Key Takeaways

📈 Getty offers a 6.67% dividend yield with a 13-year history of steady growth, supported by reliable lease income and disciplined capital allocation.

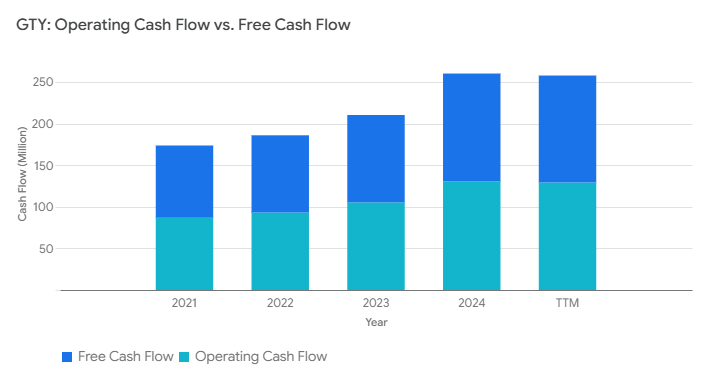

💵 Operating and free cash flow remain strong, with TTM free cash flow at $128.5 million, ensuring consistent dividend coverage despite limited capital expenditure.

🟢 Analysts maintain a consensus price target of $32.40, with recent upgrades highlighting strong rent performance and stable FFO growth.

Last Update 5/7/25

Getty Realty Corp. (GTY) is a net lease REIT focused on convenience stores, gas stations, and automotive retail properties across 42 states, offering investors consistent income through long-term, triple-net leases with high-occupancy, creditworthy tenants. With a market cap of \$1.56 billion and a dividend yield above 6.5%, the company blends predictable cash flow with disciplined growth.

Led by a seasoned management team, Getty continues to execute on a targeted acquisition strategy, expanding its portfolio while maintaining conservative financial practices. Its stable cash flow, proactive debt management, and high dividend payout make it a dependable choice for income-focused investors.

Recent Events

Shares of GTY have pulled back a bit this year. On May 6, the stock closed at $28.19—off from its 52-week high of $33.85, but still a good distance from the low of $25.70. It’s also trading under its 50-day and 200-day moving averages, which sit at $29.72 and $30.89, respectively. That technical dip reflects pressure from broader market conditions, particularly rising interest rates, which tend to weigh on real estate investment trusts across the board.

From a business standpoint, though, Getty has kept things steady. Revenue in the most recent quarter (ending March 2025) was up 6.9% year over year. Operating margins stayed strong at just over 52%, which is impressive in today’s inflation-sensitive environment. Net income came in at $66 million, but earnings per share saw a slight dip, down 11.6% from the same quarter last year. While not ideal, this pullback doesn’t seem structural—more a reflection of timing and broader macro headwinds.

Getty also continues to generate strong cash. Levered free cash flow was around $158 million, while EBITDA came in at $169 million. These are healthy figures for a company of this size, and they help support what’s arguably the most important part of Getty’s value proposition: the dividend.

Key Dividend Metrics 🏛️💵📈📊

🏛️ Forward Dividend Yield: 6.67%

💵 Annual Dividend Rate: $1.88 per share

📈 Payout Ratio: 153.3%

📊 5-Year Average Yield: 5.53%

📆 Next Dividend Date: July 10, 2025

🔄 Ex-Dividend Date: June 26, 2025

Dividend Overview

Getty currently yields 6.67%, a full percentage point higher than its five-year average. That makes the current payout particularly attractive, especially as the share price has softened a bit. This isn’t a stock that relies on speculation or aggressive growth; it’s built around delivering consistent, reliable income.

Now, the payout ratio—over 150%—might raise some red flags if you’re used to evaluating typical companies. But with REITs, that number can be misleading. Because of their structure, REITs distribute the majority of their taxable income to shareholders, often exceeding traditional earnings-based payout benchmarks. What really matters is cash flow, and Getty has shown it has more than enough to keep the checks coming.

With quarterly dividends that arrive like clockwork and a yield that beats most fixed income alternatives, Getty delivers what many dividend investors are looking for: consistent cash, with relatively low drama.

Dividend Growth and Safety

One of the hallmarks of a dependable dividend stock is its history of growth, even if that growth is modest. Getty has raised its dividend for 13 straight years. It’s not flashy—typically a penny or two at a time—but it’s reliable. That kind of consistency reflects the company’s conservative approach, especially in managing its balance sheet.

Getty is carrying about $919 million in debt, and its debt-to-equity ratio is just under 96%. That sounds high, but for a REIT it’s not out of the ordinary. What’s important is whether the company can service that debt comfortably—and with nearly $130 million in operating cash flow and strong coverage from rental income, the answer appears to be yes.

