Updated 2/24/26

Financial Institutions, Inc. (FISI) might not grab the spotlight, but that’s not why income-focused investors pay attention. This regional bank, headquartered in Western New York, has been around for over two centuries. Through all kinds of market conditions, it’s built a reputation not on flash, but on function, serving small communities, businesses, and individuals who rely on steady financial support. After a meaningful earnings recovery and a modest but welcome dividend increase in early 2025, the income story here has quietly improved, and long-term holders have been rewarded for their patience.

FISI is the parent company of Five Star Bank, which operates primarily in upstate New York. It’s a community-focused institution that tends to fly under the radar. But with shares now trading near $32, the stock has reclaimed substantial ground from its 2023 lows, and the fundamentals underpinning that recovery look more durable than they did a year ago. The question for dividend investors today is whether the current setup still offers value, and whether the payout can grow from here.

Recent Events

Financial Institutions, Inc. has continued building on the operational turnaround it began in early 2025. The company’s return to consistent profitability has been one of the more encouraging stories in the community banking space, with net income reaching $73.4 million on a trailing basis and earnings per share coming in at $3.61. That’s a dramatic improvement from the losses the bank absorbed in prior periods, reflecting both the benefits of its investment portfolio restructuring and a more favorable lending environment over the course of 2025.

One of the most tangible developments for income investors was the dividend increase that took effect with the March 2025 payment. FISI raised its quarterly dividend from $0.30 to $0.31 per share, the first increase in several years. While modest in absolute terms, the move signaled that management had enough confidence in the sustainability of the earnings recovery to begin rewarding shareholders with higher distributions. The $0.31 quarterly rate has held through the December 2025 payment, indicating the increase was deliberate and durable rather than a one-time gesture.

The stock has traded in a range of $20.97 to $35.47 over the past 52 weeks, and the current price of $32.02 places it in the upper portion of that band. Return on equity has climbed to 12.50% and return on assets sits at 1.21%, both solid figures for a bank of this size and profile. The profit margin of 32.09% reflects a meaningfully more efficient operation than investors were looking at just 18 months ago. With a market cap just under $645 million, FISI remains a small-cap name, but it’s one that has earned renewed attention from income-oriented investors seeking value in regional banking.

Key Dividend Metrics

📈 Forward Yield: 3.85%

💰 Annual Dividend: $1.25

🧮 Payout Ratio: 34.35%

📅 Last Dividend Paid: $0.31 (December 2025)

🚫 Dividend Cuts in 5 Years: 0

📊 Recent Dividend Increase: $0.30 to $0.31 (March 2025)

🧱 Book Value per Share: $30.89

🧮 Price/Book Ratio: 1.04

Dividend Overview

For income investors, FISI’s dividend profile has improved in a meaningful way over the past year. The quarterly payout now stands at $0.31, putting the annualized dividend at $1.25 and the forward yield at 3.85% based on the current price of $32.02. That yield is not the highest in the regional banking space, but it sits well above the broader market average and is supported by a payout ratio of just 34.35%, one of the more conservative ratios among dividend-paying community banks.

What makes this setup particularly appealing is the trajectory. The company spent several years holding the dividend flat at $0.30 per quarter while it worked through credit issues and restructuring costs. The move to $0.31 in March 2025 was a deliberate signal from management that the earnings base had stabilized enough to begin growing the payout again. With EPS now at $3.61 and the annual dividend at $1.25, there is substantial room to continue increasing distributions without straining the balance sheet or the income statement.

The consistency of the dividend through the difficult 2023 and 2024 period also speaks to management’s commitment to income shareholders. Many community banks in similar situations trimmed or suspended payouts. FISI held the line, and then rewarded patience with an increase once conditions improved. That kind of behavior tends to build credibility with long-term investors, and it’s worth weighting heavily when assessing the reliability of future distributions.

Book value per share has grown to $30.89, and with the stock trading at $32.02, FISI now trades at a slight premium to book at 1.04 times. That represents a shift from a year ago when the stock traded at a discount, reflecting the market’s recognition that the business has genuinely improved. For dividend investors, the takeaway is that the income here is well-covered, modestly growing, and backed by a capital base that continues to strengthen.

