Key Takeaways

💸 GD offers a 2.2% forward dividend yield with 33 consecutive years of growth and a conservative 40% payout ratio, making it a dependable income-generating stock.

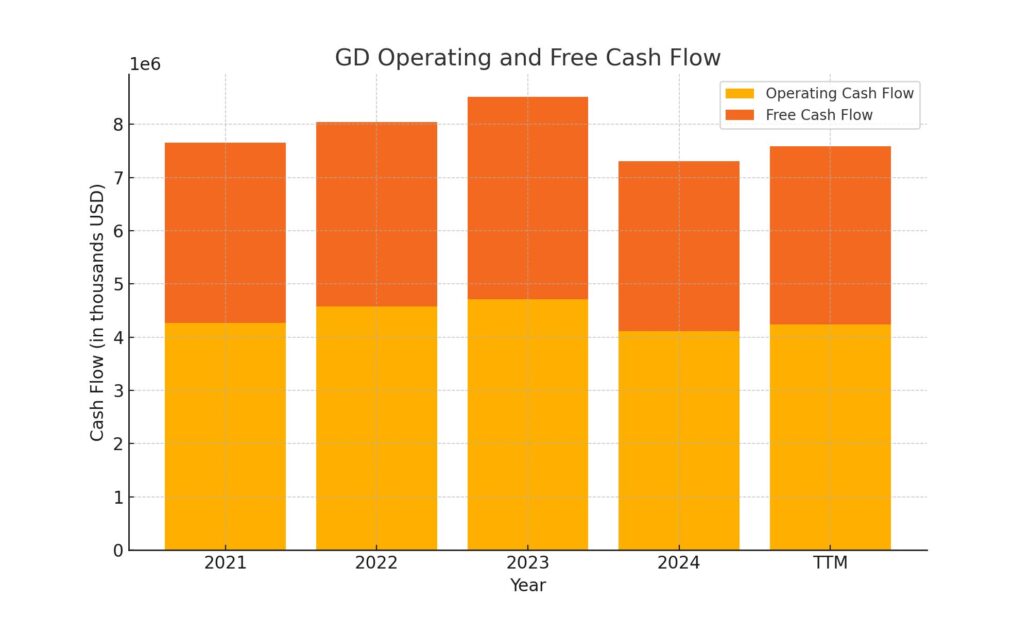

💼 The company generated $4.24 billion in operating cash flow and $3.34 billion in free cash flow over the trailing 12 months, providing strong coverage for dividends and buybacks.

📊 Analyst sentiment is cautiously optimistic, with a consensus price target near $293, reflecting confidence in GD’s earnings stability and long-term contract visibility.

Last Update 5/6/25

General Dynamics Corporation (GD) is a defense and aerospace company delivering reliable earnings, strong free cash flow, and consistent dividend growth. With a \$73 billion market cap and 33 consecutive years of dividend increases, GD combines a solid financial profile with a deep backlog of government contracts. Its operations span marine systems, combat technologies, and Gulfstream business jets, with recent quarterly results showing double-digit growth in both revenue and earnings.

The company maintains a forward dividend yield of 2.2%, supported by a sub-40% payout ratio and nearly \$3.34 billion in free cash flow over the trailing 12 months. General Dynamics’ leadership, led by CEO Phebe Novakovic, has focused on execution and capital discipline, while recent analyst ratings reflect cautious optimism with a consensus price target near \$293.

Recent Events

General Dynamics has been steadily moving forward, even if it’s not grabbing headlines every week. With its roots deep in defense and aerospace, the company continues to operate in a space where stability is the name of the game. The most recent quarter, ending March 30, 2025, showed impressive momentum—earnings rose more than 24% year-over-year, and revenue climbed nearly 14%, bringing the total to just over $49 billion for the trailing twelve months.

This growth isn’t coming from speculation or hype. It’s grounded in tangible, long-term contracts—government and defense orders that provide visibility well into the future. Demand for Gulfstream jets hasn’t wavered, and the marine and combat systems divisions are thriving thanks to a global defense environment that remains complex and fast-moving. General Dynamics doesn’t need to reinvent itself every few quarters. It does what it’s always done—deliver.

Key Dividend Metrics

🟢 Dividend Yield: 2.20%

🟡 Five-Year Average Yield: 2.27%

🟢 Annual Dividend Rate: $6.00

🟢 Payout Ratio: 39.97%

🟢 Dividend Growth Streak: 33 consecutive years

🟢 Next Dividend Date: May 9, 2025

🟡 Ex-Dividend Date: April 11, 2025

🟢 Last Split: 2-for-1 in March 2006

These numbers tell a story of dependability. That forward yield of 2.20% doesn’t jump off the page, but when paired with a sub-40% payout ratio and over three decades of uninterrupted increases, it adds up to something better than flash—it adds up to trust.

