Key Takeaways

💰 EQR offers a forward dividend yield of 3.86%, slightly above its five-year average, with steady, modest dividend growth supported by a long history of uninterrupted payments.

💵 Trailing twelve-month free cash flow stands at $1.27 billion, comfortably covering dividend obligations and reflecting strong operating fundamentals.

📊 Analyst consensus rates the stock as a hold, with a price target around $78.71 and recent adjustments signaling cautious optimism driven by stable performance.

📈 Q1 2025 earnings showed FFO growth and strong occupancy at 96.5%, with leadership expressing confidence heading into peak leasing season.

Last Update 5/4/25

Equity Residential (EQR) owns and operates high-quality apartment communities across major U.S. cities like New York, San Francisco, and Washington, D.C. With a portfolio built around affluent urban renters and a leadership team focused on operational discipline, the company has consistently maintained high occupancy, strong tenant retention, and a dependable stream of free cash flow.

Backed by experienced management and a conservative approach to growth, EQR has delivered steady dividend payments for over two decades. Its current yield sits at 3.86%, supported by a healthy cash flow profile, moderate leverage, and a long-term strategy centered on stability and income generation.

Recent Events

Shares of Equity Residential have seen a modest climb in 2025. As of early May, the stock is trading around $71.72, off its lows but still below the highs it saw over the past year. The broader real estate sector continues to grapple with elevated interest rates, and while that has pressured valuations, EQR has held up relatively well.

The company’s performance in the first quarter of 2025 paints a steady, if not spectacular, picture. Revenue is up a healthy 4.1% year over year, signaling solid occupancy and rent collection in its core markets. That said, net income took a bit of a hit, falling 13.3% from the previous year. Some of that can be chalked up to higher operating expenses and a few pockets of competition in select metro areas.

Still, cash generation remains robust. With $1.58 billion in operating cash flow and $1.45 billion in levered free cash flow over the past year, EQR has more than enough cushion to support its dividend. And for income-focused investors, that’s what matters most.

Key Dividend Metrics 🧾💰📈📆

💵 Forward Annual Dividend Rate: $2.77

📊 Forward Dividend Yield: 3.86%

📆 Dividend Pay Date: April 17, 2025

⚖️ Payout Ratio (EPS-based): 103.72%

📉 Five-Year Average Yield: 3.73%

📈 Dividend Growth Rate (5-Year CAGR): Slow and steady

🔁 Dividend Frequency: Quarterly

🏛 Years Paying Dividends: Over 20 years

🔐 Dividend Safety: Backed by strong free cash flow and stable rent base

Dividend Overview

EQR’s forward yield of 3.86% offers a steady stream of income that’s slightly higher than its five-year average. While it’s not the highest yield you’ll find in the REIT world, it reflects the company’s focus on quality over quantity—and that’s something dividend investors often appreciate. It’s a yield that fits comfortably into portfolios built for longevity rather than chasing short-term returns.

That said, the payout ratio—over 100% based on earnings—might raise a few eyebrows. But that’s where context matters. For REITs, earnings per share isn’t the most relevant metric when evaluating dividend sustainability. Instead, cash flow tells the real story, and EQR’s free cash flow is more than sufficient to support its payouts.

The company’s steady hand and conservative approach are also reflected in how the dividend has been managed. There haven’t been big, splashy hikes—but there haven’t been cuts either. Through recessions, a pandemic, and rising rates, the dividend has kept coming.

And with a relatively low beta of 0.87, the stock doesn’t tend to swing wildly, making it appealing for investors who want their income to show up quietly and reliably, month after month, quarter after quarter.

Dividend Growth and Safety

Equity Residential doesn’t rush dividend increases. Its approach is more measured, with modest growth over the years that keeps pace with the business. That’s been the company’s style for a long time—focus on core market strength, keep leverage in check, and grow the dividend when it makes sense.

Over the past five years, dividend growth has been consistent but unflashy. It’s more of a slow climb than a sprint. And in today’s environment, where some REITs have paused or even cut distributions, that kind of stability is worth paying attention to.

