Last Update 5/4/25

First Commonwealth Financial Corporation, or FCF, isn’t a household name in the dividend world, but that’s exactly what gives it a certain charm. It’s a regional banking player based in Pennsylvania, and it’s been quietly doing its thing—offering straightforward financial services, managing credit risk conservatively, and paying dividends with a reliability that income investors tend to appreciate.

FCF operates mostly in Pennsylvania and Ohio, with a community-focused approach. It’s not trying to outgrow the big banks or get into flashy fintech ventures. Instead, it has stayed grounded in traditional banking. That conservative strategy might not turn heads, but when it comes to collecting dividends over the long haul, that kind of steady approach holds value.

Recent Events

It’s been an interesting stretch for regional banks, and FCF hasn’t been immune to the broader pressures. Rising interest rates, a slowdown in lending demand, and a generally cautious sentiment in the banking sector have all made for a challenging backdrop. Still, FCF has held its ground.

In its most recent quarter, the company posted a modest 0.10% increase in year-over-year revenue. It’s not a growth story—but that’s not what you buy this stock for. What stood out was profitability. With an operating margin just under 40% and a net profit margin above 30%, FCF is running a tight ship. These aren’t the kind of margins you’d expect from a high-growth tech firm, but in banking, those are solid numbers.

Earnings per share came in at $1.34 for the trailing twelve months, and while earnings growth dipped by nearly 13% compared to last year, the core of the business hasn’t wobbled. The company’s return on equity is sitting close to 10%, and return on assets is steady at 1.17%, both signs that capital is being put to use effectively.

FCF’s stock has been quietly climbing back from last year’s regional bank sell-off. At $15.89 per share, it’s found its footing well above its 52-week low of $12.71, though it still has room to run before touching its recent high of just under $20. And with a beta of 0.71, it’s been moving with less volatility than the market—a trait that often pairs nicely with a dividend strategy.

Key Dividend Metrics

📈 Dividend Yield: 3.40% (Forward)

💵 Dividend Rate: $0.54 (Forward Annual)

🧮 Payout Ratio: 38.81%

📆 Ex-Dividend Date: May 9, 2025

📉 5-Year Average Yield: 3.56

🏦 Dividend Coverage: Backed comfortably by earnings

Dividend Overview

For income-focused investors, FCF checks a lot of the right boxes. The current forward yield sits at 3.40%, which puts it in a comfortable range—high enough to be meaningful, low enough to feel sustainable. That’s just a touch below its five-year average yield of 3.56%, which suggests the stock may not be a screaming bargain, but it’s also not overextended.

The company pays its dividend quarterly, with the last payment coming in February and the next one around the corner in early May. These consistent, timely payouts are a sign of a mature, well-run business. At $0.54 annually per share, the dividend has crept up slightly from the trailing $0.52, and that steady climb, while modest, reflects a cautious and sustainable dividend policy.

Crucially, the payout ratio stands at just under 39%. That’s the kind of number that gives you confidence the dividend isn’t under pressure. Even if earnings take another short-term dip, there’s room to maintain—and possibly grow—the payout without putting strain on the company’s finances.

Dividend Growth and Safety

This isn’t a stock you buy expecting double-digit dividend growth every year. FCF plays a longer, quieter game. Over the past few years, dividend increases have been incremental, and that’s not a bad thing. It’s a deliberate approach that keeps the dividend safe and backed by real earnings, not hope.

The balance sheet supports that safety. With $141 million in cash and $340 million in debt, the company isn’t overleveraged. It doesn’t need to take big risks to keep its dividend alive. This balance between cash reserves and liabilities is exactly what you want to see when evaluating the strength behind the yield.

Institutional ownership also tells a story. With over 74% of shares held by institutions, there’s a level of stability in the shareholder base that often encourages management discipline. It’s not just retail investors hoping for income—there’s a significant presence of long-term, professional capital behind this name.

Add in a conservative business model, a predictable operating structure, and a relatively calm share price, and what you get is a dividend that feels like it’s built to last. There’s no promise of high-octane growth, but that’s not the pitch. FCF is about keeping it steady, quarter after quarter.

