Key Takeaways

📈 Garmin offers a 1.89% dividend yield with a healthy 39.5% payout ratio and consistent dividend growth supported by strong free cash flow and low debt.

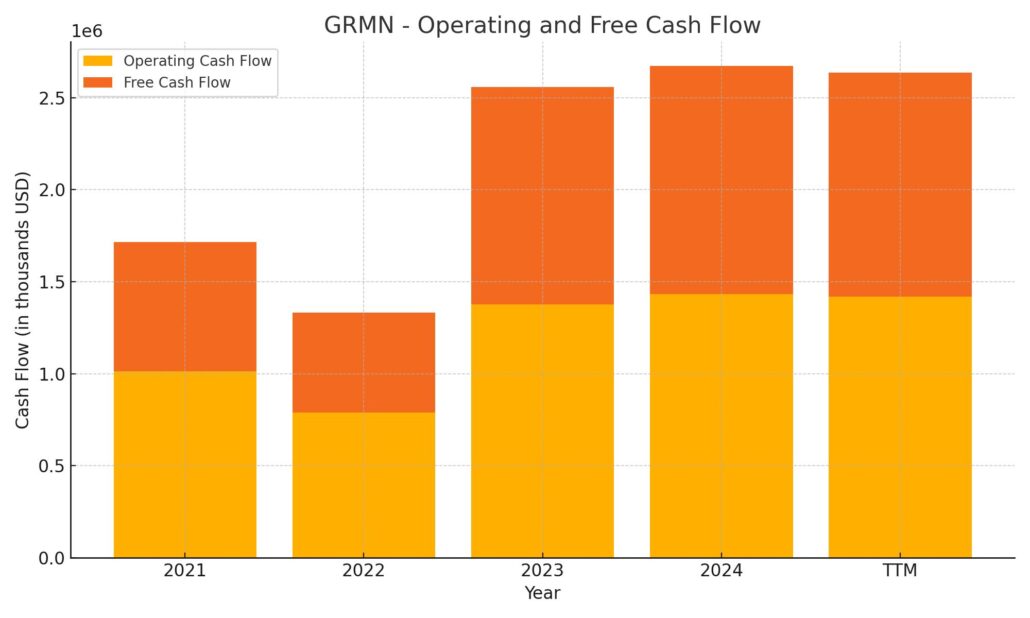

💵 Operating cash flow reached $1.42 billion TTM with free cash flow at $1.22 billion, reinforcing Garmin’s ability to fund dividends and strategic investments without leverage.

🧠 Analysts hold a neutral stance with a consensus price target around $195, citing strong growth in Outdoor and Auto OEM segments, balanced by cautious views on Fitness and Marine performance.

Last Update 5/6/25

Garmin Ltd. (GRMN) has built a reputation for dependable growth and steady execution across its diverse product lines. From smartwatches and adventure gear to aviation systems and marine tech, Garmin’s broad portfolio allows it to serve niche markets with precision. With a clean balance sheet, consistent free cash flow, and a focus on innovation, it stands out as a financially disciplined tech manufacturer that prioritizes long-term shareholder value.

Its management team, led by long-tenured CEO Clifton Pemble, continues to steer the company with a measured, strategic approach. Garmin’s dividend growth, strong cash reserves, and minimal debt load give it a solid foundation for weathering macroeconomic shifts while investing in future growth.

Recent Events

In its most recent quarter, Garmin continued to show why it’s earned its reputation for stability. The company brought in $6.45 billion in revenue over the trailing twelve months, up a strong 11% compared to last year. That growth came with healthy profitability: net margin hit nearly 23%, and return on equity was just a hair under 19%.

The company’s balance sheet stands out in a world where many tech firms are still digging themselves out of debt-fueled expansion. Garmin has just $178 million in total debt, a figure so small it barely registers next to its $2.67 billion in cash. Its debt-to-equity ratio is just 2.18%. That’s not just conservative — it’s rare.

Free cash flow came in strong, with $1.42 billion in operating cash flow and over $900 million in levered free cash flow. It’s the kind of dry powder that gives management flexibility — whether that means reinvestment, acquisitions, or simply continuing to pay a dependable dividend.

While the stock price has cooled a bit recently, hovering around $187 after peaking at $246, it remains well-supported. And with insider ownership over 15% and institutions holding nearly 57% of shares, the confidence in Garmin’s direction remains intact.

Key Dividend Metrics 📊

🧾 Dividend Yield: 1.89%

💰 Forward Annual Dividend: $3.60 per share

📈 5-Year Average Dividend Yield: 2.22%

🔁 Payout Ratio: 39.53%

📅 Next Ex-Dividend Date: June 16, 2025

💵 Last Dividend Paid: March 28, 2025

🛡️ Dividend Safety: Strong (low debt, high cash, consistent cash flow)

Dividend Overview

Garmin’s dividend isn’t the highest on the board, but it’s backed by real fundamentals. The current yield of 1.89% may not excite high-yield hunters, but for those looking for stability and longevity, it’s a different kind of value.