On the safety front, the numbers remain reassuring. The company brought in $1.58 billion in operating cash flow over the past twelve months, while its dividend obligations were around $1.05 billion. That provides decent coverage—even after accounting for capex and other obligations.

The debt load, while not light, is manageable. Total debt sits at $8.15 billion with a debt-to-equity ratio of just over 70%. EQR isn’t overleveraged, but it also doesn’t have endless room to stretch. That means don’t expect aggressive dividend hikes until rates start to ease or NOI growth picks up meaningfully. But from a sustainability standpoint, things look solid.

Institutional investors clearly like what they see. More than 95% of the float is held by institutions, a strong signal that large money managers view the business model—and the dividend—as dependable.

In short, Equity Residential offers a steady, durable income stream backed by premier real estate, conservative management, and a business model that’s built for long-term income—not flashy gains. For dividend investors who want reliability more than headlines, this is one to watch.

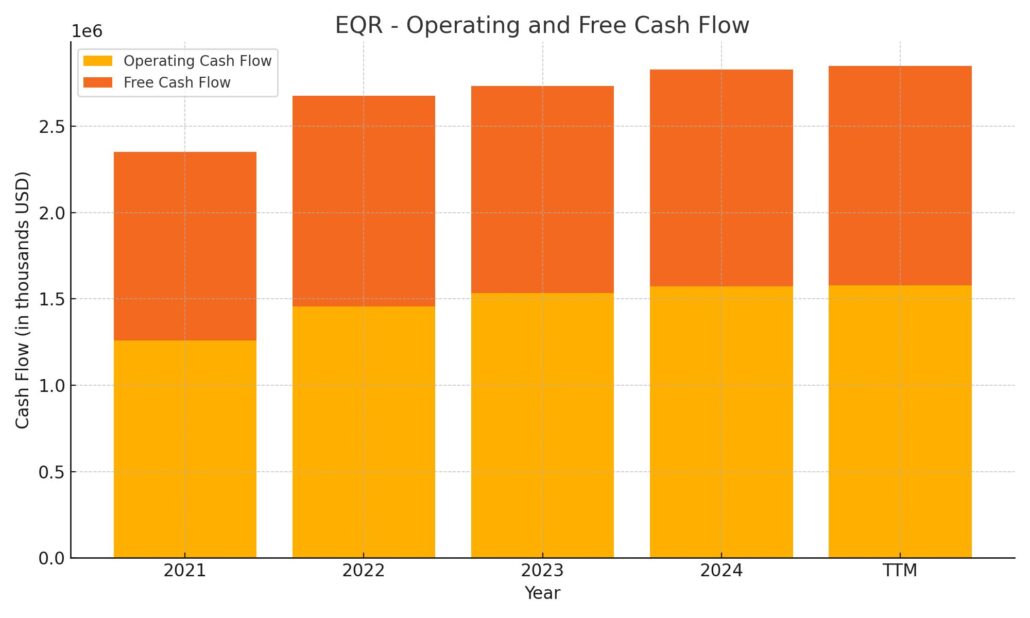

Cash Flow Statement

Equity Residential’s trailing twelve-month (TTM) cash flow highlights a solid operating performance, with operating cash flow reaching $1.58 billion—its highest in recent years. This is a clear reflection of the company’s consistent rental income and disciplined expense management across its portfolio. Free cash flow also remains strong at approximately $1.27 billion, showing that after covering capital expenditures, the company retains a healthy amount of cash to support dividends and other financial obligations.

On the investment side, the company continues to pour resources into its property base, with $1.21 billion in net outflows for investing activities. That includes over $308 million in capital expenditures, a slight decline compared to recent years. Financing cash flow stayed negative, at -$417 million TTM, as the company repaid more debt than it issued, even after a notable gross debt issuance of over $44 billion. These repayments help keep leverage in check. Despite all of this, the ending cash position was $141.5 million—stable and adequate for day-to-day liquidity, even if not excessive. Overall, EQR’s cash flow profile supports its steady dividend, with little indication of stress.

