that weren’t doing the business any favors. Leadership had hinted at a more focused strategy, and it’s already showing up in the numbers.

Total revenue came in at $32.11 billion for the quarter, which is up 8.4% from a year ago. That’s a healthy bump, especially considering Humana dropped nearly half a million Medicare Advantage members. The loss in membership wasn’t unexpected. The company had already planned to exit certain markets, targeting profitability over sheer size. What mattered more was the quality of earnings, and the benefit ratio improvement to 87.4% shows Humana is managing medical costs more efficiently.

CEO Outlook and Strategy

Humana’s new CEO, Jim Rechtin, sounded confident about where things are headed. He pointed to the strength of the Medicare Advantage segment as a key win and emphasized that the company is focused on improving how care is delivered. That includes deeper investments in clinical operations and technology aimed at reducing costs without cutting corners on care.

There’s also momentum building outside of Medicare Advantage. Humana’s CenterWell and Medicaid businesses are picking up steam. The company mentioned some new contracts and initiatives that could set the stage for more consistent growth down the line. These parts of the business may not be grabbing as much attention, but they’re becoming an increasingly important part of the story.

Rechtin made it clear that while the first quarter was strong, the company isn’t easing off the gas. They’re sticking to their full-year adjusted EPS guidance of $16.25, which signals confidence in their ability to deliver despite regulatory pressure and cost challenges that still linger in the background.

This earnings report painted the picture of a company that’s made some tough calls and is beginning to reap the rewards. Humana appears committed to growing the right way—balancing profitability, operational discipline, and a strong foundation in managed care.

Management Team

Humana’s leadership has seen meaningful changes lately, signaling a more targeted approach to both healthcare delivery and financial oversight. Jim Rechtin stepped into the CEO role in mid-2024, bringing with him deep operational experience from time spent at Envision Healthcare and OptumCare. His early months at the helm have focused heavily on sharpening operational efficiency and guiding the company through a shifting Medicare Advantage environment.

Celeste Mellet became the new Chief Financial Officer in early 2025, following the retirement of Susan Diamond. With a financial background that includes senior positions at Global Infrastructure Partners and Evercore, Mellet brings a disciplined, strategic perspective to Humana’s evolving capital priorities. Her focus appears to be on aligning the company’s financial direction with its long-term care delivery strategy.

The executive team is also supported by Michelle O’Hara, Chief Human Resources Officer, who has taken on a central role in shaping the company’s workforce strategy and internal culture. Together, this team is steering Humana through a transitional period with a clear focus on disciplined growth, cost management, and value-driven healthcare innovation.

Valuation and Stock Performance

So far in 2025, Humana’s stock has taken investors on a bit of a ride. After peaking near $406, the stock has steadily pulled back, now trading in the low $230s. That kind of movement has turned some heads, as it’s a notable retreat from highs reached just months ago. The declines reflect more than just company-specific news. Broader concerns around rising medical costs, tighter margins in Medicare Advantage, and shifting government reimbursements have weighed heavily on sentiment.

That said, analysts haven’t walked away. The average 12-month price target sits around $287, suggesting there’s still belief in a recovery if Humana can deliver on its strategy. Valuation-wise, the forward P/E ratio, based on guidance of $16.25 in adjusted earnings per share, places the stock at a level where value-oriented investors might take notice. The company isn’t cheap in the traditional sense, but relative to its history and peers, it’s not expensive either.

Humana’s ongoing repositioning, including pulling back from less profitable markets, is expected to help reset its financial base. While this has trimmed membership numbers, it could improve margin stability, which in turn should help restore confidence in both the company’s fundamentals and its long-term stock performance.

Risks and Considerations

There’s no denying that Humana operates in one of the most highly regulated industries in the market. The company’s reliance on Medicare Advantage makes it particularly vulnerable to changes in government reimbursement policies. A slight shift in funding or program rules can have an outsized impact on profitability. This risk became clear when some of Humana’s plans saw their CMS star ratings lowered, reducing the potential for bonus payments and hurting their competitiveness.

Operationally, the company is in the middle of expanding its use of digital health tools and tech-driven services, which come with both opportunity and complexity. Managing these changes—especially at the scale Humana operates—means maintaining secure systems and effective integrations. Execution missteps could slow progress or increase costs in the short term.

The competitive field is another area that can’t be ignored. Other major insurers and care delivery players are aggressively trying to expand their Medicare Advantage presence. Humana, while well-positioned, will need to keep innovating and fine-tuning its offerings to hold and grow market share. Add to that general macroeconomic pressures—rising wages, inflation, and shifting utilization trends—and it’s clear that managing costs will be a constant balancing act.

Final Thoughts

Humana is clearly in transition, but it’s a transition that feels intentional. With a new CEO, a new CFO, and a tighter strategic lens, the company is working to reinforce its strengths while addressing known vulnerabilities. The moves to exit lower-margin markets, invest in clinical and tech capabilities, and double down on execution reflect a commitment to long-term sustainability.

There are real challenges ahead—regulatory, competitive, and financial—but Humana seems to be facing them with clarity and a plan. Whether it’s managing its membership mix more carefully or building out its CenterWell and Medicaid operations, the company is taking steps that signal both caution and conviction. For investors who understand the rhythm of the healthcare sector and can look beyond short-term volatility, Humana is worth watching as it reshapes its future one step at a time.