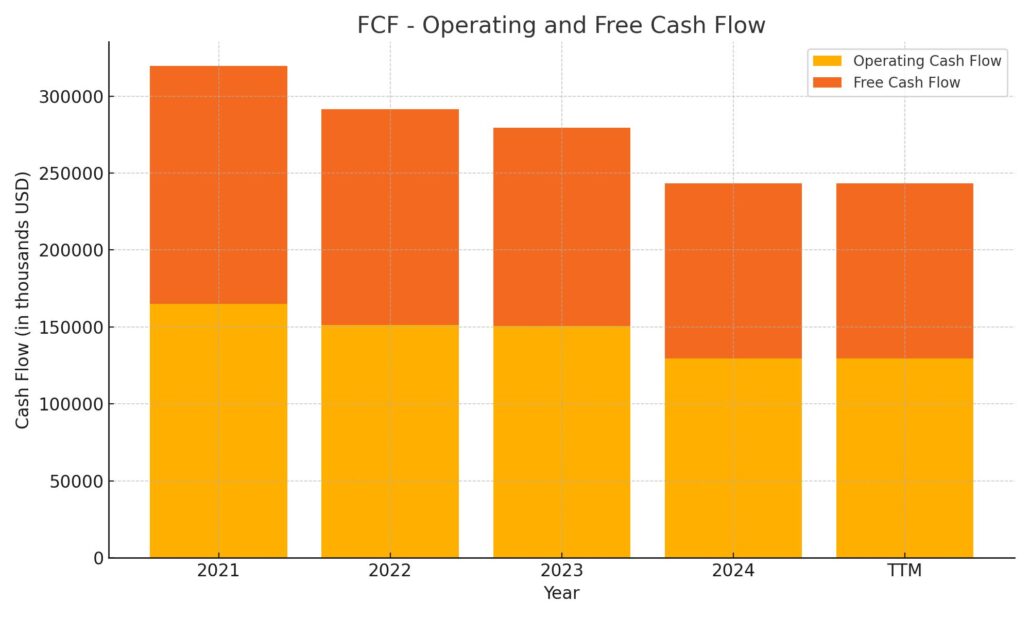

Cash Flow Statement

First Commonwealth Financial’s cash flow statement for the trailing twelve months reveals a company generating healthy operational cash flow, totaling $129.5 million. While that’s down from the $150–165 million range seen in prior years, the bank continues to convert its earnings into cash effectively. Free cash flow came in at $113.9 million, offering plenty of room to support its dividend and maintain flexibility in capital allocation.

On the investing side, outflows remained substantial at -$121.7 million, consistent with the bank’s pattern of reinvestment over recent years. Financing cash flow turned negative at -$21.3 million, a shift from the large positive inflows seen in 2022 and 2023, due in part to reduced debt issuance and continued stock buybacks. The net cash position at year-end stood at $133.4 million—slightly lower than prior years but still stable. This shows FCF is maintaining balance despite a tougher rate and lending environment.

Analyst Ratings

First Commonwealth Financial Corporation (FCF) has seen a shift in analyst sentiment lately. ❌ StockNews.com recently downgraded the stock from a “hold” to a “sell” rating, pointing to weakness in earnings momentum and potential challenges in sustaining profitability through ongoing economic headwinds. That move raised some eyebrows among conservative investors who had grown used to the bank’s relatively stable footing.

On the other hand, some analysts have continued to back the stock. ✅ DA Davidson reiterated its “buy” rating and held firm with a $21.00 price target. 📈 Stephens echoed that optimism, also labeling FCF as “overweight” with a target of $21.50. Royal Bank of Canada landed more in the middle, maintaining an “outperform” rating but trimming its price target to $18.00. ⚖️ Keefe, Bruyette & Woods followed a similar line with a revised target of $18.00 and a “market perform” rating. These updates suggest a divide in perspective—where some see short-term pressure, others are focused on long-term value potential.

The overall consensus across analysts is a “Moderate Buy,” with an average price target sitting at $19.58. 🎯 That implies room for upside from current levels, though not without some cautious tones in the short run.

Earnings Report Summary

Steady Results with Solid Fundamentals

First Commonwealth Financial kicked off 2025 with a solid first quarter, reporting net income of $32.7 million, or $0.32 per share. That’s right in line with what they delivered last quarter and pretty much what the market was expecting. The bank’s net interest income ticked up to $95.9 million, thanks in part to a net interest margin that improved to 3.62%. That margin tells us they’re managing their funding costs well while keeping loan yields steady—no small feat in this rate environment.

On the lending side, they added $99 million in loans, mostly from commercial clients. That’s an annualized growth rate of 4.4%, which is healthy and shows demand hasn’t dried up. Deposits also moved higher, growing by about $183.6 million, or nearly 8% on an annualized basis. That kind of growth suggests customer loyalty remains strong. Noninterest income was the one softer spot, dipping to $22.5 million. The drop came from fewer gains on SBA loan sales and some seasonal slowdowns in fee-based business.

Expense and Asset Quality Trends

Operating expenses edged up to $71.1 million. That rise was driven by higher payroll and benefit costs, plus a bit more spent on branch operations and real estate. Nothing too surprising there, especially in a tight labor market. The bank continues to keep a close eye on credit quality, and it showed. Nonperforming loans declined to $59.4 million, and net charge-offs were down to $3.1 million, which is encouraging. They booked $5.7 million for credit losses—slightly less than last quarter—suggesting they’re comfortable with the current risk in the loan book. Their allowance for credit losses stayed consistent at 1.32% of total loans.

