Key Takeaways

📈 Honeywell offers a stable dividend yield of 2.06% with consistent mid-single-digit growth and a payout ratio of just over 50%, signaling dependable income backed by long-term discipline.

💵 Free cash flow stands strong at $5.06 billion with operating cash flow at $6.25 billion, providing a healthy cushion for dividend payments and continued reinvestment.

📊 Analyst sentiment is cautiously optimistic with a consensus price target of $237.42, supported by strong Q1 results and strategic transformation plans despite some concerns around near-term execution risks.

Updated 5/13/25

Honeywell International Inc. (HON) stands as a diversified industrial company with strong roots in aerospace, building technologies, performance materials, and automation. Backed by over \$6 billion in annual operating cash flow and a steady dividend track record, it continues to appeal to long-term income investors looking for reliability and growth. The current yield sits at just over 2%, with a payout ratio around 50%, signaling a well-covered and sustainable income stream.

With a strategic plan underway to spin off key segments and sharpen its operational focus, Honeywell is entering a transformative period under the leadership of CEO Vimal Kapur. The company’s ability to generate consistent free cash flow, manage capital effectively, and invest in future-facing businesses positions it well for continued shareholder value over time.

Recent Events

In the most recent quarter, Honeywell posted solid revenue growth of nearly 8% year-over-year, reaching $39.22 billion. That’s a healthy sign of demand holding strong across its key segments. Earnings per share dipped slightly by about 1%, but that doesn’t raise alarm bells when you look deeper into the numbers. Margins remain strong, with an operating margin above 21% and a profit margin near 15%. Those figures tell us Honeywell is still running a tight ship.

One of the more encouraging signs for dividend investors is the company’s discipline with its capital. It’s been gradually reducing its share count while continuing to increase its dividend. And with over $10 billion in cash on hand and a levered free cash flow of $4.35 billion, Honeywell has the flexibility to keep supporting shareholders even if macro conditions get a bit choppy.

Key Dividend Metrics

📈 Forward Yield: 2.06%

💸 Annual Dividend: $4.52 per share

🧮 Payout Ratio: 50.8%

📅 Next Ex-Dividend Date: May 16, 2025

🔁 5-Year Average Yield: 2.00%

📊 Dividend Growth Rate (5Y): Roughly 6–8% annually

🧷 Dividend Safety: Strong, backed by solid cash flow and balance sheet

Dividend Overview

Honeywell’s dividend yield isn’t going to turn heads at first glance. At just over 2%, it’s not the kind of payout that will anchor a high-income portfolio. But what it lacks in headline numbers, it more than makes up for in reliability and consistency. The current yield is slightly above the five-year average, which may suggest shares are trading at a more attractive valuation from an income perspective.

With a payout ratio hovering just above 50%, Honeywell strikes a comfortable balance between rewarding shareholders and keeping capital available for reinvestment or debt management. This isn’t a company stretching to support its dividend. It’s methodically building a sustainable flow of income that investors can count on through different market cycles.

When you compare the payout to free cash flow, the picture gets even clearer. The $4.35 billion in free cash covers the dividend with room to spare. That gives the company breathing room to manage the payout, even in tougher economic stretches.

Dividend Growth and Safety

What really sets Honeywell apart for income investors is its commitment to growing the dividend steadily over time. The company doesn’t chase high-growth fireworks. Instead, it delivers consistent mid-single-digit increases that compound nicely for long-term holders.

The last few years have shown a pattern of dependable dividend hikes, and there’s no sign the company plans to change course. With a return on equity north of 32% and a strong cash position, Honeywell has the financial strength to continue supporting those increases. The capital structure is relatively conservative despite having a sizable debt load—total debt stands at nearly $34 billion, but there’s a large cash reserve, and interest coverage is not a concern.

Management has proven its discipline. Even during periods of economic strain, Honeywell has kept the dividend flowing. That speaks volumes about its priorities and the underlying strength of its business.

