Key Takeaways

💵 Gilead offers a forward dividend yield of 3.23% with nine consecutive years of growth, supported by a conservative payout ratio and consistent dividend increases.

💰 Free cash flow remains strong at $9.95 billion over the trailing twelve months, comfortably covering dividend payments and supporting ongoing R&D investments.

📊 Analysts maintain a moderately positive outlook with a consensus price target of $110.55, reflecting confidence in Gilead’s earnings power and future pipeline potential.

Last Update 5/7/25

Gilead Sciences (GILD) has established itself as a financially solid, dividend-paying biopharma leader, with a strong foundation in HIV treatments and expanding efforts in oncology and inflammation. Backed by steady free cash flow, shareholder-friendly capital allocation, and a management team focused on long-term growth, the company remains a consistent performer.

With products like Biktarvy continuing to lead HIV market share, a healthy pipeline including lenacapavir and Trodelvy, and dependable cash returns to investors, Gilead balances reliable income with strategic reinvestment—making it a meaningful presence in dividend-focused portfolios.

Recent Events

Gilead’s stock took a hit on May 6, closing at $97.88 after a 4.8% dip. That drop came on the heels of its Q1 2025 report, where revenue came in slightly below expectations, ticking down 0.3% year-over-year. While not disastrous, that modest decline was enough to stir some short-term negativity in the market.

But context matters here. Even with that slight revenue softness, Gilead posted $28.74 billion in trailing twelve-month sales. Its free cash flow? A rock-solid $12.71 billion over the same period. That kind of financial strength doesn’t get shaken easily. The company isn’t bleeding money or restructuring just to stay afloat—it’s running a mature, profitable operation.

Shares are now trading well below the 50-day moving average of $108.68. To some, that might signal a buying opportunity. But for dividend-focused investors, what really matters is the long-term story, and Gilead’s commitment to returning capital remains strong.

Institutional ownership sits near 89%, and short interest is minimal. There’s clearly a level of trust among professional investors that’s worth noting.

Key Dividend Metrics

💰 Dividend Yield: 3.23%

📈 5-Year Average Yield: 3.97%

📅 Ex-Dividend Date: June 13, 2025

📤 Payout Ratio: 65.13%

💵 Forward Annual Dividend: $3.16

🔁 Dividend Growth: 9 years running

💪 Free Cash Flow Coverage: Extremely healthy

📉 Beta (5Y): 0.28 — a steady hand in volatile markets

Dividend Overview

One of the things that makes Gilead an attractive name for income investors is how comfortably it funds its dividend. With a forward yield just over 3%, the payout is competitive, but more importantly, it’s sustainable. The company only pays out about two-thirds of its earnings, leaving room for both growth and defense.

Since initiating its dividend in 2015, Gilead has never missed an annual increase. It’s not trying to win any races in dividend growth, but it shows up, year after year, with a slight bump—exactly what many income investors want from a healthcare name. No drama, no risk of dividend cuts hanging overhead.

The yield also holds up nicely against the broader market, especially considering how conservative Gilead’s business profile has become. With a beta of just 0.28, the stock doesn’t whip around with every headline or rate shift. That kind of stability makes dividend reinvestment smoother, and long-term compounding more predictable.

Dividend Growth and Safety

There’s no dividend without cash, and Gilead has plenty of it. The company ended the most recent quarter with just under $8 billion in cash and a current ratio of 1.3. Even though total debt stands at $25 billion, it’s more than manageable given the $13.6 billion EBITDA and over $10 billion in operating cash flow.

And this is not a company stretching to hit those numbers. It’s posting returns on equity of over 32%, and return on assets of 12%. These are not artificially inflated metrics—they reflect a highly efficient machine that knows how to convert revenue into real profit.

Free cash flow coverage of the dividend is particularly strong. Gilead only needs a fraction of its cash flow to cover the payout. That means even in a tough year or two, the dividend isn’t likely to be in danger. Management has options, and they’ve shown time and again that supporting shareholder returns is a top priority.

The business mix is another point of strength. While HIV therapies still generate the bulk of revenue, there’s more happening in the background. Oncology, inflammation, and liver disease treatments offer additional growth legs—and because they’re at different stages of maturity, they don’t all move in sync. That kind of diversification builds resilience into the business, which feeds directly into dividend reliability.

So while some may see Gilead as a slow-moving stock, dividend investors see something else entirely—a financially sound, cash-rich operation that prioritizes capital returns, invests wisely, and doesn’t get caught up in fads.

And that’s exactly the kind of story you want backing your income.

