Key Takeaways

💰 HLNE offers a forward dividend yield of 1.24% with a 10% annual dividend increase, supported by a conservative 35.4% payout ratio and steady historical growth.

💵 Trailing twelve-month free cash flow reached $272.9 million, comfortably covering dividend payments and reflecting a strong cash-generating business.

📊 Analyst sentiment is mixed with a consensus “Hold” rating and a $164.14 average price target, reflecting balanced views on valuation and growth potential.

Last Update 5/8/25

Hamilton Lane (HLNE) is a global private markets investment manager with a focused strategy, strong free cash flow, and a steadily growing dividend. The firm ended fiscal 2024 with \$124 billion in assets under management and reported a 22% increase in management and advisory fees. Leadership is stable and experienced, with a culture rooted in disciplined growth and shareholder alignment.

With over 96% institutional ownership and a consistently rising dividend, HLNE has delivered a total return of over 36% in the past year. The stock trades with healthy valuation multiples, supported by a high-margin business model and a clear emphasis on long-term value creation.

Recent Events

The past year has been kind to Hamilton Lane. The stock has posted a gain of over 36%—a pace well ahead of broader indices. The December quarter told much of the story. Net income shot up more than 170% from a year ago. Revenue jumped 34%. Those are not minor numbers; they reflect a firm benefiting from a real shift in how investors view private markets.

The firm’s profitability is also worth noting. A 45% operating margin is not just strong—it’s elite. Same with its 31% profit margin. That efficiency is supported by an impressive return on equity of 42.7%, driven not by excessive leverage but by disciplined operations.

The valuation has eased a bit recently, with a trailing P/E of 29.3 and enterprise value to EBITDA around 17.6. While not cheap in absolute terms, it’s far from overheated compared to where it was during peak enthusiasm in 2023. The share price, hovering around $158, is still well off its 52-week high of $203, giving long-term investors a more balanced entry point.

Key Dividend Metrics

📈 Forward Yield: 1.24%

💸 Trailing Yield: 1.21%

🔄 5-Year Average Yield: 1.65%

📊 Payout Ratio: 35.4%

📅 Most Recent Dividend: April 4, 2025

❌ Dividend Cuts: None

Dividend Overview

Hamilton Lane isn’t throwing off a huge yield, and that’s not what it’s trying to do. What it offers is a consistent, well-covered dividend that comes from real earnings and real cash flow—not financial engineering.

The payout ratio sits at 35.4%. That’s a healthy level—room to grow the dividend, room to reinvest, and no signs of stretching. This isn’t a company that’s scrambling to fund distributions. Its levered free cash flow over the past year came in at over $150 million, while cash on the books is close to $285 million. That kind of cushion goes a long way toward ensuring stability, especially in the lumpy world of private markets.

This is the type of dividend story that leans more on quality than quantity. You’re not buying HLNE for a big payday right now—you’re buying for a steady income stream that gets a little better every year, backed by a business that generates cash without needing heavy capital outlays.

And here’s what else matters: no dividend cuts. Not in the recent past. Even during volatile periods, the firm has held the line, delivering consistency. That track record doesn’t get talked about enough in the dividend world.

Dividend Growth and Safety

What stands out with HLNE is its consistency. The dividend hasn’t exploded higher every year, but the direction has been steadily upward. The five-year average yield is higher than today’s, which tells you the stock has appreciated, not that the payout has shrunk.

Dividend increases have come regularly, and they’ve been backed by real financial strength. Cash flows are strong, the balance sheet is clean, and the business doesn’t require massive reinvestment to grow. That’s the formula dividend investors love.

On the safety side, there’s not much to worry about here. Cash reserves are robust. The current ratio is a solid 3.85, and total debt remains very manageable. Debt to equity is under 45%, and most importantly, cash flow continues to support the dividend with a wide margin.

