Key Takeaways

📈 EPD offers a forward dividend yield of 7.16% and has increased its distribution for over 25 consecutive years, with steady, modest growth supported by strong distributable cash flow.

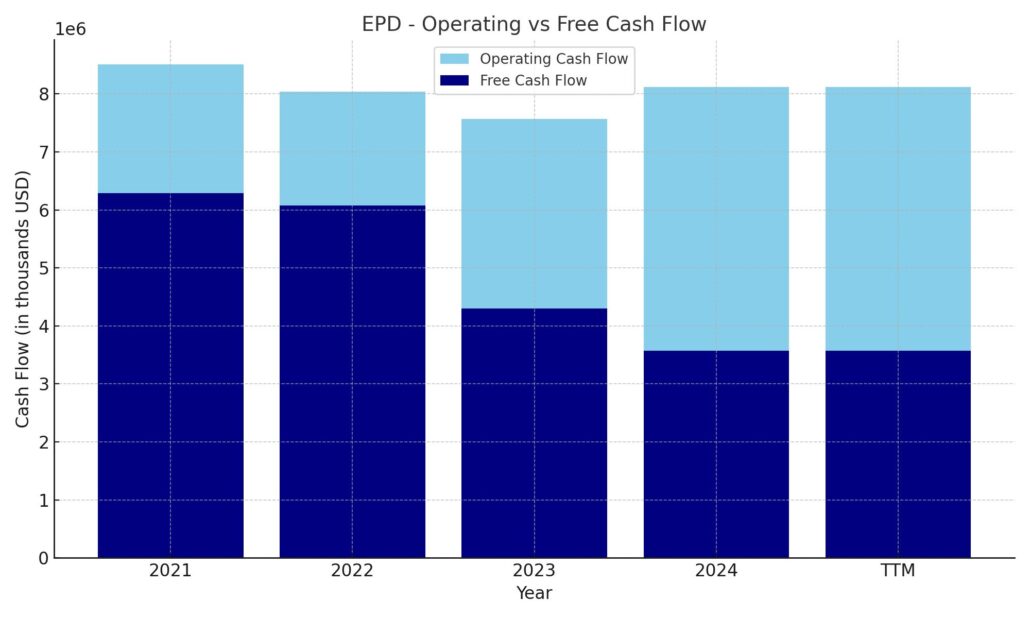

💵 Operating cash flow for the trailing twelve months reached $8.1 billion, with free cash flow at $3.57 billion, reflecting strong internal funding despite elevated capital expenditures.

🔍 Analysts maintain a consensus “Buy” rating with a price target around $36.89, citing the company’s stability, attractive yield, and reliable asset base.

📊 The latest earnings report showed $15.42 billion in revenue and $1.4 billion in net income, with management emphasizing long-term strategy and steady growth amid slight margin pressures.

Last Update: 5/1/25

Enterprise Products Partners L.P. (EPD) operates one of the largest and most integrated energy infrastructure networks in the United States, with nearly 50,000 miles of pipelines and a strong presence in natural gas, NGLs, crude oil, and petrochemicals. The company is structured as a master limited partnership and has delivered over 25 consecutive years of distribution increases, supported by fee-based cash flows and long-term contracts.

Led by a management team with decades of experience and strong insider ownership, EPD continues to focus on disciplined capital allocation, strategic growth projects, and reliable income generation. With a forward yield above 7 percent, consistent cash flow, and a clear long-term strategy, the company remains a key income-producing name in the midstream sector.

Recent Events

Looking at recent results, the top line shows some healthy momentum. EPD reported trailing twelve-month revenue of $56.88 billion, reflecting a year-over-year gain of 4.5%. That’s a solid figure, especially in the context of the broader energy landscape. That said, earnings growth slipped a bit, down 4.3% year-over-year for the most recent quarter. Margins are still in decent shape, with a 10.26% profit margin and a 10.88% operating margin, but some compression is evident.

