Key Takeaways

💸 EPRT offers a forward dividend yield of 3.64% with a consistent growth track record, supported by long-term net lease structures and a near-fully occupied portfolio.

💼 Operating cash flow reached $381.1 million over the trailing 12 months, with free cash flow of $300.8 million, reflecting continued strength in the company’s core leasing operations.

📊 Analysts maintain a strong buy consensus across 20 firms, with an average 12-month price target of $36.15 and a high end of $40.00, implying meaningful upside from current levels.

📈 Revenue for the trailing twelve months came in at $561.2 million, with net income of $252.1 million and EPS of $1.28, as the company continues to execute its disciplined acquisition strategy.

Updated 2/25/26

Essential Properties Realty Trust (EPRT) specializes in single-tenant, service-oriented properties under long-term net leases, with a portfolio spanning over 2,100 locations and an occupancy rate near 99.7%. Focused on sale-leaseback transactions with middle-market operators, the company has built a stable stream of cash flow backed by predictable lease terms and inflation-linked rent escalators.

Its trailing financials reflect sustained momentum, with revenue of $561.2 million, net income of $252.1 million, and operating cash flow of $381.1 million. The stock currently yields 3.64% and continues to attract a broad institutional following thanks to its consistent dividend growth and conservative balance sheet management.

Recent Events

Essential Properties Realty Trust has continued executing its core strategy heading into early 2026, maintaining the disciplined acquisition pace and tenant quality standards that have defined the company since its early years. The portfolio remains anchored in service-oriented, necessity-driven businesses, and the company’s sale-leaseback model continues to generate a reliable pipeline of new deals with middle-market operators seeking capital flexibility.

The most recent dividend payment of $0.31 per share was made on December 31, 2025, reflecting a dividend that has moved steadily higher over the past several quarters. The quarterly payout has grown from $0.275 in early 2023 to the current $0.31, marking a consistent upward trajectory that income investors have come to expect from this name. The annualized dividend now stands at $1.24 per share.

Institutional interest in the stock remains firm, and the shares have climbed meaningfully over the past year, trading near the top of their 52-week range of $27.44 to $33.35. The stock’s current price of $33.27 reflects positive sentiment around the company’s fundamentals and the broader stabilization of the rate environment, which has lifted net lease REITs as a category. Short interest stands at roughly 9.7 million shares, a figure worth monitoring but not one that signals unusual bearish conviction at current levels.

The company’s balance sheet continues to support both growth and income objectives. With operating cash flow of $381.1 million and free cash flow of $300.8 million on a trailing twelve-month basis, EPRT has demonstrated that its capital-intensive acquisition model does not come at the expense of cash generation quality. Management has maintained a posture of steady, methodical growth rather than chasing volume, and that approach has translated into financial results that continue to reward patient shareholders.

Key Dividend Metrics 📊

💰 Forward Dividend: $1.24

📈 Yield: 3.64%

📅 Last Ex-Dividend Date: December 31, 2025

📊 5-Year Average Yield: 4.28%

🔁 Payout Ratio: 94.14%

📉 Dividend Growth (Since Q1 2023): ~12.7%

📆 Last Paid Dividend: $0.31 per share

🏛 Dividend Safety: Stable and growing

Dividend Overview

EPRT’s forward yield of 3.64% sits modestly below its five-year average of 4.28%, which reflects the meaningful price appreciation the stock has seen as investor confidence in the company’s model has grown. That compression in yield relative to historical norms is not a warning sign, it is a natural consequence of a stock whose fundamentals have earned a higher market multiple over time. Income investors entering today at $33.27 are still receiving a competitive yield relative to many net lease peers.

The payout ratio based on GAAP earnings comes in at 94.14%, which is high by traditional standards but entirely consistent with how REITs are designed to operate. The more meaningful metric is coverage relative to AFFO, where EPRT has historically maintained a comfortable cushion. With operating cash flow of $381.1 million and a total annual dividend obligation well below that figure given current share count, the income stream has ample support from actual cash generation rather than accounting constructs.

The nature of EPRT’s tenant base continues to reinforce dividend stability. These are operators in businesses people use consistently, from car washes and early childhood education centers to auto repair shops and medical clinics. That mix of everyday-use, service-oriented tenants creates a durable foundation for cash collection, and the long-term lease structures mean that foundation doesn’t shift quarter to quarter based on short-term economic conditions.

