Key Takeaways

📈 FactSet offers a 2.28% dividend yield with over two decades of consecutive annual increases and a payout ratio of just 27.61%, leaving substantial room for continued growth.

💵 The company generated $761.2 million in operating cash flow and $545.5 million in free cash flow over the trailing twelve months, comfortably funding both dividends and share repurchases.

🧐 Analyst consensus sits at hold with a mean price target of $305.24, reflecting a wide range of views and meaningful upside from the current price of $201.49.

📊 With EPS of $15.72, a profit margin of 25.40%, and return on equity approaching 29%, FactSet continues to demonstrate the operational quality that has defined it for years.

Updated 2/25/26

FactSet Research Systems Inc. (FDS) delivers financial data and analytics to the institutions that shape global markets. With over two decades of consistent dividend growth, high margins, and strong free cash flow, it has built a reputation for dependable execution and steady returns. Its client base, largely made up of wealth managers and institutional firms, relies heavily on its platform, which drives recurring revenue and low churn.

Leadership remains focused on long-term growth through disciplined capital allocation and ongoing technology investment. Despite meaningful stock pressure over the past year, FactSet maintains strong fundamentals and a clear roadmap for expansion, and the pullback has produced a valuation setup that looks notably different from where the stock has traded historically.

Recent Events

FactSet has been navigating a challenging stretch in its stock performance, with shares sitting at $201.49 as of February 25, 2026, well off the 52-week high of $474.79 and trading near the lower end of its annual range of $185.00 to $474.79. The magnitude of that decline represents one of the more significant resets the company has seen in recent years, and it has attracted renewed attention from investors weighing whether the selloff has overshot fundamentals. The company generated revenue of $2.36 billion over the trailing twelve months, with net income of $599.6 million and EPS of $15.72, all of which reflect a business that continues to operate with genuine financial strength despite the pressure on the share price.

The broader context for the decline appears tied to a reassessment of valuation across the financial data and analytics space, as well as investor concern about the pace of subscription growth in an environment where institutional clients have grown more cautious about technology spending. FactSet’s model remains anchored in recurring subscription revenue, which provides resilience but also limits the kind of upside surprise that can quickly reverse sentiment. Management has continued to invest in front-office solutions and data infrastructure, with those efforts positioning the company for longer-term relevance even as near-term growth expectations have been tempered.

The dividend history tells a straightforward story of discipline. The most recent quarterly payment of $1.10 per share was paid in November 2025, following an increase from $1.04 that took effect in May 2025. That increase marked the latest in a long series of annual raises, reinforcing FactSet’s standing as one of the more reliable dividend growers in the financial services sector. With operating cash flow of $761.2 million and free cash flow of $545.5 million, there is no credible concern about the dividend’s sustainability at current levels.

Key Dividend Metrics

📈 Forward Yield: 2.28%

💰 Annual Dividend (Forward): $4.40

📆 Dividend Growth Streak: 25+ consecutive years

🧮 Payout Ratio: 27.61%

💵 Last Quarterly Payment: $1.10 per share

🎯 Most Recent Ex-Dividend Date: November 28, 2025

📊 Free Cash Flow: $545.5 million

📉 Share Count: Approximately 37.4 million and trending down

Dividend Overview

FactSet’s dividend has quietly become one of the more compelling stories in its category. At a yield of 2.28%, it now offers meaningfully more income than it did when the stock was trading above $400, and that shift reflects the arithmetic of a lower share price applied to a growing dividend rather than any deterioration in the underlying business. The annual payment of $4.40 per share is backed by $15.72 in earnings per share, producing a payout ratio of just 27.61%, which is conservative by any measure and leaves the company with enormous flexibility.

The progression of recent payments illustrates the growth trajectory clearly. Quarterly dividends rose from $0.89 in early 2023 to $0.98 later that year, then moved to $1.04 in mid-2024, and most recently increased to $1.10 beginning in May 2025. That cadence reflects a company that raises its dividend deliberately and consistently, without stretching to impress or pulling back when conditions tighten. For income investors, that kind of reliability has real value, particularly in a period when many dividend payers have faced pressure on their payouts.

What distinguishes FactSet’s dividend is how unremarkable it appears on the surface and how substantial it looks on closer examination. There is no drama here, no stretched payout ratio, no leverage-driven yield inflation. It is simply a well-covered, consistently growing payment from a company with recurring revenue and strong margins.

Dividend Growth and Safety

FactSet has now strung together more than 25 consecutive years of dividend increases, a streak that has survived multiple market cycles, interest rate environments, and industry shifts. Over the past two years alone, the quarterly dividend has grown from $0.89 to $1.10, a cumulative increase of nearly 24%. That pace comfortably outstrips inflation and reflects genuine earnings growth rather than an expansion of the payout ratio.

