Key Takeaways

📈 Hormel offers a forward dividend yield of 4.61% and has increased its dividend for 60 consecutive years, most recently raising the quarterly payment to $0.293 per share in January 2026.

💰 The company generated $845 million in operating cash flow over the trailing twelve months, with free cash flow of $288 million continuing to underpin dividend commitments despite elevated payout ratios.

🔍 Analysts carry a consensus “Buy” rating with an average price target of $27.25, suggesting modest upside from current levels as the company works through ongoing margin and earnings pressure.

Updated 2/24/26

Hormel Foods (HRL) has built its reputation on consistent execution, a diverse brand lineup, and a deep-rooted commitment to returning value to shareholders. Known for household staples like SPAM, Skippy, and Applegate, the company operates with a steady hand through shifting market cycles. Backed by reliable cash flow and a 60-year track record of dividend increases, it continues to appeal to long-term income-focused investors.

Recent earnings have faced meaningful pressure, with profits compressed by commodity price shifts and persistent operational challenges across several segments. Still, Hormel maintains a clear strategic direction through its Transform and Modernize initiative and a disciplined approach to capital allocation, all while offering a yield above 4.6% and a low-volatility profile that suits income-oriented portfolios.

Recent Events

Hormel Foods has been navigating a difficult stretch as it heads into early 2026. The company continues to work through its Transform and Modernize initiative, a broad effort to drive between $100 million and $150 million in cost savings and operational improvements. Management has framed this program as a multi-year repositioning rather than a short-term fix, with investments flowing toward capacity expansion in growth product lines like Fire Braised and Applegate alongside enterprise-wide efficiency projects.

The leadership transition that had been anticipated for the end of 2025 has brought some organizational attention as well. Jim Snee, who joined Hormel in 1989 and has served as President and CEO through a period of significant brand portfolio expansion, stepped back from the day-to-day role while remaining available to the board in an advisory capacity. The transition places added weight on the executive bench to sustain strategic continuity through an uneven earnings environment.

On the brand side, Planters continues its recovery narrative after prior disruptions, while SPAM and Hormel Black Label have maintained solid consumer demand. International operations, particularly in China, remain a closely watched variable given ongoing trade uncertainty and fluctuating export margins. The broader food sector is dealing with volume softness as consumers remain price-sensitive, and Hormel has not been immune to that dynamic. Short interest in the stock stands at nearly 19.8 million shares, reflecting a degree of skepticism from the market about the pace of the earnings recovery.

Key Dividend Metrics

📈 Forward Dividend Yield: 4.61%

💰 Annual Dividend: $1.17 per share

📆 Most Recent Quarterly Payment: $0.293 per share (January 2026)

📊 Payout Ratio: 133.33%

🧾 5-Year Average Yield: 2.61%

🧱 Dividend Streak: 60 years of uninterrupted increases

🛡️ Safety: Supported by $845 million in operating cash flow and a conservative balance sheet

These numbers reflect both the appeal and the complexity of Hormel’s current income profile.

Dividend Overview

At 4.61%, Hormel’s forward dividend yield stands well above its five-year average of 2.61%, and that gap is almost entirely a function of share price weakness rather than an unusually large dividend increase. The stock has traded down significantly from its 52-week high of $32.07, which mechanically pushes the yield higher for new buyers entering at current prices near $25.80. For income investors, that kind of yield expansion relative to historical norms tends to attract attention.

The most recent dividend increase came in January 2026, when Hormel raised its quarterly payment from $0.290 to $0.293 per share, continuing a streak that now spans six decades. The increase is modest, consistent with the measured pace of recent years, but it confirms that management has no intention of breaking what has become one of the most celebrated dividend growth records in the consumer staples universe. The payout ratio of 133% is elevated relative to reported net income, which reflects the current gap between accounting earnings and the company’s cash generation capacity. Operating cash flow of $845 million provides the real coverage picture, and while free cash flow of $288 million is tighter than investors have seen in prior years, it continues to support the dividend at current levels. Hormel’s beta of 0.33 further reinforces its role as a low-volatility income holding, a characteristic that becomes particularly valuable when broader markets are unsettled.

