Last Update 5/4/25

Fidelity D & D Bancorp, trading under the ticker FDBC, is one of those steady regional players in the banking world that’s been quietly building value for shareholders over the years. Based out of Dunmore, Pennsylvania, this institution traces its roots back over a century, offering a full range of community banking services with an old-school approach. It’s not flashy, and it doesn’t need to be. What makes it stand out—especially for income-focused investors—is its financial discipline and consistent dividend track record.

As the market continues to juggle rate expectations and economic outlooks, some of the most attractive opportunities lie in smaller, more conservative banks that keep things simple. Fidelity D & D fits neatly into that mold.

Recent Events

The stock closed May 2 at $43.10, up nearly 4% on the day. That’s not an insignificant move ahead of its upcoming earnings call scheduled for May 5 at 12:30 PM EDT. It’s a timely moment to take stock of how things are shaping up.

Fidelity has been putting together some solid numbers lately. Earnings per share over the past 12 months came in at $3.75, up 18.5% year-over-year. Revenue also rose 11.3% from the prior year, totaling $81.62 million. That’s solid growth in a market where many regionals are reporting flat or declining numbers.

What’s more, the bank is operating with impressive margins. Operating margin is sitting at 32.7%, while net margin came in at 26.6%. Those numbers aren’t just good—they’re healthy signs of a well-run institution.

One of the most compelling aspects? The balance sheet. Fidelity is holding $211 million in cash against just $6.2 million in debt. That’s an enviable position and adds a layer of financial resilience that many investors overlook.

Key Dividend Metrics

📈 Forward Dividend Yield: 3.71%

💵 Annual Dividend Rate: $1.60

🕐 Trailing Dividend Yield: 3.76%

📊 5-Year Average Yield: 2.79%

📌 Payout Ratio: 41.6%

📆 Ex-Dividend Date: February 14, 2025

💰 Last Dividend Paid: March 10, 2025

Dividend Overview

When it comes to dividends, Fidelity D & D checks a lot of the right boxes. It’s paying out a forward yield of 3.71%, which stands out nicely compared to both peers and broader market averages. More notably, that current yield is well above the company’s five-year average of 2.79%, suggesting the yield is not only attractive—but historically high for this stock.

The company has been pretty disciplined with its payout, and the numbers back that up. The payout ratio sits at just 41.6%, meaning there’s plenty of room to continue paying and even increasing the dividend without putting stress on operations.

The most recent dividend was $0.40 per share, continuing a string of quarterly distributions that have been gradually trending higher over the years. While the pace of growth isn’t explosive, it’s consistent—and consistency is gold for dividend investors.

Another factor worth pointing out is the ownership structure. About 18.6% of shares are held by insiders. That kind of alignment usually bodes well for dividend reliability since insiders tend to favor steady and dependable income streams just like long-term investors do.

Dividend Growth and Safety

Over the past several years, the dividend has quietly increased without a lot of noise. You won’t see splashy headlines about massive hikes, but Fidelity D & D has demonstrated a steady commitment to rewarding shareholders. That consistency builds trust—especially for those who rely on dividends for regular income.

As for safety, this is where the company really shines. With a mountain of cash on hand and virtually no debt, there are no red flags suggesting the dividend is at risk. If anything, the numbers suggest it’s one of the more secure payouts in the regional banking space.

Add to that a return on equity of 10.77%—a solid figure that shows management is putting capital to work efficiently—and the picture becomes even clearer. This isn’t a high-growth rocket ship, but it’s a financially sound institution that knows how to take care of its shareholders.

The stock is down about 10% over the last year, but that only makes the current yield more appealing. With a 52-week low of $37 and a high of $61.21, today’s price puts the stock closer to its lower range. That adds a bit of cushion for investors looking for both income and potential price recovery down the road.

For those who prioritize dependable dividends from companies with strong balance sheets and a conservative mindset, Fidelity D & D Bancorp continues to offer a compelling case.