Dividend Growth and Safety

The dividend history over the past three years tells a straightforward story. Starting at $0.275 per quarter in early 2023, the payout has climbed steadily to the current $0.31, representing cumulative growth of roughly 12.7% over that period. That works out to a measured but reliable pace of increases, with the company raising the dividend multiple times without skipping a beat. Investors who reinvested along the way have benefited from both the income and the compounding effect of a rising payout on an appreciating stock.

Safety is supported by several structural factors. Lease terms averaging approximately 14 years mean that the revenue base is largely locked in, reducing the risk of sudden occupancy gaps or rent roll-offs that can destabilize less defensively structured portfolios. A high percentage of leases include rent escalators tied to inflation or fixed annual increases, which provides the company with a built-in mechanism to grow revenue without deploying additional capital.

Leverage remains manageable. EPRT has historically maintained a net debt to EBITDAre ratio in the low-to-mid 3x range, which is conservative relative to many of its net lease peers. The company’s fixed-rate debt profile limits sensitivity to near-term rate movements, and its access to capital markets through equity and credit facilities provides flexibility to fund growth without being forced into dilutive transactions at inopportune times.

Institutional ownership continues to reflect strong demand for the stock among funds that require reliable dividend income to meet their mandates. That steady base of long-term holders helps support price stability and reinforces the dividend’s perceived durability. For investors who prioritize income consistency above all else, EPRT’s track record over the past several years is difficult to argue with.

Chart Analysis

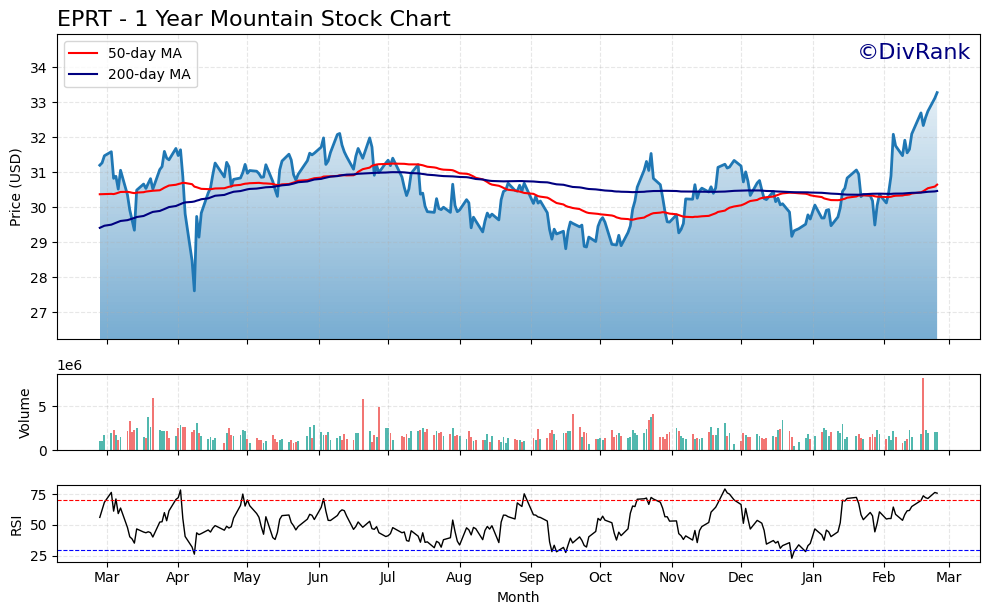

Essential Properties Realty Trust has put together a strong run over the past year, climbing from a 52-week low of $27.61 to its current price of $33.27, a gain of roughly 20.5% from the trough. What makes the current reading particularly notable for trend followers is that today’s price also represents the 52-week high, meaning EPRT is trading at its strongest level in at least twelve months with no overhead resistance from prior price history to contend with. That kind of upward trajectory, built steadily rather than in a single spike, reflects genuine accumulation and improving sentiment toward the name rather than a short-term technical squeeze.

The moving average picture reinforces the bullish setup. The 50-day moving average sits at $30.64 and the 200-day at $30.46, and the fact that the shorter-term average has crossed above the longer-term average places EPRT in a confirmed golden cross configuration, which technical analysts broadly regard as a signal that intermediate momentum has turned constructively in favor of buyers. The stock is trading roughly 8.6% above its 50-day and approximately 9.2% above its 200-day, so there is meaningful separation between price and both averages, which typically indicates a trend with real conviction behind it rather than one that is merely flirting with a breakout.