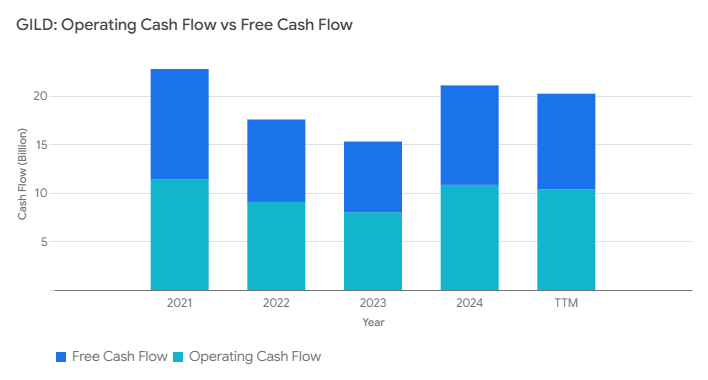

Cash Flow Statement

Gilead Sciences continues to demonstrate strong cash generation, with $10.37 billion in operating cash flow over the trailing twelve months. This is consistent with prior years, highlighting the company’s ability to maintain high profitability even in the face of moderate revenue shifts. Free cash flow also remains robust at $9.95 billion, providing more than enough coverage for dividends and signaling efficient capital management. While the latest figure dipped slightly from the previous year’s $10.30 billion, it’s still well above the levels seen in 2022 and 2021.

On the investing side, outflows were modest at $1.66 billion over the TTM, reflecting disciplined deployment of capital rather than aggressive expansion. Financing cash flow came in at negative $5.50 billion, largely due to debt repayments and shareholder returns, including share buybacks. The end cash position stands at $7.93 billion—down from $9.99 billion a year ago, but still solid given the scale of capital returned. Gilead isn’t stretching to support its dividend; it’s doing so from a position of financial strength, backed by consistent free cash flow and a stable cash reserve.

Analyst Ratings

Gilead Sciences has recently seen a mix of analyst activity, reflecting a combination of confidence in its fundamentals and caution regarding sector headwinds. 🟢 DZ Bank upgraded the stock from “hold” to “buy” with a new price target of $108.00. This shift came after evaluating Gilead’s solid financial footing and continued momentum in its HIV drug pipeline. 🏥 JPMorgan also raised their target from $120.00 to $130.00, citing strength in recent earnings and signs of growth from its oncology investments. Meanwhile, Piper Sandler nudged their price objective up from $105.00 to $110.00, noting stable recurring revenue and margin resilience.

🔴 On the flip side, Oppenheimer lowered its target slightly from $132.00 to $125.00, though it maintained an “outperform” rating. Their more conservative target reflects expected pricing pressure in the HIV space and competitive dynamics. Needham held its “neutral” stance, not ready to commit to an upgrade just yet, pointing to regulatory uncertainty and a cautious view on pipeline execution.

📊 As of now, the average consensus price target for Gilead sits around $110.55. Analyst expectations range from a low of $90.00 to a high of $140.00, implying moderate upside from current trading levels. That midpoint target reflects a balance between Gilead’s reliable cash flow engine and ongoing questions about long-term growth catalysts.

Much of the analyst enthusiasm centers on advancements like lenacapavir, a long-acting HIV treatment showing real promise. Pair that with Gilead’s strong cash position and shareholder-friendly policies, and there’s a reason analysts remain broadly constructive. Still, the presence of cautious voices in the mix reminds investors that the road ahead could include competitive pressure and regulatory hurdles.

Earning Report Summary

Stable Results with Pockets of Growth

Gilead’s latest earnings report for Q1 2025 delivered a mixed but overall stable performance. Total revenue came in at $6.7 billion, basically flat compared to the same quarter last year. What stood out, though, was the continued strength in the HIV portfolio. Sales in that segment rose 6% to $4.6 billion, with Biktarvy driving the charge. That single product brought in $3.1 billion, up 7% from a year ago. Descovy also posted a solid gain, climbing 38% to $586 million.

Their liver disease treatments added some lift, increasing 3% to $758 million. But as expected, COVID-related revenue continued to decline. Veklury sales dropped 45% to $302 million, reflecting the lower number of hospitalizations and less demand overall.

Challenges in Oncology and Cell Therapy

It wasn’t all smooth sailing. The oncology segment took a slight step back, with Trodelvy sales dipping 5% to $293 million. This seemed to be tied more to timing issues and pricing factors rather than any demand drop. On the cell therapy side, Gilead reported a 3% decrease overall. Yescarta managed a modest 2% increase, while Tecartus fell 22%, making it a bit of a mixed bag.

