Updated 2/24/26

First American Financial Corporation (FAF) operates at the heart of real estate transactions, providing title insurance and settlement services that support both residential and commercial property activity. With over a century of experience and a strong position in a cyclical industry, the company has continued to deliver reliable financial performance, even in periods of market uncertainty.

Backed by a resilient business model, a tenured leadership team, and a consistent dividend yield near 3.3%, FAF offers income-focused investors a balanced mix of cash flow strength and operational stability. Its exposure to a gradually recovering housing market, alongside disciplined capital returns, adds to its long-term appeal.

Recent Events

First American Financial has continued to navigate a real estate environment defined by elevated mortgage rates and restrained transaction volumes. The title insurance industry as a whole has faced persistent headwinds from affordability pressures that have kept existing home sales below pre-pandemic norms. Despite that backdrop, FAF has demonstrated resilience, generating $7.45 billion in total revenue over the trailing twelve months and producing earnings per share of $6.00, a figure that reflects meaningful improvement in the company’s profitability trajectory from the cyclical trough experienced in prior years.

As of February 24, 2026, shares are trading at $67.08, sitting near the upper end of their 52-week range of $53.09 to $68.75. That positioning reflects improving investor sentiment toward rate-sensitive financials as expectations around Federal Reserve policy have gradually shifted. The stock has recovered considerably from its lows of last year, and the current price represents a meaningful gain that has rewarded patient income investors who held through the volatility.

CEO Mark Seaton, who took the helm in April 2025, has maintained a steady public posture, emphasizing the company’s commercial real estate momentum and the longer-term opportunity in residential title as mortgage origination volumes eventually normalize. Management has continued its practice of returning capital to shareholders through both dividends and selective share repurchases, reinforcing confidence in the underlying cash generation of the business.

Key Dividend Metrics

💵 Forward Dividend Yield: 3.29%

📈 5-Year Average Yield: ~3.4%

💰 Annual Dividend Rate: $2.19 per share

🧮 Payout Ratio: 36.33%

📅 Last Dividend Payment: $0.55 per share

🪙 Cash Flow Backing: $950.8M in operating cash flow, $557.9M in free cash flow

📊 Dividend Growth: Slow and steady, with incremental increases maintained

📉 52-Week Range: $53.09 – $68.75

Dividend Overview

The dividend yield currently sits at 3.29%, a level that feels appropriate for a specialty insurer tied to cyclical real estate activity. It is attractive enough to make FAF a meaningful contributor to an income portfolio, but not so elevated that it signals financial distress or an unsustainable payout. The annual dividend now stands at $2.19 per share, with the most recent quarterly payment of $0.55 marking a modest step up from the $0.54 per share that was paid through the first two quarters of 2025.

One of the most encouraging shifts in FAF’s dividend story right now is the payout ratio, which has declined dramatically to just 36.33%. This is a far cry from the elevated ratio seen in prior periods when net income was depressed by the difficult transaction environment. With EPS rebounding to $6.00, the dividend is now thoroughly covered by reported earnings, and even more so by the company’s robust operating cash flow of $950.8 million. The payout no longer requires any cash flow accounting gymnastics to look sustainable. It simply is sustainable, by a wide margin.

That combination of a reasonable yield and a conservative payout ratio gives FAF the profile of a dividend grower with meaningful room to continue raising its payout as earnings normalize further.

Dividend Growth and Safety

First American’s approach to dividend growth is deliberate rather than aggressive. Looking at the recent payment history, the quarterly dividend has moved from $0.52 in early 2023 to the current $0.55, a cumulative increase of roughly 5.8% over approximately three years. That translates to a modest but consistent compounding effect for long-term holders. The company does not chase headline dividend growth rates, but it has demonstrated a clear willingness to inch the payout higher as the business supports it.

The safety of that dividend is now on firmer footing than it has been in recent memory. Operating cash flow of $950.8 million provides a coverage ratio that dwarfs the company’s annual dividend obligation, and free cash flow of $557.9 million is more than sufficient to fund distributions without relying on external financing. The payout ratio of 36.33% against earnings of $6.00 per share represents a healthy buffer that management could sustain even if earnings retreated meaningfully from current levels.