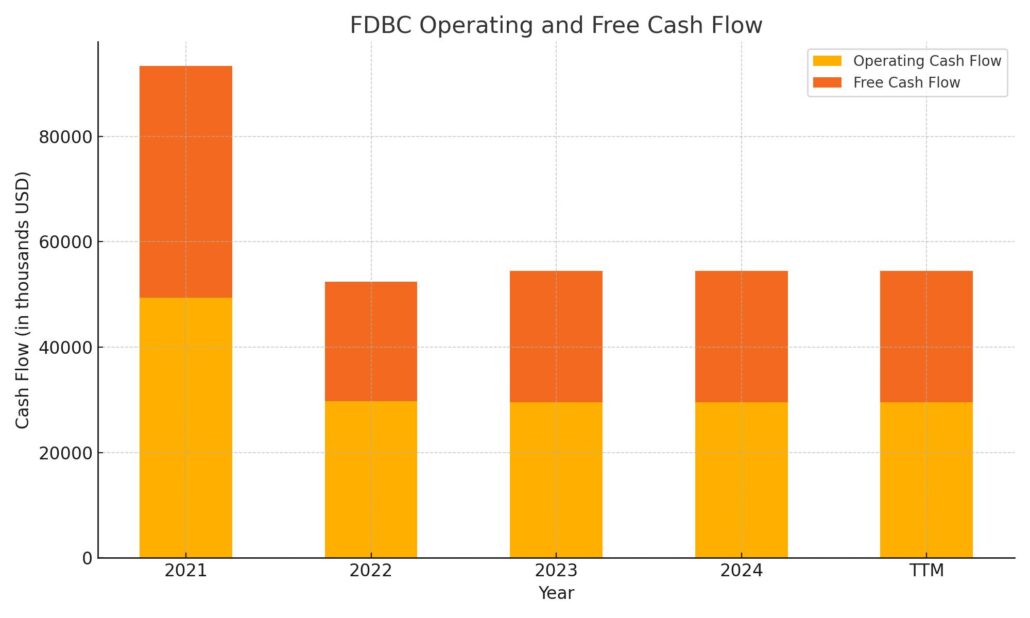

Cash Flow Statement

Fidelity D & D Bancorp’s trailing 12-month cash flow shows a healthy generation of cash from core operations, with operating cash flow landing at $29.56 million. This figure is nearly flat compared to the prior year but still demonstrates solid consistency. Free cash flow, which strips out capital expenditures, came in at $24.9 million—enough to comfortably support its dividend payments and still leave room for reinvestment or strategic moves.

The larger story this year lies in the investing and financing sections. Investing activities resulted in a significant outflow of $113.59 million, driven largely by securities purchases or loan originations—common for a growing bank. On the other hand, financing cash flow was strongly positive at $55.43 million, reflecting capital inflows that helped offset investment spending. The year-end cash position stands at $83.35 million, showing that despite heavy investing, the bank is maintaining strong liquidity. This steady cash posture adds confidence for shareholders focused on dividend stability.

Analyst Ratings

📉 Fidelity D & D Bancorp (FDBC) was recently downgraded from a “Hold” to a “Sell” rating by analysts tracking regional banking stocks. This shift in sentiment appears to be driven more by technical weakness than a change in the company’s core fundamentals. The stock has been trading below its long-term moving averages, and momentum indicators like MACD have tilted negative, suggesting further downside pressure could be ahead if trends continue.

📊 Despite the downgrade, FDBC reported solid first-quarter earnings for 2025. Earnings per share came in at $1.03, up from $0.88 the same time last year. Revenue grew by over 10% year-over-year, reaching $28.3 million. These numbers reflect operational strength and careful cost management. The downgrade, however, seems rooted in the recent price action rather than underlying performance. Technical traders are reacting to signs of bearish momentum building as the stock lingers closer to its 52-week low.

💬 At the moment, there is no official consensus price target from analysts, which is not unusual for a smaller-cap regional bank with limited coverage. The lack of institutional attention doesn’t necessarily reflect on quality—it often comes down to market size and visibility. Still, for investors watching analyst sentiment, the recent downgrade is a signal worth noting alongside the bank’s strong quarterly results.

Earning Report Summary

Solid Start to 2025

Fidelity D & D Bancorp kicked off 2025 with a solid performance, reporting $6 million in net income for the first quarter. That translates to $1.03 per diluted share, up nicely from last year’s first quarter. It’s the kind of progress that reflects both smart execution and healthy demand in their market.

Total assets pushed up to $2.7 billion, thanks to growth in both loans and deposits. Interest-earning assets increased by $148 million, and yields improved by 21 basis points. That helped drive net interest income to $17 million, a 14% jump compared to the same period last year.

Margin Expansion and Revenue Growth

The bank’s net interest margin improved to 2.89%, up from 2.69%. That’s a good sign they’re managing the balance sheet effectively, especially in a rate environment that’s been tricky for a lot of regional lenders. Non-interest income was also up by 9%, coming in at $5 million. Contributions from wealth management and card-related fees helped push that figure higher.

Operating expenses did rise, up 6% to $14.6 million. Most of that was tied to increased compensation and marketing. But even with the added spending, overall profitability remained solid.

Comments from Leadership

CEO Dan Santaniello sounded upbeat about the results. He pointed out that reaching $2.7 billion in assets, along with loan and deposit growth, was a strong way to begin the year. He also highlighted the improvement in net interest margin and made it clear the bank is focused on keeping expenses in check while staying committed to its strategic goals.

