Last Update 5/8/25

Greene County Bancorp (NASDAQ: GCBC) is a steadily growing community bank headquartered in upstate New York, operating with over \$3 billion in assets. Through disciplined lending, conservative financial management, and a strong focus on customer relationships, the bank has built a reputation for consistent earnings growth, solid credit quality, and a well-covered dividend.

Led by a seasoned management team and supported by a high insider ownership stake, GCBC continues to expand its footprint across the Hudson Valley and Capital Region. With a long-standing commitment to shareholders and a growing dividend supported by low payout ratios, the stock appeals to investors seeking stability and steady income.

Recent Events

Shares of GCBC have been under pressure lately. As of May 7, they closed at $21.98, down almost 3% for the day and far off last year’s highs. But there’s more to this story than just the price.

Quarterly revenue is up 23% year over year, and earnings are growing even faster—up more than 37%. Those aren’t the numbers you usually get from a small-cap bank, especially not in a higher-rate environment where many regional players are seeing margins squeezed.

What’s even more interesting is the valuation reset. GCBC’s price-to-earnings ratio has dropped to just over 13 from above 23 in the past year. Its price-to-book is also down to a much more palatable 1.63. That suggests the market’s been overly cautious, not that the business itself has hit trouble. For a bank with solid profitability and a clean balance sheet, those kinds of multiples look conservative.

Key Dividend Metrics 📊

📈 Dividend Yield: 1.64%

💵 Annual Dividend: $0.36 per share

📅 Next Ex-Dividend Date: May 16, 2025

📆 Dividend Payment Date: May 30, 2025

📉 Payout Ratio: 20.96%

📊 5-Year Average Yield: 1.32%

🧱 Dividend Growth Streak: More than a decade of steady payouts

🪙 Last Stock Split: 2-for-1 in March 2023

Dividend Overview

GCBC isn’t a high-yield play, and that’s just fine. The bank pays a 1.64% yield—not the biggest out there, but it’s as steady as they come. The current annual payout stands at $0.36 per share, and more importantly, it’s covered by a wide margin.

The payout ratio is a very conservative 21%, which leaves plenty of room for flexibility. The bank doesn’t need to dip into reserves or stretch earnings to keep its dividend intact. It simply pays what it can comfortably afford, which is exactly the approach you want from a company focused on the long term.

GCBC also runs like clockwork when it comes to distributions. Investors can expect quarterly payments, with the next ex-dividend date scheduled for May 16. The regularity of those payments is part of what makes this name appealing to income-oriented portfolios.

Then there’s the stock split in 2023—a 2-for-1 move that brought more liquidity into the stock. It also signaled management’s optimism and intent to keep shares accessible to individual investors. For a company this size, maintaining an investor-friendly capital structure makes a real difference.

Dividend Growth and Safety

The real story with GCBC’s dividend isn’t how high it is—it’s how safe and durable it feels. With earnings per share of $1.67 and a dividend payout of just $0.36, the bank could double its dividend tomorrow and still be operating from a position of strength. That cushion is what allows the company to keep growing the payout, even during tougher years.

The bank’s return on equity sits at a solid 13.33%, and its return on assets just under 1%. These are healthy levels for a bank of this size and one that isn’t chasing risky lending or high-yield investment strategies. It’s a clean operation, and that makes its dividend even more reliable.

Cash reserves are another major strength. The bank is sitting on over $157 million in cash, which works out to more than $9 per share. When you consider that the stock trades around $22, nearly half of that value is backed by cash alone. Debt is modest, at $94 million, and there are no complicated financing structures to worry about.

Volume in the stock is relatively low, which is typical for a name like this, but insider ownership is high—nearly 60%. That aligns management with shareholders and provides some reassurance that decisions are being made with long-term value in mind.

Over the past five years, the yield has quietly risen from its average of 1.32% to the current 1.64%. That slow upward climb reflects steady earnings growth and a prudent approach to capital returns. There’s been no drama, no cuts, and no chasing investor attention with unsustainable hikes.