The RSI reading of 75.86 does demand some attention. A reading above 70 places EPRT in technically overbought territory, and at nearly 76 the stock is pushing into a range where short-term consolidation or a modest pullback is a reasonable expectation. This does not imply a change in the underlying trend, but investors initiating or adding to a position at current levels should be aware that buying at a 52-week high with an elevated RSI carries more near-term timing risk than entering during one of the quieter consolidation phases the stock experienced earlier in the year.

For dividend investors, the technical picture is broadly constructive. A golden cross, clean uptrend, and a fresh 52-week high all point to a stock that the market is rewarding with a higher valuation, which matters for income investors because price appreciation compounds total return on top of the dividend yield. The one practical takeaway is patience. Given the overbought RSI, investors who are not already fully positioned may be better served by waiting for a pullback toward the $30.50 to $31.00 range, near moving average support, before adding aggressively. Those already holding are in a favorable position with both price action and trend structure working in their favor.

Cash Flow Statement

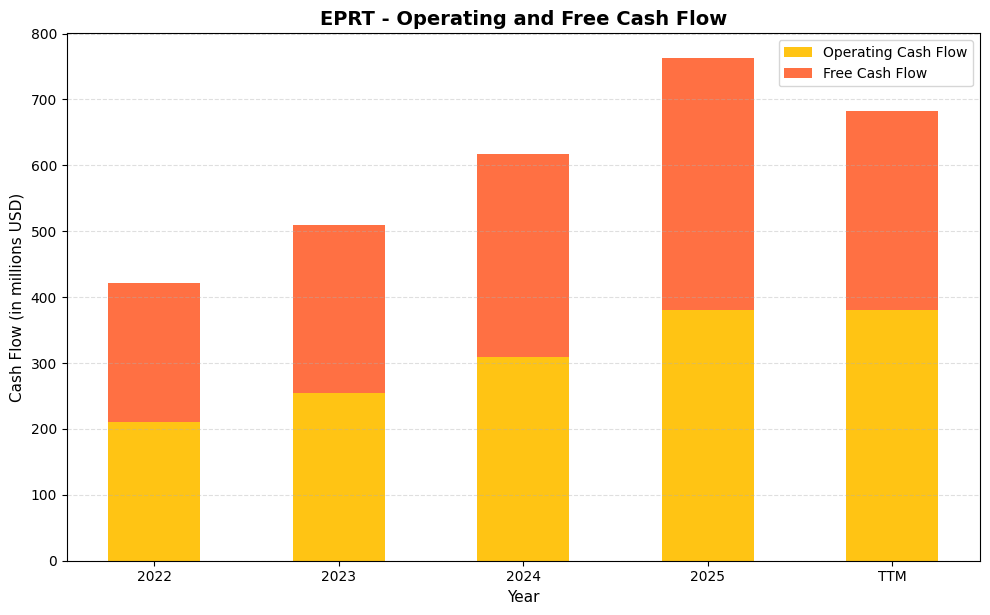

Essential Properties Realty Trust has delivered a clean and consistent expansion in operating cash flow over the past three years, moving from $211.0 million in 2022 to $254.6 million in 2023, $308.5 million in 2024, and $381.1 million in 2025. Because EPRT’s portfolio consists of net lease properties where tenants cover most operating expenses, the company carries minimal capital expenditure obligations, which explains why free cash flow has historically matched operating cash flow almost exactly. The TTM figure shows a modest divergence, with operating cash flow at $381.1 million and free cash flow at $300.8 million, a gap of roughly $80 million that reflects some incremental capital deployment, though the underlying generation remains strong. For dividend investors, this trajectory is highly encouraging, as the payout is being covered by a growing and structurally efficient cash engine rather than relying on asset sales or leverage to meet distribution obligations.

The compounding rate of operating cash flow growth here is genuinely impressive for a net lease REIT of this size, representing an increase of approximately 81% from 2022 through 2025 in just three years. That kind of expansion reflects the cumulative effect of EPRT’s disciplined acquisition strategy, which has focused on service-oriented, necessity-based tenants across industries like convenience stores, car washes, and medical services. These are tenants with durable unit economics that tend to honor long-term leases, keeping occupancy high and rent collections predictable. For shareholders, what this means in practical terms is that management has room to continue growing the dividend without stretching the payout ratio, and the widening cash flow base provides a buffer against any isolated tenant credit events that might otherwise pressure coverage metrics.

