Key Takeaways

📈 WTRG offers a forward dividend yield of 3.36 percent with a payout ratio of 54.96 percent and a multi-decade streak of consistent annual dividend growth.

💵 Operating cash flow remains solid at $952 million, comfortably supporting the dividend, while free cash flow is negative due to heavy infrastructure investment.

🧐 Five analysts cover the stock with a mean price target of $41.40, suggesting modest upside from current levels, with a high target of $45.00 reflecting longer-term confidence in the fundamentals.

📊 Trailing EPS stands at $2.40 with a profit margin of 28.09 percent; the company continues to execute on its multi-year capital investment plan targeting billions in infrastructure upgrades through 2029.

Updated 2/25/26

Essential Utilities (WTRG) is a regulated utility serving over 5 million customers across 10 states through its water, wastewater, and natural gas operations. Backed by a long history of steady performance, consistent dividend growth, and a disciplined infrastructure investment strategy, the company remains focused on long-term value creation through essential services and modernized systems.

With a forward yield of 3.36 percent and a payout ratio around 55 percent, WTRG delivers a reliable income stream supported by strong operating cash flow. Recent earnings strength, continued capital deployment, and a leadership team committed to regulatory alignment highlight the company’s durable positioning in the sector.

Recent Events

Essential Utilities has continued pressing forward with its long-term infrastructure modernization strategy, keeping capital flowing into water and wastewater system upgrades across its operating footprint. The company has maintained its pace of investment consistent with the multi-year plan outlined by CEO Christopher Franklin, which targets nearly $8 billion in capital expenditures through 2029. That commitment has remained a central talking point as management engages with regulators and investors alike on the rationale behind sustained high spending levels.

On the dividend front, Essential raised its quarterly payment to $0.343 per share beginning with the August 2025 distribution, up from $0.326 per share in the prior period. That increase represents a roughly 5.2 percent raise and keeps the company’s multi-decade streak of annual dividend growth intact. The most recent payment of $0.343 was made on February 9, 2026, continuing the pattern of February, May, August, and November distributions that income investors have come to rely on.

The broader utility sector has seen renewed investor interest as the rate environment has shifted, and WTRG has benefited from that rotation toward defensive income names. The stock currently trades at $39.76, sitting comfortably within its 52-week range of $35.96 to $42.37, and remains well-supported by institutional ownership as investors weigh the balance between yield, stability, and the company’s ongoing capital intensity.

Key Dividend Metrics

💰 Dividend Yield: 3.36% (Forward)

📈 5-Year Average Yield: 2.64%

🔁 Dividend Growth Streak: Over 30 Years

🧮 Payout Ratio: 54.96%

📅 Last Dividend Payment: February 9, 2026 ($0.343 per share)

🔒 Dividend Safety: Backed by Regulated Cash Flows

Dividend Overview

WTRG’s current yield of 3.36 percent sits noticeably above its five-year average of 2.64 percent, which makes the present entry point more attractive on a historical basis for income-focused investors. That spread between current yield and historical average suggests the stock is offering better-than-usual income relative to where it has typically traded, even if the underlying business hasn’t changed dramatically in character.

The 54.96 percent payout ratio is one of the more reassuring figures in the dividend profile. It reflects a dividend that is well within the earnings capacity of the business and leaves meaningful room for continued growth without straining the balance sheet. For a regulated utility, this range represents a healthy balance between returning cash to shareholders and retaining enough flexibility to fund ongoing capital needs.

Essential Utilities has now raised its dividend for over 30 consecutive years, a streak that includes economic downturns, rising rate environments, and shifting regulatory landscapes. The most recent increase, from $0.326 to $0.343 per quarter, was implemented in August 2025 and reflects management’s confidence in the durability of the company’s cash generation. Annual dividend payments have now reached $1.37 per share, and the trajectory of increases over the past several years has averaged in the mid-single-digit to low-single-digit range annually.

The company’s beta of 0.81 adds further appeal to the income picture. Lower volatility relative to the broader market means the dividend stream is less likely to be disrupted by sentiment-driven price swings, and the stock tends to behave more like a bond proxy than a growth equity during periods of market stress.

Dividend Growth and Safety

Looking at the recent dividend history, the pattern of growth is clear and methodical. Payments moved from $0.287 per share in May 2023 to $0.307 by August of the same year, held steady through early 2024, then stepped up to $0.326 in August 2024, and most recently reached $0.343 in August 2025. Each increase has been measured, sustainable, and aligned with the company’s earnings trajectory, which is precisely the kind of cadence that long-term income investors find reassuring.