Dividend Growth and Safety

Hormel’s promotion to 60 consecutive years of dividend increases places it firmly among the most decorated dividend growers in the entire market. The trajectory of recent increases tells the story clearly: $0.275 per quarter through most of 2023, stepping up to $0.283 in early 2024, then $0.290 in early 2025, and now $0.293 beginning with the January 2026 payment. Each increment is small, but the consistency is the point. Hormel does not skip years, does not cut, and does not reduce the pace to zero even when earnings come under pressure.

The safety of that dividend rests primarily on operating cash flow rather than reported net income. With earnings per share at just $0.87 on a trailing basis, the accounting payout ratio looks stretched at 133%, which can understandably give investors pause. But operating cash flow of $845 million against annual dividend obligations in the neighborhood of $643 million based on roughly 549 million shares outstanding and $1.17 per share annually paints a more comfortable picture. Free cash flow of $288 million is the tighter constraint, and sustained weakness at that level would eventually pressure the growth rate. Return on equity of 6% and a profit margin of 3.95% signal that the fundamental earnings engine needs to recover for the dividend growth story to regain its historical momentum. For now, the streak remains intact and the company has both the cash balance and the institutional commitment to protect it.

Chart Analysis

Hormel’s chart tells a story of a stock that spent most of the past year under meaningful pressure before finding its footing. The 52-week range of $21.02 to $30.47 reflects a wide swing in sentiment, and shares are currently sitting at $25.80, which places them roughly 15% below the annual high but more than 22% above the trough set earlier in the trailing twelve months. That kind of recovery off the lows is constructive, and the price action over the past several months suggests that the worst of the selling may be behind HRL for now. Income investors who were patient through the drawdown are in a materially better position than those who capitulated near the bottom.

The moving average picture is mixed but improving at the margin. The 50-day moving average sits at $24.03, and with shares trading at $25.80, HRL is comfortably above that near-term trend line, which reflects the momentum built during the recent recovery. The 200-day moving average comes in at $25.60, and the stock has just crossed back above it, a development that longer-term trend followers will view as a meaningful signal. The caveat here is that the 50-day remains below the 200-day, a configuration known as a death cross, which technically carries a bearish designation. That pattern reflects the damage done by the prolonged downtrend earlier in the year, and it will take additional time and sustained price strength before the moving averages realign in a bullish order.

Momentum, as measured by the relative strength index, is sitting at 60.57, which is a healthy reading without being an overstretched one. RSI levels in the upper 50s to low 60s tend to indicate a stock with genuine buying interest behind it rather than speculative froth, and HRL is not yet approaching the overbought threshold near 70. That leaves room for continued appreciation before the chart starts flashing caution signals on momentum grounds. The combination of an RSI trending higher alongside a price that has reclaimed its 200-day moving average is the kind of setup that tends to attract incremental buying rather than trigger profit-taking.

For dividend investors, the technical picture supports a measured approach rather than an urgent one. The death cross is a real overhang and deserves acknowledgment, but the stock’s ability to recover from the $21 lows and push back above its 200-day average suggests that long-term buyers are stepping in at these levels. At $25.80, HRL is trading in a zone where the chart is neither screaming opportunity nor flashing outright danger. Investors focused on the dividend and willing to look through near-term technical noise will find the current setup acceptable, particularly given that any meaningful pullback toward the 50-day moving average around $24 would represent a more compelling entry point on a risk-adjusted basis.

