Key Takeaways

📈 Eversource offers a forward dividend yield over 5%, well above its 5-year average, with a history of consistent annual increases despite a currently high payout ratio.

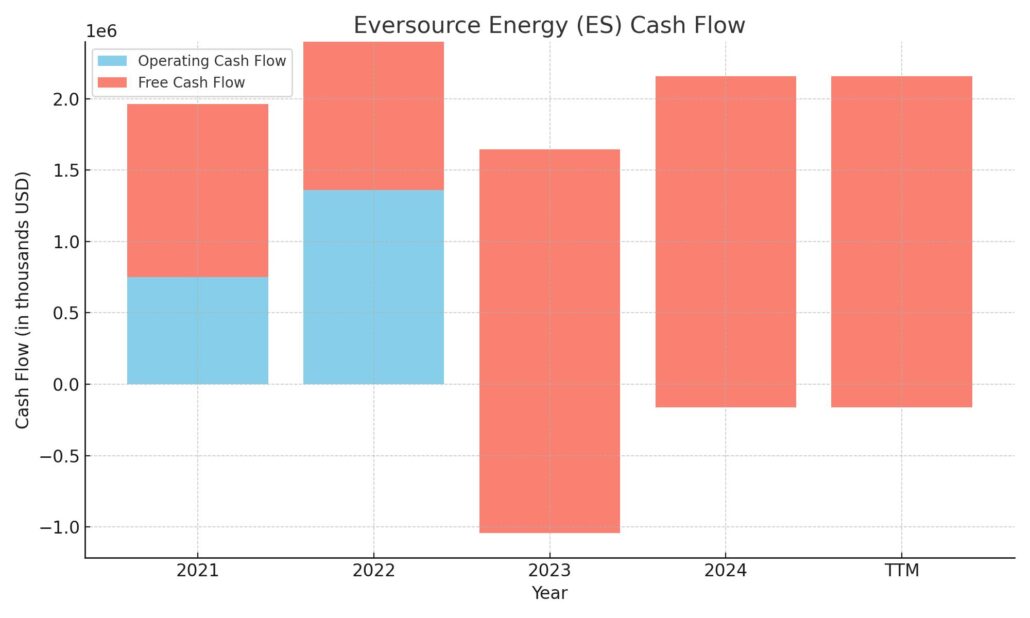

💵 Free cash flow remains negative due to heavy capital expenditures, while operating cash flow improved to $2.16 billion over the trailing 12 months.

📊 Analyst sentiment is mixed, with recent downgrades driven by regulatory risks and rising debt, but the consensus price target sits near $66, suggesting moderate upside.

📅 First-quarter earnings beat expectations, with net income rising 5.5% year-over-year and leadership reaffirming full-year guidance while emphasizing a return to core utility operations.

Last Update 5/4/25

Eversource Energy (ES) delivers electric, gas, and water services across New England, with a strategy grounded in regulated utility operations and infrastructure investment. The company has recently exited offshore wind development, refocusing on core grid modernization, electrification, and long-term capital planning. Backed by a seasoned leadership team and deep regulatory experience, Eversource is steering through a period of transition while maintaining earnings stability.

The stock offers a forward dividend yield above 5% and trades at a modest valuation, with a forward P/E near 12 and a price-to-book around 1.4. While challenges like elevated debt levels and regulatory scrutiny persist, the company’s steady cash flow and capital discipline continue to support its long-term dividend strategy.

Recent Events

One of the biggest stories around Eversource lately is its decision to exit the offshore wind business. The company is working on selling its stakes in projects like Sunrise Wind and Revolution Wind. While that shift may reduce long-term growth potential from renewables, it could also free up capital and simplify the business—potentially a smart move for a utility that’s traditionally been about consistency, not ambition.

At the same time, the financial picture is a bit more complex. The most recent quarter shows Eversource carrying just over $29 billion in total debt. With a debt-to-equity ratio north of 190%, that’s a serious amount of leverage—even for a utility. Dividend investors tend to tolerate higher debt in this sector because revenues are so steady, but that kind of balance sheet weight does tighten the room for maneuvering.