The safety picture is anchored by the company’s free cash flow generation. At $545.5 million in free cash flow against a total annual dividend obligation that represents a small fraction of that figure, there is a wide margin of protection. Even if earnings were to compress meaningfully, the dividend would remain well covered. Operating cash flow of $761.2 million reinforces that picture, and the company’s return on equity of 28.83% and return on assets of 11.42% both speak to efficient capital deployment.

The profit margin of 25.40% is a reminder that FactSet’s business model generates cash with consistency. Subscription-based revenue, high renewal rates, and deep integration into client workflows create a durability that is difficult to replicate and that forms the financial foundation for continued dividend growth. With a beta of 0.73, the stock also tends to be less volatile than the broader market, which suits income-oriented portfolios well. The combination of a low payout ratio, strong free cash flow, and a proven track record of annual increases makes the dividend about as safe as dividends in this sector get.

Chart Analysis

FactSet’s price action over the past twelve months tells a story of persistent and accelerating deterioration. The stock has shed more than half its value from its 52-week high of $468.95, with the current price of $201.49 sitting just 6% above the 52-week low of $190.06. That proximity to a multi-year floor is not a sign of stabilization so much as a reflection of how relentlessly sellers have controlled this tape. The trend has been decidedly lower across virtually every timeframe, and the stock has found no meaningful base or consolidation zone to suggest that institutional buyers have stepped in with conviction at current levels.

The moving average picture reinforces that bearish assessment in unambiguous terms. FactSet is trading well below both its 50-day moving average of $260.78 and its 200-day moving average of $335.52, sitting approximately 23% beneath the former and a striking 40% beneath the latter. More significantly, the 50-day has crossed below the 200-day, forming what technicians recognize as a death cross, a configuration that signals sustained downside momentum and typically discourages institutional accumulation. When a stock trades this far below both major averages simultaneously, any short-term recovery attempt is likely to encounter overhead resistance at each of those levels before a sustainable trend reversal can take hold.

The RSI reading of 38.77 places FactSet in oversold territory without yet reaching the deeply washed-out readings below 30 that sometimes precede sharp mean-reversion bounces. This is a nuanced position. The stock is technically cheap on a momentum basis, but the absence of a true capitulation reading suggests the selling pressure has been methodical rather than panicked, which can mean a bottom is harder to identify and longer to form. Momentum investors have no reason to step in here, and the RSI trajectory will need to stabilize and curl upward before any constructive technical signal emerges.

For dividend investors evaluating FactSet at current prices, the chart presents a genuine dilemma. The income thesis may be improving on a yield basis as the price declines, but a stock trading 57% off its highs with a confirmed death cross and no clear technical support argues strongly for patience over urgency. Income-focused investors who are drawn to the improved yield context should at minimum wait for the RSI to show a sustained recovery above 40 and for the price to reclaim the 50-day moving average before treating the technical picture as anything other than a headwind to a new position.