Looking Ahead

On the capital side, First Commonwealth boosted its quarterly dividend by nearly 4%, a signal that they feel confident about the bank’s position and future cash flows. That’s always welcome news for income-focused investors. Leadership also touched on their upcoming acquisition of CenterGroup Financial, which just got the final approvals. It’s set to close soon and will give the bank a stronger footprint in the Cincinnati area. Executives are upbeat about the integration, pointing out that they’re adding some seasoned professionals and expanding into a growing market.

Overall, the quarter didn’t bring any fireworks—but that’s kind of the point. This is a bank that’s delivering consistent, predictable results while quietly growing both loans and deposits. Management seems focused on the long game, balancing cautious expense control with strategic expansion.

Management Team

First Commonwealth Financial Corporation is led by a seasoned executive team that blends long-standing institutional knowledge with fresh perspectives. At the helm is Mike Price, who has served as President and CEO since 2012. With over 30 years in the banking industry, Price brings a steady hand and a deep understanding of regional banking dynamics. His leadership has been instrumental in navigating the company through various economic cycles and in executing strategic initiatives that have strengthened the bank’s market position.

Supporting Price is a team of experienced executives. Jane Grebenc serves as President and Chief Revenue Officer, overseeing revenue-generating activities and playing a key role in strategic planning. Jim Reske holds the position of Executive Vice President and Chief Financial Officer, managing the company’s financial operations with a focus on maintaining fiscal discipline and supporting growth objectives. The recent appointment of Mike McCuen as Chief Lending Officer adds a dynamic element to the leadership team. McCuen, who joined the company in 2023, brings a wealth of experience in commercial banking and is expected to drive growth in the bank’s lending portfolio.

The board of directors also reflects a balance of continuity and fresh insights. Recent changes include the nomination of Todd D. Brice, former CEO of S&T Bancorp, bringing additional banking expertise and regional knowledge to the board. These leadership developments underscore First Commonwealth’s commitment to strong governance and strategic growth.

Valuation and Stock Performance

As of early May 2025, First Commonwealth Financial Corporation’s stock is trading at $15.89, positioning it in the mid-range of its 52-week spectrum, which spans from a low of $12.71 to a high of $19.96. This performance reflects a recovery from broader market pressures that impacted regional banks in the previous year. The stock’s beta of 0.71 indicates lower volatility compared to the overall market, appealing to investors seeking stability.

From a valuation standpoint, the company presents an attractive profile. With a trailing price-to-earnings (P/E) ratio of 11.86 and a forward P/E of 10.95, the stock is trading at a reasonable multiple, suggesting that the market has appropriately priced in the company’s earnings potential. The price-to-book (P/B) ratio stands at 1.12, indicating that the stock is valued close to its book value, which can be appealing to value-oriented investors.

The company’s dividend yield is currently at 3.40%, with a payout ratio of 38.81%, signaling a sustainable dividend policy. This yield is slightly below the five-year average of 3.56%, suggesting room for potential growth in dividend payouts as the company continues to strengthen its financial position.

Risks and Considerations

Investing in First Commonwealth Financial Corporation entails several considerations. The regional banking sector is susceptible to economic fluctuations, particularly in the areas where the bank operates. Economic downturns in Pennsylvania and Ohio could impact loan demand and credit quality. Additionally, the bank’s exposure to commercial lending means that any significant disruptions in the commercial real estate market could affect asset quality.

Interest rate volatility remains a key risk factor. Changes in interest rates can influence net interest margins, affecting profitability. While the bank has managed interest rate changes effectively in the past, future rate movements could pose challenges.

Operational risks, including cybersecurity threats and compliance with evolving regulatory requirements, are inherent in the banking industry. First Commonwealth’s commitment to risk management and compliance is crucial in mitigating these risks.

The bank’s ESG (Environmental, Social, and Governance) risk rating of 33.5, categorized as high risk, indicates areas for improvement in managing ESG-related risks. Addressing these concerns could enhance the company’s reputation and appeal to socially conscious investors.

Final Thoughts

First Commonwealth Financial Corporation presents a compelling case for investors seeking a stable, dividend-paying regional bank with a solid management team and a clear strategic direction. The company’s prudent financial management, consistent dividend policy, and focus on community banking position it well for steady performance. While there are inherent risks associated with regional banking, including economic sensitivity and regulatory challenges, First Commonwealth’s proactive approach to risk management and governance provides a level of assurance. As the company continues to execute its strategic initiatives, including leadership enhancements and market expansion, it remains a noteworthy consideration for investors aiming for long-term, stable returns.