Still, not all the recent data is discouraging. Revenues are up nearly 24% year-over-year, and earnings managed a 5.5% bump—impressive when you consider the challenging backdrop of divestitures and shifting investment priorities. For a company this size, that’s a decent showing, especially while restructuring parts of the business.

📊 Key Dividend Metrics

📈 Forward Dividend Yield: 5.12%

💰 Annual Dividend Rate: $3.01

📉 Payout Ratio: 127.08%

📆 Ex-Dividend Date: May 15, 2025

📊 5-Year Average Dividend Yield: 3.48%

🧮 Trailing Dividend Yield: 4.91%

⚠️ Total Debt: $29.24B

📕 Book Value Per Share: $41.02

🛡️ Beta: 0.59

Dividend Overview

At around $59 per share, Eversource is offering a forward yield north of 5%. That’s well above its five-year average and stands out in the current market, especially for a utility. For dividend-focused portfolios, that kind of yield is attractive—particularly from a company with a long-standing commitment to its payout.

That said, there’s no avoiding the fact that the payout ratio has ballooned to over 127%. This tells us that dividends are now exceeding earnings, which isn’t sustainable over the long term unless other financial levers—like asset sales or debt—are helping bridge the gap. In a low-growth sector, that can be manageable for a time, but it’s a red flag worth watching.

Even with that challenge, Eversource hasn’t wavered in its payment schedule. The next ex-dividend date is May 15, and there’s been no guidance suggesting a cut or suspension. Institutional holders continue to make up a hefty share of ownership, around 86%, which indicates long-term investor confidence hasn’t disappeared.

Dividend Growth and Safety

Eversource has been a reliable dividend grower for years, with regular annual increases that align with the slow-and-steady nature of the utility world. While the rate of growth hasn’t been flashy, it has been dependable, and that predictability has made the stock a cornerstone for many income investors.

Now, though, dividend safety is less of a sure thing. That high payout ratio, coupled with a mountain of debt, is a signal that management may need to reconsider its dividend policy if conditions worsen. Free cash flow is tight. Levered free cash flow isn’t readily visible, and with asset divestitures in progress, it’s tough to forecast exactly how much breathing room the company will gain.

What does help is the regulated nature of Eversource’s business. Revenue streams are fairly consistent, and utilities typically have the ability to pass some costs on to customers through rate adjustments. That stability acts as a buffer, helping to support dividends even during restructuring phases.

The stock’s beta is just 0.59, which reinforces its low-volatility profile. That’s another reason dividend investors look to names like Eversource—it behaves more like a bond with a yield kicker, not a speculative equity.

That said, the next year is going to be a telling one. The company needs to pull off its wind exit cleanly, reinforce its financial position, and keep operational earnings steady. If it can thread that needle, the dividend should hold. But this is not a “set it and forget it” stock at the moment. Investors would do well to keep a close eye on earnings and cash flow developments in the quarters ahead.

Cash Flow Statement

Eversource Energy’s cash flow profile over the trailing twelve months tells a story of significant capital intensity. Operating cash flow improved to $2.16 billion, a notable recovery from 2023 levels, indicating stable earnings power from its regulated utility operations. However, that strength is more than offset by aggressive capital expenditures, which reached $4.48 billion—resulting in negative free cash flow of $2.32 billion. This ongoing investment cycle has been a consistent trend for the company and reflects continued spending on infrastructure and grid modernization.

To fund this gap, Eversource has leaned heavily on the capital markets. The company issued over $4.5 billion in new debt and nearly $1 billion in equity, using the proceeds to support investment activities and refinance existing obligations. Despite these inflows, its end-of-period cash position dropped to just $127 million, highlighting the pressure on liquidity. Interest costs are rising too, with over $1 billion paid in the last twelve months, underscoring the cost of carrying a $29 billion debt load. While utilities typically operate with negative free cash flow during expansion phases, the margin of shortfall here is something income-focused investors should keep on their radar.