Debt remains a relevant consideration for dividend safety. Essential carries a substantial debt load consistent with the capital-intensive nature of utility operations, and the ongoing free cash flow deficit of $677 million reflects the scale of current infrastructure investment. That negative free cash flow number can look alarming in isolation, but the operating cash flow figure of $952 million provides important context. The dividend consumes a fraction of that operating cash generation, and the remaining capital needs are funded through a combination of debt issuance and equity access that is standard practice in the regulated utility model.

Institutional ownership remains high, and short interest stands at approximately 5.77 million shares, a relatively modest figure that signals limited bearish conviction among sophisticated market participants. That positioning, combined with the regulated nature of the business and the consistency of rate case outcomes, supports confidence in the dividend’s durability. The return on equity of 10.29 percent and profit margin of 28.09 percent further reinforce that Essential is generating real economic value from its operations, not just recycling capital.

Chart Analysis

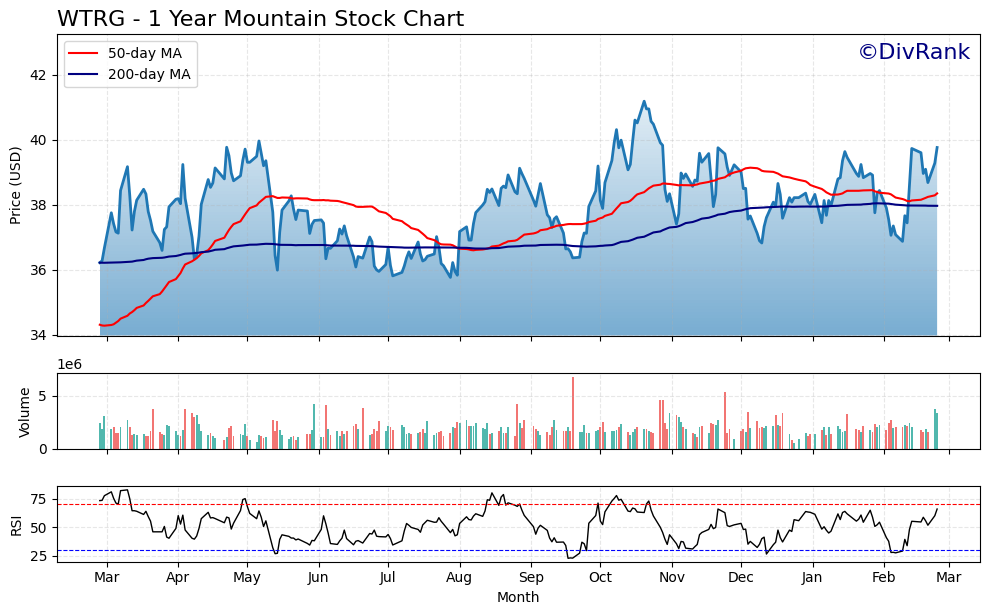

Essential Utilities (WTRG) has traced a constructive recovery arc over the past twelve months, climbing from a 52-week low of $35.76 to its current price of $39.76, a gain of roughly 11% from the trough. The stock reached a 52-week high of $41.18 earlier in the cycle, and at the current level it sits just 3.46% below that peak. For a regulated water utility, that kind of price stability and directional consistency is precisely what income investors should expect, and the chart largely delivers on that expectation. The broader trend reflects improving investor appetite for rate-regulated utilities as the interest rate narrative has shifted, with WTRG benefiting from its defensive earnings profile and visible dividend growth history.

The moving average picture is unambiguously constructive. WTRG is trading at $39.76, comfortably above both its 50-day moving average of $38.35 and its 200-day moving average of $37.96. More meaningfully, the 50-day has crossed above the 200-day, forming what technicians call a golden cross, a configuration that historically signals sustained upward momentum rather than a short-term bounce. The spread between the two averages is relatively tight at roughly 39 cents, which suggests the bullish alignment is still in its early stages rather than an overextended condition. For long-term dividend holders, the fact that both moving averages are rising and price is above both levels confirms that the path of least resistance remains upward.

The Relative Strength Index reading of 65.98 lands in firm bullish territory without yet breaching the 70-level threshold that would flag overbought conditions. That positioning is arguably ideal for new buyers, as the stock carries meaningful upside momentum without the technical vulnerability that comes with an RSI reading above 70. Utilities can spend extended periods with elevated RSI readings given their low-volatility, income-driven ownership base, so this level is less alarming here than it might be in a cyclical sector. The momentum profile suggests buyers remain engaged and that recent price strength has not yet exhausted near-term demand.

