Key Takeaways

💵 Fifth Third Bancorp offers a 3.99% forward dividend yield with a five-year history of steady growth and a conservative payout ratio of 46.35%.

💰 Free cash flow came in at $2.41 billion for 2023, showing strong coverage of dividends despite a year-over-year decline in operating cash flow.

📊 Analyst sentiment is mixed but leans positive, with a consensus price target of $46.24 and recent upgrades citing strong capital management and regional growth.

📈 First quarter 2025 earnings beat expectations at $0.71 per share, with leadership reaffirming full-year net interest income growth despite higher credit loss provisions.

Last Update 5/4/25

Fifth Third Bancorp (FITB), headquartered in Cincinnati, has built a strong presence across the Midwest and Southeast with a focus on consumer and commercial banking, capital markets, and wealth management. Under CEO Tim Spence, the bank has maintained stable profitability, careful credit risk management, and steady dividend growth—prioritizing long-term shareholder value in an evolving economic landscape.

The company currently offers a forward dividend yield of 3.99% with a payout ratio of 46.35%, supported by consistent free cash flow and solid capital reserves. Trading around \$37.10 with a forward P/E of 10.22, FITB presents a value-oriented option for income-focused investors.

Recent Events

The latest quarter, ending March 31, 2025, painted a picture of cautious stability. Revenue was down slightly, falling 2.2% year-over-year, and net income dipped by a modest 1%. While that’s nothing to celebrate, the context matters—many regional peers are posting steeper declines, or worse, cutting guidance. Fifth Third’s net income stood at $2.15 billion over the trailing twelve months, with a profit margin of 29.2%. That’s not just decent; it’s durable.

Return on equity clocked in at 11.72%, reinforcing that the bank is still managing its capital wisely. And while the topline is under some pressure, Fifth Third is maintaining a healthy spread between what it earns and what it pays out to investors. That cushion is key.

It’s also worth noting that short interest in the stock has dropped significantly—from 24.43 million shares in mid-March to 17.59 million by mid-April. That’s a sign the bearish bets are starting to ease, which can help stabilize the stock price and reduce volatility.

Key Dividend Metrics

📌 Forward Yield: 3.99%

💵 Forward Annual Dividend Rate: $1.48

📈 5-Year Average Yield: 3.73%

💡 Payout Ratio: 46.35%

📆 Most Recent Dividend Date: April 15, 2025

🚨 Ex-Dividend Date: March 31, 2025

🔍 Dividend Growth Trend: Steady and consistent over time

Dividend Overview

Fifth Third’s dividend profile checks many of the boxes dividend investors care about. At a forward yield just shy of 4%, the stock offers a steady income stream without the red flags that often accompany higher-yield names. It’s also comfortably ahead of broader market averages.

The latest payout of $0.37 per share, delivered in mid-April, wasn’t a raise—but it wasn’t a cut either. And in today’s environment, consistency is often just as valuable as growth. What stands out is how sustainable the dividend looks under the hood. With a payout ratio of 46.35%, Fifth Third isn’t overextending itself. That leaves room to maintain—or even grow—the dividend, even if earnings take a slight hit in the quarters ahead.

The bank’s trailing twelve-month earnings per share came in at $3.15, giving it ample breathing room to continue covering its dividend. And with no signs of financial strain or drastic operational changes, that cushion appears stable for the foreseeable future.

Dividend Growth and Safety

One of the most appealing parts of the FITB dividend story is how methodically it has grown over time. There’s a certain quiet confidence in the way the bank raises its payout—not flashy, but reliable. Over the last five years, Fifth Third has steadily nudged its dividend upward, usually by a few cents each year. It doesn’t chase high growth, but it doesn’t pull back either. That kind of steady hand is valuable in a sector that often deals with boom-and-bust cycles.

From a safety perspective, several things stand out. First, profitability remains intact. A profit margin just under 30%, combined with a return on assets of 1.08%, shows that the bank is still generating healthy returns relative to its size.

Second, the balance sheet is solid. Total cash on hand is over $4.1 billion, or $6.25 per share. That’s more than enough to cover dividend payments, especially when combined with recurring revenue from interest and fees. Yes, total debt sits at $20.2 billion, but for a regional bank of this scale, that’s manageable—especially with consistent net income to support it.

Market-wise, the stock is currently trading at $37.10, down from its 52-week high of $49.07. It’s also slightly below its 50-day and 200-day moving averages, which are $38.04 and $42.04, respectively. That doesn’t scream bullish momentum, but for long-term dividend investors, the opportunity lies in the stability and the yield, not the daily price swings.

The 5-year beta sits at 1.01, suggesting the stock tends to move with the broader market. That’s about what you’d expect from a mature financial institution with a diversified book of business—not too erratic, not overly defensive.