Dividend Growth and Safety

The March 2025 dividend increase, the first in several years, marks a meaningful inflection point for FISI’s income profile. At a payout ratio of 34.35% against EPS of $3.61, the company retains the vast majority of its earnings, which gives it both the flexibility to continue growing the dividend and the cushion to absorb any near-term earnings softness without threatening the payout. That combination of low payout ratio and recovering earnings power is exactly the profile dividend growth investors should be looking for in a regional bank.

Over the past five years, the dividend history reflects a period of stability followed by a careful resumption of growth. Payments held firm at $0.30 per quarter from 2023 through the end of 2024, then stepped up to $0.31 beginning in March 2025 and remained there through December 2025. The absence of any cuts during that entire stretch, even when the company was absorbing losses, is a strong indicator of how the board prioritizes income shareholders in its capital allocation decisions.

The stock’s beta of 0.69 adds another layer of comfort for income-focused investors. FISI tends to move less dramatically than the broader market, which makes it a more predictable holding in a diversified dividend portfolio. The company’s return on equity of 12.50% is healthy for a community bank of this size and suggests the earnings power supporting the dividend is not just a recovery-quarter phenomenon but a sustainable baseline going into 2026.

Operating cash flow and free cash flow figures are not available in the current data set, but the profitability metrics, including a 32.09% net profit margin and $73.4 million in net income, paint a picture of a company generating meaningful earnings well in excess of its dividend obligations. With annual dividend payments totaling roughly $25 million against net income of $73.4 million, the coverage ratio is strong and gives management room to continue raising the payout at a measured pace without compromising financial flexibility.

Chart Analysis

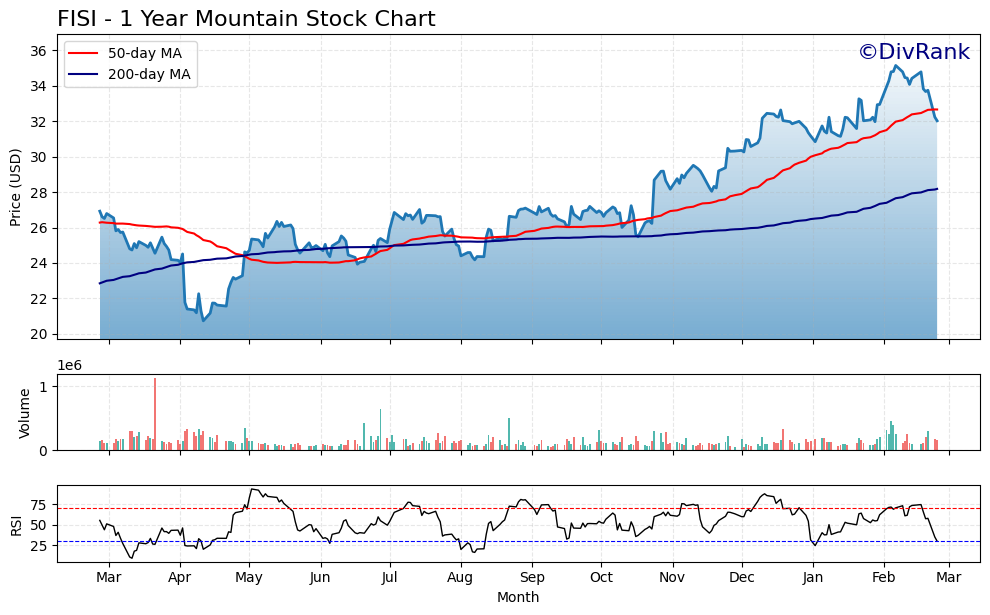

Financial Institutions Inc. has staged a meaningful recovery over the past year, climbing from a 52-week low of $20.73 to its current level of $32.02, a gain of roughly 54% from the trough. That upward move reflects a broad re-rating of regional bank stocks as interest rate fears gradually eased and credit quality concerns stabilized across the sector. The stock reached a 52-week high of $35.14 earlier in the cycle, and at the current price of $32.02, FISI sits approximately 8.9% below that peak. The pullback from the high is modest in the context of the full-year recovery, and the overall price structure remains constructive for investors focused on entry points rather than short-term momentum.

The moving average picture reinforces that longer-term constructive view. FISI is trading above its 200-day moving average of $28.18 by a comfortable margin, which confirms that the primary trend established off the lows remains intact. The 50-day moving average has crossed above the 200-day, producing a golden cross formation that technicians generally read as a bullish structural signal. The near-term softness is evident in the fact that the current price of $32.02 sits just below the 50-day moving average of $32.66, suggesting the stock is digesting recent gains rather than breaking down. For dividend investors, that slight compression between price and the 50-day average often represents a lower-risk area to build or add to a position.