Since initiating its dividend back in 2012, Garmin has never wavered. No cuts, no drama. The $3.60 forward annual payout is well-covered by earnings, with a payout ratio sitting comfortably under 40%. That means the company retains plenty of earnings to reinvest in the business while still rewarding shareholders.

This isn’t a firm using dividends to distract from shaky fundamentals. Instead, it’s a company that’s rewarding patience, running a clean operation, and staying committed to long-term investors. The dividend is a reflection of a well-managed business, not a gimmick.

Dividend Growth and Safety

If there’s one thing Garmin’s dividend offers, it’s safety. With almost no debt and a war chest of cash, the company has options — and it doesn’t need to stretch to maintain its payout.

Over the past year, Garmin generated nearly $902 million in free cash flow. With around 192.5 million shares outstanding and a $3.60 dividend, that’s roughly $693 million in annual dividend obligations — a gap that leaves the company with financial breathing room. That kind of buffer is exactly what dividend investors like to see, especially during uncertain economic periods.

Garmin has also shown a steady hand when it comes to growing its dividend. It may not raise it every single year like clockwork, but the pattern has been clearly upward. The increases are measured, not flashy — but they come from a place of strength. That reflects a company more interested in building something sustainable than chasing headlines.

With earnings growing at a double-digit clip and revenue rising steadily, Garmin is building a solid case for continued dividend growth. The PEG ratio, a useful measure for judging growth vs. valuation, sits below 2.6 — suggesting earnings are still growing at a pace that supports more upside over time.

If you zoom out, Garmin’s five-year average yield is 2.22%, a bit above its current yield. That suggests the stock is trading a little higher than its historical yield range, possibly reflecting optimism around its fundamentals. Even so, the long-term setup remains favorable for dividend-focused investors. The payout may not make headlines, but it doesn’t need to. It just needs to keep showing up — quarter after quarter.

Cash Flow Statement

Garmin’s cash flow profile over the trailing twelve months reflects a company running with strong internal efficiency. Operating cash flow reached nearly $1.42 billion, slightly down from the previous year but still demonstrating consistent strength in core business operations. Free cash flow, an important figure for dividend investors, came in at about $1.22 billion — more than enough to comfortably cover dividend commitments while retaining flexibility for other uses.

On the investing side, Garmin spent just under $490 million, up from prior years, signaling a steady reinvestment into business development, technology upgrades, or infrastructure. Financing cash flow remained negative at roughly $675 million, reflecting consistent outflows likely tied to dividend payments and share repurchases rather than new debt. With no debt issuance or repayments reported, Garmin continues to lean on internal capital rather than borrowed funds. The company’s ending cash position rose to $2.18 billion, up over $100 million from the prior year, reinforcing its financial stability.

Analyst Ratings

Garmin has recently seen a mix of analyst activity, with views split between confidence in its growth potential and caution around some segment-specific headwinds. 📊 The average 12-month price target sits around $194.80, with a wide range from a low of $152 to a high of $285. This spread reflects the contrasting opinions across the street about where Garmin is headed next.

🏔️ One of the more bullish voices is from Tigress Financial, which raised its target to $285 while maintaining a strong buy rating. This optimism is largely driven by Garmin’s standout performance in its Auto OEM and Outdoor divisions, which have shown clear momentum. These areas are proving to be key growth engines as consumer interest in integrated vehicle tech and adventure gear continues to rise.

📉 On the other side, Barclays remains more reserved, lowering its target to $152 and holding an underweight rating. Their concern lies with the Marine and Fitness segments, which haven’t kept up the pace. Slower demand and tighter margins in these categories are creating a drag on overall performance, even as other units surge ahead.

⚖️ JPMorgan has taken a more balanced approach, adjusting its target to $215 with a neutral rating. The firm noted Garmin’s solid revenue results but also pointed out some pressure on EPS, which has led them to a wait-and-see stance.

📝 The overall consensus rating is hold, suggesting that while Garmin has pockets of strength, investors should be mindful of the uneven performance across its product lines. For now, analysts are watching how Garmin navigates softness in some areas while continuing to build on its strengths.

Earning Report Summary

Garmin kicked off 2025 with a strong first quarter, showing solid momentum across much of its business. Revenue came in at $1.54 billion, up 11% from the same time last year. That top-line growth wasn’t just broad-based—it came with healthy margins too. Gross margin landed at 57.6%, and the company posted an operating margin of 21.7%, which helped push operating income to $333 million. Earnings per share climbed to $1.72 on a GAAP basis, with adjusted EPS at $1.61, marking a 13% gain over the prior year.

Segment Highlights

Fitness saw a nice boost, with revenue growing 12% to $385 million. Garmin leaned into product updates, including a new vívoactive 6 and the rollout of its Garmin Connect+ service, which brings smarter health tracking and personalization to users. The outdoor category delivered even stronger results, jumping 20% to $438 million. Popular models like the Instinct 3 and Descent G2 watches were in high demand.