There’s also something subtle but important at play—alignment. Insider ownership sits near 8%, and institutions hold over 96% of the float. That tells you there are smart, long-term players in the stock who are likely aligned with shareholder interests. That includes dividends.

Cash Flow Statement

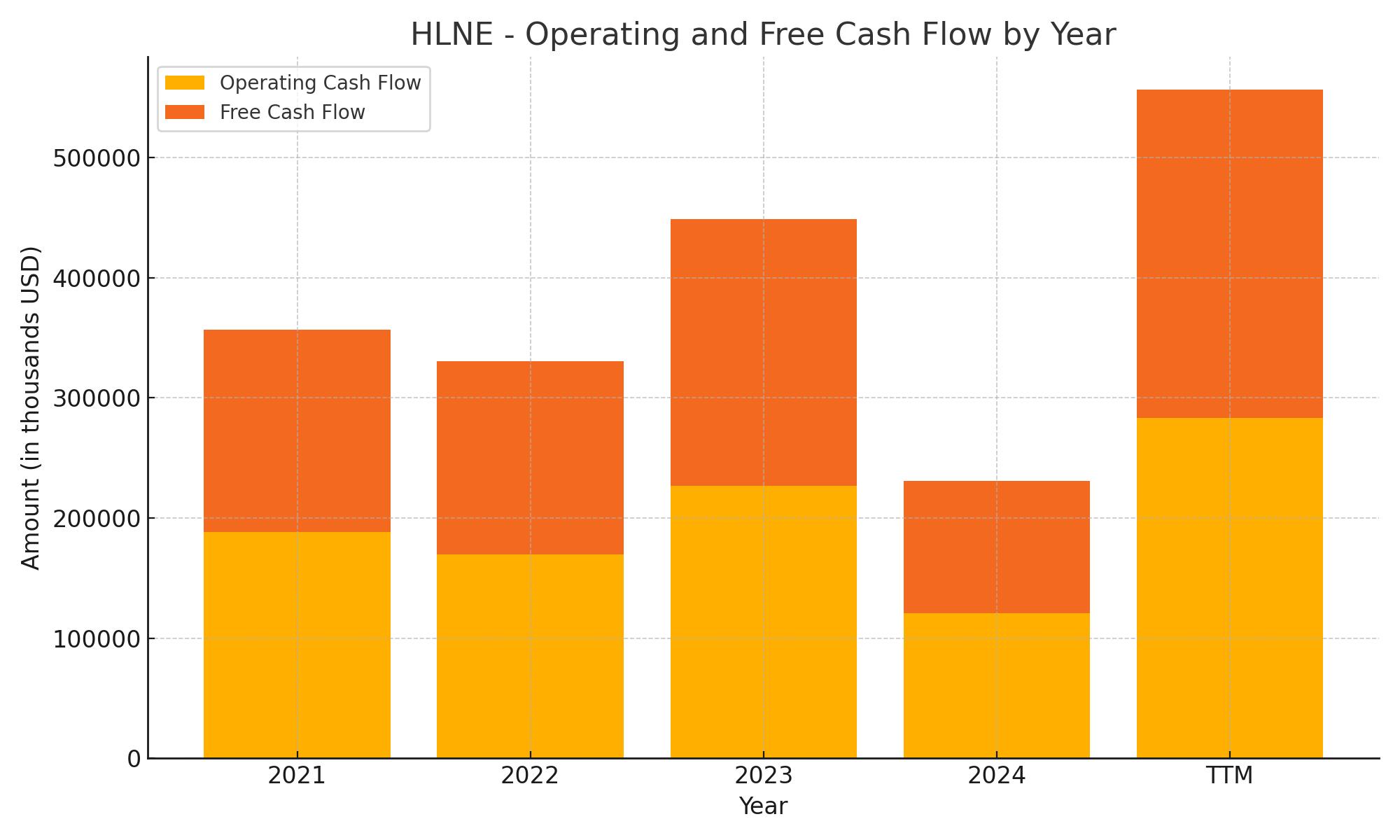

Hamilton Lane’s cash flow profile over the trailing twelve months paints a picture of a company generating solid, reliable operating income. With operating cash flow reaching $283 million, the firm is showing clear strength in its core business. That’s a significant step up from the previous fiscal year and represents ample internal funding power. Free cash flow sits at $272.9 million, indicating low capital expenditure needs and strong cash conversion from operations—an encouraging signal for income-focused investors.

