Key Takeaways

💰 EXPO’s forward dividend yield is 1.56%, above its 5-year average, with a strong history of steady annual growth and a sustainable payout ratio under 56%.

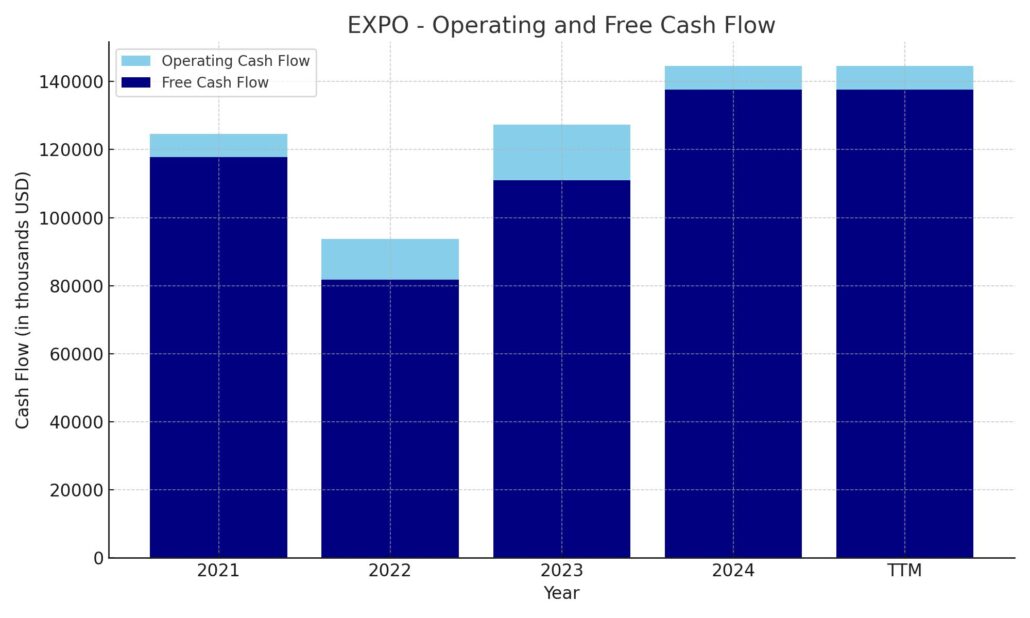

💵 Free cash flow reached $137.6 million in the trailing twelve months, supported by stable operating cash flow and minimal capital expenditures.

📊 Analysts have mixed views, with a consensus price target around $98 and recent ratings reflecting caution due to valuation and modest near-term growth.

📉 The latest earnings report showed flat year-over-year revenue and a dip in profit, with leadership remaining confident in long-term growth despite short-term headwinds.

Last Update 5/4/25

Exponent, Inc. (NASDAQ: EXPO) delivers specialized consulting rooted in science and engineering, serving clients in industries where technical precision is critical. From litigation support to regulatory advisory, its work spans sectors like healthcare, consumer products, and chemicals—often in high-stakes environments. The company is known for strong margins, low debt, and a consistent approach to shareholder returns through dividends and selective buybacks.

Over the past year, EXPO has faced modest headwinds, with flat revenue growth and a dip in earnings, leading to a nearly 19 percent decline in its stock price. Still, it remains well-capitalized, with a forward dividend yield of 1.56%, robust free cash flow, and a leadership team focused on long-term execution.

Recent Events

The past year has been rough for EXPO’s stock. Shares have slid nearly 19% over the last 12 months, while the broader market has moved higher. It’s a notable underperformance, especially for a company with steady revenue and a clean balance sheet. The 52-week range tells the story: a high of $115.75 and a low down near $73.37. The current price? Right around $76. That’s a long way off its moving averages.

What’s caused the stumble? Mostly, softer earnings. Revenue growth was flat—just 0.2% year-over-year. Meanwhile, earnings actually shrank a bit, down more than 11% compared to the same quarter last year. Those aren’t the kind of numbers investors want to see from a company with a premium valuation, and Exponent’s P/E ratio remains north of 37, even after the sell-off.

Still, it’s not all negative. Exponent remains highly profitable, with a profit margin just over 20% and an operating margin above 32%. Return on equity is an impressive 25.87%, and the company holds over $245 million in cash with very little debt. That kind of financial strength is what allows EXPO to keep its dividend intact—and growing—even in less-than-perfect operating conditions.