Analyst Ratings

Eversource Energy has recently seen a change in how analysts view the stock, with several adjusting their ratings and price expectations. 🛑 JPMorgan downgraded the stock from Neutral to Underweight in early April, citing mounting concerns over the financial burden of offshore wind project costs, higher utility bills in the Northeast, and regulatory friction, particularly in Connecticut. The firm also trimmed its price target from $69 to $58, signaling caution about near-term pressures on the business.

🔻 Jefferies also took a more conservative stance, cutting their price target from $52 to $47 while maintaining an Underperform rating. Their concerns stem largely from valuation and limited near-term catalysts. 🔍 Scotiabank followed suit, lowering its target to $55 and holding onto its Sector Underperform view, emphasizing the complex regulatory environment Eversource is navigating in key states.

Not all outlooks are negative, though. 💬 BMO Capital Markets actually raised its price target from $71 to $72 while sticking with a Market Perform rating, a move that suggests a belief in the underlying strength of Eversource’s regulated operations. 🟢 Guggenheim has remained optimistic, reiterating a Buy rating based on the long-term prospects of the core utility business.

📊 The current consensus price target across analysts stands at $65.78. That points to roughly 11.9% upside from where the stock is currently trading. Despite the recent downgrades, the average target reflects a belief that Eversource still has room to recover, especially if it successfully navigates its portfolio shift and manages regulatory relationships more effectively.

Earning Report Summary

Strong Start to the Year

Eversource Energy kicked off 2025 with a solid set of numbers. The company posted earnings of $1.50 per share for the first quarter, just a notch above last year’s $1.49. Net income came in at $552.7 million, showing a 5.5% year-over-year increase. Revenue topped $4.1 billion, which was well ahead of what most expected. That strength came largely from the core electric and gas businesses, which continue to perform well.

The electric transmission segment led the way with gains, thanks to ongoing investments in the grid and system improvements. On the electric distribution side, earnings got a boost from modernization projects and supportive rate plans. The natural gas side also pulled its weight, helped by infrastructure upgrades. There was a drag from the parent company and other segments though, mostly due to higher interest costs—something not unexpected in this rate environment.

Outlook and Strategy

Even with those solid results, the stock slipped a little following the release. Still, Eversource held its full-year earnings guidance steady, calling for earnings between $4.67 and $4.82 per share. Leadership also stuck to their long-term goal of 5% to 7% earnings growth annually through 2029.

A big part of that strategy centers around a five-year, $24.2 billion capital investment plan. A lot of that money is going toward modernizing the electric grid and expanding electrification, especially in Massachusetts. The company noted it has already rolled out about 40% of its advanced metering infrastructure in that state, and it also highlighted the recent purchase of the Mystic site in Everett. That site is set to become an important hub for connecting renewable energy sources to the grid.

In Connecticut, Eversource is adjusting its spending a bit more carefully due to regulatory emphasis on affordability. The company is clearly trying to balance investing in its system while also being mindful of the impact on customers’ bills.

Leadership Commentary

CEO Joe Nolan sounded upbeat on the earnings call, emphasizing the company’s position as a leader in transmission and distribution. He pointed to a strong pipeline of projects and confidence in the regulatory environment, especially outside of Connecticut. CFO John Moreira added that cash flows are in better shape this year, helped by the recovery of regulatory costs from prior periods. That improvement should help firm up the company’s balance sheet going forward.

Overall, Eversource is pushing forward with its long-term plan while managing the short-term headwinds. The quarter was a reminder that even with challenges, the company’s core utility business continues to deliver reliable results.

