Key Takeaways

💰 LAND offers a forward dividend yield near 6%, with monthly payouts holding steady since 2021 despite pressure on growth due to tenant performance and market conditions.

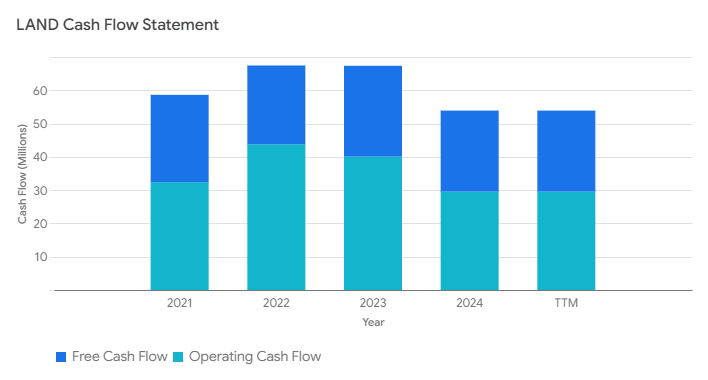

💵 The company generated $29.55 million in operating cash flow over the trailing twelve months, maintaining positive free cash flow while navigating lower base rents and selective capital spending.

📊 Analysts have mixed views, with a consensus “Hold” rating and an average price target of $15.50, reflecting cautious optimism about recovery amid soft earnings and tenant challenges.

Last Update 5/7/25

Gladstone Land Corporation (LAND) offers monthly income through a portfolio of U.S. farmland leased to operators growing fruits, vegetables, and nuts. With a current yield near 6%, it provides access to real assets tied to essential food production.

The REIT has faced recent headwinds, including a dip in rental income, tenant challenges, and rising interest rates, but management continues to prioritize dividend stability, asset quality, and long-term value preservation.

Recent Events

LAND’s stock hasn’t had the smoothest ride recently. As of May 6, it closed at $9.38, down almost 30% over the past year. Rising interest rates have weighed heavily on REITs in general, but for LAND, the pressure has been even more intense. The company carries a hefty debt load, and higher borrowing costs squeeze margins and lower investor appetite for leveraged income plays.

To make matters more challenging, revenue is sliding. Year-over-year, quarterly revenues dropped 13.5%, and earnings took a hard hit, down more than 70%. That’s tough for any business, especially one trying to support consistent payouts. Still, the dividend hasn’t been cut, which says a lot about how management is thinking. They’re clearly betting that things stabilize and the current income stream can hold.

Another important note: the next dividend payout is scheduled for June 30, and the stock goes ex-dividend on May 21. That’s right around the corner, and it could be a key catalyst for near-term trading activity.

Key Dividend Metrics

🌾 Forward Dividend Yield: 5.97%

💰 Forward Dividend Rate: $0.56

📉 Payout Ratio: 1,111.8%

📆 Next Dividend Date: June 30, 2025

🚨 Ex-Dividend Date: May 21, 2025

📈 5-Year Average Yield: 3.31%

📉 52-Week Range: $8.66 – $15.36

Dividend Overview

Let’s be honest—a nearly 6% forward yield will always get attention. But it comes with questions, especially when the payout ratio jumps off the page like this one does. Over 1,100% based on net income? That’s enough to make any investor pause.

But there’s a catch. REITs often report high payout ratios because of how they account for depreciation and other non-cash items. On paper, LAND lost money. In practice, the company still generated $29.5 million in operating cash flow and $49.4 million in levered free cash flow over the past year. So while net income tells one story, actual cash coming in the door tells another—and for now, that story supports the dividend.

The question is whether that cash flow holds up in the face of falling revenue and rising expenses. LAND has a relatively small market cap of around $340 million, so every move matters. Still, with roughly $20 million paid out in dividends each year, there’s some breathing room as long as the core business doesn’t deteriorate further.

Dividend Growth and Safety

One thing investors love about LAND is the monthly payout. It creates a steady rhythm of income, which can be especially helpful for retirees or anyone budgeting off investment returns. But if you’re hoping for growth, you might be disappointed. The dividend has been stuck at $0.045 per month since late 2021. Before that, LAND had a habit of increasing it ever so slightly—fraction-of-a-cent hikes every few quarters. Those days appear to be on hold for now.

What about the safety of the dividend going forward? Debt is a concern. LAND holds close to $588 million in total debt, compared to just $26 million in cash. Its debt-to-equity ratio is around 86%, which is high for a company with modest earnings power. That said, this isn’t a mall REIT with collapsing tenants. Farmland tied to food production is still a stable asset class, and tenants generally have long-term leases with inflation-linked terms.

The market seems skeptical though. Shares trade well below book value, which currently sits at $18.99 per share. That’s more than double the stock price. The disconnect could mean the market is bracing for further property revaluations or cash flow erosion. But it also suggests that LAND might be undervalued if it can hold the line on income and keep its tenants in place.