Enterprise’s market cap sits at roughly $65 billion, while its enterprise value has climbed to over $96 billion. That tells you investors still see long-term cash generation in this business, even if the stock hasn’t made dramatic moves lately. Shares are trading around $30, having moved between a low of $27.37 and a high of $34.63 over the past year.

This isn’t a high-beta stock—it moves slowly, in both directions. But that’s part of the appeal. With a beta of just 0.76, EPD brings a steadying presence to income-focused portfolios.

And for those keeping an eye on the calendar, the company’s latest ex-dividend date was April 30, with the next payout scheduled for May 14.

Key Dividend Metrics

📈 Forward Dividend Yield: 7.16%

💰 Forward Annual Dividend Rate: $2.14

📆 Next Dividend Date: May 14, 2025

⚖️ Payout Ratio: 78.65%

🔁 5-Year Average Yield: 7.72%

📉 Trailing Dividend Yield: 7.01%

🔎 Ex-Dividend Date: April 30, 2025

Dividend Overview

What separates Enterprise from the crowd isn’t just its yield—it’s the staying power. A 7%+ yield might raise eyebrows in today’s market, but this isn’t a sudden spike driven by a falling share price. It’s been a deliberate, measured strategy built over decades.

EPD has raised its distribution for more than 25 years straight. That’s no small feat, especially in the cyclical energy sector. But Enterprise doesn’t chase growth for growth’s sake. The approach is cautious, focusing on slow, consistent distribution increases. The current annual payout of $2.14 is only a small step up from last year’s figure, but that kind of modest, predictable growth is exactly what many long-term income investors look for.

With a payout ratio hovering just under 80%, EPD still has breathing room—particularly because MLPs base their distributions on distributable cash flow, not just traditional earnings. And in that department, Enterprise has shown it can comfortably cover its distributions year after year.

Yes, the debt load is high. Total debt stands at $32.37 billion, and the debt-to-equity ratio sits north of 100%. But the company has managed this leverage carefully, keeping maturities spread out and maintaining strong credit ratings. That discipline goes a long way in this space.

Dividend Growth and Safety

EPD isn’t about flashy dividend hikes. It’s a slow burn—one or two cents per quarter, just enough to keep pace with inflation and show commitment to growth. Over the past five years, that’s averaged out to roughly 2% per year. It won’t turn heads, but when you’re already starting with a yield over 7%, that kind of stability is exactly what you want.

What gives this growth a solid foundation is the company’s business model. Long-term, fee-based contracts provide visibility and help insulate the company from big swings in energy prices. Even when markets turned south in 2020, EPD kept distributions steady. That kind of performance isn’t common and speaks volumes about the strength of its underlying cash flows.

Enterprise’s assets are the kind that are hard to replicate—pipelines, storage terminals, and processing plants located at critical junctions across the U.S. Gulf Coast and beyond. These are real, physical assets with long lifespans and durable demand.

Management’s alignment with unitholders also adds a layer of comfort. With insiders holding nearly 33% of the partnership, they have a direct interest in maintaining stable, growing distributions over time.

Valuation-wise, Enterprise trades at a forward P/E of just over 10 and a price-to-book ratio of 2.25. These aren’t stretched numbers, especially considering the yield and asset base. The PEG ratio, sitting near 2.86, reflects slow earnings growth expectations, but that’s not really the story here. The income is the story.