For dividend-focused investors, the technical setup for WTRG is supportive rather than cautionary. The combination of a golden cross, price action well above both moving averages, and an RSI that signals strength without excess gives the chart a steady, accumulation-friendly character. The 3.46% gap to the 52-week high represents a modest resistance zone worth watching, but a stock in this configuration, trading above rising moving averages with constructive momentum, is one where the technical picture reinforces rather than complicates the income thesis. Investors adding to positions at current levels appear to be doing so with the trend at their backs.

Cash Flow Statement

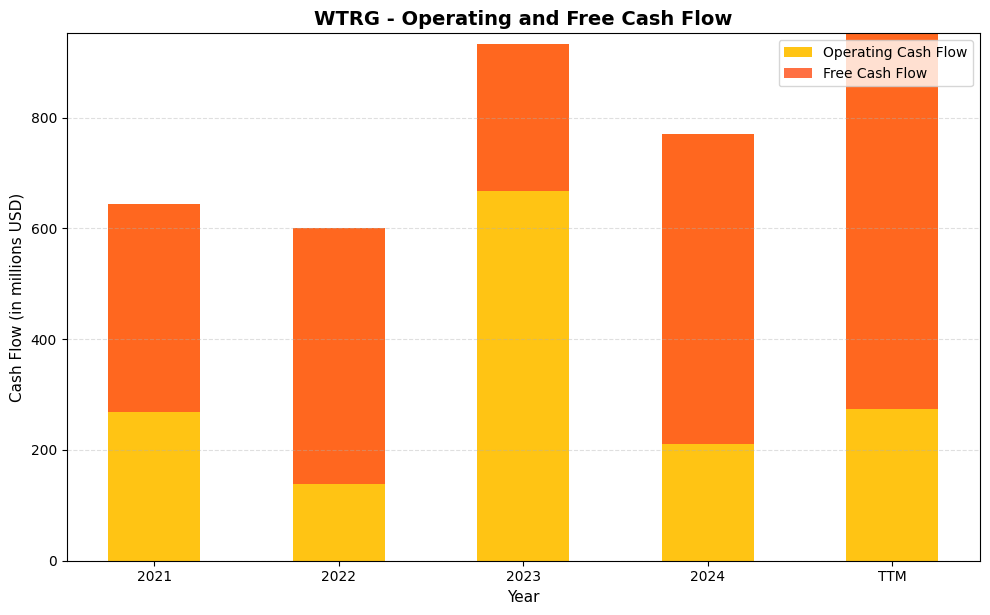

Essential Utilities (WTRG) generates a solid and growing operating cash flow base, with trailing twelve month operating cash flow reaching $952.2 million, the highest level in the period shown. That figure compares favorably to $770.3 million in 2024 and $933.6 million in 2023, confirming that the underlying business is producing meaningful cash from operations at scale. Free cash flow, however, tells a more complicated story. Capital expenditures run extraordinarily heavy at a regulated utility, and free cash flow has been deeply negative throughout this entire period, coming in at negative $677.4 million on a TTM basis. That is the widest deficit in the dataset, reflecting accelerating infrastructure investment rather than operational deterioration. For dividend investors, this means the dividend is not being funded from free cash flow in any traditional sense, which is entirely normal for capital intensive regulated utilities where dividends are instead supported by a combination of operating cash flow, regulated rate recovery, and access to debt and equity capital markets.

Looking across the full timeline, operating cash flow dipped modestly from $644.7 million in 2021 to $600.3 million in 2022 before recovering sharply to $933.6 million in 2023, then pulling back to $770.3 million in 2024 and rebounding again on a TTM basis. This pattern reflects the lumpy nature of working capital movements and rate case timing at regulated utilities rather than any structural erosion in earnings power. The free cash flow deficit has widened considerably from negative $375.8 million in 2021 to negative $677.4 million on a TTM basis, which signals that WTRG is in a sustained period of elevated capital deployment into water and wastewater infrastructure, much of it recoverable through future rate base growth. For shareholders, the key takeaway is that the dividend coverage calculus here is anchored to regulated earnings and the ratemaking process, not to traditional free cash flow metrics. As long as WTRG continues to earn authorized returns on its expanding rate base and maintains access to capital at reasonable costs, the dividend framework remains intact even as free cash flow stays firmly in negative territory.

Analyst Ratings

Five analysts currently cover Essential Utilities, and the price target range they’ve established spans from a low of $38.00 to a high of $45.00, with a mean target of $41.40. At the current price of $39.76, the mean target implies roughly 4 percent upside, which is modest but meaningful for a low-volatility utility where price appreciation plays a supporting role to the income thesis rather than the starring one. The high target of $45.00 suggests that at least one analyst sees a path to considerably stronger performance if rate case outcomes and capital deployment proceed as planned.

