Key Takeaways

📈 H&R Block offers a forward dividend yield of 2.61%, supported by a low payout ratio of 35.86% and a track record of steady dividend growth.

💰 The company generated $767 million in operating cash flow and $687 million in free cash flow over the trailing twelve months, providing strong coverage for dividends and buybacks.

📊 Analysts maintain a consensus “Hold” rating with a $62 price target, reflecting moderate upside and confidence in the company’s earnings consistency and capital return strategy.

Updated 5/13/25

H&R Block has quietly established itself as a consistent dividend payer, supported by a strong balance sheet, reliable cash flow, and a clear focus on shareholder returns. With a forward yield of 2.61% and a payout ratio under 36%, the company continues to provide dependable income while keeping plenty of room for reinvestment and growth.

Leadership is steering the business with a long-term mindset, modernizing the client experience and expanding digital services. The latest earnings report showed healthy revenue and profit growth, reaffirmed guidance, and robust capital returns, including buybacks and a steady dividend. For investors focused on income and stability, H&R Block offers a compelling mix.

Recent Events

Over the past year, shares of HRB have been on a slow and steady climb. They’re up just over 8% in the past 52 weeks—not blowing the doors off, but solid enough to show that investors are staying interested. The company continues to grow at a manageable pace, with revenue up a little over 4% year-over-year. Earnings growth has been keeping pace, with net income hitting nearly $565 million and earnings per share sitting at $4.03.

Cash flow is a big part of the story here. H&R Block pulled in over $530 million in levered free cash flow, giving it plenty of breathing room to support dividends and buy back stock. Management has shown they’re not afraid to use that flexibility, and they’ve kept a strong cash position—$773 million as of the most recent quarter.

One red flag? The short interest is worth a mention. Around 15% of the float is sold short, which is higher than average. That could mean some traders see a pullback coming, but from an income investor’s point of view, the focus stays on dividend reliability and cash generation. On that front, HRB continues to check the right boxes.

Key Dividend Metrics

📈 Forward Dividend Yield: 2.61%

💵 Annual Dividend: $1.50 per share

📅 Ex-Dividend Date: June 4, 2025

📆 Next Payment Date: July 3, 2025

📊 Payout Ratio: 35.86%

📉 5-Year Average Yield: 3.72%

📊 Dividend Growth Rate (5Y): Consistent, moderate increases

💰 Free Cash Flow Payout: Strong, well-supported

Dividend Overview

At first glance, H&R Block’s 2.61% forward yield doesn’t scream high-income opportunity. But take a closer look, and there’s more to appreciate. This dividend is backed by predictable earnings and free cash flow, not financial gymnastics. The company pays out $1.50 per share annually and keeps its payout ratio under 36%. That’s a healthy level that leaves room for both dividend growth and operational flexibility.

Looking at historical yield, the five-year average is closer to 3.7%, so the current figure is a bit lower. That’s partly due to the recent share price strength—it’s not that the dividend dropped, it’s that the stock price went up. That’s often a good problem to have for long-term holders.

The balance sheet shows smart cash management. With over three-quarters of a billion in cash and just under $2 billion in debt, H&R Block isn’t highly leveraged. Their current ratio sits at 0.78, typical for seasonal businesses, and doesn’t raise major red flags. With the kind of profit margins they run—nearly 43% operating margin—this business remains a cash machine during its peak periods.

Dividend Growth and Safety

Consistency is the theme here. H&R Block doesn’t chase headlines with huge hikes or flashy announcements, but they’ve steadily raised the dividend over time. It’s become a routine part of their capital return strategy, which includes both dividends and aggressive share repurchases. That buyback activity helps reduce share count, increasing earnings per share and keeping the dividend well-covered.

What’s reassuring for income investors is how sustainable this dividend looks. With solid free cash flow, a low payout ratio, and a highly recurring revenue model, there’s a strong cushion against any potential downturn. Taxes still need to be filed, regardless of economic cycles, and that gives H&R Block the kind of predictability that income-focused investors should appreciate.

With a forward P/E of around 12 and a PEG ratio just under 1, the market isn’t baking in wild expectations. That’s okay. This isn’t a stock that’s trying to grow at lightning speed. It’s one that aims to reward shareholders year after year without rocking the boat.

And for investors who value stability and a steady stream of income, that might be exactly what makes HRB worth a close look.