Dividend Overview

The dividend at General Dynamics is one of its most dependable traits. While some companies boast yields that are unsustainable or erratic, GD offers something more useful for patient investors: consistency. A 2.20% forward yield might not top the charts, but it’s steady, backed by a healthy balance sheet, and comes with low volatility. For long-term dividend investors, that’s exactly what you want to see.

With 33 straight years of growth, General Dynamics has solidified its place among the most reliable dividend payers in the market. That consistency doesn’t just come from profit alone. It’s supported by serious free cash flow—$4.24 billion in operating cash flow and $2.48 billion in levered free cash flow over the past year. The dividends paid over that same period? About $1.6 billion. Well covered, no stress.

The company’s financial position backs this up. It isn’t overleveraged. The total debt sits at around $11.5 billion, balanced by just over $1.2 billion in cash and a current ratio of 1.34. It’s not flush with cash, but it doesn’t need to be. This is a capital-intensive business that operates on the kind of multi-year contracts that most companies can only wish for. That financial stability is one reason GD can keep rewarding shareholders even when the broader market wobbles.

Another thing to like: the stock’s low beta of 0.50. It moves less than the broader market, which can be a relief for income investors who prefer steady cash flow to excitement. When paired with a yield over 2%, it’s clear that General Dynamics offers something solid in an often-uncertain world.

Dividend Growth and Safety

There’s nothing erratic or surprising about how General Dynamics handles its dividend. The growth rate over the last five years has hovered around 7%, and it’s been a smooth ride. It’s not showy, but that’s kind of the point—it’s dependable, and that reliability matters more than dramatic spikes.

Looking at the payout ratio, which is just under 40%, there’s no reason to think that growth can’t continue. EPS stands at $14.42 while the dividend payout is currently $6.00. That’s not just sustainable—it’s comfortably conservative. The company has room to keep boosting that payout, even if earnings growth cools a bit in the years ahead.

Capital allocation here is deliberate. The company isn’t loading up on debt to chase buybacks or acquisitions. It’s sticking to what it knows: delivering for governments, operating efficiently, and sharing the results with its shareholders. That approach has worked for decades, and it doesn’t look like it’s going to change anytime soon.

The most recent dividend was declared at $1.50 per share, with an ex-dividend date of April 11 and a payment date of May 9. Shareholders won’t be surprised—it’s the same dependable cadence they’ve come to expect. The streak continues, quietly but powerfully, and General Dynamics looks well-positioned to keep it going.

Cash Flow Statement

General Dynamics produced $4.24 billion in operating cash flow over the trailing twelve months, showing consistent generation of core cash from operations. This figure held close to the previous year and supports the company’s ability to fund both capital needs and shareholder returns without straining its finances. Free cash flow during the same period came in at $3.34 billion, slightly above last year’s $3.20 billion, reinforcing that GD remains an efficient converter of earnings into usable cash.

On the investment side, capital expenditures remained relatively controlled with $901 million in outflows. Financing activities showed a sizable net cash outflow of $3.13 billion, largely driven by debt repayments and dividend distributions. The company repaid $1.25 billion in debt during the year, while choosing not to issue new debt or equity, signaling a conservative and shareholder-friendly capital strategy. The ending cash balance stood at $1.24 billion, a decline from prior years, but still enough to provide flexibility without depending on external financing.

Analyst Ratings

🟡 General Dynamics has seen a mix of analyst actions recently, reflecting both confidence in its core defense operations and caution around its aerospace segment. 🔻 Morgan Stanley downgraded the stock from Overweight to Equal-Weight, adjusting the price target to $305 from $315. The decision was influenced by concerns over potential tariff headwinds affecting the Gulfstream business and risks associated with the Technologies segment, which comprises a significant portion of the company’s revenue and earnings.

🟢 Despite these concerns, other analysts have maintained or even adjusted their outlooks upward. 🔺 TD Securities raised its price target to $290 from $275, maintaining a Buy rating, citing the company’s strong defense backlog and consistent cash flow. 🛡️ Argus increased its price target to $295 from $280, pointing to the company’s efforts in boosting production efficiency and navigating supply chain challenges with better execution.

📈 The current analyst consensus places the average price target for General Dynamics around $292.88, which suggests a modest upside from where shares are trading now. This target reflects a balance between the dependable, contract-driven nature of its defense segment and some cautious optimism that its aerospace business will regain momentum in the quarters ahead.

Earning Report Summary

Strong First Quarter Performance

General Dynamics kicked off 2025 with a solid quarter, showing growth across the board. The company brought in $12.2 billion in revenue, which marked a healthy 13.9% increase compared to the same time last year. Net income came in at $994 million, translating to earnings of $3.66 per share, up more than 27% year-over-year. Margins also improved, with operating margin climbing to 10.4%, thanks to tighter execution and continued focus on efficiency.

Aerospace Leads the Charge

The Aerospace segment was the standout performer this quarter. Revenue for that division jumped over 45%, and operating earnings rose almost 70%. Those numbers were driven by stronger production levels and more deliveries, especially on the Gulfstream side. Leadership pointed to improved manufacturing flow and economies of scale as key reasons margins expanded to 14.3%—a solid leap from where they were a year ago. CEO Phebe Novakovic noted that this kind of performance is a result of consistent investment in processes and teams over time.

