Key Takeaways

📈 Emerson offers a forward dividend yield of 2.01% with a 67-year streak of annual dividend increases, supported by a conservative payout ratio and consistent growth.

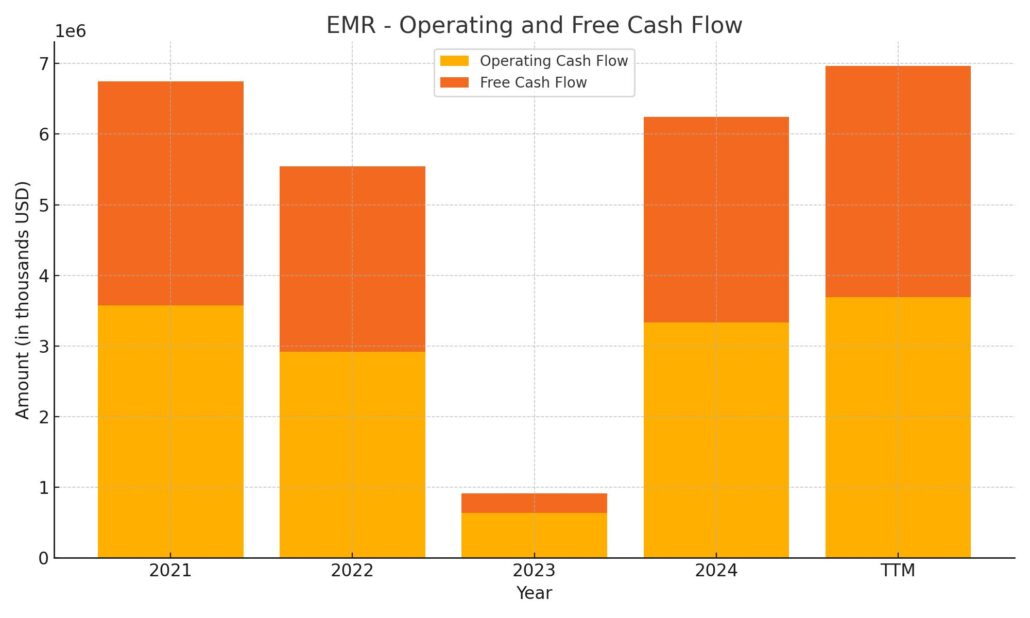

💰 Strong free cash flow of $3.27 billion in the trailing 12 months comfortably covers dividend payments and supports future capital returns.

🧭 Analysts maintain a mixed outlook with a consensus price target of $131.32, reflecting long-term confidence despite recent target reductions.

📊 First-quarter earnings showed solid profitability with EPS up 13% year-over-year and operating cash flow up 75%, pointing to improved efficiency and execution.

Last Update: 5/1/25

Emerson Electric has been a consistent performer in the industrial sector for over a century, with a renewed focus on automation, software, and high-margin technologies. Following a series of strategic moves, including the acquisition of National Instruments and the divestiture of non-core assets, the company has positioned itself to thrive in the evolving landscape of digital infrastructure and industrial efficiency.

Backed by a management team with deep operational experience and a long-standing commitment to shareholder returns, Emerson continues to generate strong free cash flow and deliver steady dividend growth. With a solid balance sheet, disciplined capital strategy, and clear long-term direction, the company remains a compelling option for income-focused investors.

Recent Events

Lately, Emerson has been busy reshaping itself. It’s sold off several legacy parts of the business—most notably its Climate Technologies division, which went to Blackstone for $8.2 billion. That wasn’t just a way to raise cash. It marked a bigger strategic pivot toward higher-growth areas, especially automation and industrial software.

At the same time, Emerson was also on the offensive. It used part of that capital to acquire National Instruments, another $8.2 billion deal. That move pulls Emerson deeper into high-tech testing and data acquisition, and opens up opportunities in industries like semiconductors, aerospace, and automotive—all of which are becoming more digital.

You wouldn’t know all of that change was happening just by looking at revenue, which only grew 1.4% year-over-year in the most recent quarter. But the bottom line tells a different story: earnings jumped over 300% in that same period. That kind of margin improvement is the quiet engine behind future dividend strength.