Return on equity of 11.96% and return on assets of 3.95% indicate that the business is generating a reasonable return on its capital base, which reinforces the sustainability of shareholder distributions over time. With a book value per share of $53.92 and a profit margin of 8.34%, the underlying economics of the business are supportive of continued dividend reliability. Institutional ownership remains high, reflecting the professional investment community’s continued confidence in FAF’s capital allocation framework and long-term earnings power.

Chart Analysis

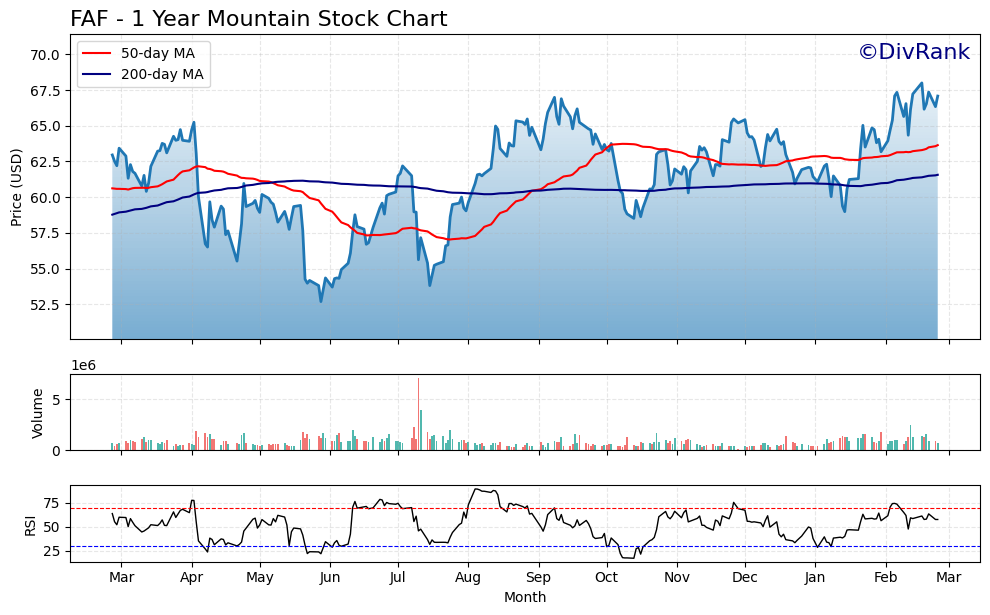

First American Financial has staged an impressive recovery over the past year, climbing roughly 27% off its 52-week low of $52.69 and pushing all the way to within striking distance of its 52-week high of $68.00. At a current price of $67.08, FAF sits just 1.35% below that annual peak, which tells a clear story about the momentum that has been building throughout the chart. For a title insurer that is sensitive to real estate transaction volumes and interest rate expectations, this kind of price recovery reflects growing investor confidence that the housing market headwinds of the past few years may finally be easing.

The moving average picture reinforces that constructive view. FAF is trading above both its 50-day moving average of $63.64 and its 200-day moving average of $61.57, and the 50-day has crossed above the 200-day to form what technicians call a golden cross. That configuration is a broadly bullish signal, suggesting that shorter-term price momentum is now aligned with the longer-term trend rather than working against it. The spread between the current price and the 200-day moving average is approximately $5.51, which represents a healthy but not extreme distance, indicating that the trend has room to sustain itself without looking overextended on a longer-term basis.

The current RSI reading of 57.51 sits in a comfortable middle zone, well above the 50 level that typically separates bullish from neutral momentum, yet comfortably short of the 70 threshold where overbought conditions begin to raise caution flags. For a stock approaching its 52-week high, an RSI in this range is actually an encouraging sign. It suggests that the rally has been methodical and broad-based rather than driven by a short-term speculative burst, which tends to produce more durable price action going forward.