No specific analyst actions have been reported in the current period, but the distribution of price targets reflects the balanced sentiment that tends to surround regulated utilities in the current environment. The floor target of $38.00 sits just below the recent 52-week low of $35.96, indicating that even the most cautious analyst in the coverage group does not anticipate a significant deterioration in fundamentals. The presence of a $45.00 high target points to continued optimism around the company’s long-term earnings growth as infrastructure investments work their way through the rate base and begin generating authorized returns.

The overall picture from the analyst community is one of measured confidence. WTRG is not a stock that generates aggressive price target upgrades or dramatic sentiment swings, and that stability in analyst opinion is itself a reflection of the business’s predictability. For income investors, the absence of controversy in the coverage community is generally a positive signal.

Earnings Report Summary

Strong Finish to the Year

Essential Utilities has delivered trailing twelve-month earnings per share of $2.40, a clear step forward from the $2.17 reported for the full year 2024. That improvement reflects both the revenue growth generated by rate case outcomes and the continued contribution from the company’s natural gas segment alongside its core water and wastewater operations. Revenue for the trailing period reached $2.38 billion, and the 28.09 percent profit margin demonstrates that Essential is converting top-line growth into bottom-line earnings with reasonable efficiency given the cost structure of a capital-intensive utility.

Net income of $668 million represents strong absolute earnings power for a company of this size, and the return on equity of 10.29 percent reflects the disciplined use of the regulated asset base to generate authorized returns. Management has continued to emphasize that the earnings improvement is not driven by one-time items but by the structural benefit of completed infrastructure investments moving into the rate base and earning a regulated return.

Investments That Go Beyond the Quarter

The longer-term investment narrative remains front and center for Essential’s leadership. With capital expenditures consistently running above $1.3 billion annually and a target of nearly $8 billion through 2029, the company is in the middle of one of the most ambitious infrastructure modernization programs in its history. These investments span pipeline replacements, treatment plant upgrades, and system reliability improvements that serve both the regulatory mandate and the practical need to serve growing customer bases across the company’s 10-state footprint.

CEO Christopher Franklin has been consistent in framing this capital deployment as the engine of future earnings growth rather than a drag on near-term performance. Each completed project represents an addition to the rate base, and each rate base addition supports future rate case filings that generate authorized returns. That flywheel of investment, regulatory approval, and earnings growth is the core of the utility model, and Essential has executed on it reliably through multiple economic cycles.

Outlook Grounded in Stability

The combination of $952 million in operating cash flow, a well-covered dividend at a 54.96 percent payout ratio, and a clear multi-year capital plan gives Essential a financial profile that income investors can model with reasonable confidence. Management’s guidance philosophy has consistently emphasized steady earnings growth in the mid-single-digit range, driven by rate base expansion and modest customer growth, with dividend increases tracking earnings over time. That approach may lack the drama of a high-growth equity story, but for investors who prioritize income reliability and capital preservation, it represents exactly the kind of visibility that justifies holding WTRG through market cycles.

Management Team

The leadership at Essential Utilities brings a mix of operational expertise, long-term strategic vision, and a clear understanding of the regulatory landscape they operate within. Christopher Franklin, who has served as Chairman and CEO since 2015, has been with the company for over 25 years. Under his watch, Essential has transformed from a regional water utility into one of the largest publicly traded water, wastewater, and natural gas providers in the United States. Franklin’s approach emphasizes steady infrastructure investment, disciplined acquisitions, and consistent shareholder return, including a strong focus on dividend growth.

The rest of the executive team reflects that same mindset, with experienced leaders carrying deep roots in both the utility sector and public service. Their emphasis on operational reliability, environmental stewardship, and proactive regulatory relationships has helped position the company for long-term resilience. In a space where management often flies under the radar, Essential’s leadership has delivered consistent results while keeping the business on track through challenging economic cycles.

The board and executive team maintain strong alignment with shareholders through compensation programs tied to financial performance and operational targets. That structure reinforces accountability and helps ensure the company stays focused on delivering predictable returns over time, which is the core promise that makes a utility like WTRG worth holding through periods of broader market uncertainty.

Valuation and Stock Performance

At its current price of $39.76, WTRG trades at a P/E ratio of 16.57 times trailing earnings, which represents a discount to where the stock has historically traded and sits below the typical range for large-cap regulated utilities. The price-to-book ratio of 1.65, against a book value per share of $24.09, reflects the asset-heavy nature of the business and is consistent with the regulated return framework that governs utility valuations. Neither metric suggests the stock is expensive at current levels, and the relative value case becomes more interesting when layered against the income the stock produces.