On the investing side, cash flow was negative $96.1 million, largely reflecting continued investments into the business rather than asset sales. Financing activities were relatively muted, with a net outflow of $29.2 million. While the company raised nearly $98 million in new debt, it continued reducing liabilities and returning capital through stock repurchases. The result of this healthy cash management is a year-end cash position of $327.3 million, its highest in recent years and nearly triple the previous year’s level.

Analyst Ratings

🔍 Hamilton Lane (HLNE) has seen a mix of analyst sentiment in recent months, with several firms adjusting their outlooks. The consensus rating currently stands at “Hold,” reflecting a cautious stance among analysts. The average 12-month price target is approximately $164.14, suggesting a modest upside from current levels.

📉 In April 2025, one major investment bank maintained its “Equal-Weight” rating but lowered the price target from $190 to $157, citing concerns over valuation and potential headwinds in the private markets sector. Another firm took a more conservative view, trimming its target from $152 to $147 in light of broader uncertainty in capital flows and fund performance expectations.

📈 On the more optimistic side, one equity research group raised its price target from $158 to $168 while sticking with a “Market Perform” stance. The upgrade was driven by steady earnings growth and the firm’s consistent expansion in managed assets, signaling confidence in its long-term strategy despite short-term noise.

🚨 Earlier this year, a downgrade came from a top-tier firm that moved HLNE from “Neutral” to “Sell,” setting a price target of $139. The reasoning focused on concerns about slowing fundraising cycles in private equity and the potential for fee compression in a more competitive environment.

💬 Overall, while some analysts are dialing back expectations amid shifting market dynamics, others continue to see HLNE as a stable performer with room for measured growth, especially as institutions maintain interest in alternative investments.

Earning Report Summary

Solid Finish to Fiscal 2024

Hamilton Lane closed out its fiscal year with momentum, delivering a strong set of numbers that underscored its steady hand in the private markets space. Management and advisory fees climbed 22% year-over-year, hitting just under $452 million. That’s no small feat in a landscape where volatility has been the norm.

The firm’s assets under management also moved higher, finishing the year at $124 billion. Fee-earning assets, which are the real engine for recurring revenue, grew 15% to $66 billion. The carried interest balance saw a healthy jump too, up 19%, signaling confidence in future performance fees as investments mature.

Leadership Insights and Dividend Growth

On the leadership side, Co-CEO Erik Hirsch spoke with confidence about the year’s results. He pointed to strong execution across the board and emphasized the firm’s continued growth potential. His tone was optimistic but grounded, highlighting how Hamilton Lane is positioning itself for long-term opportunity in the private markets sector.

Earnings per share landed at $3.69, based on $140.9 million in net income. That’s the kind of profitability that gives the board room to reward shareholders, and they did just that. The company raised its dividend 10% for the year, bringing the full-year payout to $1.96 per share. They’re not chasing yield, but the steady upward movement says a lot about confidence in their financial position.

Looking Ahead

The story for Hamilton Lane going forward seems to be one of steady scaling. With fee-earning assets growing, and a solid cash flow foundation in place, there’s room to keep rewarding shareholders while investing in growth. Leadership’s tone suggests they see opportunity, not just in client demand, but in the firm’s ability to keep building its platform and expanding its global footprint. It’s a business that appears to be growing with discipline—quietly compounding value, quarter by quarter.

