Key Takeaways

💰 EFSC offers a 2.31% forward dividend yield with a low 21.61% payout ratio and steady 9.1% year-over-year dividend growth, signaling strong potential for continued increases.

💵 Operating and free cash flow remain solid at $247.4 million and $239.9 million respectively, with a stable cash position that supports both dividend payments and growth initiatives.

📊 Analysts maintain a positive outlook with a consensus price target of $67.33, citing strong fundamentals despite recent modest target reductions.

📈 First-quarter earnings came in strong at $1.31 per share, with leadership highlighting growth in net interest income, healthy loan expansion, and optimism around new market entry through branch acquisitions.

Last Update: 5/1/25

Enterprise Financial Services Corp (EFSC) is a regional bank that blends consistent financial performance with a disciplined approach to growth. Headquartered in Missouri, the company operates primarily through Enterprise Bank & Trust, with a strong presence across the Midwest and Southwest. Its focus on commercial clients, conservative underwriting, and steady expansion has allowed it to deliver reliable earnings and a growing dividend over time.

Backed by experienced leadership and a healthy balance sheet, EFSC continues to invest in its footprint while maintaining solid margins and asset quality. With earnings growth, prudent loan management, and shareholder-focused capital deployment, the company stands out for its stability and long-term orientation.

Recent Events

EFSC has been quietly putting up strong numbers. In the most recent quarter that ended March 31, 2025, the company delivered a year-over-year earnings growth of 23.7%. Revenue rose too—up over 8% from the same period a year ago. Those aren’t explosive numbers, but they’re consistent and well-supported by the company’s solid business model.

Margins are another area where EFSC shines. The bank is currently running with a profit margin of 31.46% and an operating margin nearing 39%. That’s healthy, particularly in a sector where compression from interest rate changes and regulatory costs can eat into performance.

On the balance sheet, EFSC is sitting on about $483 million in cash and carrying $617 million in debt. That’s a respectable cushion, giving the company flexibility without looking overleveraged. At a market cap of $1.92 billion, the company is valued at just over 1.07 times book value, which suggests the market isn’t pricing in a lot of excess optimism—always a plus when hunting for value in dividend payers.

From a trading perspective, EFSC’s beta is 0.85, so it tends to move a little less than the broader market. That’s another feather in its cap for income investors who value stability as much as returns.

🧮 Key Dividend Metrics (as of April 30, 2025)

- 💰 Forward Dividend Yield: 2.31%

- 📈 5-Year Average Dividend Yield: 2.00%

- 🔁 Payout Ratio: 21.61%

- 📆 Ex-Dividend Date: June 16, 2025

- 🗓️ Last Dividend Paid: March 31, 2025

- 📊 Dividend Growth (Trailing Year): 9.1%

- 🏦 EPS (TTM): $5.09

Dividend Overview

There’s a quiet confidence to EFSC’s dividend approach. The forward annual dividend stands at $1.20 per share, which gives it a forward yield of 2.31%—a bit higher than its five-year average of 2%. That might not sound flashy, but it’s a steady, consistent return that comes with relatively low payout risk.

The current payout ratio of just 21.61% tells you almost everything you need to know. It means that EFSC is returning a portion of its profits to shareholders, but still keeping the majority to reinvest in the business or shore up its financials. That balance is what long-term investors tend to appreciate: income today without sacrificing growth tomorrow.

The last dividend was paid at the end of March, and with the next ex-dividend date approaching on June 16, the cycle is moving along like clockwork. There’s no sign of interruption or uncertainty—just consistency, which is exactly what many dividend investors are looking for in a regional bank stock.

Dividend Growth and Safety

The growth in EFSC’s dividend might not be headline-grabbing, but it’s quietly impressive. From $1.10 last year to $1.20 today, that’s a solid 9.1% increase. And with earnings climbing and the payout ratio still low, there’s plenty of room for further hikes down the road.