Put simply, Fifth Third’s dividend isn’t just an attractive yield on paper—it’s underpinned by years of disciplined financial stewardship. The company hasn’t chased aggressive expansion or leaned on risky bets to fuel growth. Instead, it’s carved out a dependable, long-term income profile. And in a world where steady income is often hard to come by, that’s worth paying attention to.

Cash Flow Statement

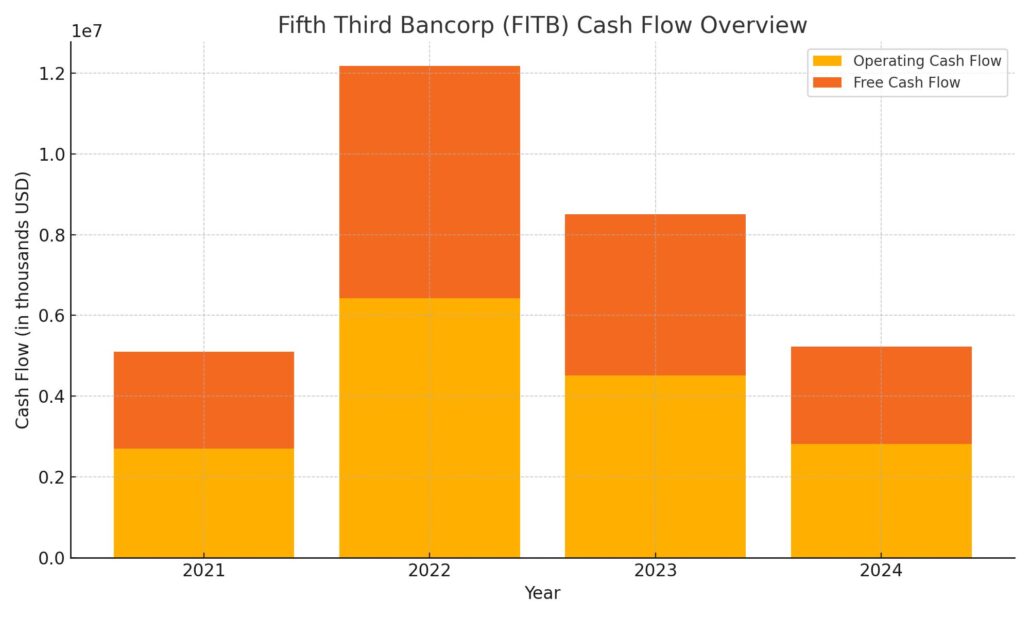

Fifth Third Bancorp’s cash flow statement over recent years reflects a business adjusting to changing financial conditions while maintaining underlying strength in free cash generation. In 2023, operating cash flow totaled $2.82 billion, a notable decline from $4.5 billion in 2022 and $6.4 billion in 2021. This decrease is a reflection of lower earnings and a tighter lending environment, though free cash flow remained healthy at $2.41 billion for the year—plenty of coverage for dividend obligations.

On the investing side, 2023 saw a positive cash flow of $1.04 billion, a reversal from prior years where outflows were significant, such as nearly $9.5 billion in 2022. This swing was largely driven by reduced loan activity and more conservative capital deployment. Financing cash flow turned negative at -$3.99 billion, as the company paid down debt aggressively and returned capital through buybacks and dividends. The end cash position landed at $3.01 billion, fairly consistent with recent years. Even with lower earnings, Fifth Third managed to protect its cash buffer and generate enough free cash flow to remain flexible in a higher-rate landscape.

Analyst Ratings

📈 Analysts have recently adjusted their outlooks on Fifth Third Bancorp, reflecting a more cautious stance as the banking environment continues to shift. 🎯 The consensus 12-month price target is currently around $46.24, pointing to a potential upside of roughly 24% from where shares are trading today.

📉 Several firms have trimmed their targets in light of tightening margins and slower loan growth. JPMorgan, for instance, brought their target down from $49 to $42, flagging pressure on net interest margins. Citigroup echoed similar concerns, dialing back their target from $52 to $43 and sticking with a neutral rating. DA Davidson also narrowed their expectations slightly, lowering their target from $45 to $42 amid expectations of flat earnings over the next few quarters.

📊 Not everyone is leaning conservative, though. Baird took a more optimistic turn, upgrading the stock from Neutral to Outperform and assigning a new target of $47. Their view highlights Fifth Third’s strong capital positioning and strategic moves into faster-growing regional markets as key reasons for potential outperformance.

🧭 On balance, the analyst sentiment around FITB still tilts positive. The average rating sits at “Moderate Buy,” reflecting confidence in the bank’s ability to weather near-term headwinds while keeping its long-term growth story intact.

Earning Report Summary

Fifth Third Bancorp kicked off 2025 with results that edged past expectations. The bank posted earnings of $0.71 per share in the first quarter, a performance that reflected steady loan growth and an improved interest income picture. Net interest income climbed 4% from the same period last year, hitting $1.44 billion. That growth came largely from gains in both commercial and consumer lending, paired with better management of deposit costs.