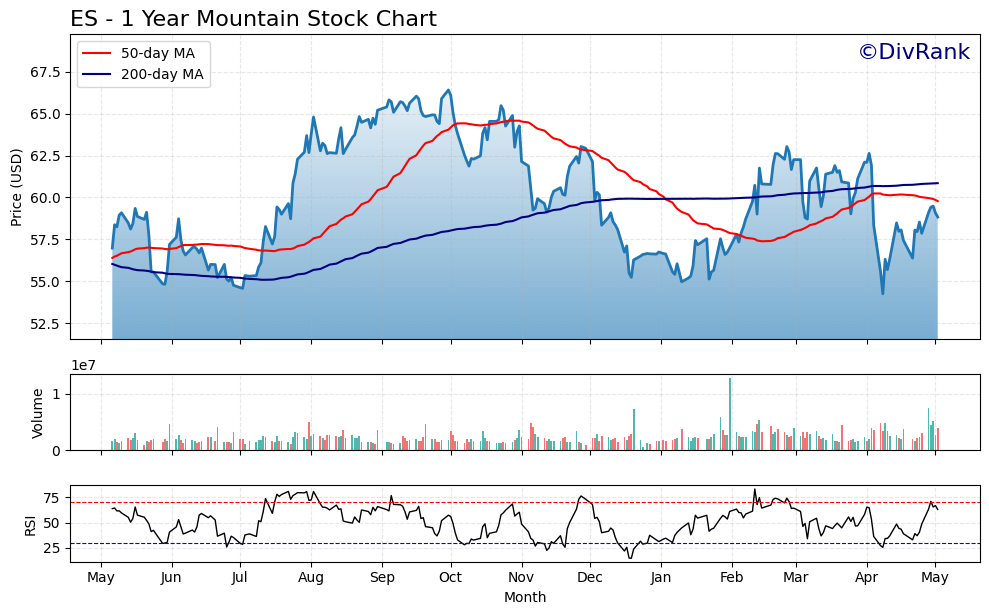

Chart Analysis

Price Trends and Moving Averages

Looking at the 1-year chart for Eversource Energy (ES), there’s a clear narrative of volatility framed by two key moving averages. The 50-day moving average (in red) shows more responsive trends, rising steadily from June through November before sloping downward through the winter and into early spring. The 200-day moving average (in blue), a longer-term indicator, remained relatively flat with a gentle upward slope, acting almost like a median trend line across the year.

From May through early July, the price hovered below both moving averages, reflecting weakness and consolidation. A sharp rally followed in late July, carrying the stock above both MAs and pushing into the mid-60s range by fall. But the strength didn’t hold. By December, prices had slipped below the 50-day and, eventually, the 200-day average. Since then, the price has bounced between the two MAs, failing to sustain momentum in either direction. That back-and-forth movement hints at a market still digesting the company’s structural changes and shifting investor sentiment.

Volume Activity

Volume has stayed mostly stable, with occasional spikes—most notably during sharp price corrections in December and April. These surges suggest stronger hands stepping in during weakness or possibly reacting to news-driven events. Consistent volume without sustained upward follow-through indicates a market that’s not yet convinced of a breakout.

RSI and Momentum

The relative strength index (RSI) tells another piece of the story. The stock spent time near the overbought level (above 70) during late summer and again in February and March, signaling moments when buyers were crowding in. Most recently, the RSI hovered in the mid-60s range, pulling back slightly in April. It’s still above the midpoint of 50, which shows a tilt toward buying strength, but not enough to call it overheated.

The combination of RSI resilience, stable volume, and the stock’s attempts to reclaim moving averages paints a picture of a name that’s trying to stabilize after a rocky few months. It’s not in a confirmed uptrend, but it’s also not breaking down. This kind of setup often reflects cautious optimism—especially in sectors where price moves are more about sentiment shifts and less about explosive momentum.

Overall Read

The stock has yet to fully recover the momentum it had mid-year, but recent price action suggests some buyers are returning, particularly near the $56–58 zone. The path forward may depend on whether the price can decisively hold above the 200-day moving average, which would go a long way in signaling strength returning to the chart. Until then, this remains a chart in search of a clear direction.