The 3.36 percent current yield, sitting meaningfully above the five-year average of 2.64 percent, is one of the more compelling arguments for the stock at this price. Investors who have followed WTRG for years understand that buying when the yield is elevated relative to its own history has generally been a rewarding entry strategy, and the current spread between current and historical yield is among the widest it has been in recent memory.

Over the past year, WTRG has traded in a range of $35.96 to $42.37, and the current price of $39.76 places it roughly in the middle of that band. The stock has recovered from its lows and is consolidating at a level that appears to reflect fair value by most measures. The mean analyst price target of $41.40 implies modest appreciation from here, and the high target of $45.00 represents approximately 13 percent upside if the most optimistic scenario plays out. For a utility with a beta of 0.81 and a reliable dividend, that combination of income and potential appreciation positions the stock as a solid holding in a balanced income portfolio.

With a market capitalization of approximately $11.26 billion, Essential Utilities is a meaningful-sized company in the regulated utility universe, large enough to command institutional coverage and attract steady ownership from income-oriented funds. The return on assets of 3.14 percent is modest but appropriate for a regulated business, and the overall financial profile supports the case that current valuation is neither demanding nor deeply discounted, but rather grounded in the underlying earnings and cash flow reality of the business.

Risks and Considerations

Essential Utilities operates in a heavily regulated environment, and its ability to earn adequate returns is closely tied to the approval process managed by state and local regulatory bodies. Delays or unfavorable outcomes in rate cases can compress margins and slow the earnings growth that supports dividend increases. While the company has historically managed these relationships with skill and consistency, regulatory risk is always present in the utility model and can be particularly acute during periods of elevated capital spending when utilities are seeking larger rate increases to recover their investments.

The debt load on Essential’s balance sheet warrants ongoing attention. The company carries substantial long-term debt to fund its infrastructure program, and while this structure is standard for regulated utilities, it creates sensitivity to interest rate movements that can increase borrowing costs over time. If rates remain elevated or move higher, the cost of refinancing maturing debt or issuing new debt to fund capital expenditures could put pressure on earnings and cash flow, reducing the headroom available for dividend growth.

Weather, natural disasters, and the long-term effects of climate change represent operational risks that are difficult to fully quantify or insure against. Water utilities in particular face exposure to droughts, flooding, and severe storm events that can damage infrastructure, disrupt service, and generate significant unplanned capital costs. Essential has invested meaningfully in system hardening and resilience, but the unpredictability of weather-related events means this risk cannot be eliminated.

The company’s acquisition strategy, while historically well-executed, carries the inherent risks of integration complexity, regulatory approval timelines, and the potential for cost overruns when absorbing systems with deferred maintenance or outdated infrastructure. Future deals may face a more scrutinized regulatory environment or may involve systems that prove more expensive to upgrade than initially anticipated, which could affect the financial returns from those investments.

Finally, the persistently negative free cash flow resulting from high capital spending is a dynamic that long-term investors should monitor. As long as operating cash flow remains robust and capital market access stays open, the dividend and investment program are both sustainable. A deterioration in either of those conditions, whether from earnings pressure, rising credit spreads, or a significant increase in borrowing costs, could force a reassessment of the capital allocation strategy and potentially slow the pace of dividend growth.

Final Thoughts

Essential Utilities brings a lot to the table for investors who appreciate stability, income, and a clear long-term focus. The company operates in a sector where change comes slowly and predictability is a strength. With strong leadership, a clear growth strategy centered on infrastructure investment, and a multi-decade commitment to dividend increases, WTRG remains a dependable name in the utility space.

Its valuation at 16.57 times trailing earnings is grounded in reality and arguably more attractive than it has been in recent years, while its yield of 3.36 percent, well above the five-year average, offers a reliable stream of income that compares favorably in a still-uncertain rate environment. The company’s ability to manage its debt, execute on capital projects, and maintain favorable regulatory relationships will remain the key drivers of long-term value from here.

Investors looking for a business with low volatility, steady earnings growth, and a dividend with more than 30 years of consecutive increases are likely to find comfort in Essential’s approach. The next phase for the company seems focused on continuing to modernize its systems, expand the rate base, and return value to shareholders through both capital appreciation and a growing dividend. It is not trying to be exciting, and that is exactly why it continues to earn a place on the watchlist for those who prefer consistency over spectacle.