For dividend investors, the technical setup adds a useful layer of confidence to the fundamental income thesis. FAF is not a beaten-down value trap in the midst of a dead-cat bounce. It is a stock in a confirmed uptrend, trading near multi-year highs, with momentum indicators that remain constructive rather than flashing warning signs. Investors looking to establish or add to a position should be aware that buying within 1.35% of the 52-week high carries some near-term resistance risk, but the overall weight of the technical evidence suggests the path of least resistance remains upward, which is a reasonable backdrop for income investors collecting dividends while they wait.

Cash Flow Statement

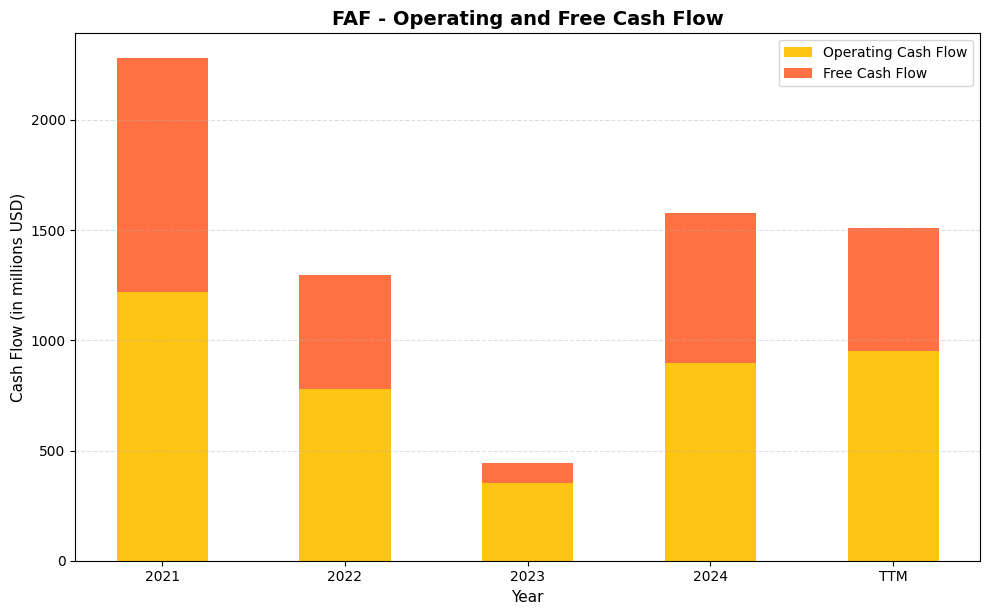

First American Financial’s operating cash flow tells a story of meaningful cyclical pressure followed by a solid recovery. The business generated $1,219.9M in operating cash flow in 2021, a banner year for real estate and title insurance activity, before volumes contracted sharply and pushed operating cash flow down to $777.6M in 2022 and further to $354.3M in 2023 as rising interest rates choked mortgage origination activity. The 2024 rebound to $897.5M in operating cash flow, with free cash flow recovering to $679.2M, demonstrates that FAF’s earnings power is intact when transaction volumes normalize. On a trailing twelve-month basis, operating cash flow sits at $950.8M with free cash flow of $557.9M, a level that comfortably covers the company’s dividend obligations and signals that the payout is on firm ground heading into the current environment.

The broader four-year arc here reflects how deeply FAF’s cash generation is tied to real estate transaction cycles, and 2023 represented a genuine stress test. Free cash flow bottomed at just $90.9M that year, compressing the margin of safety for dividend coverage to its thinnest point in recent memory. The fact that management maintained the dividend through that trough, and that free cash flow has since rebounded to more than six times the 2023 low, speaks to both the durability of the underlying franchise and the discipline with which capital expenditures are managed. Capital spending has remained relatively modest throughout the cycle, as the gap between operating and free cash flow has stayed in a consistent range, which reflects a capital-light business model that converts a high proportion of earnings into distributable cash. For income investors, the key takeaway is that FAF’s free cash flow generation, even at mid-cycle levels, provides ample room to sustain and incrementally grow the dividend without stretching the balance sheet.