The RSI reading of 29.73 is the most attention-grabbing data point in the current setup. A reading below 30 places FISI squarely in oversold territory by conventional technical standards, indicating that near-term selling pressure has been disproportionate relative to the underlying trend. Oversold readings in a stock that remains above its 200-day moving average frequently precede a mean-reversion bounce, as the longer-term trend reasserts itself once short-term sellers are exhausted. Momentum is clearly negative in the immediate term, but the severity of the RSI compression suggests the downside may be limited from current levels.

For dividend investors, the technical setup presents an interesting combination of signals. The golden cross, the healthy distance above the 200-day moving average, and the deeply oversold RSI together suggest that FISI is experiencing a short-term corrective phase within a larger recovery trend rather than the beginning of a sustained breakdown. Investors who prioritize yield and long-term total return over short-term price precision may find the current entry in the low $32 range appealing, particularly given that the stock is nearly 9% below its 52-week high while its moving average structure remains broadly supportive. As always, a position-sizing approach that allows for further volatility is prudent in any regional bank name.

Cash Flow Statement

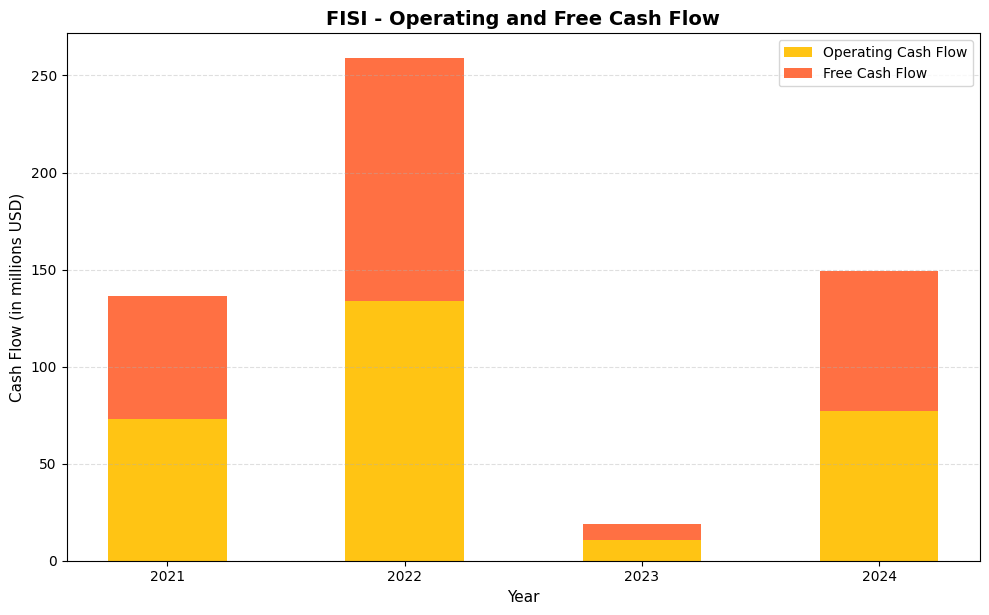

Financial Institutions Inc. generated $77.1 million in operating cash flow in 2024, a meaningful recovery from the severely compressed $10.9 million posted in 2023. Free cash flow followed the same trajectory, rebounding to $72.2 million last year after falling to just $7.9 million in 2023. That 2023 trough was a clear outlier in the context of FISI’s broader cash generation history, and the 2024 rebound restores a much more comfortable cushion relative to the company’s annual dividend obligations. With free cash flow now running well above what is required to fund the dividend at current payout levels, near-term dividend sustainability looks solid from a cash coverage standpoint.

Stepping back across the full four-year window, FISI’s cash flow profile shows both the strength and the variability inherent in community banking operations. The $133.6 million operating cash flow recorded in 2022 represented a high-water mark driven by favorable interest rate dynamics and balance sheet positioning, while 2023’s sharp contraction reflected the pressures many regional banks faced as deposit costs surged and margin compression took hold. What stands out from a capital efficiency perspective is how little the company consumes in capital expenditures relative to its operating cash generation, with the gap between operating and free cash flow averaging less than $5 million annually across the period. That lean capex profile leaves the bulk of operating cash available for dividends, share repurchases, or balance sheet fortification, all outcomes that serve income-focused shareholders well over a full rate cycle.