Return on equity is 7.23%, and return on assets is 3.60%—both middle-of-the-road, but consistent with a low-risk, income-generating business model. These are not numbers that scream rapid expansion, but that’s not the point here. Getty’s mission is steady returns and cash flow, not growth at all costs.

Institutional investors seem to agree. Around 88% of shares are held by institutions, while insiders hold just under 8%. That’s a solid mix—professionals see it as a stable allocation, and insiders have enough skin in the game to care about long-term outcomes.

Another factor worth pointing out is Getty’s beta: just 0.86. That means the stock tends to move less than the broader market. In a world where volatility is becoming a norm, a lower beta is a comfort for those prioritizing preservation of capital and steady income.

In short, Getty isn’t trying to be exciting. Its appeal is in the stability of its cash flows, the reliability of its tenants, and the straightforwardness of its dividend strategy. For investors who are less interested in quarterly surprises and more interested in their next quarterly payout, that’s a business model that still works.

Cash Flow Statement

Getty Realty’s cash flow profile over the trailing 12 months shows a company generating solid operating performance while actively investing in its property portfolio. Operating cash flow came in at $129.2 million TTM, slightly lower than the prior year but still well above levels seen in 2022 and 2021. Free cash flow closely mirrors this, reaching $128.5 million—an indication of low capital expenditure needs and a capital-light business model typical of triple-net lease REITs. Even with rising interest payments, which totaled $38.4 million, Getty’s operations comfortably support both debt servicing and dividend distributions.

On the investing side, outflows remain substantial at $174.5 million, consistent with Getty’s strategy of steady property acquisitions and occasional redevelopment. Financing cash flows turned positive at $42.7 million, supported by net debt issuance. The company issued $676 million in debt and repaid $568.8 million, a clear sign of refinancing activity aimed at managing maturity schedules or interest exposure. Despite this financial activity, cash on hand stands at $10.4 million—enough to manage near-term obligations, though not a cushion that implies any excess liquidity. Overall, the company is putting capital to work while keeping cash flow strong and consistent.

Analyst Ratings

🟢 Getty Realty Corp. (GTY) has recently seen a mix of analyst opinions that point to both confidence in its core operations and caution surrounding the broader REIT space.

🟢 Back in October 2024, one of the major firms upgraded GTY from Neutral to Buy, increasing the price target from $31 to $34. The move came on the heels of strong earnings and consistent rent collection across its portfolio. Analysts pointed to the company’s reliable tenant base, long lease terms, and focus on essential retail locations like gas stations and convenience stores—sectors that have remained resilient even through inflationary pressure. The view was that Getty offered a dependable income stream at a time when many REITs were seeing more volatility.

🟡 More recently in March 2025, another large firm initiated coverage on the stock with a Neutral rating and a $32 price target. While they acknowledged Getty’s financial strength and operating consistency, they were a bit more cautious due to macroeconomic conditions. Rising interest rates and shifting capital flows across the REIT universe were noted as risks. The takeaway wasn’t negative—just measured, with a wait-and-see approach on how the interest rate picture evolves.

📈 The current consensus price target stands around $32.40, suggesting moderate upside from current levels. Overall, analysts seem to agree that GTY is a stable income-focused REIT, but its near-term growth may be tethered to broader market conditions more than company-specific issues.

Earnings Report Summary

Solid Start to 2025 Despite Profit Dip

Getty Realty Corp. kicked off 2025 with a performance that balanced steady growth with a few margin pressures. For the first quarter, net income came in at $14.8 million, or about $0.25 per share. That’s down a bit from last year’s $0.30, but not unexpected given the broader real estate environment and higher interest costs rolling through the system.

The more important numbers for a REIT like Getty are funds from operations—those ticked higher. FFO came in at $0.56 per share, up from $0.53, and AFFO reached $0.59, compared to $0.57 the same time last year. That 3.5% growth in AFFO shows that underneath the earnings dip, the cash-generating engine is still running strong.

Rent Growth and Portfolio Strength

Rental income jumped by 13% year-over-year to $50.6 million. That growth came from a mix of new acquisitions and built-in rent bumps that were scheduled to kick in. Getty’s properties are still nearly full, with a 99.7% occupancy rate and a weighted average lease term of 10 years. Long leases and low turnover keep the cash flow steady, even in a tougher macro backdrop.

They also stayed active on the investment front. During the quarter, Getty deployed $10.9 million across six new properties, and the returns are solid—starting yields near 7.8%. The company has also teed up a $110 million pipeline of deals that will expand its footprint even further, all focused on convenience and automotive retail.

Managing Debt and Looking Ahead

One of the more reassuring points in the update was around the company’s debt. Getty wrapped up refinancing all its debt maturities due in 2025, which clears the calendar of major payments until at least mid-2028. That gives them breathing room, and with $450 million in available liquidity, they’ve got the dry powder to keep investing or weather any near-term turbulence.