Key Dividend Metrics

📈 Forward Yield: 2.01%

💸 Annual Payout: $2.11 per share

🔁 5-Year Average Yield: 2.26%

📊 Payout Ratio: 59.2%

🔒 Free Cash Flow Coverage: Strong — $3.88B FCF vs. ~$1.18B in dividend payments

🔋 Dividend Growth Streak: 67 years and counting

📆 Next Dividend Date: March 10, 2025

✂️ Last Stock Split: 2-for-1 in 2006

Emerson’s dividend may not jump off the page with a sky-high yield, but it’s built on rock-solid foundations and a track record few can match.

Dividend Overview

At today’s prices, Emerson offers a forward dividend yield of just over 2%. That’s slightly under its five-year average, which might hint at a market that’s pricing in confidence about its recent business evolution.

What stands out more than the yield itself is the consistency. Emerson has raised its dividend every year for the past 67 years. That’s not just impressive—it’s rare. Very few companies have managed to increase their dividend for that long without a single interruption.

And this isn’t a case of a company overextending to maintain a streak. The payout ratio is just under 60%, right in the sweet spot. Not too high to be at risk, and not so low that it suggests management is hoarding cash at the expense of shareholders.

There’s also the cash flow to consider. Emerson pulled in nearly $3.9 billion in free cash flow over the past year, while paying out around $1.18 billion in dividends. That kind of buffer gives the company breathing room even if business slows or markets get choppy.

Dividend Growth and Safety

If you’re looking for explosive dividend growth, Emerson probably won’t be your top pick. The increases tend to be modest—low single digits most years. But there’s a reason for that. Management is conservative, not flashy. They focus on long-term sustainability rather than chasing short-term yield spikes to impress investors.

What’s encouraging is the direction the business is heading. With higher-margin operations taking a bigger role and legacy divisions fading into the rearview mirror, Emerson is positioned to improve both earnings and cash flow over the coming years. That could open the door for slightly more generous dividend hikes down the line.

The balance sheet supports that view. Debt is manageable, at just over $8.2 billion, and cash on hand sits at a healthy $2.8 billion. The debt-to-equity ratio is comfortably under control at 31.3%. The company also maintains a current ratio of 1.54, suggesting it has the liquidity to handle near-term obligations without sweating it.

Most importantly, the dividend is safe. It’s well covered by earnings and even more so by cash flow. That’s the kind of thing that lets you sleep at night if you’re depending on your portfolio for steady income.

Emerson may not be a thrill ride, but it’s the kind of steady, cash-generating business that dividend investors tend to stick with for a reason.

Cash Flow Statement

Emerson Electric’s cash flow profile over the trailing twelve months reflects a company operating with disciplined financial control and a solid base of recurring cash. Operating cash flow came in at $3.69 billion, a healthy improvement from the prior year and a return to pre-2022 levels. With capital expenditures remaining modest at $425 million, Emerson generated $3.27 billion in free cash flow—strong coverage for its dividend and enough flexibility for strategic investments or debt reduction.

On the investing side, the company reported $2.95 billion in net inflows, a stark reversal from significant outflows in the two previous years. This swing is largely the result of business divestitures and proceeds from asset sales. Financing cash flow, however, showed a substantial outflow of $5.8 billion, driven by share repurchases and debt repayments—signaling a shareholder-friendly capital return strategy alongside a tightening of the balance sheet. The ending cash balance of $2.92 billion is down slightly from a year ago, but still reflects comfortable liquidity in light of its consistent free cash flow generation.

Analyst Ratings

Emerson Electric has been the subject of mixed analyst sentiment recently, reflecting both cautious optimism and some concern about short-term execution. 🎯 The average 12-month price target now sits around $131.32, suggesting analysts see meaningful upside from the current share price.

🏦 Citigroup recently adjusted its price target for EMR from $132 down to $119 while maintaining a buy rating. The revision had less to do with confidence in the business and more with near-term pressure on guidance, particularly related to softness in its Discrete Automation segment. ⚙️ Barclays also made a downward revision, moving its target from $105 to $99 and sticking with an underweight rating. Their stance pointed to sector-level headwinds and potential margin compression as reasons to stay cautious.