Analyst Ratings

📊 Equity Residential (NYSE: EQR) has recently seen a mix of sentiment from Wall Street analysts, with a cautious but generally stable outlook. The current consensus among 17 analysts is a “Hold,” with 9 maintaining that position and 8 calling it a buy. The average 12-month price target sits at $78.71, pointing to a potential upside of nearly 10% from where the stock is currently trading.

📈 Several firms have increased their price targets in recent months following steady operating performance and resilient rental income. On March 10, 2025, Truist Securities raised its price target from $76 to $78, reaffirming its positive stance. Around the same time, Scotiabank nudged its target from $78 to $79 while keeping a neutral outlook. Evercore ISI also showed confidence by moving its target up from $74 to $76, though they continue to view the stock as fairly valued.

📉 On the flip side, not all analysts are leaning bullish. Barclays lowered its target from $83 to $79 back in January while still holding an overweight rating, signaling confidence but with a more tempered upside view. Wells Fargo adjusted its expectations from $77 down to $75, and Mizuho pulled its target from $78 to $74, citing broader market concerns and macroeconomic headwinds.

🎯 Overall, price targets range from $70 on the low end to $85 on the high end. This wide spread shows a market divided on how Equity Residential will perform in the face of high rates and evolving housing dynamics. Still, the consistency in dividend payments and cash flow keeps the stock in good standing among income-focused portfolios.

Earning Report Summary

Steady Start to 2025

Equity Residential opened the year with a solid, steady first quarter that kept pace with expectations. The company reported normalized funds from operations (FFO) at $0.95 per share, a slight uptick from $0.93 in the same period last year. That kind of quiet growth reflects strength in several of its core markets, especially in places like New York and Washington, D.C., while even historically slower regions like San Francisco and Seattle showed some encouraging signs of life.

Occupancy stayed strong at 96.5%, and turnover hit a record low of 7.9%, which is a clear sign that residents are choosing to stay put. Renters are staying longer, and that’s exactly what a landlord likes to see. Revenue from same-store operations climbed 2.2%, while net operating income nudged higher by 1.3%. The only real dip came in reported EPS, which slipped to $0.67 from $0.77. But that drop had more to do with timing around property sales and depreciation, rather than anything operational.

Activity in the Portfolio

During the quarter, Equity Residential sold two properties totaling 546 units for around $225 million. Those sales came with a yield of about 5.2%, giving the company some flexibility to reposition capital. On the flip side, it also brought new development projects online—adding 945 fresh units in New York, Denver, and San Francisco. That blend of pruning and growing keeps the portfolio aligned with high-demand urban areas, which has always been part of EQR’s strategy.

Guidance and Outlook

Looking ahead, the company expects second-quarter FFO to come in somewhere between $0.96 and $1.00 per share. EPS is projected to range from $0.49 to $0.53. Lease growth expectations are modest but positive, with blended rate increases between 2.8% and 3.4%. These are not blockbuster numbers, but they reflect consistency, which is really what long-term income investors are after.

CEO Mark Parrell remains confident in the direction things are going. He emphasized that despite broader economic uncertainties, the company’s mix of stable markets and operational discipline continues to serve them well. He pointed to strong demand, particularly in affluent, high-barrier cities, and noted that supply is unlikely to spike meaningfully in the near term, which works in their favor.

COO Michael Manelis also added that heading into the prime leasing season, the company feels well-positioned. He mentioned stable occupancy and solid renewal activity as key themes. Perhaps most interestingly, he suggested that new apartment starts may slow down due to economic pressures, which could actually help existing landlords like EQR over the coming quarters.