With trailing twelve-month earnings per share sitting at $5.09, the company has more than four times the earnings needed to cover its annual dividend. That coverage ratio is a strong indicator of safety. Even if earnings were to take a temporary dip, there’s a comfortable cushion in place.

Cash on hand is another part of the story. With $483 million in cash, EFSC is in a position to fund operations, support its loan book, and still reward shareholders—all without having to lean heavily on outside financing.

The return on equity is another sign that management knows how to use capital effectively. At 10.82%, EFSC is delivering solid returns, especially considering its conservative dividend stance. Meanwhile, institutional investors own about 81% of the stock, which often correlates with more disciplined corporate behavior and long-term focus.

EFSC’s dividend isn’t just safe—it’s growing steadily and backed by a strong balance sheet and rising earnings. For investors who care more about reliability than excitement, that’s a combination that’s hard to beat.

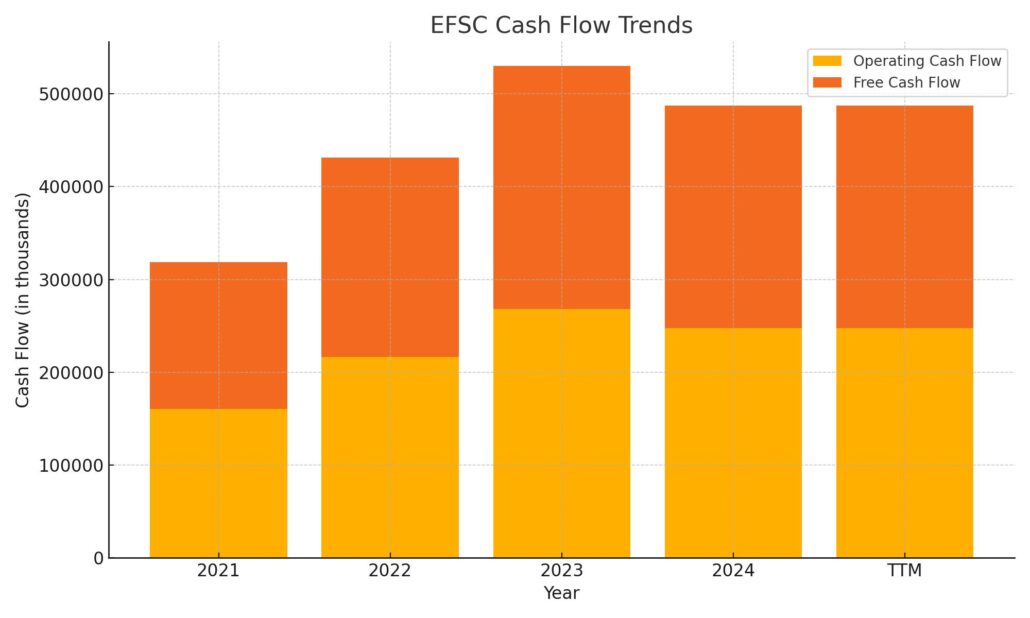

Cash Flow Statement

Enterprise Financial Services Corp has maintained a healthy level of operating cash flow over the trailing twelve months, bringing in $247.4 million. While this represents a slight dip from the previous year’s $268.2 million, it’s still significantly higher than 2021 levels. Free cash flow followed a similar pattern, coming in at $239.9 million—down slightly year-over-year, but well above where it stood three years ago. These figures reflect the bank’s ongoing ability to generate consistent internal cash from core operations, even amid varying market conditions.

On the investing side, the outflows remain substantial at nearly $797 million over the trailing twelve months. That continues a multi-year trend of heavy investment activity, much of it likely tied to securities and loan portfolio changes. Financing cash flow, on the other hand, swung sharply positive again at $880.6 million, rebounding from 2021’s significant outflows. The result is a robust end cash position of $764.2 million, reflecting strong liquidity and management’s ability to balance capital uses while still growing available cash.

