Key Takeaways

💰 Evercore offers a forward dividend yield of 1.57% with a 5% recent increase, supported by a low 30.56% payout ratio and consistent dividend growth around 8% annually.

📊 Free cash flow for the trailing twelve months reached $958 million, with operating cash flow doubling year-over-year, reflecting strong earnings quality and disciplined capital spending.

📈 Analyst sentiment is mixed but leaning constructive, with a consensus price target around $228.50 and views ranging from cautious due to market volatility to optimistic based on backlog strength.

🧾 The latest earnings report showed 19% revenue growth and a 64% jump in EPS, with leadership highlighting record backlogs and a continued focus on talent and operational efficiency.

Last Update 5/4/25

Evercore Inc. (EVR) has steadily built a reputation as one of the leading independent investment banks, focused entirely on advisory work in mergers, acquisitions, and restructurings. With a disciplined, client-focused model, the firm generates strong free cash flow and maintains a healthy balance sheet, allowing it to return significant capital to shareholders through dividends and buybacks. The company’s leadership, backed by experienced hires and a growing backlog, continues to position it for long-term strength.

Recent earnings showed revenue growth of 19% year-over-year and a 64% jump in EPS, driven by a resurgence in advisory activity. Analysts have offered a mixed but largely constructive outlook, with a consensus price target near \$228.50. As the stock works to reclaim its trend after a sharp pullback, Evercore remains a solid example of a capital-light, high-margin firm with a consistent record of execution.

Recent Events

In the past year, Evercore has quietly delivered a solid performance. Shares have risen a little over 10%, edging out the broader S&P 500. That’s a decent return on its own, but it’s especially notable considering the firm’s reliance on M&A and capital markets—areas that haven’t exactly been booming across the board. The most recent quarterly numbers were strong: revenue jumped nearly 20% year-over-year, and earnings surged by more than 70%. Those aren’t small moves, and they speak to real operational momentum.

Behind those numbers is a business that’s become incredibly efficient. Costs are tightly controlled, employee productivity remains high, and the quality of deals continues to shine. That’s the kind of setup that dividend investors appreciate: strong margins, growing profits, and no need for financial gymnastics to fund the payout.

Evercore’s market cap has grown from around $6.4 billion at the end of last year to over $8.2 billion today. That rise reflects confidence—not just from Wall Street analysts but also from long-term shareholders who value consistency and capital return. The dividend has remained intact and dependable, with the next ex-dividend date just around the corner on May 30.

Key Dividend Metrics 🧾💰📈📅🔒

🧾 Forward Dividend Yield: 1.57%

💰 Forward Annual Dividend Rate: $3.36 per share

📈 5-Year Average Dividend Yield: 2.17%

📅 Upcoming Ex-Dividend Date: May 30, 2025

🔒 Payout Ratio: 30.56%

Dividend Overview

At 1.57%, Evercore’s current dividend yield might not seem like much compared to some traditional income plays. But context matters. For a financial advisory firm that doesn’t rely on interest spreads or leverage to generate returns, this yield is both solid and sustainable. It shows a company that doesn’t just talk about shareholder value—it delivers it.

The more important detail here is the payout ratio. At just over 30%, the company has plenty of cushion. It’s not stretching to send out those checks every quarter. Evercore is sitting on nearly $900 million in cash, and while total debt comes in around the same number, the nature of its business doesn’t require heavy investment or borrowing. That balance gives it more room to operate—and more flexibility to keep the dividend secure during rocky markets.

Institutional holders own more than 88% of the float, which is usually a sign of confidence from large, long-term-focused investors. Insiders also hold close to 5%, so there’s real skin in the game. That mix tends to favor stability, which is just what dividend investors want to see.

Dividend Growth and Safety

Now let’s look at how the dividend’s been moving. The past few years have shown steady growth. The current forward payout of $3.36 is up from the trailing $3.24, a modest increase, but meaningful given that capital markets activity has only recently started picking back up. That small hike speaks volumes about how the company views its long-term cash flow picture. It’s not about big leaps. It’s about consistency.