Cash Flow Statement

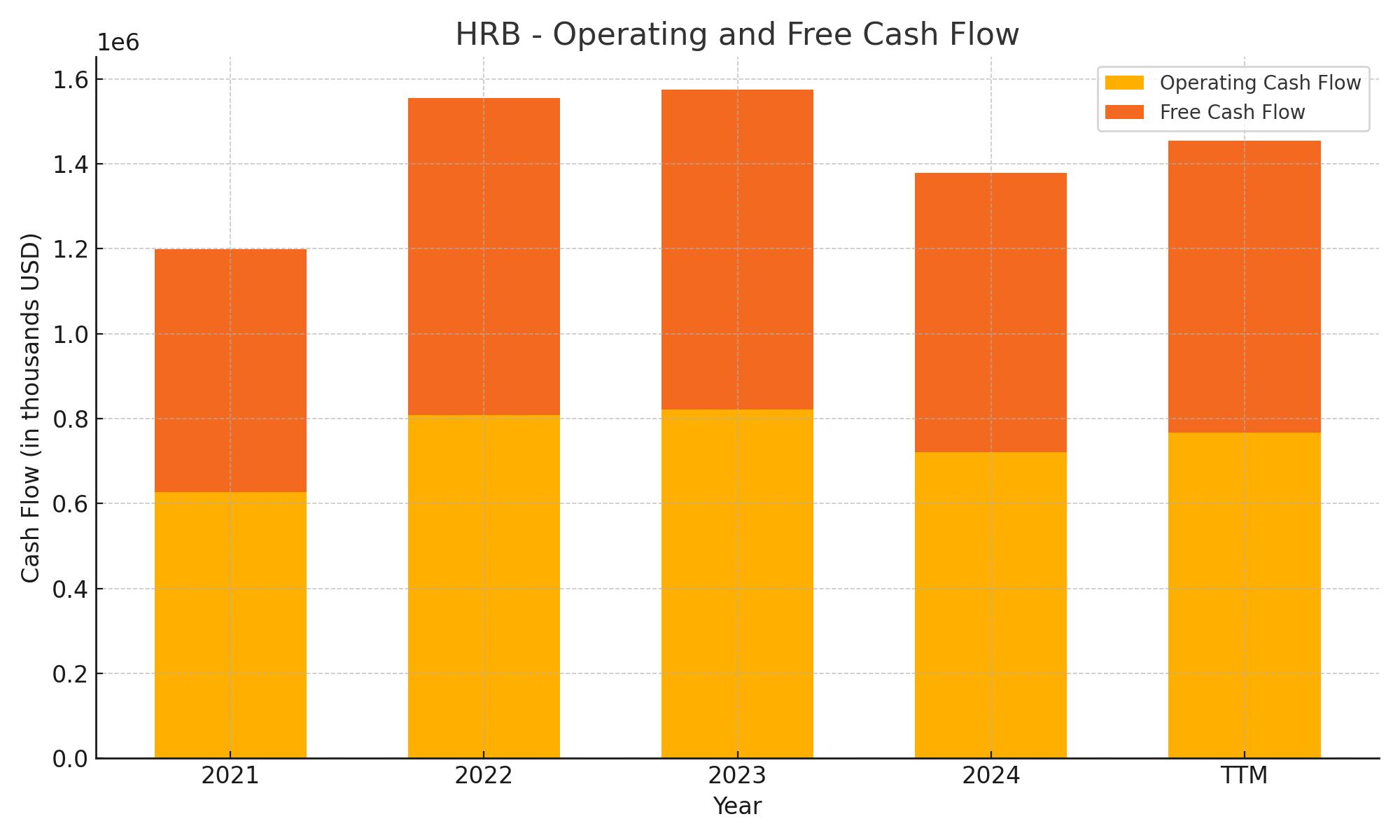

H&R Block continues to demonstrate solid operational discipline, with trailing twelve-month (TTM) operating cash flow at $767 million. While slightly down from peak levels in 2022, this still reflects a healthy inflow considering the nature of its seasonal business. Free cash flow sits at $687 million for the TTM, comfortably covering dividend commitments and buybacks, and giving the company room to maneuver without stretching its balance sheet.

.

On the financing side, H&R Block has been consistently active. Over the past year, they issued $1.09 billion in debt and repaid a nearly identical amount, showing a strategy of rolling over rather than expanding debt. Share repurchases remained a major outlay at $437 million, reinforcing the company’s focus on returning capital to shareholders. The end cash position, however, has dipped to $354 million from over $1 billion the year prior, mostly due to these aggressive capital returns and steady investment activities. Still, with stable free cash flow and measured capital expenditures, the cash burn doesn’t raise immediate concerns.

Analyst Ratings

🔍 H&R Block has recently seen a shift in analyst sentiment. On May 2, Northcoast Research downgraded the stock from “Buy” to “Neutral.” This adjustment came after the company’s earnings report showed a loss of $1.73 per share, coming in slightly below analyst expectations. The downgrade reflects a more cautious outlook on near-term performance, as some analysts questioned the strength of seasonal earnings and growth trajectory heading into the back half of the fiscal year.

📈 Still, not everyone is pulling back. Barrington Research maintained its “Buy” rating and reaffirmed a price target of $70, signaling continued belief in the long-term thesis. Analysts at Barrington pointed to H&R Block’s strong cash flow generation, dependable dividend growth, and robust capital return strategy as reasons to remain bullish despite short-term noise.