Analyst Ratings

Analyst coverage of Financial Institutions, Inc. is limited, with only two analysts currently providing estimates, which is typical for a community bank with a market cap under $700 million. Among those covering the stock, the price target range runs from $36.00 on the low end to $38.00 on the high end, with a mean target of $37.00. Based on the current price of $32.02, that consensus target implies upside of roughly 15.5% before accounting for the dividend yield, putting the total return potential in the neighborhood of 19% to 20% over a 12-month horizon.

No formal consensus rating has been published, and no recent analyst actions are available in the current data set. However, the price target range itself is instructive. With both targets sitting meaningfully above the current market price and above book value of $30.89, the analysts following the stock appear to be pricing in continued earnings improvement and potentially further dividend growth. The gap between the $37.00 mean target and today’s $32.02 price is notable for a stock that has already retraced much of its prior losses, suggesting the analytical community sees additional fundamental upside rather than just multiple expansion. For income investors, the combination of a well-covered 3.85% yield and double-digit price appreciation potential is a setup that merits serious consideration.

Earning Report Summary

A Full-Year Return to Profitability

Financial Institutions, Inc. has completed a full earnings recovery that would have been difficult to predict during the depths of its 2023 and 2024 struggles. On a trailing twelve-month basis, the company generated net income of $73.4 million, or $3.61 per share, against revenue of $233.3 million. The profit margin of 32.09% reflects an operation that has moved well past the one-time charges and restructuring costs that weighed on earlier results. Return on equity reached 12.50% and return on assets came in at 1.21%, both metrics that place FISI in solid standing relative to its community bank peer group.

Margin Expansion and Operational Discipline

The improvement in profitability traces back to several strategic decisions made in late 2024, including the repositioning of the investment securities portfolio and a renewed focus on commercial and industrial lending. Those moves, which were referenced by management as central to the Q1 2025 recovery, appear to have sustained their benefit throughout the year. The combination of higher net interest income and controlled noninterest expenses has driven the kind of consistent earnings power that gives the board confidence to grow the dividend and maintain its capital position.

Balance Sheet Strength

Book value per share has grown to $30.89, reflecting steady retained earnings accumulation and disciplined capital management. The stock trading at just 1.04 times book means the market is only barely pricing in the franchise value above tangible assets, which continues to represent a reasonable entry point for investors focused on long-term total return. Short interest of 378,023 shares is modest relative to the float, suggesting there is no meaningful skepticism from the short-selling community about the current earnings trajectory.

Looking into 2026

With a return on equity above 12% and a payout ratio well below 40%, FISI enters 2026 with more financial flexibility than it has had in several years. Management has not provided updated 2026 guidance in the current data set, but the earnings baseline established over the past four quarters gives them room to pursue measured loan growth, continued dividend increases, and further balance sheet optimization without taking on undue risk. The trajectory from loss-making bank to consistently profitable community lender has been completed, and the next chapter is about what the company does with that recovered earnings power.

Management Team

Financial Institutions, Inc. is led by a highly experienced executive team with a strong background in community banking and financial services. Martin K. Birmingham serves as President and CEO, a position he has held since 2013. His leadership has been central to the company’s strategic direction, guiding the bank through the difficult restructuring period of 2023 and 2024 and positioning it for the earnings recovery that has defined the past year. Birmingham’s willingness to make difficult but necessary portfolio decisions in late 2024 has validated the long-term approach that has characterized his tenure.

Jack Plants, the company’s Chief Financial Officer and Treasurer, played a pivotal role in the investment portfolio repositioning that improved net interest income and margins throughout 2025. His oversight of capital structure decisions, including the equity raise that funded the securities portfolio overhaul, demonstrated the kind of proactive financial management that dividend investors rely on to keep payouts safe and growing. With the earnings recovery now well established, his focus has shifted toward optimizing the balance sheet for sustained profitability in a potentially shifting rate environment.

Samuel J. Burruano Jr., EVP and Chief Legal Officer, brings depth to governance, legal affairs, and ESG strategy. Together with regional leadership and a streamlined organizational structure, the management team has demonstrated an ability to execute through a challenging cycle without sacrificing the dividend or the capital base. That combination of operational discipline and shareholder focus is a meaningful differentiator for a bank of FISI’s size, and it continues to underpin the investment case heading into 2026.