From a safety standpoint, Honeywell’s dividend is in excellent shape. The balance sheet holds up well under scrutiny, the cash flow is consistent, and the payout ratio is far from stretched. Investors looking for a stock they can hold and rely on for steady income won’t find many with a better track record.

If your goal is to own shares of a company that lets you sleep well at night while quietly growing your income, Honeywell checks a lot of boxes. The yield may not be the highest, but the dependability of the payout and its growth make it a solid foundation for any dividend-focused portfolio.

Cash Flow Statement

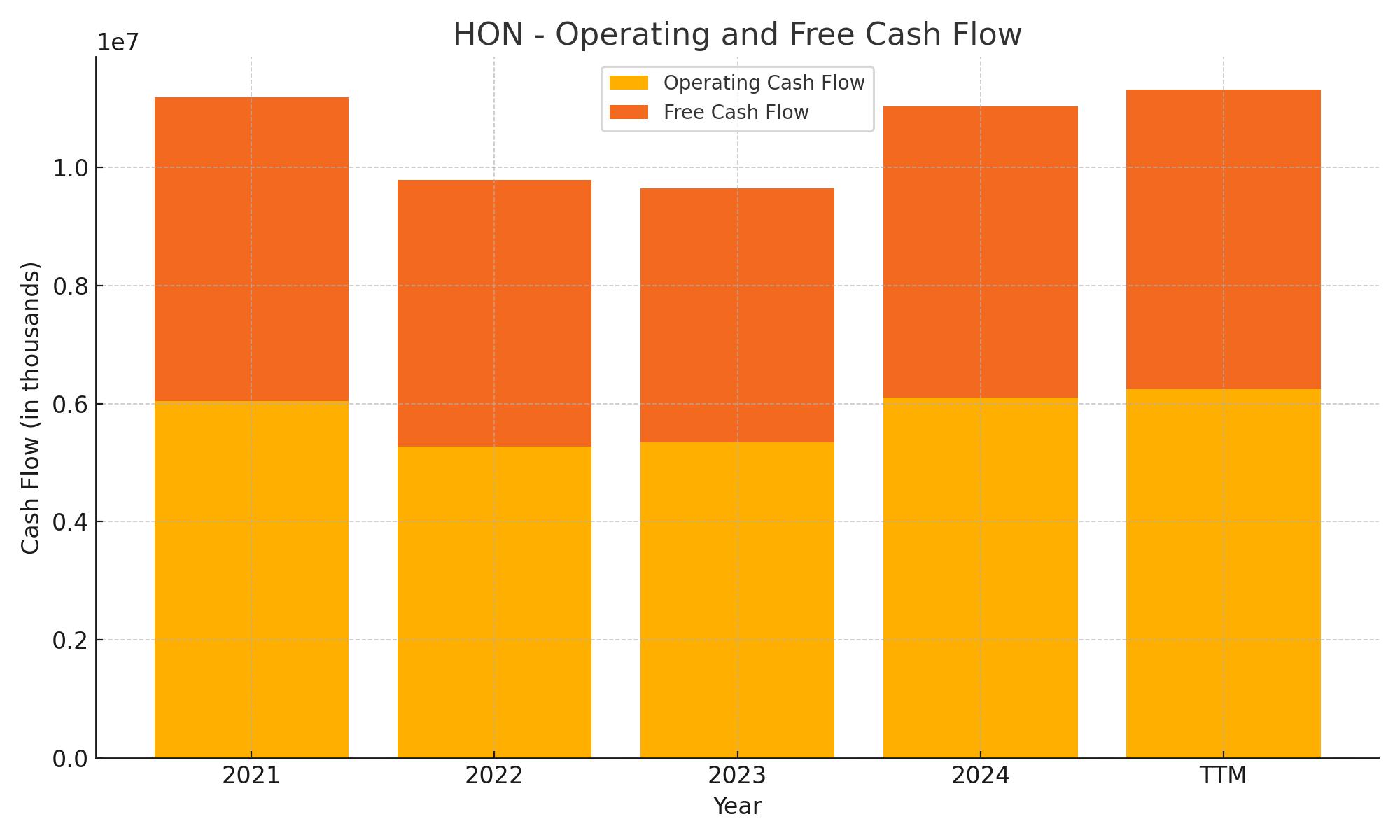

Honeywell’s trailing twelve-month operating cash flow came in at $6.25 billion, showing a modest improvement over last year and reinforcing the company’s reliable cash-generating ability. This consistency helps support its dividend and other capital allocation decisions. Free cash flow remains strong at $5.06 billion, giving Honeywell a solid buffer to cover its dividend payments, which require less than half that amount. Capital expenditures have remained stable, suggesting the company is investing thoughtfully without overextending.

On the investing side, there’s been a significant outflow of $10.26 billion—considerably higher than in recent years. This spike suggests large-scale investments, potentially in acquisitions or technology upgrades, as it’s far above the company’s usual pace. Meanwhile, financing activities flipped from outflows in 2023 to a positive $1.96 billion, likely driven by new debt issuance exceeding repayments. The net debt activity—borrowing over $21 billion while repaying about $13.8 billion—alongside stock repurchases of nearly $2.9 billion, shows a strategic shift in capital structure. Honeywell closed the period with nearly $9.71 billion in cash, maintaining a healthy liquidity position despite elevated investment levels.

Analyst Ratings

📈 Honeywell International (HON) has recently experienced a mix of analyst sentiment, reflecting both confidence in its long-term strategy and caution over near-term challenges. 🏦 Bank of America upgraded the stock from Neutral to Buy, raising its price target to $250. This upgrade was driven by a strong first-quarter performance and an improved earnings outlook, with 2025 EPS estimates increased to $10.44. The firm’s diverse portfolio, particularly in aerospace and building solutions, is seen as a buffer against economic fluctuations.