Most important of all, the dividend’s foundation is getting stronger. With revenue and earnings both climbing year over year, GCBC has room to either raise its payout, boost reserves, or do both. And with a payout ratio this low, it’s hard to see a scenario where the dividend would need to be reduced—even if the economy hits a rough patch.

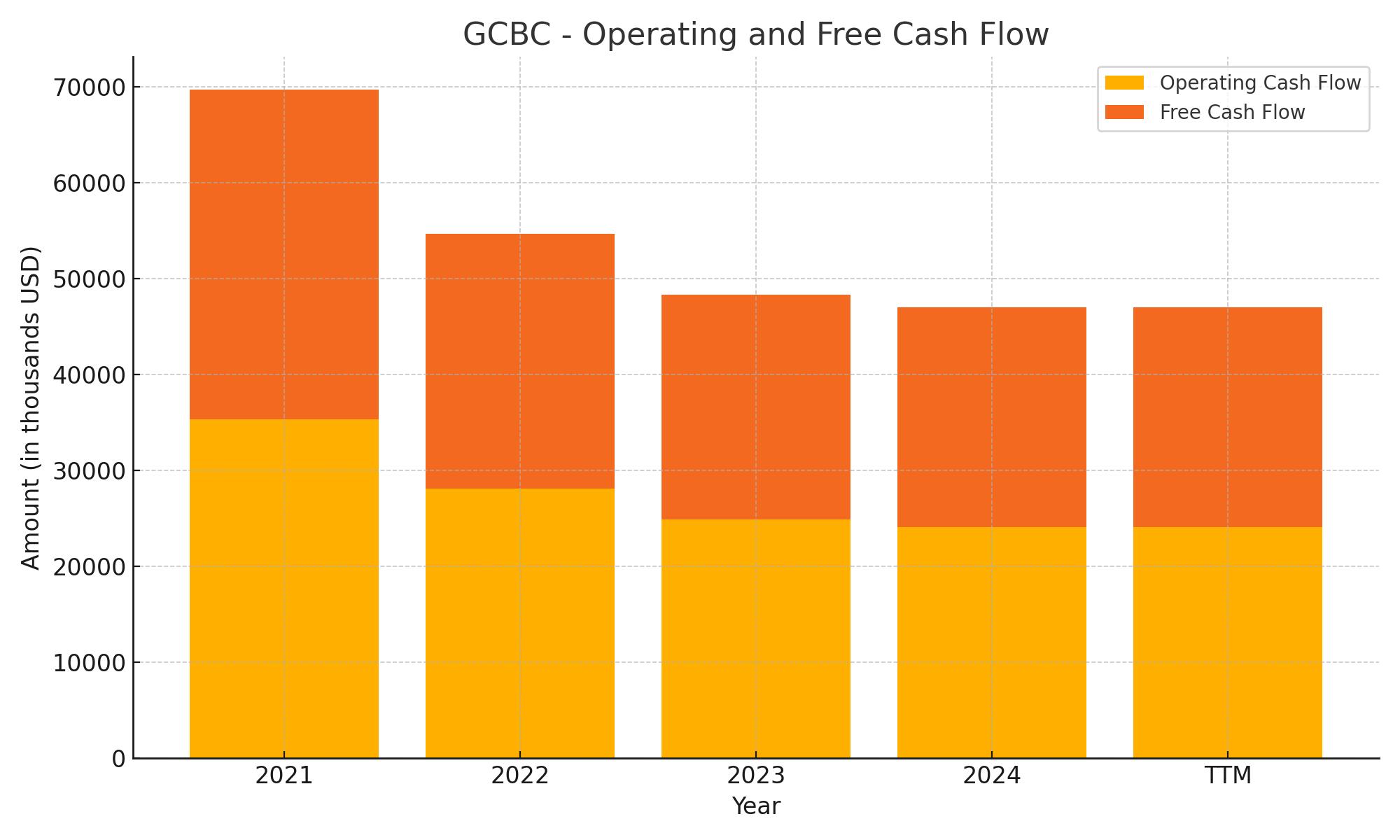

Cash Flow Statement

Greene County Bancorp’s cash flow story over the trailing twelve months (TTM) shows a solid base of operating performance, with $24.1 million in operating cash flow. While this is a slight dip from the previous two fiscal years, it’s still consistent with the bank’s stable earnings and operational efficiency. Free cash flow also remains healthy at nearly $23 million, showing the bank continues to generate more than enough liquidity from its core operations to fund dividends, modest capital expenditures, and maintain financial flexibility.