Analyst Ratings

The analyst community holds a constructive view on First American Financial, with the consensus rating sitting at buy across the five analysts who actively cover the stock. The mean price target of $79.40 implies upside of approximately 18% from the current price of $67.08, which is a meaningful gap for a dividend-paying financial services name. The range of targets spans from a low of $70.00 to a high of $90.00, reflecting a spread of views on how quickly the residential mortgage market will recover and how much incremental earnings power that recovery will unlock for FAF.

At the conservative end, the $70.00 target still represents roughly 4% upside from current levels, suggesting that even the most cautious analyst does not see the stock as overvalued at this price. The $90.00 high target implies a more optimistic scenario in which a meaningful pickup in home purchase and refinancing activity drives title insurance volumes back toward normalized levels, expanding margins and lifting earnings well above current figures. With the stock trading near the upper bound of its 52-week range, the question for investors is whether the easy money from the recovery trade has already been made or whether the longer-term earnings normalization case still justifies accumulation at these prices.

Given the buy consensus, the upside implied by the mean target, and a payout ratio that leaves ample room for continued dividend growth, the analyst community appears to view FAF as a name worth holding and adding to on any near-term pullbacks tied to housing market sentiment shifts.

Earnings Report Summary

A Solid Start to the Year

First American Financial has delivered materially improved financial results over the trailing twelve months, with total revenue reaching $7.45 billion and net income climbing to $621.8 million. Earnings per share of $6.00 reflect a dramatic improvement in profitability compared to the depressed results of prior periods when rate-driven transaction volume declines weighed heavily on the title insurance business. The profit margin of 8.34%, while modest in absolute terms, is a meaningful step forward for a business model that operates on relatively thin but consistent spreads.

The recovery in earnings has been driven by a combination of higher commercial real estate activity, improved fee per order in the residential segment, and the tailwind from a higher interest rate environment boosting investment income. First American’s investment portfolio, which is heavily weighted toward fixed-income securities, has benefited from rates remaining elevated, contributing a reliable stream of income that supplements underwriting results.

Steady Gains in Home Warranty

The Home Warranty segment has continued to provide a stable, less cyclical earnings contribution alongside the core title operations. While this segment does not generate the scale of the title business, it offers predictable revenue and has shown improving underwriting discipline that has lifted margins over recent reporting periods. Lower claim severity and better cost management have allowed the segment to grow its pretax contribution even in an environment of modest top-line growth, demonstrating the value of FAF’s business diversification beyond pure title exposure.

Cash Position and Capital Moves

Return on equity of 11.96% and return on assets of 3.95% indicate the business is putting its capital base to productive use. Book value per share stands at $53.92, and with the stock trading at 1.24 times book, the market is assigning a modest premium to FAF’s franchise value and earnings power. Management has continued to repurchase shares opportunistically, reflecting a view that the stock represents good value even as it has appreciated from last year’s lows. Operating cash flow of $950.8 million provides substantial flexibility to fund dividends, buybacks, and any strategic investments simultaneously.

A New Face at the Helm

Mark Seaton, who became CEO in April 2025, has now had several quarters to establish his strategic priorities. His messaging has remained consistent: lean into the commercial real estate momentum, maintain financial discipline, and position the company to benefit from the eventual normalization of residential mortgage volumes. His background as CFO for over a decade gives him a granular understanding of FAF’s financial levers, and the leadership team around him has remained stable and experienced.

Management Team

First American Financial Corporation is led by CEO Mark E. Seaton, who transitioned into the top role in April 2025 after serving as the company’s Chief Financial Officer for more than a decade. Seaton joined First American in 2006 and built deep familiarity with the company’s financial operations, investment strategy, and technology infrastructure during his tenure as CFO. His elevation to CEO represented an internal succession that prioritized continuity and institutional knowledge over outside disruption, a choice that has thus far been well received by the investment community.