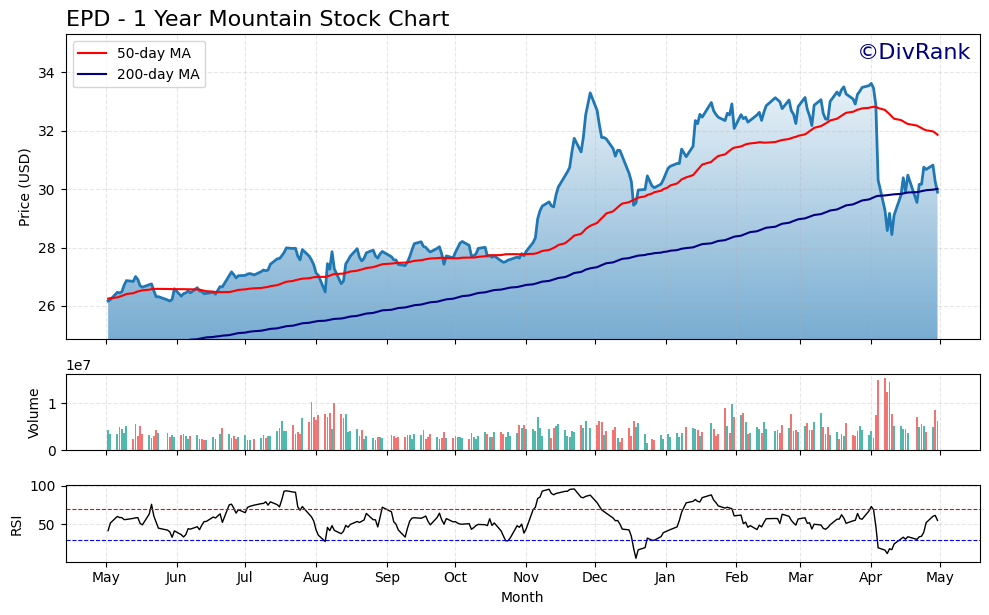

From a technical standpoint, the stock has been trading below both its 50-day and 200-day moving averages. For those reinvesting distributions, this kind of sideways action can be a positive—it allows for better accumulation when yields are high and price momentum is muted.

In short, Enterprise Products Partners continues to deliver on what it’s always promised: reliable, well-supported income backed by real assets and conservative management.

Cash Flow Statement

Enterprise Products Partners continues to generate strong cash from operations, posting $8.1 billion in operating cash flow over the trailing twelve months. This figure is a slight rebound from 2023 but still sits just below 2021 levels. Despite consistent earnings, free cash flow has trended lower, coming in at $3.57 billion—down from over $6 billion in both 2021 and 2022. The key reason for this decline is increased capital spending, which jumped to $4.54 billion, more than double the 2021 figure. The company is clearly investing heavily back into infrastructure, and while that’s a long-term play, it’s trimmed the free cash flow cushion in the near term.

On the financing side, Enterprise kept a tight grip. Net debt activity was relatively neutral with about $53.7 billion issued and $50.5 billion repaid. Distributions and other equity-related outflows pulled total financing cash flow down to a negative $2.16 billion. While cash reserves remain modest at $838 million, they’re up from the previous year, showing improved liquidity. Overall, Enterprise continues to fund its investments largely through internal cash generation and measured debt issuance, maintaining balance while supporting its capital-intensive operations.

Analyst Ratings

📈 Enterprise Products Partners L.P. (EPD) recently saw its Relative Strength (RS) Rating edge higher, moving from 68 to 76. This improvement reflects stronger price performance compared to its peers over the last 12 months. The stock is currently shaping up in a consolidation pattern, often seen as a potential setup for a breakout if the trend continues.

🟢 Analysts remain broadly positive on the stock, with a consensus rating of “Buy.” The average 12-month price target sits around $36.89, which suggests roughly 23% upside from current levels. The range of estimates runs from $35 on the low end to as high as $40, pointing to a generally confident outlook across the board.

📊 JP Morgan has kept its “Buy” rating intact, nudging its price target up from $37 to $38. The firm pointed to Enterprise’s steady cash flow and dependable asset footprint as reasons for optimism. Barclays followed suit, reaffirming its “Buy” stance while raising its target from $35 to $37. Their analysts noted the company’s consistent operational performance and well-timed capital investments as key strengths.

💵 The prevailing sentiment among analysts is that EPD offers attractive income potential, backed by resilient financials and a strong foothold in the U.S. energy logistics space.

Earning Report Summary

Solid Revenue Growth, but Earnings Came in a Bit Light

Enterprise Products Partners started off 2025 with revenue that beat expectations, climbing to $15.42 billion for the first quarter. That’s a healthy 4.5% gain over the same period last year. But on the earnings side, things were a little softer. Net income landed at $1.4 billion, or $0.64 per unit, which came in just under what analysts were looking for. Management pointed to tighter margins in a few segments and some elevated operating costs as reasons for the dip.