Analyst Ratings

The analyst community’s view on Essential Properties Realty Trust is firmly positive heading into late February 2026. Across 20 covering firms, the consensus stands at strong buy, making it one of the more uniformly supported names among mid-cap net lease REITs. That level of conviction reflects sustained confidence in the company’s fundamentals, portfolio quality, and management execution rather than any single near-term catalyst.

The average 12-month price target among analysts is $36.15, which implies approximately 8.7% upside from the current share price of $33.27. The range of targets is reasonably wide, spanning from a low of $33.00 to a high of $40.00, which captures both more conservative views on valuation given where the stock has already traded and more optimistic scenarios tied to continued portfolio growth and potential rate relief. The $40.00 high target in particular suggests that some analysts see meaningful room for multiple expansion if the macro backdrop becomes more favorable for REITs.

The price target floor of $33.00 sits essentially at the current trading price, indicating that even the most cautious analysts covering the name see limited downside from here. That kind of floor support is meaningful for income investors evaluating risk-adjusted return potential, as it suggests the dividend yield provides real compensation even in a scenario where the stock trades sideways. With the shares near the top of their 52-week range and the consensus pointing higher, the balance of analyst opinion suggests the stock has further room to run as long as the operating environment remains constructive.

Earning Report Summary

Sustained Growth Through Consistent Execution

Essential Properties Realty Trust’s trailing financial results reflect a company that has continued to grow without deviating from the disciplined approach that defines its model. Revenue on a trailing twelve-month basis reached $561.2 million, a significant increase from prior periods, driven by portfolio expansion through acquisitions and the compounding effect of rent escalators embedded in existing leases. Net income came in at $252.1 million, translating to EPS of $1.28, and the profit margin of 45.1% underscores how efficiently the net lease model converts revenue into earnings.

Operating cash flow of $381.1 million and free cash flow of $300.8 million represent the most important measures of the company’s financial health from a dividend investor’s perspective. These figures confirm that the payout is backed by genuine cash generation, not balance sheet engineering. Return on equity stood at 6.52% and return on assets at 3.55%, both consistent with the capital-intensive nature of real estate investment but reflective of a portfolio that is earning its keep.

Leadership’s Posture and the Path Forward

CEO Pete Mavoides has consistently communicated a focused and confident tone in discussing the company’s strategy, emphasizing the durability of EPRT’s tenant relationships and the strength of its pipeline. The sale-leaseback model continues to attract middle-market operators who need capital and are willing to commit to long-term lease terms in exchange, and that dynamic has not changed materially despite the higher rate environment of the past few years.

The portfolio remains nearly fully occupied at approximately 99.7%, and lease terms averaging around 14 years continue to provide revenue visibility that few other real estate models can match. With the dividend now at $0.31 per quarter and a clear track record of gradual increases, management has signaled its commitment to returning capital to shareholders in a reliable and growing manner. The company’s capital position, supported by its credit facility and equity market access, gives it the flexibility to continue pursuing acquisitions selectively and maintain the growth profile that has earned it its current analyst consensus.

Management Team

At the core of Essential Properties Realty Trust’s strategy is a leadership team that clearly knows the business of net lease real estate inside and out. CEO Pete Mavoides brings decades of experience in sale-leaseback transactions, and his approach reflects a steady hand rather than a speculative one. He has been with the company since its early days and has steered it through both expansive growth and more cautious, rate-sensitive environments with clarity and consistency.

The broader executive team operates with a low-profile, no-drama style that fits well with the company’s methodical acquisition strategy. Their communication with shareholders has been consistent, with a strong emphasis on transparency, long-term focus, and discipline when it comes to capital allocation. Bold proclamations and overreaching ambitions are notably absent from their public commentary, and that restraint is part of what gives EPRT its credibility among institutional investors who have followed the company across multiple market cycles.

Management has done a commendable job maintaining tenant quality and navigating a period of elevated interest rates without compromising balance sheet strength or dividend growth. The consistency in execution suggests a team that understands risk and knows when to lean in versus when to hold back. That combination has helped preserve dividend stability and build investor trust, particularly among those who prioritize reliability over short-term excitement in their income portfolios.