Management Team

Hamilton Lane’s leadership brings a depth of experience that’s reflected in how the business operates. Co-CEOs Mario Giannini and Erik Hirsch lead a rare dual-leadership structure that works well, largely thanks to their long tenure and alignment with the firm’s vision. Giannini has been instrumental in building Hamilton Lane into a major player in private markets, guiding it with consistency through multiple economic cycles. Hirsch balances that foundation with strategic oversight, particularly in tech and innovation, which has allowed the company to grow efficiently without sacrificing focus.

The broader leadership team includes professionals with extensive experience in investment banking, private equity, and institutional finance. This diversity shows up in the firm’s ability to adapt across market environments and to spot growth opportunities early. Internally, the culture emphasizes a client-first mindset and careful risk management. With insider ownership approaching 8%, there’s a solid alignment between leadership and shareholders. This isn’t a group chasing quarterly optics—it’s a team playing the long game.

Valuation and Stock Performance

Over the last year, Hamilton Lane has delivered a strong stock performance, rising more than 36%. That strength hasn’t come on speculation but on rising earnings and growing assets under management. With fundamentals improving and dividend payouts increasing, the market has responded with confidence.

Currently, the stock trades with a trailing price-to-earnings ratio near 29 and a forward P/E in the low to mid-30s. These are not bargain-level multiples, but they reflect a business that delivers high margins and consistent fee-based revenue. Price-to-sales remains elevated in the 12 to 14 range, but again, that’s common for asset managers with recurring income and strong client retention. Enterprise value to EBITDA is around 17.6, sitting well within the typical range for alternative asset managers in growth mode.

The share price has stabilized around $158, not far from its longer-term moving averages. It remains below its 52-week high of just over $200, but it’s holding a firm base that reflects both solid investor support and healthy trading volumes. The institutional ownership tells its own story, with more than 96 percent of shares held by professional investors. That helps limit volatility and signals confidence in the business’s direction.

Risks and Considerations

Hamilton Lane operates in a part of the market that comes with its own set of risks. The biggest is exposure to the pace and health of private capital flows. If investor interest in private equity or alternative strategies starts to slow—whether because of macro uncertainty, rising rates, or liquidity concerns—Hamilton Lane could see a drag on new fund commitments and fee growth.

Competition is another area to watch. The private markets space has become increasingly crowded, with both established and newer players fighting for investor dollars. That could pressure fees over time or require more investment in services and technology to differentiate. While Hamilton Lane has been proactive on that front, it’s an ongoing battle.

From a valuation perspective, the current multiples assume continued growth. If that narrative gets disrupted—either by market slowdown or earnings variability—the stock could re-rate quickly. While dividend payouts provide some cushion, that doesn’t fully offset the risk of multiple compression in a more cautious investing environment.

There’s also the broader rate environment to consider. Hamilton Lane doesn’t carry excessive debt, but higher borrowing costs or shifts in investor preferences could impact its ability to attract capital into new funds. That in turn would impact revenue, which is largely tied to assets under management and advisory activity.

Final Thoughts

Hamilton Lane has carved out a solid position in the world of private market investing. With a leadership team that stays focused on fundamentals and a strategy that emphasizes measured growth, the company has quietly become one of the more consistent performers in the space.

For investors looking at the stock through a dividend lens, the appeal lies in the stability of the business model. Recurring fee income, low capital intensity, and conservative payout policies combine to support a dividend that’s modest but steadily rising. This isn’t a high-yield stock, but it’s one where dividend growth feels dependable.

What also stands out is how the company avoids chasing flash. It’s building on what works—expanding its platform, deepening client relationships, and keeping a strong balance sheet. That kind of consistency doesn’t always get the spotlight, but it tends to deliver results over time.

Risks remain, as they do with any business tied to capital flows and market sentiment. But Hamilton Lane seems well-equipped to navigate those challenges. It’s a firm with a clear identity, solid leadership, and a track record of disciplined execution. For long-term investors focused on income and quality, those traits go a long way.