He didn’t shy away from the importance of credit quality either, emphasizing that metrics remain healthy and in line with expectations. That kind of consistency matters when building long-term confidence.

Balance Sheet and Outlook

Shareholders’ equity increased by $7.7 million during the quarter, reaching $211.7 million. Most of that growth came from retained earnings, showing the company is keeping profits close to home. Non-performing assets stayed low at 0.23% of total assets, another reassuring sign for anyone keeping an eye on asset quality.

All in all, the first quarter sets a confident tone for the rest of the year. Between margin improvement, balance sheet strength, and a clear commitment to controlled growth, Fidelity D & D looks focused and grounded in its approach to 2025.

Management Team

Fidelity D & D Bancorp has a leadership team that reflects the company’s roots in community banking. At the top is Dan Santaniello, who serves as President and CEO. He’s been with the bank for decades and brings a clear understanding of both the market and the company’s culture. His approach isn’t about chasing trends but about steady growth, strong relationships, and risk awareness. That mindset has kept the bank on solid footing through various market cycles.

What stands out about this management team is how tightly focused they are on the fundamentals. They aren’t making headlines with flashy acquisitions or risky bets, but rather staying disciplined with lending practices, expanding customer relationships, and keeping overhead in check. The board and executive team have deep local ties, and that’s translated into a culture of accountability and long-term thinking. It’s also worth noting that insiders own a meaningful portion of shares, which aligns their interests closely with shareholders.

This team has managed to consistently grow the bank’s footprint, even in a competitive environment. Over the last few years, they’ve shown they can handle rising interest rates, margin pressure, and economic uncertainty with a calm and measured approach. That kind of steady leadership is important for investors who prioritize income, stability, and a long-term view.

Valuation and Stock Performance

Looking at valuation, Fidelity D & D isn’t trading at frothy multiples. In fact, its current price-to-earnings ratio sits at 11.49, which looks reasonable given the growth in earnings and revenue. Compared to its own history and to peers in the regional banking space, this valuation suggests the stock is sitting in fair-to-undervalued territory.

The stock has had a choppy ride over the past year, falling about 10 percent from its 52-week high. Shares peaked near 61 dollars and have since pulled back to the 43 dollar range. Despite the dip, the fundamentals remain intact. The company’s earnings have continued to grow, and the dividend yield has ticked higher as a result. For income-focused investors, that pullback could be seen as an opportunity to pick up a well-run bank at a more attractive yield.

Its price-to-book ratio of 1.17 also suggests the stock isn’t being overly bid up by the market. That could reflect broader caution toward regional banks, but it also gives investors a chance to own a steady dividend payer at a reasonable entry point. With a beta of just 0.65, this stock tends to move less dramatically than the broader market, which can appeal to more conservative, income-focused portfolios.

Risks and Considerations

No investment comes without risk, and that holds true for FDBC. One of the more immediate concerns is tied to the broader economic environment. If interest rates begin to drop significantly, net interest margins could come under pressure. While the company has managed these shifts well in the past, it’s something that could affect earnings if spreads compress.

Another factor to consider is the regional nature of the bank’s business. While its community focus is a strength, it also means limited geographic diversification. Any economic stress in its core markets—like a downturn in the local housing or small business economy—could have a more direct impact on performance.

Liquidity appears to be in excellent shape, with over 200 million dollars in cash on the balance sheet and very modest debt. However, the banking industry still faces regulatory scrutiny and the potential for changing capital requirements. These are external risks that could affect even well-managed banks like Fidelity.

Lastly, trading volume in the stock is low, which means liquidity for investors is more limited compared to larger names. This doesn’t affect the underlying business, but for investors who need to make large trades or want higher daily volume, it’s something to keep in mind.

Final Thoughts

Fidelity D & D Bancorp offers a profile that many dividend investors look for—consistent earnings, a reliable and growing dividend, conservative management, and a strong balance sheet. While it doesn’t have the scale or media attention of larger banks, its quiet consistency has been a strength, not a weakness.

The management team has shown that it knows how to operate through different rate environments and has remained focused on long-term results over short-term gains. The dividend yield is now meaningfully higher than its five-year average, supported by a low payout ratio and ample free cash flow. That combination should offer some peace of mind for those seeking stable income.

With a valuation that’s not demanding and a track record of profitability, Fidelity D & D may not be a flashy stock, but it’s one with staying power. Investors who appreciate disciplined operations and dependable dividends will find a lot to like here. While there are risks tied to regional exposure and market sentiment around smaller banks, this is a company that’s kept a steady hand on the wheel.

For those building or maintaining a dividend-focused portfolio, Fidelity D & D stands as an example of the kind of quietly strong business that deserves attention. It’s not always about chasing the biggest names—sometimes, it’s the steady performers that make the best long-term partners.