Aviation moved forward with modest gains—up 3% to $223 million—largely on the back of steady OEM sales. The marine business dipped a bit, down 2%, coming in at $319 million. Management noted this was mainly due to the timing of promotions, not a fundamental weakness. On the bright side, the auto OEM segment posted the strongest growth, up 31% to $169 million, thanks to increased demand for Garmin’s in-vehicle domain controllers.

Leadership Perspective and Outlook

Garmin kept its full-year EPS guidance unchanged at $7.80, even while raising its revenue forecast to $6.85 billion, a 9% lift from last year. While the earnings outlook stays steady, it’s clear the company is keeping an eye on some external factors—tariffs, for instance, could add as much as $100 million in costs this year. That said, they’re also expecting foreign exchange to help balance things out, and internal strategies are in place to manage through the added expense.

CEO Cliff Pemble emphasized how Garmin’s vertically integrated structure and wide product range continue to give it a real advantage. The business doesn’t rely too heavily on any one segment, which gives it the flexibility to adjust when certain markets soften or face pressure.

Cash Position and Capital Allocation

Garmin ended the quarter in great shape financially, holding nearly $3.9 billion in cash and marketable securities. Free cash flow was strong at $381 million for the quarter. Shareholders saw their share of returns, with the company paying out $145 million in dividends and buying back $27 million in stock. Leadership made it clear they’re committed to ongoing investment in innovation while maintaining shareholder-friendly practices.

All in all, Garmin’s start to the year reinforces its position as a stable, cash-generating business with a clear strategy and healthy discipline on both the growth and capital management fronts.

Management Team

Garmin’s leadership is led by CEO Clifton Pemble, a long-serving executive who has helped shape the company’s direction for over three decades. Having been with Garmin since 1989, Pemble stepped into the CEO role in 2013 and has since overseen a period of continued innovation and diversification. Under his leadership, Garmin has expanded far beyond its original GPS devices, branching successfully into fitness, aviation, marine, and automotive segments.

Supporting Pemble is a stable executive team. Patrick Desbois and Brad Trenkle serve as Co-Chief Operating Officers, each bringing deep expertise from within Garmin’s core businesses. Desbois focuses on operations and technology infrastructure, while Trenkle leads product strategy in the outdoor and consumer fitness spaces. Chief Financial Officer Doug Boessen brings a disciplined approach to Garmin’s financial strategy, ensuring the company’s cash-rich, low-debt profile remains intact. Together, the leadership team has proven to be consistent and forward-thinking, balancing product innovation with careful capital allocation and long-term growth.

Valuation and Stock Performance

Garmin’s stock has seen a bit of a pullback after hitting its 52-week high of $246.50 earlier in the year. As of early May, shares are trading around $187, representing a notable drop but not an alarming one. This move reflects both broader tech sector volatility and shifting investor sentiment after an extended run-up. Despite the retreat in price, Garmin’s fundamentals remain healthy.

The company currently trades at a forward price-to-earnings ratio of around 24.5, which is above the market average. However, Garmin’s clean balance sheet, strong free cash flow, and consistent earnings growth make a case for that premium valuation. With a market capitalization near $36 billion and a return on equity just above 19%, investors are still recognizing the company’s ability to deliver value over time.

Consensus among analysts is relatively neutral, with an average 12-month price target hovering near $195. Opinions differ depending on which segments analysts expect to outperform. Some see promise in Garmin’s expanding auto and outdoor segments, while others remain cautious about competition in the wearables market and potential macroeconomic challenges that could impact consumer spending.

Risks and Considerations

Like any company, Garmin faces a range of business risks. One of the more pressing concerns is the impact of global trade dynamics. With manufacturing and supplier relationships spanning multiple countries, including China and Taiwan, any major disruptions from tariffs or geopolitical tensions could weigh on margins and production timelines.

Competitive pressure is another key issue. In the wearables category, Garmin goes up against much larger players like Apple, Samsung, and other tech brands with far broader ecosystems. Staying relevant will depend on Garmin’s ability to maintain product differentiation and continue delivering devices tailored to niche markets like outdoor sports, aviation, and marine navigation.

Consumer demand patterns also carry some risk. Shifts in spending, especially in non-essential electronics, could affect key segments. As Garmin adds services like Garmin Connect+, it steps further into the ecosystem model, which brings new opportunities but also new execution risks. The company will need to continue balancing hardware excellence with meaningful digital service development.

Final Thoughts

Garmin has shown that it can grow steadily without taking on large financial risk. Its business model is diversified, and its products have proven resilient in multiple market cycles. What sets Garmin apart is its focus on functionality and reliability—traits that have earned it loyalty in specific user groups that are often overlooked by broader consumer tech brands.

The leadership team remains stable, with decades of combined experience. Their conservative approach to spending and strong cash generation gives them room to continue innovating and returning capital to shareholders. While there are competitive and macroeconomic challenges ahead, Garmin has consistently found a way to adapt and stay relevant.

For long-term investors looking for a company with strong fundamentals, reliable profitability, and a measured growth trajectory, Garmin brings a mix of financial health and strategic clarity. It’s not a name built on hype, but rather on consistent execution and a firm understanding of its core users.