Cash Flow Statement

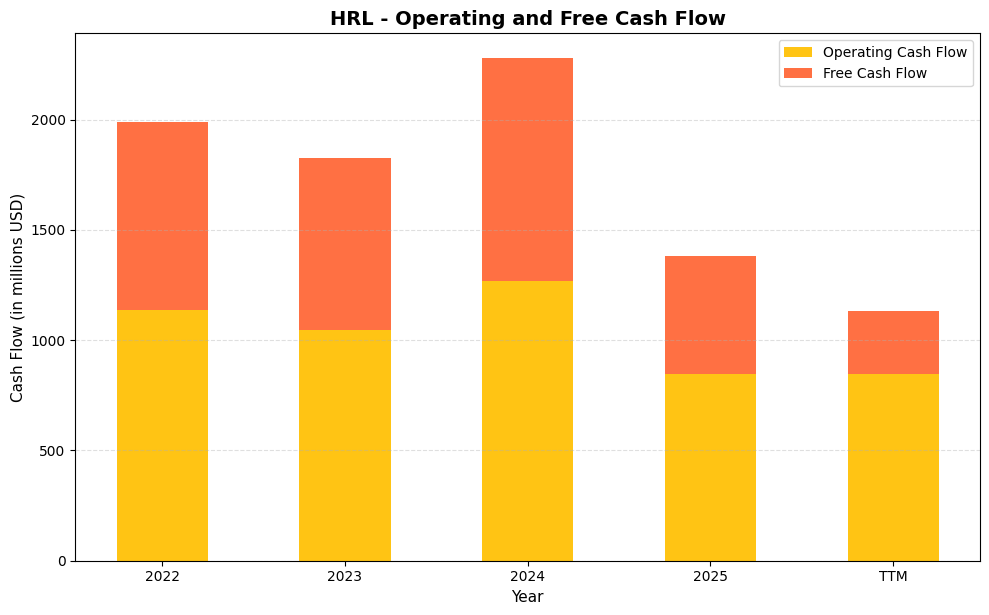

Hormel’s cash flow profile tells a more nuanced story than the income statement alone. Operating cash flow climbed from $1,135.0M in 2022 to a peak of $1,266.7M in 2024, a move that briefly made the dividend coverage picture look quite comfortable. Free cash flow followed the same arc, reaching $1,010.3M in 2024 before pulling back sharply to $534.3M in 2025. The TTM free cash flow figure of $288.0M is the number that demands attention from dividend investors, because Hormel paid out roughly $500M in dividends over the past year, meaning free cash flow is currently falling short of covering the dividend on a trailing basis. That gap is not unusual during periods of elevated capital spending or working capital absorption, but it does shift the burden of proof onto management to demonstrate that 2025 represents a trough rather than a new baseline.

Stepping back across the full four-year window, the pattern is one of solid mid-cycle generation followed by a meaningful compression. The 2022 to 2024 stretch showed Hormel converting earnings into cash at a healthy rate, with free cash flow margins running well above what was needed to fund the dividend and leave room for debt service. Capital expenditures, calculated as the difference between operating and free cash flow, ran in the $270M to $290M range through most of that period before rising noticeably in 2025, which accounts for a portion of the free cash flow decline. For long-term shareholders, the 2024 performance serves as evidence that the underlying business can generate over a billion dollars in free cash flow under reasonable operating conditions. The question heading into 2026 is whether the 2025 softness reflects temporary headwinds in turkey and pork markets, or whether structural cost pressures are permanently resetting the free cash flow ceiling. Until that clarity emerges, dividend coverage warrants close monitoring each quarter.

Analyst Ratings

The analyst community has arrived at a consensus “Buy” rating on Hormel as of February 2026, based on coverage from eight analysts, though the range of price targets reflects the genuine uncertainty about the pace of earnings recovery. The mean price target of $27.25 implies modest upside of roughly 5.6% from the current price of $25.80, while the high target of $30.00 and the low of $25.00 bracket a relatively narrow band of outcomes. The low target sitting essentially at the current trading price signals that at least one analyst sees limited near-term catalysts for appreciation.

The consensus upgrade to “Buy” from the prior “Hold” is notable given that the fundamental picture has not dramatically improved. It likely reflects a valuation argument more than an earnings momentum case: after a prolonged decline from the 52-week high of $32.07, some analysts appear to be concluding that the risk-reward has shifted in favor of buyers at these levels. The 4.61% yield, the 60-year dividend growth streak, and the low-beta profile of 0.33 all contribute to a floor-of-value argument even while earnings per share remain depressed at $0.87. The mean target of $27.25 is unambitious, but in the context of a stock that has spent considerable time under pressure, even that modest implied return combined with the dividend yield represents a reasonable total return proposition for patient income investors.