Cash Flow Statement

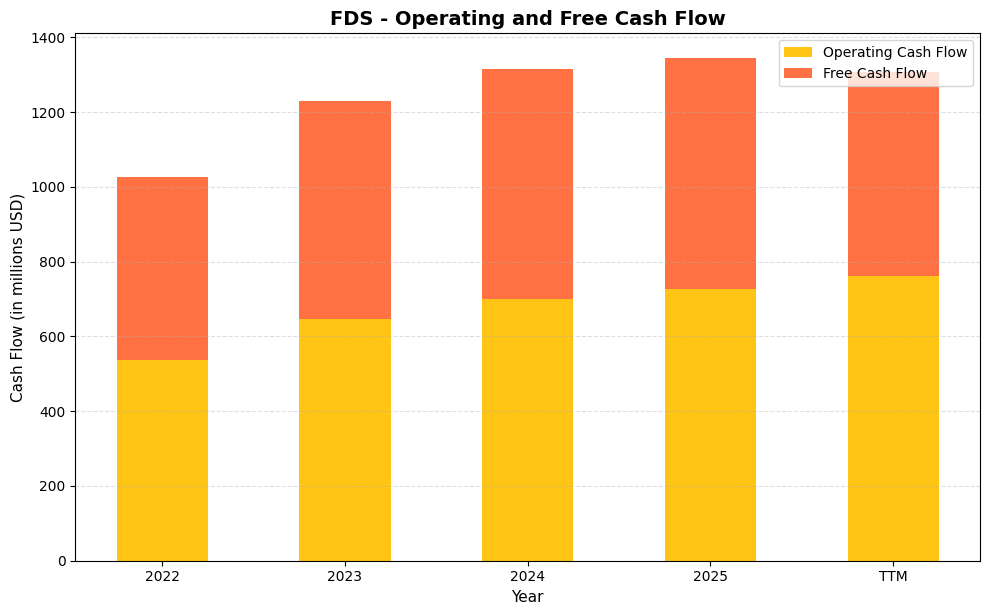

FactSet’s cash generation profile is one of the cleaner stories in the financial data space. Operating cash flow has climbed steadily from $538.3 million in fiscal 2022 to $761.2 million on a trailing twelve-month basis, a gain of more than 41% over roughly three years. Free cash flow tracked closely through fiscal 2025, reaching $617.5 million, though the TTM figure of $545.5 million reflects a step down that warrants attention. That gap between operating and free cash flow in the TTM period suggests elevated capital expenditures or capitalized software development costs are absorbing more cash than in prior years, which is worth monitoring but does not undermine the dividend case at current payout levels. FactSet declared approximately $170 million in dividends over the past year, meaning free cash flow covers the dividend by roughly 3.2 times even on the softer TTM number. That is a wide margin of safety for income investors.

Stepping back across the full data set, the compounding trajectory here is genuinely impressive for a business of FactSet’s size. Free cash flow grew from $487.1 million in 2022 to a peak of $617.5 million in fiscal 2025, representing a cumulative gain of about 27% before the TTM pullback. The company’s capital intensity has historically been modest relative to peers, which is what allowed free cash flow conversion to stay close to operating cash flow for most of the period. The slight divergence in the TTM window could reflect investment in workflow automation tools, AI-driven analytics infrastructure, or client-facing platform upgrades, all of which are growth-oriented rather than defensive in nature. For dividend growth investors, the core message is straightforward: FactSet generates substantially more cash than it needs to sustain and grow its dividend, and the long-term direction of that cash generation remains firmly upward.

Analyst Ratings

The analyst community’s current read on FactSet reflects a stock that many view as fairly valued to slightly undervalued at current levels, though the range of opinion is notably wide. The consensus rating across 17 analysts sits at hold, with a mean price target of $305.24. That target represents roughly 51% upside from the current price of $201.49, a gap that is larger than what typically accompanies a hold consensus and suggests that at least some analysts believe the recent selloff has overshot the fundamentals. The low end of the target range sits at $195.00, close to the current price, while the high end reaches $430.00, not far from where the stock was trading less than a year ago.

The dispersion in price targets reflects genuine uncertainty about the pace of subscription growth and how quickly institutional clients will expand their spending in the current environment. Bears point to competitive pressure and slowing growth as reasons to stay cautious, while bulls argue that the valuation has reset to levels that price in too much pessimism for a company with FactSet’s margin profile and dividend track record. With the stock near the lower end of its 52-week range and the mean target implying substantial upside, the risk-reward setup has shifted considerably in favor of patient, income-oriented investors compared to where it stood twelve months ago.

Earning Report Summary

Steady Growth and Strong Client Demand

FactSet’s most recent results reflect a business that continues to grow its revenue base and protect its margins, even as the broader environment for financial data spending has become more selective. Full-year revenue came in at $2.36 billion, supported by the company’s subscription model and its deep integration into the workflows of buy-side institutions and wealth managers. Annual Subscription Value continues to be the metric that management and analysts watch most closely, and its trajectory has remained positive, underscoring the stickiness of the client base and the high renewal rates that define the business model.

Margins Under Some Pressure

EPS of $15.72 and a profit margin of 25.40% reflect solid earnings power, though margins have seen some compression relative to the levels FactSet has historically maintained. The investment in front-office capabilities and data infrastructure has carried real costs, and those costs have shown up in the operating results. Return on equity of 28.83% remains impressive and speaks to how efficiently the company deploys its capital base, but the margin trajectory is something management will need to address if it expects to recapture investor confidence on the growth side of the story.

Leadership’s Outlook

Management has communicated a continued commitment to building out FactSet’s analytics and data platform, with an emphasis on solutions that serve front-office workflows at institutional firms. The leadership team has been consistent in framing near-term cost pressures as investments in future competitive positioning rather than structural deterioration. CFO Helen Shan has maintained a clear focus on free cash flow generation and balance sheet discipline, and CEO Phil Snow has emphasized the long-term value of the company’s client relationships and the breadth of its integrated data offering.

Guidance Holds Firm

Management has maintained a constructive outlook for the business, pointing to a healthy pipeline and ongoing demand for its core data and analytics products. The company’s recurring revenue model provides visibility that many businesses in the technology-adjacent space cannot match, and that visibility underpins confidence in the dividend growth trajectory. Investors will be watching upcoming quarterly results for signs that subscription growth is reaccelerating and that the investments in product and technology are beginning to show returns in the revenue line.