The bank has been very active on the financing side, bringing in $199.8 million, largely tied to new debt issuance. This helped counterbalance the sharp outflows from investing activities, which totaled $233.5 million—likely due to loan originations or securities purchases, typical of a growing bank. The ending cash balance stands at $166.4 million, a strong position even after heavy investment, indicating that GCBC is managing its inflows and outflows with a disciplined approach while maintaining liquidity.

Analyst Ratings

📈 Greene County Bancorp (GCBC) recently caught a bit of positive momentum from analysts. On April 26, 2025, the stock was upgraded from a “sell” to a “hold” rating by a coverage outlet, signaling a shift in perception following a strong quarterly performance. This upgrade came on the heels of a report showing net income had climbed 31.2% for the quarter ending December 31, 2024, compared to the same period a year prior. That kind of earnings jump tends to force a reevaluation, even among the more cautious voices in the room.

📊 Despite the upgrade, GCBC still flies under the radar in terms of analyst coverage. The most recent consensus price target that’s been floating around is wildly outdated and pegged at $7.50—clearly a relic of a much earlier era and no longer useful for investors gauging the bank’s current valuation, especially with the stock trading around $21.98. The market has moved on, and so has the company.

🔍 The “hold” designation seems to reflect a wait-and-see attitude. Analysts appear to recognize that GCBC is performing well operationally, but with limited coverage and perhaps broader market uncertainties, they’re not rushing to slap a buy rating on it just yet. For now, the story is one of cautious optimism.

Earning Report Summary

Strong Quarter with Record Growth

Greene County Bancorp turned in a very solid third fiscal quarter, and it shows. Net income climbed to $8.1 million, which is a noticeable jump from $5.9 million in the same quarter last year. Over the nine months leading up to March 31, the company earned $21.8 million, reflecting an increase of more than 20% from the prior year. Earnings per share came in at $0.47 for the quarter and $1.28 for the nine months, both healthy figures that suggest the bank is maintaining momentum.

What’s really worth highlighting is the growth in assets. GCBC has now crossed the $3 billion mark in total assets—a significant milestone by any measure. Loan activity is also up, with net loans now sitting at $1.6 billion. Deposits continue to trend higher too, reaching $2.7 billion. Interest income played a big part in the results, with net interest income growing to $16.2 million for the quarter, driven by a larger base of interest-earning assets and smart balance sheet moves.

CEO Perspective and Focus on Long-Term Strategy

CEO Donald Gibson didn’t shy away from sharing his enthusiasm about hitting the $3 billion mark. He reminded shareholders that it took the bank well over a century to reach its first billion, but just seven years to triple it. That kind of acceleration is meaningful, and he credited it to the company’s focus on organic growth, its community-first mindset, and a consistent culture that prioritizes customer relationships.

The bank isn’t just focused on growth for growth’s sake. Credit quality continues to look strong. Nonperforming loans actually declined, and the allowance for credit losses now stands at 1.31%. The provision for credit losses has gone up this year, but that’s more about the bank being cautious and proactive than reacting to any major issue.

Some Expense Pressure, but Nothing Alarming

Expenses were up slightly—about $1.6 million more than last year during the same period. That was mainly due to higher employee-related costs and credit allowances, which isn’t unexpected for a growing institution. The bank also took a $665,000 hit from selling some securities, but it didn’t weigh heavily on the overall performance. The strength in net interest income and the bank’s steady operating discipline helped balance things out.

Steady Outlook Moving Forward

Leadership continues to keep an eye on the broader economic environment, especially interest rate shifts and Federal Reserve policy. There’s a clear focus on managing deposit rates carefully and preserving the long-term value of customer relationships. The message from the top is clear: stay steady, adapt where needed, and continue serving the community with the same disciplined approach that got them this far.