📉 JPMorgan followed suit by lowering its price target from $135 to $110 while keeping a neutral rating. Their concern focused on broader industrial slowdowns that could weigh on Emerson’s more cyclical business lines. Despite these downward adjustments, not all sentiment is bearish. 🌟 KeyBanc trimmed its price target from $158 to $125 but reiterated an overweight rating. Their view hinges on long-term strategic shifts that should position the company well in automation and digital solutions.

Right now, analyst targets range from a low of $99 to a high of $168, which captures the spread of opinion in the market. While short-term caution is evident, there’s still underlying belief in Emerson’s ability to execute its transformation and deliver value over time.

Earnings Report Summary

Solid Start to the Year

Emerson Electric opened fiscal 2025 on steady footing, showing strength across its core businesses. For the quarter ending December 31, 2024, the company posted $4.18 billion in net sales, a modest year-over-year increase of 1%. It wasn’t a blockbuster top-line quarter, but the story underneath the surface was a lot more compelling.

Profitability saw a major jump. Pretax earnings came in at $775 million, a big leap from $175 million in the same quarter last year. That kind of swing pushed their pretax margin up to 18.6%, compared to just 4.2% previously. The efficiency was even more obvious when looking at the adjusted EBITA, which reached $1.17 billion with a margin of 28%—a nice improvement of 340 basis points.

Earnings per share followed suit, with GAAP EPS rising to $1.02 and adjusted EPS landing at $1.38, up 13% from the prior year. On the cash side, Emerson had a particularly strong quarter. Operating cash flow was up 75% to $777 million, while free cash flow jumped nearly 90% to $694 million. That kind of cash generation gives the company room to maneuver and reinvest where needed.

Leadership’s Take

CEO Lal Karsanbhai didn’t hold back his optimism. He pointed to the strength of Emerson’s portfolio and the execution by the company’s team. He also reinforced their confidence in meeting full-year guidance, noting steady demand in process and hybrid markets. There’s a sense that while the macro environment remains a bit cloudy, Emerson is positioned well to navigate it.

Management expects a pickup in discrete markets in the second half of the year, which could add another layer of momentum to the business. There’s also a continued focus on operational discipline, with an eye toward margin expansion and innovation in automation and industrial software.

Emerson is sticking to its capital return game plan. The company plans to return about $3.2 billion to shareholders this fiscal year. That breaks down to roughly $2 billion in share repurchases and another $1.2 billion in dividends.

The most recent dividend declaration came in at $0.5275 per share, set to be paid out in March 2025. With strong free cash flow backing these returns, Emerson isn’t just paying dividends to maintain a streak—it’s doing so from a position of strength. Investors focused on income and long-term value have reason to feel good about where things are heading.

Earnings Report Summary

Solid Start to the Year

Emerson Electric opened fiscal 2025 on steady footing, showing strength across its core businesses. For the quarter ending December 31, 2024, the company posted $4.18 billion in net sales, a modest year-over-year increase of 1%. It wasn’t a blockbuster top-line quarter, but the story underneath the surface was a lot more compelling.

Profitability saw a major jump. Pretax earnings came in at $775 million, a big leap from $175 million in the same quarter last year. That kind of swing pushed their pretax margin up to 18.6%, compared to just 4.2% previously. The efficiency was even more obvious when looking at the adjusted EBITA, which reached $1.17 billion with a margin of 28%—a nice improvement of 340 basis points.

Earnings per share followed suit, with GAAP EPS rising to $1.02 and adjusted EPS landing at $1.38, up 13% from the prior year. On the cash side, Emerson had a particularly strong quarter. Operating cash flow was up 75% to $777 million, while free cash flow jumped nearly 90% to $694 million. That kind of cash generation gives the company room to maneuver and reinvest where needed.