Over the last five years, the dividend has grown at an average rate of roughly 8% annually. That puts it in a sweet spot for investors who want growth without taking on too much risk. Evercore isn’t borrowing to fund the dividend. It’s not issuing new stock. It’s doing it the old-fashioned way—through profits.

There’s nothing in the numbers right now to suggest the dividend is under any threat. The company’s debt load is well within reason, and its capital-light model doesn’t demand heavy reinvestment. The payout ratio is low, earnings are rising, and the balance sheet remains clean.

A quick glance at the beta—1.33—tells you the stock can move a bit more than the broader market. That’s something to keep in mind if you’re building a lower-volatility income portfolio. But it also means the stock can reward patient investors when things are going well, and Evercore is showing signs that the current cycle may be working in its favor.

In short, Evercore has carved out a reliable, disciplined space for itself in a high-stakes corner of finance. Its dividend isn’t built on fluff or financial engineering. It’s built on client trust, strong deal execution, and smart capital allocation. For income-focused investors who want something a little off the beaten path, but grounded in sound fundamentals, Evercore might be worth a closer look.

Cash Flow Statement

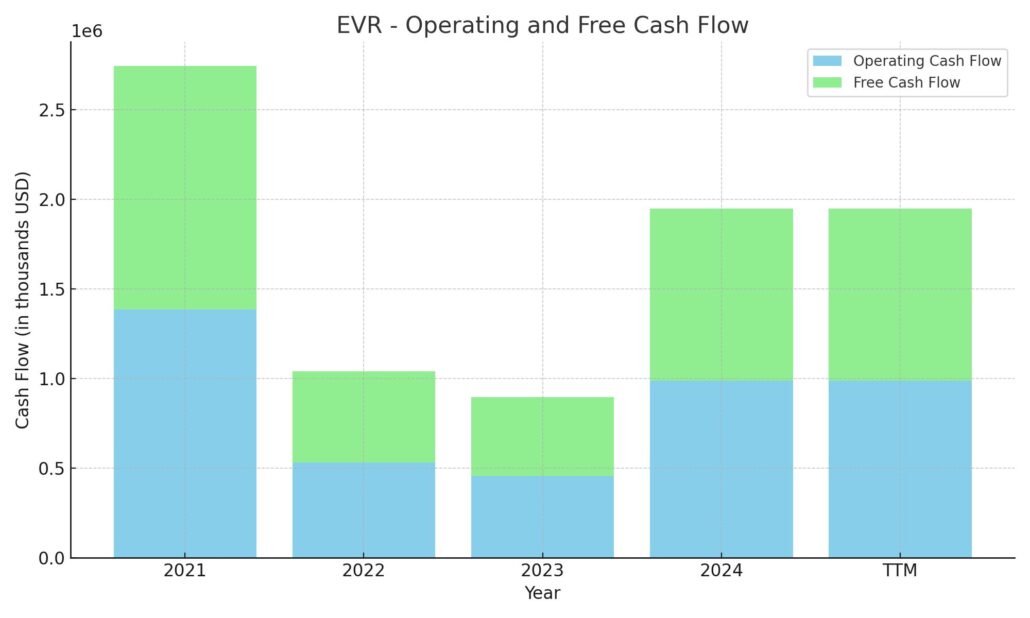

Evercore’s cash flow profile over the trailing twelve months reflects a business running on strong fundamentals and disciplined capital management. Operating cash flow came in at $988 million, more than double the prior year’s figure and a return to levels last seen in 2021. This robust performance is a direct result of higher advisory activity and strong earnings conversion, with free cash flow reaching $958 million. Capital expenditures remained modest at just over $30 million, aligning with the firm’s asset-light business model and leaving most of the operating cash untouched.

On the financing side, the company returned a significant amount of capital to shareholders, with $450 million allocated to share repurchases. Combined with dividend payments, financing cash flow was negative $628 million, consistent with Evercore’s strategy of distributing excess cash rather than hoarding it. No new debt was issued during the period, and previous debt repayments were already completed in earlier years. The end cash position rose to $882 million, reflecting the company’s ability to generate cash organically while still rewarding shareholders. This kind of consistency in cash generation provides a strong foundation for maintaining and growing dividends moving forward.