Key Dividend Metrics

📈 Forward Dividend Yield: 1.56%

💵 Forward Dividend Rate: $1.20 per share

⏳ 5-Year Average Dividend Yield: 1.00%

📅 Next Ex-Dividend Date: June 6, 2025

📊 Payout Ratio: 55.88%

🛡️ Dividend Safety: Strong

📈 Dividend Growth: Steady and reliable

🔄 Last Stock Split: 2-for-1 on June 8, 2018

Dividend Overview

At 1.56%, Exponent’s yield isn’t going to blow anyone away—but it’s actually higher than usual for the company. Over the past five years, the average yield has hovered closer to 1%. So with the recent dip in stock price, income-focused investors are getting a bit more yield for their money.

The company’s annual dividend sits at $1.20 per share. That dividend is well-covered by earnings, with a payout ratio under 56%. For a company like EXPO—one that doesn’t require huge amounts of reinvestment to maintain growth—that’s a sustainable level. It leaves room for continued increases while keeping plenty of cash available for operations and other shareholder-friendly moves.

Another thing worth mentioning is the low-volatility nature of the stock. EXPO has a beta of 0.85, which means it tends to move less than the broader market. That kind of smooth ride can be valuable for dividend investors looking to avoid wild swings in their portfolio’s income-producing holdings.

Dividend Growth and Safety

Exponent has made a habit out of raising its dividend. The company has increased its payout steadily over the years, building a track record that appeals to long-term investors. In fact, it’s become one of those quiet compounders—reliable, consistent, and predictable.

The dividend has grown from less than $0.50 per share a decade ago to $1.20 today. That’s not flashy growth, but it’s consistent and clearly managed with discipline. The increases have been regular, and there hasn’t been a hint of distress during tough macroeconomic periods.

On the safety front, EXPO checks all the boxes. The company is sitting on a healthy cash pile—$245 million at last count—and has just $80 million in total debt. That translates to a low debt-to-equity ratio around 18%. Its current ratio of 3.32 also signals strong short-term liquidity.

What really makes EXPO’s dividend feel secure is the nature of its business. This is a company that gets paid to provide answers in complex situations—product recalls, litigation support, regulatory compliance. These needs don’t disappear during a downturn. In fact, they can intensify. That makes the business model more resistant to economic swings than most.

In short, EXPO might not deliver huge yield upfront, but it offers a well-balanced package: modest income today, steady growth, low risk, and strong financial fundamentals. For dividend investors who care more about preservation and consistency than chasing yield, that kind of setup is worth a closer look.

Cash Flow Statement

Exponent’s cash flow profile remains one of its core strengths, with consistent growth in operating cash flow over the years. For the trailing twelve months (TTM), the company generated $144.5 million in operating cash flow, up from $127.4 million the previous year and significantly higher than $93.8 million in 2022. This rising trend aligns with the firm’s steady profitability and low capital intensity, leaving plenty of room for reinvestment and shareholder returns. Free cash flow came in at $137.6 million TTM, reflecting minimal capital expenditures and efficient cash conversion.

On the investing side, cash outflows have been light, just $6.9 million for the TTM, mostly tied to capital expenditures. Financing cash flow was deeply negative at -$65.1 million, driven largely by share repurchases and dividend payments, though the outflows were lower than the previous year’s $86 million. The net result of strong operating inflows and restrained spending is a healthy cash position of nearly $259 million. Exponent continues to demonstrate disciplined capital allocation, using internally generated cash to support dividends, occasional buybacks, and a strong balance sheet without resorting to debt expansion.

Analyst Ratings

📊 Analyst sentiment for Exponent (NASDAQ: EXPO) has been mixed in recent months, reflecting both confidence in the company’s long-term prospects and caution over near-term challenges. 🧐 Truist Securities has maintained a Buy rating on the stock, adjusting its price target from $120 to $100 in April 2024. 📉 This revision was attributed to anticipated headwinds from reduced regulatory activities, though Truist also noted potential growth opportunities arising from increased scrutiny on food chemicals and supply chain shifts. 🚛

🔍 UBS initiated coverage with a Neutral rating and a $99 price target in June 2023, reflecting a more cautious stance amid concerns about the company’s premium valuation. 💵

🎯 The consensus among analysts places the average price target for EXPO at approximately $98, with estimates ranging from $96 to $100. This suggests a modest upside from the current trading price. 📈 The stock’s performance will likely depend on how effectively Exponent navigates the evolving regulatory landscape and capitalizes on emerging opportunities in its consulting services. 🌱

Earning Report Summary

Revenue and Profit Snapshot

Exponent kicked off 2025 with a steady top line, reporting total revenues of $145.5 million for the first quarter. When you strip out reimbursements, the core revenue came in at $137.4 million—virtually unchanged from the same period last year. That consistency speaks to the resilience of the business, especially given some internal headwinds.