⚠️ Conversely, some analysts have expressed reservations. 🏛️ JP Morgan maintained a Hold rating but lowered the price target to $178, citing concerns about profit margins and uncertainties surrounding the upcoming spin-off of Honeywell’s advanced materials business. Similarly, Baird downgraded the stock to Hold, reducing the price target to $217 due to ongoing weaknesses in short-cycle businesses that are more sensitive to macroeconomic swings.

📊 Despite these differing views, the overall consensus among analysts remains moderately positive. The average 12-month price target for Honeywell stands at approximately $237.42, suggesting a potential upside of around 9% from current levels. This reflects a balance between optimism about the company’s strategic initiatives and some caution regarding near-term economic headwinds.

Earning Report Summary

Strong Start to the Year

Honeywell kicked off 2025 with a solid first quarter, putting up numbers that came in ahead of expectations. Revenue came in at $9.82 billion, marking an 8% increase over the same period last year. Adjusted earnings per share reached $2.51, which was a 7% year-over-year bump. Segment profit also rose by 8% to $2.26 billion, with segment margins holding steady around 23%. It’s the kind of quarter that shows steady hands on the wheel.

Aerospace Leading the Pack

The Aerospace Technologies division really stood out, posting a 14% sales increase to $4.17 billion. Commercial aftermarket demand remained strong with a 15% gain, and even the defense and space side picked up, growing by 10%. That’s a clear sign Honeywell continues to benefit from long-term demand in aviation and defense. Other areas like Building Automation also delivered, with an 8% rise in sales, while a few spots like Industrial Automation and Advanced Materials lagged behind slightly, showing minor declines.

Margins, Cash Flow, and Guidance

Operating income was up 6% to $1.97 billion, though margins dipped just a touch. The operating margin came in at 20.1%, a slight drop from last year. More encouragingly, free cash flow jumped by 61% year-over-year to $346 million—a sign the company is becoming more efficient with its capital.