Analyst Ratings

📉 In early April, Morgan Stanley shifted its stance on Evercore, moving the rating from Overweight to Equal Weight and trimming the price target from $306 to $173. This downgrade was primarily rooted in growing concerns about a deceleration in M&A activity, which serves as a major revenue driver for the firm. Analysts noted that corporate leaders have become more cautious, likely due to persistent macroeconomic uncertainty, which could impact the volume and scale of deals in the pipeline.

📈 Around the same time, JMP Securities took a different view, upgrading Evercore from Market Perform to Market Outperform and assigning a price target of $230. Their more bullish outlook stems from expectations of a moderate recovery in deal-making activity and confidence in Evercore’s strong client relationships and executional consistency, even during periods of volatility.

💬 As it stands, the consensus price target from analysts hovers near $228.50 over the next 12 months. This suggests a fairly neutral sentiment across the board—some viewing the stock as a steady operator in a soft environment, others betting on a meaningful uptick in advisory demand. Overall, analysts seem to agree that while short-term pressure exists, the long-term framework for Evercore remains intact.

Earning Report Summary

Strong Start to the Year

Evercore opened 2025 on a high note, reporting solid numbers for the first quarter. Revenue came in at nearly $700 million, up 19% from the same quarter last year. Most of that lift came from advisory fees, which jumped by 30%. That surge tells a clear story—deal flow is picking back up, and Evercore is landing some of the more lucrative mandates out there.

Earnings per share came in at $3.49, which is a healthy 64% improvement year-over-year. Operating income also moved higher, reaching $116 million with an improved margin of 16.6%. That’s up from 15.4% a year ago, and it reflects some real discipline in managing expenses while still investing in growth.

Leadership’s Take

CEO John Weinberg called the quarter one of strength, particularly in light of the complex market backdrop. He pointed to strong backlogs—record levels, in fact—as a sign of continued momentum heading into the rest of the year. Weinberg also underscored the firm’s long-term focus, saying Evercore is built to deliver no matter what the market throws its way.

The leadership team seems confident but grounded. They acknowledged there could be bumps ahead, especially if macro conditions shift. Still, the tone was optimistic, with a clear belief that the firm’s strategic investments in talent and technology are paying off.

Capital Returns and Future Focus

Evercore didn’t hold back when it came to rewarding shareholders. The quarterly dividend was bumped up to 84 cents, a 5% increase. They also returned more than $450 million in the quarter through a mix of dividends and share buybacks. That level of capital return signals a lot of confidence from the inside.

The firm has also continued adding experienced hands to its investment banking ranks, bringing on new senior managing directors to strengthen key sectors. It’s a move that speaks to a broader strategy—preparing not just for the next few quarters, but for long-term positioning in an increasingly competitive advisory space.

Chart Analysis

Trend Overview

EVR has had a volatile 12 months, with the price climbing steadily from May through late December, peaking near the $320 mark. The uptrend was well-supported by the 50-day moving average for most of that period, which remained above the 200-day average and offered clear momentum to the upside. From late December into March, however, the chart reflects a clear reversal. The price broke below both moving averages, and the 50-day began sloping downward, eventually crossing under the 200-day line—often a sign of longer-term weakness setting in.

More recently, there’s been a noticeable recovery from the April lows around $160. Price action has turned upward again with some conviction, and there’s an initial push back toward the 200-day average. The question now is whether that move has enough follow-through to reclaim more meaningful territory or if it stalls beneath long-term resistance.

Volume and Participation

Volume started picking up in March as the stock sold off sharply, and that elevated activity has continued into May during the rebound. This increase in volume near both lows and the bounce indicates stronger participation, not just algorithmic drift. There appears to be real interest coming back in at lower levels.

That kind of action can be telling. A rising stock on increased volume suggests more conviction behind the move, and we’re beginning to see that in the most recent candles. Still, the overall volume structure doesn’t scream euphoric buying—more like careful re-entry.