Valuation and Stock Performance

EPRT’s stock has had a strong run over the past year, climbing from a 52-week low of $27.44 to its current price of $33.27, a gain of approximately 21% from the trough. That performance places the stock near the top of its annual range, with the 52-week high sitting at $33.35, just a few cents above where shares are trading today. That proximity to the high reflects positive momentum but also raises a reasonable question about near-term upside without a fresh catalyst.

The valuation picture is nuanced. At a P/E ratio of 25.99, the stock trades at a multiple that reflects the market’s respect for EPRT’s consistency and income reliability rather than any expectation of dramatic earnings acceleration. For a net lease REIT with a near-fully occupied portfolio and inflation-linked lease escalators, that premium to book value of 1.66x is defensible. The book value per share of $20.03 confirms that the market is ascribing meaningful goodwill to the quality and durability of the cash flows EPRT has demonstrated it can generate.

With the stock at $33.27 and the analyst consensus price target at $36.15, there is approximately 8.7% in implied price appreciation available over the next twelve months, on top of the 3.64% dividend yield. That total return potential of roughly 12% to 13% is competitive for a REIT with this level of stability and income predictability. The beta of 0.99 indicates the stock moves roughly in line with the broader market, which means income investors are not taking on unusual volatility risk to access that return profile.

The market cap of approximately $7.0 billion reflects EPRT’s growth from a smaller-cap name into a meaningfully sized institutional-grade REIT. That scale brings with it greater liquidity, broader analyst coverage, and a more stable shareholder base, all of which tend to reduce the kind of erratic price behavior that can accompany smaller names in the sector.

Risks and Considerations

Interest rate sensitivity remains the most prominent structural risk for EPRT. While the company has managed its fixed-rate debt profile thoughtfully and maintained leverage at conservative levels, sustained elevated borrowing costs still affect the economics of new acquisitions and the relative appeal of the dividend yield compared to risk-free alternatives. Any reversal in the rate outlook that pushes long-term yields higher could weigh on the stock’s multiple even if the underlying business continues to perform well.

Tenant concentration within specific service categories is worth monitoring. The portfolio’s emphasis on businesses like car washes, early childhood education, auto services, and casual dining creates some exposure to sectors that could face stress if consumer spending deteriorates meaningfully in a recessionary environment. While the diversification across more than 2,100 properties limits single-tenant risk, a broad pullback in discretionary consumer activity could affect the credit quality of a portion of the tenant base simultaneously.

The payout ratio of 94.14% based on GAAP earnings is elevated, and while the AFFO coverage provides a more comforting picture, income investors should understand that there is limited room for the dividend to grow faster than earnings without the company drawing down its coverage cushion. If acquisition activity slows or cap rates compress to the point where new deals are less accretive, the pace of dividend growth could moderate further from its already measured trajectory.

Regulatory and tax considerations specific to REITs represent a lower-probability but real long-term risk. Any legislative changes to REIT tax treatment, depreciation rules, or 1031 exchange provisions could have ripple effects across the sector. EPRT’s current structure is well-suited to the existing regulatory framework, but the company, like all REITs, would be subject to any broad policy changes that alter the economics of property ownership and income distribution.

Final Thoughts

Essential Properties Realty Trust continues to offer something that is increasingly valuable in a complicated investment environment: a straightforward business model executed with consistency and discipline. Its focus on service-oriented, necessity-driven tenants under long-term leases has produced a financial track record that income investors can rely on, and the steady progression of the dividend from $0.275 per quarter in early 2023 to $0.31 today is the clearest evidence of that reliability.

The stock’s approach to its 52-week high suggests the market has already recognized much of what makes EPRT compelling, and near-term upside may be more measured than it was earlier in the year. But with a strong buy consensus across 20 analysts, a mean price target of $36.15, and a dividend that has grown without interruption, the case for holding or initiating a position at current levels remains intact for long-term income investors.

Management’s track record of conservative capital allocation, portfolio curation, and transparent communication with shareholders gives the company a credibility that takes years to build and is not easily replicated. That credibility is part of what justifies the current valuation premium and supports confidence in the dividend’s continued growth trajectory.

EPRT is not a high-yield REIT chasing maximum income at the expense of quality. It is a carefully managed, institutionally respected income vehicle that has demonstrated it knows how to grow a portfolio, protect a dividend, and reward patient shareholders. In an environment where dependability matters, that profile continues to stand out.