Valuation and Stock Performance

Financial Institutions, Inc. trades at $32.02 per share, giving the company a market capitalization of approximately $644.6 million. The stock has moved significantly higher over the past 12 months, trading within a 52-week range of $20.97 to $35.47. At the current price, FISI sits in the upper third of that range, reflecting the market’s recognition of the earnings improvement that has unfolded over the past several quarters. The stock is not cheap in the way it was when it traded below book value, but it remains modestly valued by most measures.

The trailing price-to-earnings ratio of 8.87 is well below the multiples typically assigned to banks with comparable returns on equity and profit margins. A 12.50% return on equity would normally command a premium to book value, yet FISI trades at just 1.04 times book, barely above tangible asset value. That disconnect between the quality of the earnings being generated and the valuation being assigned suggests the market has not yet fully repriced the stock to reflect the sustained nature of the recovery. With EPS at $3.61 and analysts targeting $37.00 on a mean basis, there is a credible path to further multiple expansion if earnings hold or improve from current levels.

For income investors, the 3.85% yield at the current price, combined with analyst price targets of $36.00 to $38.00, offers an attractive total return setup. The beta of 0.69 means investors are taking on below-market volatility to access that combination of income and potential appreciation. The stock has come a long way from its 2023 lows, but based on where valuation multiples sit relative to the current earnings power and book value, the recovery story does not appear fully priced in.

Risks and Considerations

Credit risk remains the most consequential variable for any regional bank, and FISI is no exception. The company has navigated through a difficult credit cycle with its dividend and capital base intact, but a deterioration in the upstate New York economy or stress in its commercial and industrial loan book could pressure earnings and force a reassessment of the capital allocation strategy. The bank’s concentration in a single geographic region means it does not have the diversification buffer that larger institutions can lean on during localized downturns.

Interest rate risk is an ongoing consideration given that FISI’s net interest margin improvement over the past year was partly a function of the rate environment and the investment portfolio repositioning executed in late 2024. If the Federal Reserve pursues a more aggressive easing cycle in 2026, spread compression could erode some of the margin gains that have driven the earnings recovery. Management’s portfolio restructuring provides some protection, but the risk of narrower spreads in a lower-rate environment is real and worth monitoring closely.

The stock’s move into the upper portion of its 52-week range also introduces valuation risk for investors buying at current levels. At $32.02, the stock trades at a modest premium to book, and while analyst targets suggest further upside, the easy gains from the deep-value phase of the recovery have already been captured. Investors entering now are relying more on continued earnings execution than on a simple mean-reversion trade, which raises the stakes around quarterly performance.

As a regulated financial institution, FISI must continuously invest in compliance infrastructure and cybersecurity capabilities. Both areas demand ongoing capital and human resources, and a failure in either could result in regulatory penalties or reputational damage that would be difficult and time-consuming to repair. These are not unique risks to FISI, but they are persistent ones that income investors in the regional banking space should keep in mind as they assess the long-term sustainability of the dividend and the earnings base supporting it.

Final Thoughts

Financial Institutions, Inc. has completed the earnings turnaround that long-term shareholders were waiting for, and the results speak clearly. Net income of $73.4 million, EPS of $3.61, a 12.50% return on equity, and a first dividend increase in several years all point to a company that has worked through its challenges and emerged with a stronger operating foundation. The payout ratio of 34.35% tells investors that the dividend is secure and that there is meaningful room to grow it further without compromising financial flexibility.

Management has earned credibility through a difficult cycle by keeping the dividend intact when many banks would have cut it, making the right portfolio decisions at the right time, and delivering a recovery that has pushed earnings well above their prior baseline. That track record matters when assessing whether the current dividend trajectory is sustainable or whether it reflects a favorable but potentially temporary set of conditions.

What makes FISI interesting at $32.02 is not a single metric but the combination of factors converging at once: a well-covered and modestly growing dividend yielding 3.85%, a valuation of just 8.87 times earnings with analyst targets implying 15% or more additional upside, below-market volatility, and a management team that has demonstrated exactly the kind of discipline income investors should want to see. For those seeking reliable income from a community bank with improving fundamentals and reasonable valuation, FISI remains a name worth owning.