Analyst Ratings

Enterprise Financial Services Corp (EFSC) has recently seen a wave of updated analyst coverage, reflecting a balance of enthusiasm for its performance and a touch of caution driven by the broader financial environment. 🧠 DA Davidson revised their price target slightly downward from $70 to $65 but kept their rating at “buy”—a signal that they still see meaningful upside despite short-term sector pressures. 🟢 Keefe, Bruyette & Woods followed a similar path, lowering their target from $69 to $66 while maintaining their “outperform” stance. 🟢 The moves suggest that while expectations have been tempered slightly, confidence in EFSC’s long-term fundamentals remains intact.

Across the board, the consensus 12-month price target for EFSC now sits around $67.33, with projections clustering between $62 and $70. 📊 That points to a potential upside of about 31% from current levels, reflecting strong institutional belief in the company’s growth trajectory. These adjustments are largely grounded in EFSC’s recent earnings beat, expanding margins, and consistent dividend growth. 📈 Analysts are also weighing macroeconomic headwinds such as rate volatility and regional credit tightening, both of which could play a role in moderating short-term expectations without shaking the underlying bullish sentiment.

Earning Report Summary

Enterprise Financial Services Corp started 2025 on a strong note, posting a solid first-quarter earnings report that shows they’re keeping their momentum steady. Net income came in at $50 million, translating to $1.31 per diluted share. That’s a slight bump from last quarter’s $1.28 and comfortably ahead of the $1.05 they posted this time last year. The numbers reflect a company that’s benefiting from its focused approach on lending, managing interest costs, and staying disciplined in a tough market.

Loan and Deposit Activity

The bank’s loan book saw healthy growth this quarter, rising to $11.3 billion. That’s about $78 million higher than the prior quarter. On the deposit side, there was a slight dip to $13 billion, but management didn’t seem too concerned about it. Their strategy remains focused on attracting and retaining cost-effective deposits, even in a competitive rate environment. Net interest income hit $147.5 million, with a net interest margin of 4.15%, showing that they’re getting efficient returns on their interest-earning assets.

Asset Quality and Expansion Plans

EFSC is keeping things tight on the asset quality front. Nonperforming assets made up just 0.72% of total assets, and the allowance for credit losses stayed steady at 1.27% of total loans. That suggests a cautious but confident credit stance—no signs of stress showing up yet. The company also made headlines with its planned acquisition of 12 branches from First Interstate Bank. That deal is set to bring in about $740 million in deposits and nearly $200 million in loans, helping EFSC expand its footprint in Arizona and Kansas.

Leadership’s Outlook

Management sounded upbeat during the earnings call, pointing to the strong start to the year and the strategic branch deal as key wins. They emphasized their continued focus on balance sheet strength, capital discipline, and long-term growth. The tone was confident without being over the top. They’re not chasing short-term wins—they’re thinking about the bigger picture, especially with interest rates still in flux. It’s a steady-hand approach, and that mindset continues to show up in their numbers.