Leadership’s Take

CEO Lal Karsanbhai didn’t hold back his optimism. He pointed to the strength of Emerson’s portfolio and the execution by the company’s team. He also reinforced their confidence in meeting full-year guidance, noting steady demand in process and hybrid markets. There’s a sense that while the macro environment remains a bit cloudy, Emerson is positioned well to navigate it.

Management expects a pickup in discrete markets in the second half of the year, which could add another layer of momentum to the business. There’s also a continued focus on operational discipline, with an eye toward margin expansion and innovation in automation and industrial software.

Emerson is sticking to its capital return game plan. The company plans to return about $3.2 billion to shareholders this fiscal year. That breaks down to roughly $2 billion in share repurchases and another $1.2 billion in dividends.

The most recent dividend declaration came in at $0.5275 per share, set to be paid out in March 2025. With strong free cash flow backing these returns, Emerson isn’t just paying dividends to maintain a streak—it’s doing so from a position of strength. Investors focused on income and long-term value have reason to feel good about where things are heading.

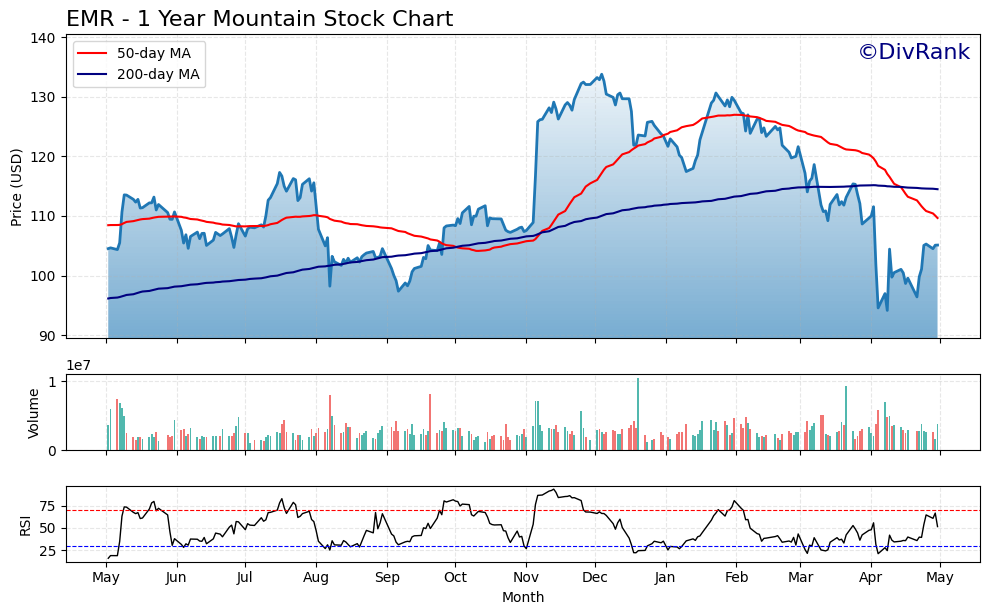

Chart Analysis

Price Trend and Moving Averages

Looking at the chart for EMR over the past year, the price movement shows a well-defined cycle. From early May through late October, the stock moved in a relatively tight range, finding support near $100 and topping out just above $110. Then came a strong run-up through November and December, with the price climbing above $130 and forming a clear peak around the turn of the year.

The red 50-day moving average tracked this surge closely, staying above the blue 200-day moving average from late November into April. That bullish crossover, which occurred around October, signaled positive momentum at the time. But now the story is shifting. The 50-day has crossed back below the 200-day—a bearish signal—just as the stock experienced a sharp pullback to near $95 in mid-April. While the stock has bounced off those lows, the slope of both moving averages is now flat to declining, which suggests that the upward momentum has cooled.

Volume and Participation

Volume remained relatively steady throughout most of the year, but spikes can be seen during the big moves—particularly during the November rally and the April drop. That kind of volume activity often reflects institutional interest, either entering or exiting positions. The recent volume on the rebound from the lows appears more measured, indicating less aggressive buying for now.