Net income, though, did take a step back. The company posted $26.7 million in profit, translating to $0.52 per diluted share. That’s a drop from $30.1 million and $0.59 per share a year earlier. Part of that decline came from a higher tax rate this quarter, along with an increase in stock-based compensation. EBITDA also softened a bit, landing at $37.5 million, which is about 27.3% of net revenues, down from just over 29% a year ago.

Business Segments and Growth Pockets

Looking at the business breakdown, the engineering and other scientific segment—which accounts for the bulk of Exponent’s revenue at 84%—held steady. There wasn’t much movement either way. On the other hand, the environmental and health sciences side of the business saw a bit of growth, up 2% from the same period last year. That bump was largely driven by an uptick in activity from clients in the chemicals industry, an area that seems to be gaining momentum.

Leadership’s Take and Looking Forward

CEO Catherine Corrigan struck an optimistic tone when addressing the quarter. She pointed out that even with staffing challenges—specifically, a 5 to 6 percent dip in technical full-time equivalents—the company still managed to hold revenues steady. That says a lot about the flexibility and strength of their model.

Corrigan emphasized the value of diversification across sectors, which helped soften the impact of economic uncertainty. While they’re expecting a slight dip in revenues in the second quarter, the full-year outlook hasn’t changed. They’re still guiding for low-single-digit growth overall, signaling confidence that things will stabilize or even pick up as the year unfolds.

Overall, Exponent seems to be navigating the current environment with a measured hand. They’re not immune to the broader pressures in the market, but their balance across industries and consistent demand for their services keep them in a strong position heading into the rest of the year.

Chart Analysis

Price Action and Moving Averages

Looking at the 12-month chart for EXPO, the price clearly peaked around late October, brushing against the $115 level before rolling over. Since then, it’s been in a fairly consistent downtrend. The 50-day moving average (in red) started declining around December and has stayed below the 200-day moving average (in blue) since early January. This sustained crossover typically suggests continued downside pressure, and the price action confirms it. As of early May, EXPO is trading below both moving averages, which tends to indicate a lack of near-term momentum or institutional buying interest.

What’s also notable is how gradually the 200-day line has started to roll over, a reflection of longer-term sentiment beginning to shift. The gap between the moving averages has widened, which suggests that any reversal would take time to materialize and would likely need a meaningful shift in either business fundamentals or investor appetite.

Volume and Participation

Trading volume has been fairly steady, with occasional spikes, particularly during the more volatile selloff periods in late 2023 and early 2024. There’s no clear accumulation pattern here—volume doesn’t appear to be building up alongside a base, which would be more constructive. Instead, volume tends to swell on down days, hinting at some distribution taking place rather than quiet buying.

That said, there hasn’t been an outright collapse in volume either. So while investors are exiting positions, it doesn’t look like a panic. The decline has been more orderly, which aligns with a repricing rather than a crisis-driven exit.

Relative Strength Index (RSI)

The RSI has mostly lived under the midpoint line of 50 for much of the year. This confirms the prevailing downtrend and suggests there hasn’t been much sustained buying pressure. While there were brief moments—like late February—where RSI ticked up near overbought levels, it quickly returned to neutral or even oversold territory. Most recently, RSI is hovering around the 30 range, pointing to a stock that may be nearing exhaustion on the downside but hasn’t found a clear catalyst to rebound yet.

This kind of RSI behavior, paired with a sloping 50-day average, typically signals that buyers are hesitant to step in at current levels. For the trend to change, you’d likely want to see RSI push above 50 and stay there, supported by stronger volume and a flattening or rising short-term average.

Technical Takeaway

Overall, the chart reflects a gradual unwinding of a previously overextended uptrend. Price remains weak and is trading under major moving averages. There’s no visible sign of accumulation or trend reversal yet, though the RSI approaching oversold levels could be something to watch. Until the stock starts holding higher lows and regains at least one of the moving averages, the trend remains under pressure.