Steady Momentum in Defense

It wasn’t just aerospace doing the heavy lifting. All three defense units—Marine Systems, Combat Systems, and Technologies—delivered revenue growth. Marine Systems posted an 8% bump, reaching $3.6 billion, fueled in part by submarine production. Combat Systems saw a smaller but steady increase at 3.5%. Meanwhile, the Technologies division continued to build momentum, reporting a healthy book-to-bill ratio, showing that demand for its solutions remains strong. Together, these segments form a steady foundation that balances out the more cyclical nature of the jet business.

Backlog and Orders Provide Visibility

New orders for the quarter totaled $10.2 billion, pushing the total backlog to $88.7 billion. That’s a meaningful number for a company like General Dynamics, which thrives on long-term government contracts. When you factor in options and future estimates, the total potential contract value sits around $141.3 billion. That kind of pipeline gives a lot of confidence in the direction the company is heading.

Capital Allocation and Outlook

From a financial standpoint, the company used $148 million in operating activities this quarter, mostly tied up in working capital shifts. At the same time, it returned $383 million to shareholders in the form of dividends and repurchased $600 million worth of stock. The cash balance at quarter-end was $1.2 billion, with total debt just under $10 billion.

Looking forward, management struck a balanced tone. They see ongoing strength in defense, particularly as they continue hiring and expanding capacity. There’s also awareness of possible headwinds like tariffs and supply issues, especially in aerospace, but they appear well-positioned to navigate them. The plan seems to be steady execution, investment where needed, and letting the order book guide the next phase of growth.

Management Team

General Dynamics is led by Chairman and CEO Phebe Novakovic, who has held the top position since 2013. Her leadership style leans heavily on operational rigor and long-term planning. She’s earned a reputation for being both strategic and hands-on, helping the company navigate through industry cycles with a steady hand. Over the years, she’s overseen key investments in technology, workforce expansion, and production capacity—particularly across the company’s defense and aerospace operations.

Supporting her is a seasoned leadership team. Kimberly Kuryea, the Chief Financial Officer, plays a central role in maintaining the company’s financial health and capital allocation strategy. Jason Aiken, Executive Vice President of Technologies, brings deep operational experience, having previously served as CFO. Together, the executive team has built a stable culture that balances shareholder returns with forward-looking investments in growth.

Valuation and Stock Performance

As of early May 2025, General Dynamics stock trades around $270, giving the company a market cap near $73 billion. With a trailing price-to-earnings ratio of roughly 18.9 and a forward P/E closer to 18.3, valuation is in line with its long-term averages. It’s not a bargain-bin stock, but that’s to be expected with a business that delivers consistent results and predictable earnings streams.

The stock has moved within a fairly broad range over the past 12 months, hitting a high of $316.90 and a low of $239.20. These swings have mostly mirrored sector trends and investor sentiment tied to defense spending, interest rate expectations, and macro headlines. Despite this volatility, General Dynamics has continued to appeal to dividend investors with a 2.2% yield and a payout ratio under 40%. The company also bought back $600 million in shares recently, signaling confidence from management and a commitment to enhancing shareholder value.

Analyst consensus currently puts the price target at just under $293. That suggests moderate upside from where shares are now, though the more important takeaway is how tightly GD is valued based on its performance and reliability.

Risks and Considerations

While General Dynamics benefits from long-term defense contracts and a deep backlog, it’s not without risks. Shifts in U.S. or allied defense budgets could impact new awards or slow down certain programs. With elections looming and shifting priorities in Washington, this remains a variable to watch. There’s also exposure to international policies and shifting geopolitical alignments, which can either delay or fast-track certain global defense deals.

The aerospace division faces its own challenges. Supply chain bottlenecks and certification hurdles have created occasional pressure on production timelines, especially with new models. These kinds of issues aren’t uncommon in aircraft manufacturing, but they can influence both delivery schedules and profitability.

Labor is another area to watch. In the Marine Systems segment, which handles submarine production, contract talks have raised concerns about possible work stoppages. While management is working to avoid disruptions, the potential for short-term delays exists if agreements aren’t reached in a timely way.

Final Thoughts

General Dynamics stands out not because it’s flashy, but because it’s steady. It isn’t trying to reinvent itself every few quarters. Instead, it keeps doing what it does best—manufacturing complex systems, fulfilling high-value defense contracts, and returning capital to shareholders. The balance between its aerospace and defense units offers a cushion during sector slowdowns and provides a measure of diversification.

Leadership is experienced, the order book is deep, and financial discipline runs through every part of the business. It’s the kind of company that doesn’t need to chase headlines to generate value. As long as it continues executing on its backlog and adapting to shifts in defense and aviation trends, General Dynamics is positioned to remain a reliable name for long-term income and capital preservation.