Loan demand stayed healthy, with average balances rising about 3% across the board. Even as the broader economy showed some signs of softening, Fifth Third kept its core banking engine moving at a decent clip. Total net income to common shareholders came in at $478 million, which is almost right where it was this time last year—showing a degree of earnings consistency that matters in this kind of rate environment.

Watching the Economy, Staying Proactive

Where the bank did make a shift was on the credit side. Provision for credit losses was bumped up to $174 million—almost double what it was a year ago. That move suggests management is staying cautious, positioning the loan book to handle any bumps in the road if the economy takes a turn.

CEO Tim Spence spoke to that directly, highlighting the bank’s conservative approach and the emphasis on forward-looking credit modeling. It’s clear they’re not ignoring the chatter around a potential slowdown, but they also aren’t pulling back dramatically.

Despite the increase in credit provisioning, leadership stood by its full-year guidance. Fifth Third still expects net interest income to grow between 5% and 6% this year. That vote of confidence tells us they believe the underlying trends—loan growth, deposit stability, and spread management—remain intact.

In short, the quarter wasn’t flashy, but it didn’t need to be. Fifth Third delivered a stable, well-managed performance, backed by prudent risk management and a clear focus on what it can control. For a regional bank in today’s climate, that’s a strong place to be.

Management Team

Fifth Third Bancorp’s leadership is anchored by Chairman, President, and CEO Tim Spence, who took on the chairman role in early 2024. Spence has played a central role in guiding the bank through a period of economic transition and regulatory change. His approach emphasizes modernization, long-term stability, and a sharper focus on the customer experience to support future growth.

Working alongside Spence is a group of experienced executives. Bryan Preston serves as Chief Financial Officer, providing the financial oversight necessary to align long-term strategy with earnings performance. Robert Shaffer leads the bank’s risk management efforts as Chief Risk Officer, helping to keep the bank resilient during times of volatility. Other key leaders include Kevin Lavender, who heads Commercial Banking, and Kala Gibson, who leads Corporate Responsibility efforts. Their expertise supports the bank’s broader mission of responsible growth.

Newer additions, such as Darren King as Head of Regional Banking, reflect Fifth Third’s commitment to strengthening its local market strategies. King’s operational know-how is expected to enhance the bank’s focus on regional customer engagement and expansion across higher-growth areas.

Valuation and Stock Performance

As of early May 2025, Fifth Third Bancorp is trading at $37.10. The stock has rebounded from a recent low of $32.25 but remains under its 52-week high of $49.07. Share price movement has followed broader trends across the regional banking sector, which has seen mixed investor sentiment tied to interest rate uncertainty and credit market conditions.

From a valuation standpoint, Fifth Third’s forward price-to-earnings ratio of 10.22 places it at a discount compared to historical levels and peers with higher multiples. That lower valuation could appeal to value investors, particularly those looking for strong balance sheet fundamentals and consistent dividend income. The dividend yield is holding at 3.99%, and the payout ratio of just over 46% suggests there’s still plenty of room for continued shareholder distributions without stretching earnings capacity.

While the stock hasn’t fully recovered to its previous highs, it has shown a degree of price stability. Lower trading volume relative to its 50-day average implies investors are waiting for more clarity on earnings visibility and macroeconomic signals before reengaging in a meaningful way.

Risks and Considerations

Like any bank, Fifth Third faces a variety of risks that investors should keep in mind. One of the more pressing concerns is its exposure to commercial real estate, especially office loans. With remote work now deeply embedded in many industries, demand for traditional office space continues to soften, creating potential risk for write-downs or credit deterioration in this segment.

Legal and regulatory issues also remain on the radar. The bank has previously faced scrutiny over unauthorized account openings and auto loan practices, and while these matters may be largely behind them, ongoing compliance monitoring and potential reputational fallout still linger.

Interest rates also play a key role in the bank’s financial performance. While Fifth Third has been actively managing its exposure through rate hedges and careful asset-liability balancing, large swings in short or long-term rates could pressure its margins or dampen loan demand. On top of that, a slow-growth environment or policy shifts could weigh on lending appetite, particularly among small businesses.

Operationally, risks like cybersecurity and reliance on external vendors continue to demand attention. With more banking services moving online, Fifth Third needs to stay proactive in protecting its infrastructure and ensuring third-party partners maintain the same standards.

Final Thoughts

Fifth Third Bancorp offers a combination of steady leadership, a shareholder-focused dividend strategy, and solid capital positioning. The management team has shown it can adapt, whether through expanding in faster-growing markets or managing credit conservatively during times of uncertainty.

While there are real risks—especially around commercial real estate and regulatory oversight—the bank has navigated similar headwinds in the past with a cautious and calculated approach. For long-term investors focused on income, Fifth Third remains a name with enough strength under the hood to weather economic ups and downs, while continuing to return value through its dividend and disciplined financial strategy.