Earning Report Summary

A Mixed Start to the Fiscal Year

Hormel’s most recent reported financial results reflect a business working through an extended period of earnings compression. Revenue on a trailing twelve-month basis came in at approximately $12.1 billion, while net income of $478 million produced earnings per share of just $0.87. That compares unfavorably to prior periods and helps explain why the payout ratio on a reported earnings basis has risen above 130%. The profit margin of 3.95% illustrates how thin the bottom line has become relative to the company’s top-line scale, a dynamic driven by input cost pressures, competitive pricing dynamics in retail, and the ongoing costs associated with the Transform and Modernize initiative.

Branded products including SPAM, Applegate, and Hormel Black Label have continued to hold their ground with consumers, providing some stability in an otherwise challenging environment. The Planters recovery narrative remains a focus for management, with the brand having stabilized after prior supply disruptions. Foodservice trends have been mixed, with volume relatively resilient but margins feeling the effect of elevated costs throughout the supply chain.

Pressure Points in Key Segments

The segment-level picture remains uneven. Retail and Foodservice have both experienced margin pressure that has weighed on overall profitability, while International operations continue to represent a variable tied closely to China demand and export pricing. The turkey category has remained a challenging backdrop for the Jennie-O segment, with whole-bird pricing dynamics creating difficult year-over-year comparisons. These pressures are not unique to Hormel, as peers across the packaged food space have navigated similar dynamics, but Hormel’s relatively narrow profit margin leaves less cushion to absorb cost shocks without visible earnings impact.

Return on equity of 6.00% and return on assets of 4.48% both reflect the subdued profitability environment. For a company of Hormel’s scale and brand quality, those returns are below what the historical record would suggest is achievable through a full business cycle, which is part of why the analyst community, while broadly constructive on valuation, remains measured in its enthusiasm about the near-term earnings trajectory.

Eyes on Transformation and Future Gains

The Transform and Modernize initiative remains the central strategic lever that management is pulling to drive a profitability recovery. The program targets $100 million to $150 million in savings and operational improvements, with investments concentrated in manufacturing efficiency, supply chain optimization, and brand-focused capacity additions for higher-growth product lines. Progress on this initiative is the most important variable for investors to monitor, as it represents the pathway back to earnings per share levels that would normalize the payout ratio and potentially reaccelerate dividend growth.

Capital expenditures have remained elevated as the company funds these improvements, which explains the gap between operating cash flow and free cash flow. Management’s willingness to invest through a down cycle reflects confidence in the long-term earning power of the brand portfolio, and the company’s balance sheet provides the financial flexibility to sustain that posture without threatening the dividend. The key question for 2026 is whether the savings from transformation efforts begin to flow through to reported earnings in a way that stabilizes the coverage picture and rebuilds investor confidence in the growth trajectory.

Management Team

Hormel Foods has been navigating a leadership transition following the retirement of long-tenured CEO Jim Snee, who joined the company in 1989 and steered it through a significant era of brand portfolio expansion and international growth. Snee has remained engaged with the board in a strategic advisory capacity following his departure from the day-to-day role, providing continuity during the handoff period. The transition places greater responsibility on the existing executive bench to carry the strategic vision forward through a period when execution on the Transform and Modernize initiative is particularly critical.

Jacinth Smiley, Executive Vice President and Chief Financial Officer, plays a central role in capital allocation decisions and the company’s ongoing efforts to manage costs while sustaining dividend commitments. John Ghingo leads the Retail segment as Executive Vice President, overseeing the branded product portfolio that includes many of Hormel’s most recognizable names. Scott Aakre serves as Group Vice President and Chief Marketing Officer for Retail, responsible for brand strategy and consumer engagement across the product lineup. The board of directors provides oversight with a range of experience spanning consumer goods, finance, and operations, and Hormel’s governance culture has historically emphasized financial conservatism and long-term shareholder orientation.