📊 The current analyst consensus sits at a “Hold” rating, with a 12-month average price target of $62. That leaves a bit of room for upside from current levels, suggesting the market views HRB as fairly valued for now. The split in opinion captures a familiar dynamic—short-term concerns versus long-term reliability. For investors focused on income, the fundamentals behind the dividend and steady cash flow story remain intact.

Earning Report Summary

H&R Block’s latest earnings show a company that’s not just holding steady but making thoughtful moves in the right direction. For the third quarter of fiscal 2025, they pulled in $2.3 billion in revenue, which is up just over 4% compared to the same period a year ago. That growth came mostly from their core business—more people using their company-owned tax prep services and paying slightly higher fees.

Solid Profit Growth

Net income came in at about $723 million, up 4.5% from last year’s quarter. Earnings per share did even better, climbing nearly 9% to $5.38. That bump wasn’t just from better earnings—it also had help from a lower share count, thanks to the company’s ongoing stock buybacks. Operating expenses did rise, mainly due to higher pay for their tax professionals, but that was tied to increased business. In short, more clients meant more work, which meant more people needed to be paid.

Leadership’s Focus

CEO Jeff Jones talked about the company’s progress in improving the client experience, and he seems pretty confident about where things are headed. He pointed out that client satisfaction is up and they’ve been growing their market share in assisted tax prep. CFO Tiffany Mason added that the financial performance reflects a good balance between pricing, volume, and service mix. It’s clear the company is trying to walk that line—giving clients more value while also keeping profitability strong.

Looking Ahead

They didn’t change their guidance for the full year, which is a sign of confidence. Revenue for the year is still expected to land somewhere between $3.69 and $3.75 billion. Adjusted EPS should fall between $5.15 and $5.35. They’re sticking to their playbook of rewarding shareholders too—over the first half of the year, H&R Block bought back 6.5 million shares for $400 million. They also announced a dividend of 37.5 cents per share, payable in early July.

All in all, it was a quarter that didn’t rock the boat—but it didn’t need to. The business is growing at a healthy clip, costs are under control, and leadership is staying focused on the long game.

Management Team

H&R Block’s leadership is anchored by President and CEO Jeffrey J. Jones II, who took the helm in 2017. Jones brings experience from major consumer-focused companies, having held top roles at Uber, Target, and The Gap. Since joining, he’s pushed for modernization across the business, especially around digital expansion and improving the customer experience.

Supporting him is Tiffany Mason, the company’s Chief Financial Officer since September 2024. Mason previously served as CFO at Driven Brands and now oversees financial strategy, focusing on balancing investment in growth initiatives with strong returns. Other key figures on the leadership team include Curtis Campbell, who oversees global consumer tax and product strategy; Jill Cress, who leads marketing and client experience; and Scott Manuel, who handles strategy and operations. Together, this group is steering H&R Block through a period of steady transformation while keeping the core business strong.

Valuation and Stock Performance

H&R Block shares are trading around $57.66, off from their 52-week high of $68.45 set in August 2024. That pullback represents roughly a 15% dip, but it doesn’t necessarily reflect trouble under the hood. The current market cap stands at $7.72 billion. With a trailing P/E of 14.31 and a forward P/E of 11.25, the stock looks reasonably priced, especially for investors focused on steady income rather than growth-at-any-cost.

Analyst sentiment reflects cautious optimism. The consensus price target sits at $62, suggesting a modest upside from current levels. The stock did take a noticeable hit on May 8, dropping more than 5% even as the broader market moved higher. But context matters—this wasn’t about company fundamentals. It was more of a reaction to short-term market movements and sector trends. The underlying story of H&R Block remains the same: a reliable business with healthy free cash flow and a long history of rewarding shareholders.

Risks and Considerations

There are a few things investors need to keep on their radar. Competition is as fierce as ever, especially with more DIY tax software and mobile options coming into the space. Even though H&R Block has a strong brand and loyal customer base, staying ahead in the tech race takes constant reinvestment. That could pressure margins or force tough choices between pricing and service.

Regulatory issues have also surfaced. The FTC filed a complaint earlier in 2024, alleging that H&R Block’s marketing around “free” tax filing was misleading. The company has pushed back on the claim and is defending itself, but legal proceedings can take time and create headline risk. Seasonality is another factor. Because tax preparation is such a time-concentrated business, revenue and cash flow can vary significantly across the year.

Tech reliance is growing, which is both a strength and a vulnerability. Cybersecurity, data privacy, and digital compliance all require continuous attention. Any breach or extended system outage could damage both the brand and the bottom line.

Final Thoughts

H&R Block has been playing the long game, and so far, it’s paying off. The company has managed to evolve without losing the steady foundation it’s known for. Leadership is clearly committed to adapting to customer needs, improving the digital experience, and keeping capital returns front and center.

Yes, there are challenges—from regulation to rising competition—but the core business remains durable. And with a reliable dividend, steady cash flow, and a management team focused on execution, the company continues to appeal to long-term, income-oriented investors. It may not be the flashiest name in the market, but for those seeking stability and a dependable payout, H&R Block still earns a close look.