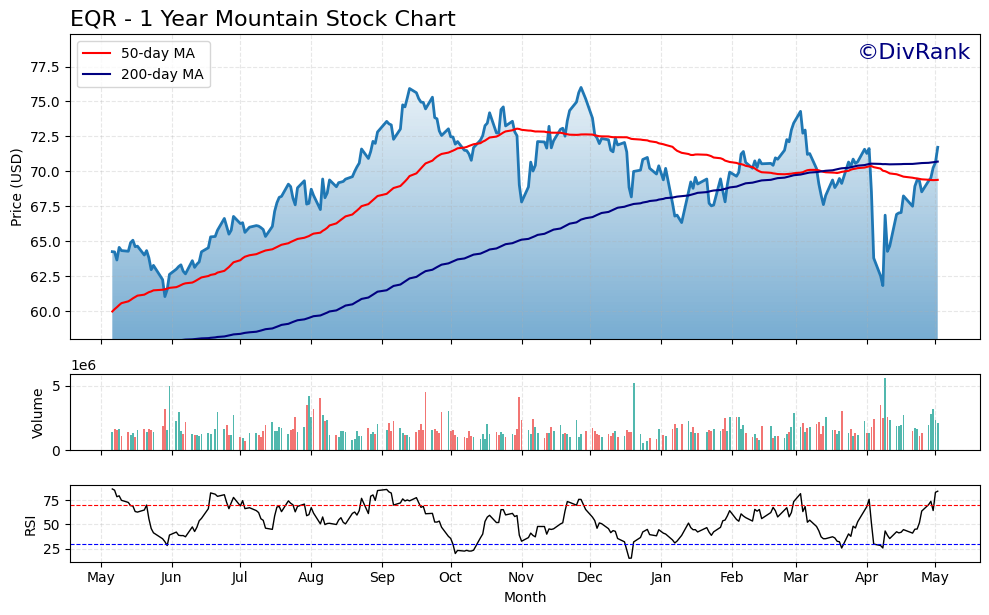

Chart Analysis

Price Trends and Moving Averages

EQR has spent the past year navigating a wide trading range, with some noticeable shifts in momentum along the way. The 50-day moving average (in red) climbed steadily through most of last year but has recently flattened and even turned lower at times, indicating some short-term softness that reflects the stock’s more recent consolidation. Meanwhile, the 200-day moving average (in blue) has continued on a gentle upward slope, suggesting that the longer-term trend is still intact despite recent volatility.

The stock dipped hard in early April but has since staged a strong rebound, recently pushing above both its 50-day and 200-day moving averages. That’s typically a healthy technical sign, pointing to potential renewed buying interest and stabilization after a brief correction. Price action holding above these key averages often serves as a cushion for further upside, as long as broader conditions remain favorable.

Volume and Momentum Signals

Volume activity shows periodic spikes, particularly during selloffs and recoveries. Notably, the recent rebound in late April and early May came with increased volume, which adds credibility to the strength behind the move. That kind of volume-backed price action suggests participation from larger players, rather than just retail noise.

At the bottom of the chart, the Relative Strength Index (RSI) has climbed sharply and is now brushing against the overbought level around 70. This could mean a short-term breather is possible, especially if the stock pauses to digest recent gains. But it’s also a reflection of strong momentum, showing how quickly sentiment has shifted back to the positive.

Key Takeaways from the Setup

Looking at the broader trend, EQR has managed to hold above its longer-term support zones even during volatility. The recent bounce from April’s low and follow-through above both moving averages tells a story of underlying strength returning to the stock. The fact that RSI is elevated isn’t necessarily a red flag—it just means that the rally has come quickly and might cool off a bit before the next leg.

This chart doesn’t show a runaway breakout, but it does show a stock regaining its footing after a correction. If it can maintain its position above the 200-day average and volume stays healthy, the setup leans constructive heading into the middle part of the year.

Management Team

Equity Residential is led by a team with a long-standing focus on urban real estate and a commitment to operational stability. Mark Parrell has been the company’s President and CEO since 2019, after previously serving as CFO. His financial background brings a strong emphasis on efficiency and steady capital deployment. He’s known for his measured approach to growth and his ability to maintain discipline, especially in a climate of rising interest rates and shifting housing trends.