Relative Strength Index (RSI)

The RSI at the bottom of the chart offers additional perspective. For much of the past year, EMR’s RSI moved in a healthy range, briefly entering overbought territory above 70 in December, and more recently dipping toward oversold levels below 30 in April. The bounce from those oversold conditions aligns with the price recovery from the recent lows. Currently, the RSI is climbing again, suggesting improving momentum, but it’s not yet near overbought territory, which means there could still be room to move higher.

Interpretation of the Recent Candles

The last five candles on the chart show a notable shift. After a clear drop in early April, the price formed a base and has now pushed higher, showing stronger closes relative to the opens and longer lower wicks—signs that buyers are stepping back in after the selloff. The shorter upper wicks indicate less selling pressure as the price rises, which is an encouraging short-term signal. Still, until the price can reclaim and hold above the 50-day average, the trend remains in recovery mode rather than full reversal.

Overall, the chart shows a stock that’s come through a correction and is now stabilizing. While near-term trends look cautious, the longer-term structure suggests a market still interested in this name, especially around historically supportive levels.

Management Team

Emerson Electric’s leadership team brings together experience, stability, and a clear sense of direction. Leading the charge is CEO and President Lal Karsanbhai, a company veteran who began his career at Emerson in 1995. His deep roots within the organization and familiarity with its global operations give him a steady hand as the company continues its transformation toward a more streamlined and technology-driven enterprise.

Supporting Karsanbhai is a strong bench of executives, including Ram Krishnan as Chief Operating Officer and Mike Baughman as Chief Financial Officer. Together, this team has emphasized operational efficiency, disciplined capital allocation, and long-term growth. Their strategy hinges on increasing Emerson’s exposure to automation, software, and digital industrial infrastructure, while phasing out slower-growing legacy businesses. The result has been a leaner company with better margins and clearer direction.

Valuation and Stock Performance

Over the past 12 months, Emerson’s stock has seen its share of ups and downs. The stock reached a high of around $134.85 in late 2024, before pulling back to the $105 range in April 2025. That decline reflects both broader market volatility and some investor uncertainty around macroeconomic conditions and the pace of recovery in discrete end markets.

Despite that, valuation remains attractive for long-term investors. Emerson is currently trading at a forward price-to-earnings ratio of about 17.4, a level that offers a balance between value and growth potential in the industrial sector. The average analyst price target sits at roughly $132.85, which suggests room for appreciation. The company’s financial performance—driven by rising margins, improved free cash flow, and a focused business mix—backs up the belief that this isn’t just a cyclical bounce, but something more durable.

Emerson also continues to reward shareholders with dividends and buybacks. With a current yield of just over 2% and a long track record of annual increases, the stock remains attractive to income-focused investors. When you add in the company’s strong cash flow and commitment to returning capital, the total return picture becomes even more appealing.

Risks and Considerations

As with any industrial company, Emerson carries a few key risks that investors should keep in mind. One of the most immediate is the execution risk tied to its recent acquisitions. Integrating National Instruments into the broader Emerson organization is no small task, and any hiccups could create short-term friction or distract leadership from core operations.

There’s also exposure to cyclical industries to consider. Emerson sells heavily into sectors like oil and gas, manufacturing, and construction—markets that can be sensitive to economic slowdowns. A softening in industrial activity or a delay in expected rebounds within discrete automation could weigh on earnings growth.

Global supply chain pressures and inflation, though easing in many parts of the economy, remain potential headwinds. Emerson must continue navigating these challenges to protect margins. And with the shift toward software and digital offerings, the company also faces increased competition from both traditional players and new entrants aiming to disrupt the space.

Final Thoughts

Emerson Electric is no longer just an old-school industrial firm. It’s becoming a more focused, tech-enabled powerhouse with exposure to some of the most important trends in the global economy. That transformation hasn’t been without its costs or growing pains, but the core of the business remains strong—and the leadership team is aligned with a clear strategy.

Investors looking for a combination of stable income and steady growth may find Emerson a worthy addition to a long-term portfolio. The company’s consistent dividend, strategic realignment, and strong cash generation form a solid foundation. While the road ahead may include occasional bumps, the overall direction Emerson is heading in appears deliberate, disciplined, and shareholder-focused.