Management Team

FactSet’s leadership has long prioritized consistency and quiet execution over headline-grabbing moves. At the helm is CEO Phil Snow, who has been with the company for more than two decades and stepped into the top role in 2015. His style is steady and focused, with an emphasis on refining and expanding the company’s core offerings rather than chasing short-term trends. Under his leadership, FactSet has broadened its data platform and tightened client relationships, while still keeping a close eye on operational discipline.

CFO Helen Shan brings a sharp focus on long-term financial health. She has led the company through careful capital allocation decisions, balancing internal investment with shareholder returns. Shan has emphasized the importance of maintaining strong free cash flow and managing leverage thoughtfully, which fits well with FactSet’s low-drama, fundamentals-first approach. The rest of the executive team is made up of veterans in data analytics, finance, and technology, and they have managed to evolve the company’s offerings without compromising on service or reliability. Their tone remains consistent: conservative but forward-looking, always pushing to stay ahead without losing sight of the company’s identity.

Valuation and Stock Performance

FactSet’s current valuation represents one of the more interesting setups the stock has offered in recent years. At a P/E ratio of 12.82, the stock is trading at a meaningful discount to where it has historically been valued, and well below the multiples that characterized the stock when it was above $400. A price-to-book ratio of 3.46 against a book value per share of $58.21 reflects the asset-light, high-return nature of the business. For a company with a return on equity approaching 29% and a 25-year dividend growth streak, a forward earnings multiple in the low teens is an unusual place to find it.

The 52-week range of $185.00 to $474.79 tells the story of a dramatic re-rating. The stock has lost more than half its value from peak to trough within a single year, and while that kind of move warrants scrutiny, the financial results do not suggest a business in crisis. Revenue is growing, margins are healthy by most industry comparisons, and free cash flow generation is robust. The gap between the current price and the analyst mean target of $305.24 is substantial, and the market cap of approximately $7.54 billion relative to $545.5 million in free cash flow implies a free cash flow yield of over 7%, which is not the profile of an overvalued company.

Share repurchases have continued to support earnings per share, and the gradual reduction in share count remains a quiet but consistent source of value for long-term holders. Combined with a dividend that has grown every year for over two decades, FactSet’s capital return profile remains one of the more dependable in the financial services sector, even as the market has repriced the stock aggressively lower.

Risks and Considerations

Competition in the financial analytics space continues to intensify, with both established players and newer technology-driven platforms working to attract clients who are growing more cost-conscious. While FactSet’s deep integration into client workflows creates meaningful switching costs, those barriers are not absolute, and rivals offering more flexible or lower-cost alternatives could gradually erode the client retention rates that underpin the subscription model.

The pace of growth in Annual Subscription Value has slowed from levels that supported higher valuations in prior years, and if institutional clients continue to exercise caution around data and technology budgets, it could take longer than expected for FactSet to reaccelerate revenue growth. That slowdown is a key reason the stock has been repriced so sharply, and any evidence that it is persisting rather than inflecting will continue to weigh on sentiment.

Cost pressures tied to technology investment and platform development have compressed margins relative to historical peaks. The company has managed this carefully, but if expenses continue to grow faster than revenue, the flexibility around dividends, buybacks, and reinvestment could narrow. Finally, FactSet’s client base is heavily concentrated in financial services, which means a meaningful downturn in institutional activity or wealth management spending could slow subscription growth more quickly than the company’s recurring revenue model might suggest at first glance.

Final Thoughts

FactSet doesn’t try to be a market darling. It doesn’t need to be. What it offers is consistency, and at the current price, that consistency comes packaged with a valuation setup that looks genuinely attractive for patient investors. A P/E below 13 for a company with 25 years of dividend growth, a 2.28% yield, a sub-30% payout ratio, and more than $545 million in annual free cash flow is not a common combination. The stock has clearly been through a difficult stretch, but the business has not deteriorated in a way that justifies the magnitude of the decline.

The leadership team keeps things running with discipline and without drama. Financially, the business is in solid shape, with strong recurring revenue, healthy margins relative to most peers, and the cash flow generation to support continued dividend growth and buybacks. The mean analyst price target of $305.24 implies that the broader analyst community sees considerably more value here than the current price reflects, even with a hold consensus that acknowledges near-term uncertainty.

Risks are present, as they are with any company, but they are largely operational and manageable. FactSet knows its strengths and continues to play to them. It is not a stock that will surge on a single headline or recover overnight from a reset of this magnitude. But for income investors who value durability, dividend growth, and a business model built for longevity, it has the quiet credentials to reward patience over time.