Chart Analysis

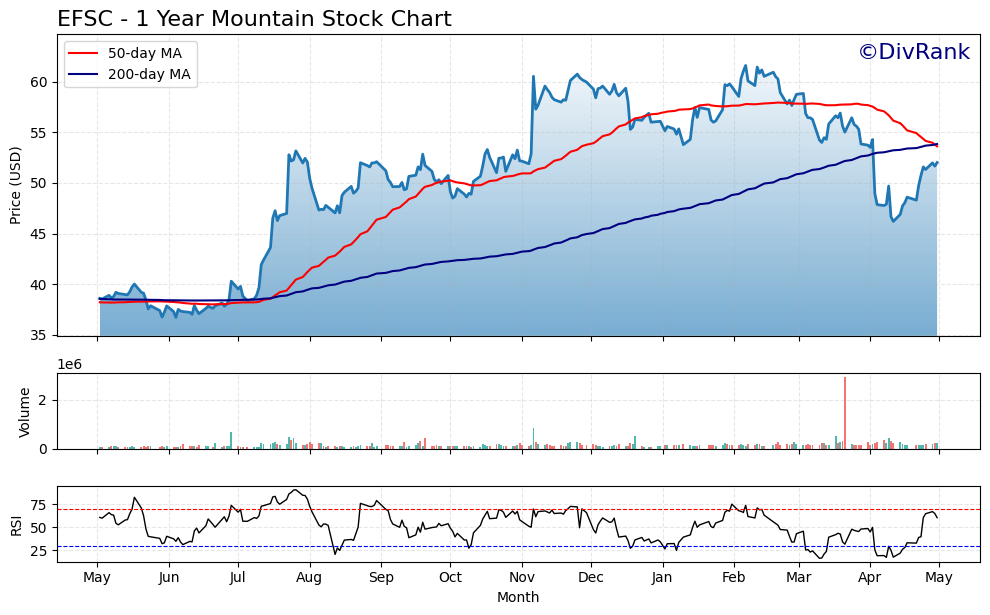

Price Movement and Trends

EFSC has experienced a full market cycle over the past year. The stock began with a modest base around the $38 range last spring, consolidating sideways before launching into a steady climb through the summer months. The uptrend strengthened into the fall, with the price breaking above $50 by August. Momentum continued through to late Q4, topping out just above $60 in early January.

From there, the stock saw a rounding top pattern and started to drift lower, pulling back gradually with a few sharp dips along the way. That decline intensified in early April, bottoming near $46 before showing a notable bounce into the start of May. The price is now recovering but still sits below its 50-day moving average, which is trending downward and currently above the price—a sign that short-term sentiment hasn’t fully reversed.

The 200-day moving average, however, is still climbing. That longer-term trendline is now acting as potential support, and the price is approaching it from below. This kind of setup often leads to a decision point where either a deeper correction resumes or a longer recovery builds strength.

Volume Behavior

Volume has mostly remained steady, with one significant spike in early April during the sharpest part of the drawdown. That high-volume flush might have marked a short-term capitulation event, clearing out weak holders. Since then, volume has normalized while the price began to recover—an encouraging sign that panic selling has likely cooled off.

There hasn’t been a heavy pickup in accumulation volume just yet, so any upward price movement may remain tentative until buyers step in more broadly. Still, the recent calm after the spike suggests the selling pressure has at least paused.

RSI and Momentum

The RSI tells its own interesting story. The index spent much of last summer and fall in the higher end of the range, reflecting strength during the rally. That shifted dramatically in March and early April, when RSI dipped toward oversold territory.

Most recently, RSI has recovered back above 50, indicating momentum is trying to turn back in the stock’s favor. While not yet signaling overbought conditions, it’s climbed enough to suggest the bounce is more than a dead-cat move. If it can stay elevated, especially if price climbs back over the 50-day moving average, that would strengthen the argument for a more sustainable recovery.

Overall, EFSC appears to be coming out of a correction phase and possibly entering the early stages of a reaccumulation. The coming weeks will be important to watch for follow-through above key averages and signs of renewed buying strength.

Management Team

Enterprise Financial Services Corp is led by a management team with deep roots in regional banking and a reputation for steady, measured execution. At the top is Jim Lally, who serves as President and CEO. His leadership has been consistent and deliberate, steering the company through both expansion and turbulence in the financial sector without veering into risky territory. Lally has spent most of his professional life in banking, and that institutional knowledge is evident in the way EFSC has navigated everything from low-rate environments to recent credit tightening.

What stands out about this team is their focus on regional banking fundamentals. They’ve built out EFSC’s footprint gradually, through both organic growth and select acquisitions, while keeping a close eye on credit quality and operational efficiency. The recent move to acquire branches from First Interstate Bank is a good example—they’re not chasing headlines but identifying regions where their model can work and expanding with purpose.