The CFO role is held by Matthew F. Wajner, who has progressed through multiple financial leadership positions at First American including treasurer and chief accounting officer. His intimate knowledge of the company’s balance sheet and capital management practices provides a strong complement to Seaton’s broader strategic focus. Lisa W. Cornehl continues as Chief Legal Officer and Secretary, and Steven A. Adams anchors the company’s technology efforts as Chief Information Officer. The executive team as a whole reflects a culture of long-tenured professionals who understand the cyclical nature of the title insurance business and have demonstrated the patience and discipline required to manage through it effectively.

Valuation and Stock Performance

As of February 24, 2026, First American shares are trading at $67.08, near the top of their 52-week range of $53.09 to $68.75. The stock has appreciated considerably from its lows, and its current positioning reflects improving sentiment toward rate-sensitive financial services names as the outlook for the housing market has become somewhat less pessimistic. The market capitalization now stands at approximately $6.84 billion, a meaningful recovery in enterprise value from levels seen in the prior year.

The P/E ratio of 11.18 is one of the more compelling aspects of the current valuation. For a company generating $6.00 in EPS with a strong cash flow profile and a stable dividend, a single-digit to low-double-digit earnings multiple looks undemanding. The price-to-book ratio of 1.24 times is equally reasonable for an insurer of FAF’s quality and market position. These multiples suggest the stock is not pricing in an aggressive recovery scenario, which leaves room for upside if mortgage origination volumes improve more than expected over the next several quarters. The mean analyst price target of $79.40 implies roughly 18% upside from current levels, providing a reasonable margin of safety for investors entering at today’s price.

The stock’s beta of 1.29 is a reminder that FAF carries somewhat more volatility than the broader market, a natural consequence of its exposure to real estate transaction cycles. For income investors willing to accept that cyclicality, the combination of a 3.29% yield, a conservative 36.33% payout ratio, and an undemanding valuation makes a compelling case for long-term accumulation.

Risks and Considerations

First American’s business is inextricably tied to real estate transaction volumes, and that dependence remains the most significant risk for investors to consider. Elevated mortgage rates have suppressed existing home sales and refinancing activity for an extended period, and while there are signs of gradual improvement, any re-acceleration of rate increases or renewed deterioration in housing affordability could delay the volume recovery that the current earnings trajectory and analyst price targets assume. A meaningful pullback in commercial real estate activity, which has been a notable source of strength in recent periods, would compound that pressure.

Cybersecurity continues to represent a material operational risk for the company. First American experienced a significant cyberattack in late 2023 that disrupted certain systems and drew regulatory scrutiny. The company processes enormous volumes of sensitive financial and personal data as part of every real estate closing it facilitates, making it an attractive target for bad actors. While management has invested in strengthening its security infrastructure since that incident, the risk of future disruption cannot be fully eliminated, and a serious breach could result in financial liability, reputational damage, and regulatory consequences.

The company’s investment portfolio introduces additional variability to reported results. Although FAF invests heavily in fixed-income securities, shifts in interest rates, credit spreads, or the value of equity and alternative investments can generate mark-to-market gains or losses that affect net income in ways that are difficult to predict. While these fluctuations do not reflect the core operating health of the business, they can create noise in quarterly results and affect the payout ratio calculation in ways that occasionally alarm income-focused investors who are not familiar with how insurance company financials work.

Final Thoughts

First American Financial enters 2026 from a position of genuine financial strength. The dramatic improvement in earnings, the robust operating cash flow of $950.8 million, and a payout ratio that has fallen to a very manageable 36.33% together paint the picture of a company that has successfully navigated one of the more difficult periods in recent real estate history without compromising its dividend or its balance sheet integrity.

The valuation at 11.18 times earnings and 1.24 times book remains undemanding for a company of FAF’s quality, and the analyst consensus buy rating with a mean target of $79.40 suggests the professional investment community sees meaningful upside from current levels. For income investors, the combination of a 3.29% yield, steady dividend growth, and improving earnings coverage makes FAF a quietly compelling candidate in the financial services space. It is not a headline-grabbing story, but it rarely needs to be. First American’s value proposition has always been built on consistency, and right now, the fundamentals are squarely supporting that reputation.