The enterprise value to EBITDA ratio, currently just over 12x, implies a fair valuation for a real estate operator. There’s not much froth here. But there also isn’t a large margin for error, especially with the farmland sector lacking the liquidity and investor coverage of more traditional commercial real estate.

Still, there’s something appealing about LAND’s model. It taps into a sector that’s hard for most investors to access—income-producing farmland. That alone gives it a different risk profile than REITs focused on offices, industrial parks, or hospitality. While the road has been bumpy lately, the dividend continues to roll in every month, and the underlying assets aren’t going out of style.

For income investors with an eye on the long term, LAND offers a unique blend of real assets, inflation protection, and yield. It’s not perfect, and it’s certainly not without risk, but it does bring something different to the table.

Cash Flow Statement

Gladstone Land’s trailing twelve-month cash flow paints a picture of a REIT managing to stay cash-flow positive despite notable revenue pressure. Operating cash flow came in at $29.55 million, down from $40.08 million in 2023 and $43.79 million in 2022, reflecting reduced rental income and some tenant weakness. Even so, the company maintained $24.35 million in free cash flow, enough to cover its $0.56 annual dividend payout with room to spare—though not by a wide margin. Capital expenditures declined to $5.20 million, suggesting a slowdown in property investments or improvements.

On the investing front, LAND saw a substantial $63.31 million inflow, a sharp reversal from prior years’ heavy spending. This likely stems from property sales or deferred acquisitions, helping to temporarily strengthen the cash position. Financing cash flow, however, showed a hefty $93.15 million outflow, driven by debt repayments of over $50 million and moderate share repurchases. While the company added $3.40 million in new debt, it wasn’t enough to offset its obligations. As a result, LAND’s cash balance slipped slightly to $18.27 million. The company also paid $24.40 million in interest over the year, a notable bite from cash resources given the rising rate environment.

Analyst Ratings

📉 Gladstone Land Corporation (LAND) has experienced a change in tone from analysts over the past year. The general consensus now leans toward a “Hold” rating, as analysts digest the company’s latest earnings trends and financial positioning. While not outright negative, there’s a noticeable level of caution in current sentiment.

🎯 The average 12-month price target for LAND is $15.50, offering a sizable potential upside of about 65% from its current trading level around $9.38. Analyst targets are ranging from a low of $14.50 to a high of $16.00, indicating a moderate spread in expectations and some uncertainty around the company’s near-term direction.

📊 Oppenheimer recently lowered its target from $20 to $16 but maintained an “Outperform” stance, noting a drop in forward earnings estimates as a reason for the trim. Meanwhile, Alliance Global Partners initiated coverage with a “Buy” rating and set a target at $16, expressing confidence in LAND’s long-term value, especially due to its farmland exposure. On the more reserved end, B. Riley revised its target slightly to $14.50 while keeping a “Neutral” rating, suggesting tempered optimism.

🧭 These updates show a divided view—some see LAND as undervalued with a stable, real-asset base, while others are waiting for stronger revenue signals before getting more bullish.

Earnings Report Summary

Slower Quarter, Mixed Year

Gladstone Land’s most recent earnings report showed a company navigating through a tough but transitional phase. For the fourth quarter of 2024, net income came in at just over half a million dollars, down noticeably from the $1.8 million they booked during the same stretch last year. Adjusted Funds from Operations, a key measure for REITs like this one, slipped to $3.4 million, or $0.09 per share, compared to $0.15 per share a year earlier.

What’s driving the decline? A big part of it was lower fixed base rents—down nearly $5 million. But that was partially offset by a $1.5 million boost in participation rents, thanks to stronger-than-expected performance from some almond and pistachio operations. The fluctuation reflects the delicate balance of tenant mix, crop performance, and lease structures that this farmland REIT juggles.

Active Year for Leasing and Asset Moves

Over the course of 2024, LAND inked 31 lease deals, both renewals and new agreements. On the row crop side, it was a strong showing, with lease renewals boosting net operating income by over 14%. Permanent crop leases were a different story, declining more than 8%, as lower commodity prices and water uncertainty weighed on the western farmland market.

The company was also active on the transactional front—selling 12 farms in Florida and Michigan for more than $70 million, locking in a net gain of $10 million. On the acquisition side, they picked up nearly 9,000 net acre-feet of water rights for about $2.1 million. Water continues to be a major theme for LAND, and management is leaning into that strategy to support long-term land values.

Leadership Commentary and Looking Ahead

CEO David Gladstone was candid about the quarter. He noted continued strong performance from the company’s row crop farms, especially in places like Florida and California, but acknowledged that the permanent crop segment has been a challenge. With higher input costs and lower commodity pricing, some tenants are feeling the pinch.

To help navigate this, Gladstone said they’ve started offering cash allowances in some leases in return for better participation rent structures. They’re even exploring direct management on certain farms using third-party operators—something they haven’t leaned heavily into before.