Looking ahead, Honeywell bumped up its full-year earnings guidance. Management now sees EPS landing somewhere between $10.20 and $10.50, which is a touch higher than the previous outlook. Revenue expectations have been adjusted slightly to a range of $39.6 to $40.5 billion. The company also reaffirmed its forecast for free cash flow, which is expected to fall between $5.4 and $5.8 billion.

Comments from Leadership

CEO Vimal Kapur had a positive tone when talking about the quarter. He emphasized that Honeywell had a strong start to the year, beating expectations across the board. While he did acknowledge that global demand looks uncertain for the rest of the year, he seemed confident in Honeywell’s ability to manage through it.

He also touched on the company’s ongoing transformation. Honeywell is moving ahead with plans to spin off its Advanced Materials business and eventually separate its Aerospace and Automation segments. The idea is to create three standalone companies by the back half of 2026, each focused on a specific core business.

A Look at Capital Allocation

In terms of how Honeywell is putting its money to work, it announced a $2.2 billion acquisition of Sundyne, a move aimed at strengthening its product portfolio. At the same time, the company returned $2.9 billion to shareholders through buybacks and dividends. That combination of reinvestment and returning capital is a clear sign of confidence in the road ahead.

Management Team

At the helm of Honeywell is Vimal Kapur, who stepped into the CEO role in June 2023. With over three decades at the company, Kapur’s journey began in 1989 at a Honeywell joint venture in India. Over the years, he has held various leadership positions, including President of Honeywell Process Solutions and Honeywell Building Technologies. His deep understanding of the company’s operations and markets positions him well to lead Honeywell through its ongoing transformation.

Kapur’s leadership is marked by a focus on innovation and sustainability. He has been instrumental in driving digital transformation initiatives and expanding Honeywell’s presence in high-growth markets. Under his guidance, the company is pursuing a strategic plan to spin off its Aerospace and Automation businesses, aiming to create three independent, publicly traded companies by the second half of 2026.

Valuation and Stock Performance

As of mid-May 2025, Honeywell’s stock is trading around $218 per share. The company’s price-to-earnings (P/E) ratio stands at approximately 25, slightly below its five-year average of 25.36. This valuation suggests that the market has moderate expectations for Honeywell’s future earnings growth.

Year-to-date, the stock has experienced a decline of about 3%, reflecting broader market volatility and investor caution amid macroeconomic uncertainties. However, over the past five years, Honeywell’s stock has delivered a total return of approximately 57.6%, highlighting its resilience and long-term growth potential.

Analyst sentiment remains cautiously optimistic, with a consensus price target of around $206.30. While some analysts have raised concerns about potential challenges related to the company’s planned spin-offs, others see these strategic moves as opportunities to unlock shareholder value.

Risks and Considerations

Honeywell faces several risks that could impact its performance. The planned separation into three distinct entities introduces execution risk, as the company must manage complex operational and financial transitions. Any delays or disruptions in this process could affect investor confidence and stock performance.

Additionally, Honeywell’s global operations expose it to geopolitical and economic uncertainties. Tariffs, trade restrictions, and fluctuations in foreign exchange rates could impact the company’s supply chain and profitability. The aerospace segment, in particular, is sensitive to supply chain disruptions, which could hinder its ability to meet customer demand.

The company’s exposure to cyclical industries, such as industrial automation and energy, means that economic downturns could lead to reduced demand for its products and services. Furthermore, the integration of recent acquisitions, like Sundyne, carries the risk of not achieving anticipated synergies or facing unforeseen challenges.

Final Thoughts

Honeywell stands at a pivotal point in its history, with significant strategic initiatives underway aimed at reshaping its business structure and focusing on high-growth areas. The company’s strong leadership, diversified portfolio, and commitment to innovation position it well for long-term success.

While the path ahead includes challenges, particularly related to the planned spin-offs and external economic factors, Honeywell’s track record of adaptability and resilience provides a solid foundation. Investors should monitor the company’s progress on its strategic initiatives and remain aware of the broader macroeconomic environment that could influence its performance.