Management Team

Eversource Energy’s leadership has been guiding the company through a time of realignment, focusing more sharply on core regulated operations and moving away from riskier growth ventures. Joe Nolan, the President and CEO since 2021, has deep roots in the organization and a strong understanding of the regulatory and operational demands of New England’s utility markets. Under his watch, the company has exited offshore wind development and returned its focus to areas like electric transmission, grid reliability, and customer service—areas where it has historically thrived.

John Moreira, the CFO, has been instrumental in navigating the financial challenges brought on by rising debt levels and capital spending. His approach reflects a balance between maintaining investment-grade credit metrics and supporting the company’s dividend commitments. Other senior leaders bring decades of utility and infrastructure experience, giving the management team a grounded, practical style of leadership. Together, this group reflects Eversource’s identity—measured, regionally savvy, and focused on long-term execution.

Valuation and Stock Performance

Eversource shares have traded in a wide range over the past year, from the low $50s to mid-$60s, reflecting a mix of market volatility, interest rate pressures, and internal restructuring. At around $59 per share currently, the stock is just under its 50-day and 200-day moving averages. The technicals suggest indecision, and that’s mirrored in the sentiment among analysts and investors.

From a valuation standpoint, the stock trades at about 12.3 times forward earnings, which is lower than its historical range and attractive for a regulated utility. The price-to-book value at 1.44 indicates a reasonable premium for a company with stable assets and consistent earnings. Eversource’s enterprise value to EBITDA ratio is near 11, which lines up with industry norms, especially for a firm with a high capital base and solid regulatory recovery mechanisms.

The real draw remains the dividend. With a forward yield of over 5 percent, Eversource offers one of the more appealing income streams among large-cap utilities. That yield is well above the company’s five-year average, and while the payout ratio is elevated—north of 125 percent—the company’s history of dividend growth and its regulatory model provide a level of reassurance to investors seeking dependable cash flow.

Analyst consensus pegs the stock’s fair value at about $66, suggesting moderate upside. While recent downgrades have highlighted regulatory and debt-related concerns, others see value at current levels, particularly for longer-term investors willing to ride out short-term headwinds.

Risks and Considerations

The utility space is known for its stability, but Eversource is facing some real challenges that investors need to factor in. The first is regulatory risk. States like Connecticut have taken a more aggressive stance on rate increases, emphasizing customer affordability and utility accountability. That has created friction and forced Eversource to adjust its investment approach in some areas.

Debt is another issue. With total obligations exceeding $29 billion, the company is carrying a significant financial load. Interest expenses are rising, and while the company continues to access capital markets, the cost of capital is no longer cheap. Any deterioration in credit ratings or higher-for-longer interest rates would likely limit the company’s flexibility going forward.

Operational execution also remains key. Even with its withdrawal from offshore wind, Eversource is still on the hook for major infrastructure upgrades and environmental mandates. Grid modernization, electrification, and climate resilience are not optional, and they come with high price tags. Supply chain delays and labor constraints only add to the cost pressure.

Then there’s market sentiment. Utility stocks often serve as income proxies, and when treasury yields climb, investor demand for these names tends to dip. That dynamic has played out over the last 12 months and is part of why the stock has struggled to sustain any momentum, even when fundamentals have remained intact.

Final Thoughts

Eversource Energy is in the middle of a strategic evolution. The company is shifting away from ambitious renewable projects that carried more risk and circling back to the steady, regulated utility model that built its reputation. The dividend remains a centerpiece of the investment case, and while the payout ratio is stretched, the leadership team appears committed to protecting that income stream.

The stock’s valuation is reasonable, especially for those who are focused on income and can stomach some short-term price movement. Management has shown they’re willing to make tough decisions to preserve long-term stability, and their familiarity with the regulatory landscape gives them an edge in managing through policy transitions.

While debt and regulatory pressure remain front and center, the core business is still delivering. If Eversource can maintain consistent earnings, reduce financing strain, and deliver on its capital investment strategy, there’s a strong case to be made that the current stock price doesn’t fully reflect its long-term value.