RSI and Momentum

Looking at the Relative Strength Index, the stock spent much of early 2024 in oversold territory, dipping below the 30 line during its steep correction. It has since rebounded sharply and now hovers around 70, brushing up against overbought levels. This kind of surge in RSI after an extended downtrend is usually a sign that the worst of the selling may be behind, at least in the near term.

That said, RSI approaching 70 doesn’t always mean a pause is imminent—but it’s often where rallies begin to slow, especially if there’s overhead resistance close by, which in this case sits near the 200-day average. Traders might watch for consolidation or minor pullbacks here before a stronger breakout attempt.

Moving Averages and Price Structure

The 200-day moving average remains flat to slightly downward, suggesting the longer-term trend hasn’t fully shifted bullish again. The 50-day is still beneath the 200-day, though the recent price move is working to flatten and potentially reverse that slope. For the bigger picture to improve, you’d want to see the price hold above $220 and the 50-day begin climbing decisively again.

All in, EVR is in recovery mode. It’s shown the ability to attract buyers on weakness and now has a chance to repair the broader chart structure. The next few weeks will be key in confirming whether this is just a bounce or the early stages of something more sustainable.

Management Team

Evercore’s leadership is one of its biggest strengths. John Weinberg, the CEO, brings deep industry experience to the role, having spent many years at Goldman Sachs before stepping into Evercore’s top spot. His approach has been steady and strategic, emphasizing long-term relationships and maintaining a focused business model. That fits well with Evercore’s reputation for disciplined, high-quality advisory work.

The rest of the executive team has a similar background—veterans of larger firms who’ve chosen Evercore for its more targeted platform. This team has been instrumental in expanding the firm’s footprint while preserving its culture. Evercore has also been active in bringing in new talent at the senior level, particularly in sectors like tech and healthcare, where deal activity tends to be more resilient. These hires reflect a strategy of thoughtful growth rather than chasing headlines.

Valuation and Stock Performance

The stock currently trades at a forward price-to-earnings ratio in the low 20s. That’s a bit higher than historical averages, but not unreasonable when you look at the full picture. Evercore has shown strong revenue momentum recently, and it’s sitting on a healthy balance sheet with a sizable cash position. Its price-to-sales and price-to-book ratios remain within typical ranges for firms in this space, signaling that it hasn’t stretched itself too thin.

Performance over the past year has been a rollercoaster. Shares reached highs around $320 before falling sharply, then rebounding to the low $200s. This type of movement isn’t unusual for a company tied so closely to the mergers and acquisitions cycle. What stands out is how the firm has weathered that volatility while still returning capital to shareholders and maintaining profitability.

With a track record of consistent buybacks and dividend growth, investors have received tangible returns even when the stock has moved sideways. It’s a name that rewards patience.

Risks and Considerations

The biggest risk with Evercore is its reliance on deal volume. It doesn’t have the benefit of diverse revenue streams like some larger financial firms. If M&A activity dries up, revenue can fall quickly. The firm has managed that well historically, staying lean and flexible during downturns, but it’s still something to watch.

Another important factor is talent retention. Evercore’s business depends on skilled professionals, and the competition for those people is fierce. So far, the firm has done a solid job keeping its top performers, but the risk of turnover is always present.

Macroeconomic pressures are another variable. Uncertainty around rates, inflation, or global markets can all delay or derail transactions. That doesn’t mean business goes away completely—some segments, like restructuring, can actually pick up—but it does affect timing and deal size.

Valuation is also a consideration. Expectations for a deal rebound are already priced in to some extent. If that recovery doesn’t materialize as quickly as hoped, the stock could see more downside before it finds its footing again.

Final Thoughts

Evercore operates with clarity. It knows its role in the financial ecosystem and doesn’t try to be everything at once. The company’s strength lies in its expertise, consistency, and ability to deliver high-value advisory services to a concentrated client base. The leadership team has kept the firm focused and profitable, even during market slowdowns.

While the stock isn’t immune to broader cycles, the long-term fundamentals remain solid. Cash flow is strong, capital is returned to shareholders regularly, and the firm continues to invest in future growth without overextending itself. Evercore may not always command the spotlight, but it continues to earn its place through steady execution and shareholder discipline.