Management Team

Greene County Bancorp’s leadership is built around a team with deep community ties and a steady hand on long-term growth. Donald E. Gibson serves as President and CEO and has been with the bank for over three decades. Since taking the CEO role in 2007, he has overseen a period of consistent expansion, taking the bank from a local institution to a regional player with over $3 billion in assets. His philosophy revolves around organic growth, sound banking fundamentals, and staying deeply connected to the communities the bank serves.

Nick Barzee, Chief Financial Officer and Senior Vice President, adds another layer of financial discipline to the leadership team. With a background in public accounting and corporate finance, he’s helped steer the bank through periods of growth and uncertainty with a conservative but forward-thinking approach. John Antalek oversees lending as Chief Lending Officer, helping to keep credit quality high while expanding the loan book in a sustainable way. Scott Houghtaling, Chief Credit and Banking Officer, provides oversight on credit risk and helps maintain balance as the bank grows. The board of directors is led by Jay Cahalan and supported by professionals from fields ranging from finance to hospitality, bringing diversity and broad oversight to strategic decisions.

Valuation and Stock Performance

As of early May 2025, Greene County Bancorp shares were trading at $21.98, reflecting a recent slide in price but not a breakdown in the company’s fundamentals. The stock has seen a wide trading range over the past year, dipping to $20.00 at its lowest and reaching as high as $37.25. Despite this volatility, the bank continues to post rising earnings and has shown strong operational discipline.

The current market cap hovers around $387 million, placing GCBC firmly in the small-cap category. Valuation metrics appear reasonable for investors who value consistency over flash. The price-to-earnings ratio sits at just over 13, suggesting the market hasn’t priced in full earnings potential. Its price-to-book ratio of 1.63 reflects a modest premium to book value, typical for a well-capitalized and profitable regional bank.

Over a longer timeframe, GCBC has rewarded patient investors. Looking back five years, the stock has delivered a return of more than 100%, largely driven by earnings growth and consistent dividend payments. The stock has historically traded with relatively low volatility, which is also reflected in its five-year beta of just 0.51. That stability tends to appeal to dividend-focused investors and those seeking defensive positioning within financials.

Risks and Considerations

Like any bank, GCBC isn’t immune to macroeconomic forces. Interest rate changes remain the most obvious headwind or tailwind. A declining rate environment could squeeze margins, while sharp increases could pressure borrowers. So far, the bank has managed these fluctuations well, but rates remain a key variable.

There’s also the risk tied to the regional economy. The bank’s footprint is still concentrated in New York’s Hudson Valley and Capital Region. If these areas face economic hardship, local lending and credit quality could be affected. Though GCBC keeps a tight handle on credit standards, no bank is entirely insulated from economic cycles.

Regulatory shifts can also bring challenges. Compliance demands continue to rise, and even small changes in policy can carry significant costs for community banks. Staying ahead of these changes requires investment in systems, training, and staff, which can impact margins over time.

Competition is another factor. Larger national banks and fintech upstarts are constantly encroaching on traditional bank territory. GCBC has managed to hold its ground by building trust and offering personalized service, but it will need to continue investing in digital infrastructure to stay competitive in a changing landscape.

Final Thoughts

Greene County Bancorp has managed to strike a balance between growth and prudence, which isn’t always easy in today’s banking environment. The leadership team’s deep experience and clear focus have helped the bank expand thoughtfully, while maintaining strong credit quality and a conservative balance sheet. With consistent earnings, a well-covered dividend, and a valuation that still leaves room for upside, the foundation is solid.

The recent dip in the stock price appears to be more about broader market pressure than anything company-specific. Underneath, the bank is delivering quarter after quarter. For long-term investors who value steady dividends and clean balance sheets over hype, GCBC offers a profile that’s easy to understand and easier to trust.

As always, risks remain—interest rate shifts, regulatory changes, and economic slowdowns could weigh on results. But for now, Greene County Bancorp remains an example of a community bank that has grown without abandoning its core principles. And that kind of discipline rarely goes out of style.