Still, even with some of these pressures, Gilead posted a notable turnaround in earnings. EPS landed at $1.04, a big swing from the $3.34 loss during the same quarter last year. Excluding some of the noise from acquisitions and impairments, their adjusted EPS came in at $1.81. That’s a strong showing. Operating cash flow also remained solid at $1.8 billion.

CEO Comments and Looking Ahead

Gilead’s CEO, Daniel O’Day, struck an optimistic tone about how the quarter played out. He pointed to solid execution across their commercial operations and tight expense control. What really energized the outlook were some promising signs from their pipeline. O’Day highlighted the recent Phase 3 data showing success for Trodelvy when combined with pembrolizumab in treating triple-negative breast cancer.

Another big milestone is just around the corner. The company expects an FDA decision by June on lenacapavir, its long-acting injectable for HIV prevention. That could mark a major step forward in expanding Gilead’s HIV portfolio beyond treatment into prevention.

Guidance Still on Track

Despite a few headwinds, Gilead is sticking with its full-year guidance. It’s expecting between $28.2 billion and $28.6 billion in product sales, and non-GAAP EPS in the $7.70 to $8.10 range. Leadership continues to lean into growth areas like oncology and inflammation, while keeping the core HIV franchise strong.

Management Team

Gilead Sciences is led by Chairman and CEO Daniel O’Day, who has been guiding the company since 2019. Under his leadership, Gilead has made strategic moves to expand beyond its core antiviral business, placing greater emphasis on oncology and immunology. His approach has focused on long-term value creation rather than short-term market reactions, helping to position the company for durable growth.

The broader leadership team brings decades of experience in pharma and biotech. Andrew Dickinson serves as Chief Financial Officer, managing the company’s capital allocation and financial strategy. Dietmar Berger, the Chief Medical Officer, plays a central role in clinical development and regulatory strategy. Johanna Mercier leads commercial operations, overseeing the global rollout of therapies. Additional leadership includes experts across research, manufacturing, HR, and legal, reflecting a well-rounded bench capable of handling both scientific innovation and operational scale.

Valuation and Stock Performance

Gilead’s stock is currently trading near $98, giving the company a market value of about $122 billion. The share price has seen some volatility over the past year, reacting to shifts in COVID-related revenue, clinical trial updates, and broader sector movements. Despite those fluctuations, Gilead has continued to deliver stable results, particularly in its HIV and liver disease segments.

From a valuation standpoint, the stock appears reasonably priced. With a forward P/E ratio of 12.36, Gilead trades at a discount to many large-cap peers in the biotech space. The price-to-sales ratio sits at 4.29, and the price-to-book ratio is 6.39, which suggests that the market values the company’s earning power and IP portfolio, rather than its physical assets. The enterprise value to EBITDA ratio of 17.55 implies a business generating solid operating income, but not without investor expectations for future growth.

Analyst sentiment remains moderately positive. The consensus price target is around $110.55, with individual estimates ranging from $90 on the low end to $140 on the high end. While not an explosive upside, this reflects steady confidence in Gilead’s earnings potential and long-term strategy.

Risks and Considerations

Gilead operates in a high-stakes environment where regulatory, competitive, and operational risks are part of the landscape. One of the bigger concerns is product concentration. A large share of revenue comes from a handful of drugs—most notably Biktarvy—so any disruption, whether from generics or new competition, could put pressure on earnings.

The oncology portfolio, while promising, hasn’t yet reached the level of consistent performance seen in HIV. Drugs like Trodelvy are still scaling, and success in this area is crucial for diversifying the revenue base. Meanwhile, cell therapies remain lumpy in terms of sales, which could continue to weigh on investor sentiment.

Another area worth watching is debt. Gilead carries a total debt-to-equity ratio north of 130%, which is on the higher side for a company of its size. Although strong cash flow helps manage the debt load, rising interest rates or changes in capital markets could present challenges if the company needs to refinance or fund acquisitions.

Pricing pressure is another wildcard. As governments and insurers push back on drug costs, particularly in the U.S. and Europe, profit margins could be squeezed. Reimbursement changes or legislative shifts might not show immediate impact, but they often ripple through over time.

Final Thoughts

Gilead remains a reliable name in the biopharma world. Its leadership team has taken thoughtful steps to move beyond its antiviral legacy, building momentum in oncology and inflammation while reinforcing its dominant position in HIV treatment. Financially, the business is in good shape, consistently generating strong cash flow and maintaining a solid dividend.

There are, of course, headwinds. Competitive threats, regulatory dynamics, and pipeline execution risks are all part of the picture. But Gilead has proven that it can weather cycles and still deliver for shareholders. For those with a long-term horizon and a focus on income, it continues to offer a mix of stability and potential.