Even with that earnings miss, the business is still generating plenty of cash. Adjusted EBITDA came in at $2.4 billion, and distributable cash flow rose to $2.0 billion—about 5% higher than this time last year. That gave the company the room to bump up its distribution again, raising the quarterly payout to $0.535 per unit. It’s another notch in Enterprise’s long history of steady income, marking 27 consecutive years of distribution growth.

Leadership Focused on Long-Term Strategy

During the earnings call, co-CEO Randy Fowler made it clear that the company isn’t focused on quarter-to-quarter noise. His words? “We think in terms of decades, not quarters.” That mindset has long shaped Enterprise’s steady, measured approach to expansion and capital spending.

Co-CEO Jim Teague added his thoughts on the broader energy landscape, noting the ongoing demand from global markets for U.S. oil and gas. According to him, countries around the world still rely heavily on American energy to fuel their economies, and Enterprise plans to stay right at the center of that demand.

Big Capital Plans and Modest Growth Expectations

Looking ahead, the company is sticking with its plan to spend between $4.0 and $4.5 billion this year on growth projects. These include two new gas processing plants in the Permian Basin and expansions to ethane and ethylene terminals. Enterprise isn’t swinging for the fences—it’s aiming for mid-single-digit growth in cash flow per unit, which aligns with the stable and dependable story it’s always told.

While they’re keeping an eye on potential headwinds like tariffs or inflationary pressure, management made it clear they feel good about the company’s position. With strong cash flow, manageable debt, and a solid backlog of infrastructure projects, Enterprise is staying the course. Their focus remains on steady, long-term returns rather than short-term surprises.

Chart Analysis

Price and Moving Averages

The chart for EPD over the past year shows a generally positive trend with a healthy run-up from the mid-$26 range to a peak above $34 before pulling back. The 50-day moving average (in red) had been trending well above the 200-day moving average (in blue) for most of the period, a sign of strength. But more recently, that gap has narrowed, with the 50-day rolling over in April. That shift signals some loss of momentum in the short term. Still, the price remains above the 200-day moving average, which tends to support a more stable, longer-term trend.

There was a sharp drop in early April, but the stock recovered quickly, bouncing back toward the $30 level. That bounce came with increased volume, which typically confirms interest returning at lower levels. The price is trying to stabilize near the 200-day moving average, which is currently acting as a support zone. If this level holds, it could mark the base of a new leg higher.

Volume Behavior

Volume remained fairly steady for most of the year, but there was a notable spike during the recent pullback and bounce. Higher volume on a move upward after a decline is often seen as a positive, especially when it coincides with support from a long-term moving average. This pattern suggests investors stepped in to buy the dip, reinforcing confidence at these levels.

Relative Strength Index (RSI)

The RSI dipped below 30 during the April decline, indicating the stock was oversold. It has since climbed back above 50, suggesting momentum has shifted slightly back in favor of buyers. There’s no clear overbought signal at the moment, which leaves room for further upside if price strength continues.

EPD appears to be in a healthy consolidation after a strong multi-month rally. While the short-term trend has weakened slightly, the broader setup remains intact. A hold above the 200-day average combined with stabilizing volume and RSI turning upward supports the idea of continued resilience.

Management Team

Enterprise Products Partners is led by a seasoned and deeply aligned management team that operates with a clear long-term vision. At the top are co-CEOs Jim Teague and Randy Fowler, both of whom have been with the company for decades. They bring continuity, deep sector knowledge, and a steady hand to the helm. Their leadership approach emphasizes capital discipline, operational efficiency, and maintaining a strong balance sheet.

What stands out is how closely tied management is to unitholder outcomes. With a sizable portion of the company still held by insiders, including the Duncan family—the founding family of Enterprise—the leadership team is heavily invested in the success of the business. That alignment translates to decision-making that prioritizes sustainable growth and steady income over chasing short-term market trends. They are not just managing for the next quarter—they are thinking years, even decades ahead.