Valuation and Stock Performance

Hormel’s stock is currently trading at $25.80, well below its 52-week high of $32.07 and only modestly above the 52-week low of $21.03 reached earlier in the cycle. The current price represents a meaningful discount to where the stock spent much of the past several years, and for investors who have held through the decline, the experience has been frustrating. For new buyers evaluating the opportunity today, however, the entry point looks meaningfully different than it did when the stock was trading closer to $35 or above.

The trailing P/E ratio of 29.66 appears elevated at first glance, but it is distorted by the compressed earnings per share of $0.87, which reflects a trough in the earnings cycle rather than a normalized run rate. The price-to-book ratio of 1.80 against a book value of $14.36 per share is modest for a consumer staples franchise of this quality, and the market cap of approximately $14.2 billion reflects a business that the market is currently pricing for continued mediocrity rather than a recovery. The analyst consensus price target of $27.25 suggests Wall Street sees some value emerging at current levels, though the mean target implies only about 5.6% in price appreciation from here. Combined with the 4.61% dividend yield, the total return proposition for a patient income investor is more compelling than the price chart alone would suggest. The beta of 0.33 means shareholders are unlikely to experience dramatic downside from market volatility, which suits the conservative income investor profile that has historically been drawn to Hormel.

Risks and Considerations

The payout ratio of 133% based on trailing earnings per share is the most immediate concern for dividend investors. While operating cash flow of $845 million provides real coverage for the dividend obligation, the gap between reported earnings and cash generation needs to close over time for the dividend growth story to remain credible. If earnings do not recover toward levels that normalize the payout ratio, the pace of future dividend increases could slow to near zero, which would diminish one of the primary reasons income investors hold the stock.

Commodity price exposure remains a persistent risk across Hormel’s business. Pork, turkey, and other protein input costs can move significantly and quickly, and the company’s relatively thin 3.95% profit margin leaves limited room to absorb those swings without visible earnings impact. The Jennie-O turkey segment in particular has shown how category-specific pricing dynamics can create meaningful headwinds that persist across multiple quarters.

The China exposure embedded in Hormel’s international business adds a geopolitical dimension to the risk profile. Trade policy uncertainty and fluctuating export margins have made international results difficult to predict, and any escalation in trade tensions between the United States and China could weigh on that segment’s contribution to overall profitability. The company has navigated these dynamics before, but the current environment adds a layer of unpredictability that deserves ongoing attention.

Consumer behavior continues to shift in ways that challenge traditional packaged food companies. Health consciousness, interest in clean-label products, and the growth of private-label alternatives at retail all represent long-term headwinds for legacy branded food manufacturers. Hormel has invested in brands like Applegate to address evolving consumer preferences, but sustaining relevance across a large and diverse portfolio requires continuous innovation and marketing investment. Short interest of nearly 19.8 million shares reflects a meaningful contingent of investors who believe the headwinds will persist longer than the bull case assumes, and that skepticism is worth taking seriously even for long-term holders.

Final Thoughts

Hormel Foods arrives at early 2026 in a complicated position: a 60-year dividend growth streak intact, a yield above 4.6% that is genuinely attractive relative to history, and a business that is clearly working through a trough in its earnings cycle rather than experiencing a permanent impairment of its competitive position. The brands remain strong, the balance sheet remains conservative, and the Transform and Modernize initiative provides a credible path back to normalized profitability if management executes.

The stock is not without its challenges, and investors who buy at $25.80 should do so with clear eyes about the fact that earnings recovery may take several more quarters to materialize in a way that brings the payout ratio back to a more comfortable level. The free cash flow figure of $288 million bears watching closely, as sustained compression there would eventually force a harder conversation about dividend growth sustainability.

For long-term income investors who value consistency, low volatility, and a yield that is now the highest it has been in years relative to the company’s own history, Hormel remains a defensible holding. The 60-year dividend record is not an accident; it reflects an institutional culture that prioritizes shareholder income above all else. That culture is not changing, and at current prices, it comes with a yield that compensates investors reasonably well for the patience required to see the earnings story through.