Working alongside him is Michael Manelis, the Chief Operating Officer. With more than two decades at the company, Manelis brings hands-on experience managing EQR’s day-to-day operations. He’s been key to the company’s success in tenant retention and occupancy management, both of which have remained high even during periods of volatility. The rest of the leadership team reflects similar tenure and experience, which contributes to the company’s ability to respond to changes without overreacting.

What stands out about this management group is their consistent track record of navigating both expansion and downturns with a focus on protecting shareholder value. They continue to prioritize steady cash flow, manageable leverage, and a dividend strategy that reflects the underlying strength of the business.

Valuation and Stock Performance

EQR trades at a valuation that aligns with its reputation as a top-tier multifamily REIT. With a current share price around 71 dollars and a market cap above 27 billion, the stock reflects investors’ willingness to pay for quality and consistency. The trailing price-to-earnings ratio is near 27, while the forward P/E looks much higher, over 60, due in part to slower earnings growth and a shift in property transaction gains.

For real estate investment trusts, however, P/E isn’t always the best metric. Investors tend to focus more on price-to-FFO (funds from operations), which provides a clearer view of cash flow available for distributions. EQR has historically traded at a premium on that basis, and that continues today, driven by the quality of its properties and strength of its rent base.

The stock’s performance over the past year has been marked by swings, with lows near 59 and highs just under 79. After a pullback in April, the recent price recovery suggests renewed strength, especially with the stock now trading above both its 50- and 200-day moving averages. That kind of technical momentum can be encouraging for investors watching for signs of a bottom.

Compared to other REITs, EQR’s stability stands out. While it doesn’t deliver explosive capital gains, it has consistently delivered on its income promise and tends to hold up well when broader markets turn volatile. That’s in part due to its lower beta, which makes it less sensitive to sharp market swings.

Risks and Considerations

Equity Residential faces several risks that investors should be aware of, even with its strong fundamentals. Chief among them is the interest rate environment. Rising rates increase borrowing costs, which can pressure margins and impact the company’s ability to fund development or acquisitions at attractive terms. While EQR’s debt profile is well-managed, any refinancing in a higher rate environment could lead to increased expenses.

There’s also regulatory risk, particularly in the markets where EQR operates most heavily. Cities like New York, Los Angeles, and San Francisco have rent control measures and housing regulations that can affect revenue growth. Any tightening of those policies could restrict rent increases and impact returns.

Demand for urban housing remains strong, but it’s not immune to change. If work-from-home trends deepen or if city populations shift due to affordability concerns, there could be some pressure on lease-up rates in specific regions. EQR’s portfolio is diversified across markets, but this remains an area to monitor.

Inflation and rising labor costs are additional concerns. Maintenance and property operations are people-heavy businesses, and sustained cost increases in these areas could weigh on margins over time.

Lastly, the dividend payout ratio based on earnings looks high, which could worry some investors. However, cash flow tells a different story, and current free cash flow levels comfortably support the dividend. Still, any sustained decline in rent collections or occupancy could shift that equation.

Final Thoughts

Equity Residential remains one of the more stable names in the real estate sector, offering a blend of reliability, quality assets, and thoughtful management. Its leadership team continues to take a long-term view, favoring balance sheet strength and tenant quality over aggressive expansion. That mindset has helped the company weather various economic cycles with relatively low volatility.

The stock’s valuation reflects its premium position in the market, and while it doesn’t scream bargain, it does offer value in the form of consistency and resilience. Its long track record of dividend payments and strong free cash flow generation backs up that reputation.

Risks tied to rates, regulation, and macroeconomic shifts are present, but the company’s diversified portfolio and conservative financial practices put it in a solid position to manage through them. The real advantage here is the predictability of the income stream, supported by demand for housing in some of the country’s most competitive markets.

This isn’t a story about chasing the next big thing. It’s about building a steady income position in a portfolio with a company that understands its role and executes on it. Equity Residential continues to deliver on that front, one quarter at a time.