Management Team

Exponent is led by a stable and deeply experienced management team that has built its reputation on analytical rigor and consistent execution. At the helm is Dr. Catherine Corrigan, who has served as President and CEO since 2018. Her background as a biomechanical engineer and her long tenure at the company give her both technical credibility and institutional insight. Corrigan has been instrumental in positioning Exponent as a go-to provider for specialized consulting in high-stakes industries.

What stands out about Exponent’s leadership is its deep bench of Ph.D.-level talent—not just in the lab or on client projects, but throughout the leadership structure. This has always been a strength of the company. They lead with subject-matter expertise, and that permeates the culture. From legal consulting to failure analysis and environmental science, the team brings real-world experience to complex problem-solving.

Under Corrigan’s direction, Exponent has remained financially conservative, prioritizing organic growth and returning capital to shareholders through a rising dividend and occasional buybacks. There’s no sign of mission creep or overreach, which can be a risk for companies with cash on hand. Leadership has stayed focused, even in a rapidly shifting macro environment, and that discipline continues to be a defining trait of the organization.

Valuation and Stock Performance

From a valuation standpoint, EXPO trades at a premium relative to most of the market. The stock’s current price-to-earnings ratio is in the high 30s, even after a multi-month decline from its 52-week high of 115.75. That’s not uncommon for a company with strong margins, recurring business, and a track record of consistent performance, but it does set the bar higher in terms of expectations.

The premium multiple reflects the market’s confidence in the durability of the business model—one that doesn’t rely on cyclical demand or heavy reinvestment. Exponent’s price-to-sales ratio is above 7, and its enterprise value to EBITDA hovers around 28. Those numbers suggest that much of the company’s safety and quality is already priced in. This may not be a name that suddenly doubles, but that’s also not what it’s built for.

Stock performance over the past year tells a more subdued story. EXPO is down nearly 19 percent from the same time last year. The decline has been gradual rather than sharp, reflecting a market repricing more than any fundamental breakdown. The stock has lagged behind the broader S&P 500, which has made positive gains over the same time period. That underperformance has brought the valuation closer to its historical range but still above many peers.

What’s important is that the stock has not been volatile in the usual sense. Its five-year beta sits at 0.85, meaning it tends to move less than the overall market. For investors looking to avoid whiplash in their portfolios, this kind of price behavior is often welcome. While it may not lead rallies in bull markets, it also tends to hold its ground better when things get bumpy.

Risks and Considerations

While Exponent offers a compelling story built around consistency and expertise, there are a few risks worth keeping in mind. One of the more immediate concerns is the slowing pace of revenue growth. The most recent earnings report showed flat revenues year-over-year and a dip in net income. That kind of stagnation, even when temporary, can weigh on a stock that carries a premium valuation.

Labor is another key issue. The company operates in a talent-driven industry where technical professionals are the primary assets. In the latest quarter, management acknowledged a 5 to 6 percent reduction in technical full-time equivalents, which may affect revenue capacity if not addressed quickly. Recruiting and retaining high-level Ph.D.-level talent is not easy, and turnover in these roles can impact both revenue and client continuity.

There’s also the matter of concentration. Although Exponent works across multiple industries, a large portion of its business is tied to litigation consulting and regulatory advisory. If legal or regulatory activity slows down in key industries, that can directly affect revenue. The firm is diversified across sectors, but not necessarily across service lines.

Finally, valuation itself presents a risk. Trading at a P/E above 35, any unexpected slowdown or margin compression could result in a further rerating of the stock. Investors are paying for stability and cash flow, but they are also accepting a lower margin for error. In that sense, this is a business that performs best in calm waters, and while it’s built to weather storms, it’s not immune to changing tides.

Final Thoughts

Exponent has built a business that stands out for its intellectual capital, financial conservatism, and track record of reliability. It’s not trying to dominate headlines or chase high-risk, high-reward opportunities. Instead, it delivers steady performance by being the expert behind the scenes when things get complicated.

The current share price reflects some uncertainty, particularly after a year of softer earnings and slower revenue growth. But underneath that, the company’s fundamentals remain intact. It’s operating with minimal debt, generating healthy free cash flow, and maintaining its shareholder return commitments without sacrificing operational strength.

For those seeking a company that’s predictable, well-managed, and committed to long-term execution, Exponent continues to check a lot of the right boxes. It may not be the fastest mover, but it’s not trying to be. It thrives in the details—in the data, in the research, and in the kind of work that takes deep knowledge and calm hands. That’s a rare quality, and one that doesn’t often go out of style.