This team has navigated through multiple commodity cycles, recessions, and energy policy shifts. Throughout all of it, they’ve maintained the company’s investment-grade credit rating and kept distributions growing. Their reputation for conservative financial management and transparent communication continues to be a key asset for Enterprise’s long-term stability.

Valuation and Stock Performance

From a valuation standpoint, EPD isn’t expensive relative to its historical norms or to peers in the energy infrastructure space. The forward price-to-earnings ratio is around 10.15, which reflects a reasonable multiple given the company’s stable earnings profile and high dividend yield. With the market still placing a premium on growth, income-producing assets like EPD have tended to trade at lower multiples—but that doesn’t mean they’re undervalued in the context of what they offer.

Looking at the price action, EPD has traded in a relatively tight band over the past year, with a 52-week range between $27.37 and $34.63. The stock is currently trading just under $30, which puts it closer to the lower end of that range. Over the past twelve months, the performance has been modest, up about 6.6 percent, trailing the broader S&P 500. But the real story lies in total return. With a yield above 7 percent, the income component provides a significant portion of investor gains and cushions the impact of market volatility.

Compared to its 50-day and 200-day moving averages, the stock has recently dipped but is showing signs of stabilization. That technical picture fits with a pattern of slow, grinding price moves—typical for a company focused more on delivering cash flow than capturing speculative attention.

From a book value perspective, EPD trades at around 2.25 times book, which again is reasonable considering the hard asset base and earnings consistency. It doesn’t scream cheap, but for investors looking for steady income with manageable risk, it presents a solid value case.

Risks and Considerations

Enterprise Products Partners operates in a sector with inherent risk. While the company generates much of its revenue from fee-based contracts that are insulated from commodity swings, it is still part of the broader energy landscape. Shifts in oil and gas prices, regulatory policy, and energy demand can all influence performance, either directly or through sentiment.

One area to watch is capital spending. The company plans to invest heavily in the coming years—up to 4.5 billion dollars in 2025 alone. While these projects are aimed at long-term growth, they require upfront capital and strong execution. Any delays or cost overruns could affect future returns.

Debt is another consideration. With total debt sitting above 32 billion dollars, the balance sheet is substantial. Enterprise has done a good job managing this leverage, spreading maturities and securing favorable rates. But a prolonged rise in interest rates or tightening credit conditions could change the math. That said, the company continues to maintain investment-grade credit ratings and has a strong track record of refinancing effectively.

Another factor to monitor is regulatory risk. The energy sector, especially anything tied to fossil fuels, is increasingly under scrutiny. Pipeline permitting, environmental compliance, and shifting U.S. energy policy could all have downstream effects on operations and growth. EPD’s management has been proactive in navigating this environment, but it’s a dynamic landscape that requires constant attention.

Finally, MLPs like Enterprise are structured differently from traditional corporations. They issue K-1 forms for tax reporting, which can add complexity for investors. While many income-focused investors are comfortable with that structure, it’s something to be aware of before allocating capital.

Final Thoughts

Enterprise Products Partners offers a unique combination of stability, yield, and long-term potential. It’s a business that’s not trying to dazzle—it’s focused on execution, reliable income, and maintaining a strong financial foundation. The leadership team, with its deep experience and aligned incentives, continues to steer the company with a focus on cash flow and operational resilience.

The valuation remains reasonable, especially when considering the consistent cash distributions and the company’s essential infrastructure footprint. While the stock may not deliver outsized capital gains, its total return profile remains compelling for investors who prioritize income and low volatility.

Of course, no investment is without risk. Energy infrastructure comes with its own set of challenges, from policy shifts to commodity-driven sentiment swings. But Enterprise has weathered many cycles and adapted without compromising its core strategy.

For those seeking a position with durability, consistent cash generation, and a leadership team that plays the long game, EPD continues to stand out. It’s not chasing trends—it’s building value, one quarter at a time.