Management didn’t waver on their full-year outlook either. The team reaffirmed their 2025 AFFO guidance between $2.38 and $2.41 per share. That signals confidence in how the year is shaping up. The leadership emphasized that their niche focus—high-traffic, essential retail properties—is what continues to set them apart in a crowded REIT space.

In short, Getty’s first quarter was less about surprises and more about quietly executing. They kept the dividend well-supported, added quality assets, and reinforced their balance sheet. That’s the kind of steady approach income investors tend to appreciate.

Management Team

Getty Realty Corp. is guided by a leadership team with a long track record in real estate, finance, and legal oversight. Christopher J. Constant has been the President and CEO since 2016, having originally joined the company in 2010 as CFO. His background includes experience in corporate finance at firms such as ING Barings and Morgan Joseph, which has shaped his steady, fiscally conservative approach to managing the REIT.

Brian R. Dickman, who holds the role of Executive Vice President, CFO, and Treasurer, joined Getty in 2020. He brings years of experience from previous CFO roles at other REITs and financial management positions at companies like Intel. His focus has been on maintaining balance sheet strength and improving capital allocation.

Joshua Dicker, serving as General Counsel and Secretary, has been with Getty since 2008. With a legal background in corporate and real estate law, he oversees regulatory compliance and ensures operational decisions are made within a strong governance framework. Mark J. Olear, Chief Operating Officer, manages day-to-day real estate operations. With a background that includes leadership positions in retail development, Olear helps guide acquisitions and redevelopment efforts across Getty’s national portfolio.

Together, the executive team has shown a consistent ability to manage the REIT through changing market conditions, with an emphasis on income stability, tenant quality, and measured growth.

Valuation and Stock Performance

Getty’s stock has experienced moderate fluctuations over the past 12 months. Currently trading near $28 per share, it sits below its 52-week high of $33.85 but well above the low of $25.70. While that may seem like a tight range, it reflects the defensive nature of the business and the predictability investors expect from a net lease REIT.

With a market cap of around $1.56 billion and enterprise value of approximately $2.47 billion, Getty remains a small-cap REIT with a stable capital structure. Its valuation is reasonable, with a trailing P/E ratio of just over 23 and a forward P/E around the same mark. The price-to-book ratio is 1.62, reflecting the premium the market places on reliable cash flow, while its EV/EBITDA multiple of 14.59 is in line with peers in the same sector.

What continues to attract investors is the dividend. Getty’s current yield is 6.82 percent, comfortably above historical averages and well above most fixed income alternatives. The payout ratio may appear high at over 150 percent, but that’s consistent with REIT norms, especially those with dependable tenant relationships and long-term leases. The stock’s beta of 0.86 suggests low correlation to broader market volatility, which is another reason income investors continue to hold it through market cycles.

The analyst consensus price target sits at roughly $32.40, implying potential for modest capital appreciation in addition to the strong yield.

Risks and Considerations

Even with its strengths, Getty isn’t without risks. The most obvious is its concentration in auto-related real estate—primarily gas stations and convenience stores. As the economy shifts toward electric vehicles and more efficient transportation options, some locations could face declining relevance. Getty has begun adapting its portfolio to account for this, but the pace of industry change remains something to monitor.

Another major factor is interest rates. Like all REITs, Getty relies on debt to finance growth. Rising rates can put pressure on spreads and make refinancing more expensive. To the company’s credit, it recently refinanced all of its 2025 debt maturities and has no major obligations due until 2028, giving it a bit of a buffer.

Tenant concentration also needs to be watched. While Getty works with a broad set of operators, a large portion of its rent comes from top tenants. If one of those were to experience financial strain or restructure leases, it could have a ripple effect on revenue. Getty’s average lease term is long, and renewal risk is low in the short term, but concentration is still a structural factor.

Environmental risks come with the territory in retail and fuel-related properties. There’s always the possibility of legacy contamination or regulatory changes affecting property use. Getty does perform extensive due diligence before acquisitions, and to date has managed these risks effectively.

Final Thoughts

Getty Realty continues to make its case as a dependable income vehicle. The business model isn’t complicated, and that’s part of its appeal—long-term leases with national tenants, relatively low capital expenditures, and consistent, tax-advantaged income to shareholders. The leadership team remains focused on long-term value rather than chasing trends, which shows in the REIT’s steady, deliberate expansion into complementary property types.

For dividend investors, the high yield, conservative debt profile, and low volatility profile make Getty a portfolio stabilizer more than a high-growth play. It won’t be the fastest mover, but it tends to deliver on what matters most to its shareholder base: predictable, quarterly cash.

With a stable outlook, manageable risks, and a strong leadership team at the helm, Getty Realty holds its place as a solid, no-frills option in the net lease space—particularly for those focused on reliable dividend income above all else.