Leadership also appears highly attuned to shareholder interests. With a relatively low payout ratio, rising dividends, and a disciplined approach to capital deployment, the team is striking a balance between rewarding investors and maintaining a conservative financial position. This isn’t a management group chasing quarterly wins. Instead, they’re clearly focused on long-term stability and sustainable growth.

Valuation and Stock Performance

EFSC’s valuation sits in a space that can be attractive for investors who understand the rhythm of regional banks. The price-to-earnings ratio is currently around 10.2 on a trailing basis, and about 12.1 on a forward basis—suggesting that the market expects continued, though modest, growth ahead. These are well below the broader market average, which gives EFSC some appeal for those looking for earnings at a reasonable price.

Price-to-book sits close to 1.07, another sign that the stock isn’t trading at an excessive premium. That valuation metric is especially important in the banking sector, where tangible assets and loan books play a central role. At just slightly above book, investors are essentially paying for the bank’s assets at fair value, with growth and profitability layered on top.

Over the past 12 months, the stock has had its share of ups and downs. It climbed steadily through mid and late 2023, hitting highs above $60 by the start of 2024. Since then, it has pulled back, bottoming near $46 in April before recovering to the low $50s. This kind of movement is fairly typical in the banking sector, where interest rate expectations and credit concerns can create short-term volatility even when underlying fundamentals remain solid.

The recovery off April lows suggests that investors see value at these levels. And with earnings growth, a rising dividend, and a leadership team that continues to execute on strategic expansion, the long-term picture still looks constructive—even if near-term price action remains a bit choppy.

Risks and Considerations

While EFSC has many strengths, no investment is without risks. One of the primary considerations here is interest rate sensitivity. Like many banks, EFSC’s profitability is tied closely to net interest margin, which is influenced by the spread between what they pay on deposits and what they earn on loans. If the Federal Reserve pivots sharply or the yield curve remains inverted, it could squeeze margins and impact earnings.

There’s also exposure to credit risk. Although the company has done a good job managing its loan portfolio, the banking sector as a whole is facing potential pressure from commercial real estate, particularly office properties in certain urban markets. EFSC’s regional focus has somewhat insulated it from the worst of that, but no loan book is immune from macroeconomic cycles.

Liquidity is another point to watch. While the bank has a healthy cash position and strong capital ratios, sudden market dislocations or changes in depositor behavior—especially in today’s digital banking environment—could create short-term challenges. EFSC appears better positioned than most to handle such stress, but it’s still a sector-wide concern.

On the valuation side, the relatively low multiples can be a double-edged sword. While they suggest value, they may also reflect broader market caution about regional banks. Investors should understand that re-rating potential could be limited unless there is a broader sector recovery or significant upside surprise in earnings.

Finally, though the bank is expanding through acquisitions, integration risk is always part of the equation. The recently announced branch acquisition is modest in scale, but execution will be important. Successfully onboarding new customers, staff, and systems without disrupting service will be key to unlocking the strategic value of the deal.

Final Thoughts

Enterprise Financial Services Corp may not draw the spotlight, but it continues to build a story that’s compelling in its consistency. This is a bank that knows what it is—and more importantly, what it’s not. It’s not chasing rapid national expansion, it’s not leaning into risky asset classes, and it’s not sacrificing long-term health for short-term earnings.

Instead, EFSC is sticking to its lane: high-quality regional banking with a commercial focus, strong underwriting, and a commitment to shareholder returns. The dividend continues to grow, supported by healthy earnings and a conservative payout ratio. The balance sheet is solid, the leadership team is experienced and deliberate, and the company continues to find smart ways to grow without overreaching.

While there are macro risks—particularly from interest rate shifts and broader credit concerns—the bank has shown it can manage through different environments without losing its footing. The market may not fully reward that kind of discipline right away, but for those who value durability and income, EFSC stands as a steady hand in a sector often marked by noise and volatility.

It’s the kind of company that doesn’t need to be loud to be effective. The fundamentals speak clearly enough.