Right now, nine properties across 12 farms are either vacant, tenant-challenged, or in a transition state. Leadership is aiming to either re-lease or sell these properties before year-end. That goal will be one to watch. On a positive note, most of their debt remains fixed-rate, and the company’s cash flow profile still supports their monthly dividend payout.

Management sounds focused on weathering the current rough patch while keeping an eye on the long-term opportunity tied to land value and food production. It’s a patient strategy, but one that will need the fundamentals—tenants, crop yields, and water access—to cooperate moving forward.

Management Team

Gladstone Land is led by a team with a strong background in real estate, finance, and agriculture—an essential mix for a farmland-focused REIT. At the top is David Gladstone, the founder and CEO, who brings decades of experience in asset management with a focus on income-generating real estate. His steady leadership and visibility across the company’s operations have been viewed as stabilizing, especially during uncertain market conditions.

Supporting him is a tight-knit group of professionals with deep knowledge of agricultural leasing, acquisitions, and capital strategy. Their approach has been straightforward: grow the portfolio through disciplined acquisitions, lock in solid tenants with long-term leases, and manage debt carefully. This isn’t a team chasing aggressive expansion; instead, they focus on predictable income and portfolio quality. That discipline has been particularly noticeable as the company shifted its focus from rapid growth to stabilization over the past year. The consistency of the leadership team and their hands-on management style give investors a sense of confidence, even in the face of operating headwinds.

Valuation and Stock Performance

Gladstone Land’s stock price has taken a hit, dropping roughly 29 percent over the past twelve months. Shares recently closed at $9.38, well off the 52-week high of $15.36. Despite the decline, the company’s real estate value has held up. With a book value per share of $18.99, the stock is trading at a significant discount—roughly half of its stated asset value.

That kind of discount draws attention, particularly when the underlying assets are essential-use farmland with long-term leases. It’s a sign the market is either pricing in some operational weakness or simply penalizing all REITs for macroeconomic conditions, especially interest rates. Either way, LAND is now valued at a price-to-book ratio of 0.49, which puts it in deeply undervalued territory by most traditional metrics.

Enterprise value to EBITDA currently sits around 12x—reasonable for a REIT and in line with farmland’s historically lower turnover and slower appreciation. The stock’s yield, which hovers near 6 percent, is a compelling draw for income investors, but the share price will likely remain under pressure until there’s clearer improvement in rental income or the broader rate environment eases.

The company’s niche focus on farmland means it’s often overlooked by large institutions, which can limit liquidity and create more pronounced movements when sentiment shifts. That said, its consistent dividend and defensive asset base give it long-term appeal, even if short-term trading feels choppy.

Risks and Considerations

Farmland is often viewed as a safe haven, but that doesn’t mean there aren’t risks. For Gladstone Land, tenant performance is a key vulnerability. A few underperforming or defaulting tenants can have an outsized impact on revenue, particularly when rent escalations or participation income fall short of expectations. Management has acknowledged these challenges, noting that several properties are currently vacant or dealing with payment issues.

Commodity prices also play a quiet but powerful role. While LAND doesn’t grow crops itself, its tenants do—and when crop prices fall, especially for items like almonds or berries, it affects tenant profitability and lease negotiations. That can reduce variable rent income and potentially delay lease renewals.

Water access is an ongoing structural concern. In regions like California and Arizona, where water rights are critical to farm viability, long-term lease value can hinge on water availability. LAND has moved to acquire water assets and mitigate this risk, but it’s a permanent part of the landscape that requires close attention.

Interest rates pose another concern. Although most of LAND’s debt is fixed-rate, elevated borrowing costs have dampened acquisition activity and could create headwinds when refinancing becomes necessary. The company’s capital structure is still manageable, but persistently high rates will eventually squeeze margins if income doesn’t rise in tandem.

There’s also the matter of scale. With a relatively small market cap and lower daily trading volume, LAND’s stock can be more volatile and harder to enter or exit efficiently. That doesn’t affect long-term fundamentals, but it’s something to consider for investors who might need liquidity or are concerned about short-term swings.

Final Thoughts

Gladstone Land stands out in the REIT universe for doing something few others do—owning and leasing farmland tied to food production. For dividend-focused investors, it brings real asset exposure with steady income, and its monthly payout rhythm sets it apart from the typical quarterly dividend cycle.

It’s been a challenging year. Revenue is down, tenant issues have surfaced, and the stock has sold off sharply. But the portfolio is still solid, the dividend has held, and the company continues to adjust with an eye on stability over growth. Whether through re-leasing properties, exploring direct operations, or securing more water rights, management appears intent on addressing problem areas rather than ignoring them.

What happens next will hinge on execution. If the company can bring underperforming assets back online, maintain stable lease income, and hold interest costs in check, it has a good chance of regaining investor confidence. For now, it remains a unique option for those looking to add income-producing farmland to their portfolio—quiet, steady, and grounded in the basics of land and agriculture.