Key Takeaways

📈 Elevance offers a forward dividend yield of 2.04% with consistent annual growth, supported by a conservative 27.13% payout ratio.

💵 Free cash flow stands at $3.40 billion over the trailing twelve months, comfortably covering dividends and share repurchases.

📊 Analyst sentiment remains constructive, with a consensus buy rating across 20 analysts and a mean price target of $387.85.

🧾 The stock has retreated sharply from its 52-week high of $458.75 and now trades at $327.14, creating a more attractive entry point for income-focused investors.

Updated 2/25/26

Elevance Health, formerly Anthem, stands as one of the leading U.S. health insurers with a growing presence across Medicare, Medicaid, and commercial markets. With over 45 million medical members and nearly $199 billion in trailing revenue, the company continues expanding its footprint through Carelon’s healthcare services and digital care investments. The leadership team, led by CEO Gail Boudreaux, remains focused on streamlining care, enhancing patient outcomes, and balancing innovation with operational discipline.

Recent Events

Elevance Health has navigated a turbulent stretch heading into early 2026, with the stock sliding considerably from its 52-week high of $458.75 to its current price near $327. The managed care sector broadly has faced persistent pressure from elevated medical cost trends, particularly in Medicare Advantage, where utilization rates have come in above expectations across the industry. Elevance has not been immune to these forces, and investor concern about margin compression has weighed on the share price throughout the back half of 2025 and into the new year.

On the operational front, Carelon continues to represent one of the more compelling growth stories within the Elevance portfolio. The healthcare services segment has been scaling its care coordination and pharmacy benefit capabilities, and management has emphasized that investment in digital infrastructure remains a priority. These efforts are aimed at improving per-member profitability over time, even as near-term cost headwinds absorb some of the benefit.

The regulatory environment remains a critical watch item. Medicaid redeterminations have reshaped membership dynamics across the industry, and Elevance has had to manage the transition carefully given its significant government-sponsored membership base. At the same time, the company has maintained its commitment to returning capital to shareholders, paying a quarterly dividend of $1.71 per share through the end of 2025, a rate established when the dividend was raised earlier that year from $1.63.

Key Dividend Metrics

📈 Forward Dividend Yield: 2.04%

💵 Annual Dividend Rate: $6.88 per share

📆 Last Dividend Payment: $1.71 per share

📊 Payout Ratio: 27.13%

📉 5-Year Average Yield: ~1.18%

🔁 Dividend Growth Streak: 13 years (unofficial)

🛡 Dividend Safety Score (Implied): Strong — ample free cash flow coverage

🚀 EPS Support: $25.22 trailing EPS provides substantial dividend headroom

Dividend Overview

Elevance doesn’t compete on yield alone, but the income story has quietly improved as the stock has pulled back from its highs. At 2.04%, the current yield is meaningfully above the company’s five-year average, which has historically hovered closer to 1.18%. For dividend growth investors who have been waiting for a more compelling entry point, the combination of a higher yield and a still-conservative payout ratio makes the current setup worth attention.

The annual dividend now stands at $6.88 per share, reflecting the most recent increase from $6.52 to $6.84 and the subsequent step up to the current rate. The quarterly payment of $1.71 per share has been consistent throughout 2025, and the payout ratio of 27.13% against trailing EPS of $25.22 leaves substantial room for continued increases without placing any strain on the balance sheet.

One of the more reassuring aspects of Elevance’s dividend profile is that it is funded by genuine earnings and cash flow rather than financial engineering. The company is not relying on elevated leverage or aggressive share count reduction to sustain the dividend. Free cash flow of $3.40 billion over the trailing twelve months covers the total annual dividend obligation with significant room to spare, making this one of the better-protected payouts in the managed care sector.

The share count remains well-managed, and there is no meaningful dilution working against income investors. Elevance has historically balanced buybacks with dividend growth, and while buyback activity may moderate in a more cautious operating environment, the dividend itself is not under any visible threat.

Dividend Growth and Safety

For long-term dividend investors, the two questions that matter most are how safe the dividend is and how likely it is to keep growing. On both counts, Elevance continues to hold up well despite the broader challenges facing the managed care sector.

The safety picture is straightforward. Trailing EPS of $25.22 against an annual dividend of $6.88 produces a payout ratio of just over 27%, which is one of the lower readings among large-cap healthcare insurers. Operating cash flow of $4.29 billion over the trailing twelve months and free cash flow of $3.40 billion both dwarf the dividend obligation, meaning that even a meaningful deterioration in earnings would not put the payout at risk in the near term.

The dividend history tells a consistent story. The quarterly payment moved from $1.48 per share through all of 2023 to $1.63 in 2024 and then to $1.71 in 2025, representing a compounding pattern of annual increases. The most recent step up from $1.63 to $1.71 represents a roughly 4.9% increase, which is a healthy rate of growth for a payout already well above where it was just two years ago. Management has not broken that annual cadence, and with the current balance sheet in solid shape, there is no structural reason to expect a departure from that pattern.

Looking further out, the growth case for Elevance’s dividend rests on the same drivers as the business itself. Healthcare demand in government-sponsored programs is structurally durable, and Carelon’s expanding services platform has the potential to improve margins and diversify revenue over time. If the company can navigate the current medical cost environment and return to stronger earnings growth, the runway for dividend increases over the next several years remains credible.

Compared to peers in the managed care space, Elevance’s dividend combines a yield that is now at the higher end of its historical range with a payout ratio that leaves meaningful growth capacity intact. That combination is relatively rare and represents a genuine point of differentiation for income-focused investors willing to hold through a period of sector-wide uncertainty.

Chart Analysis

Elevance Health has had a difficult twelve months from a price action standpoint, with shares falling roughly 27% from their 52-week high of $445.96 to the current level of $327.14. The stock did find a floor near $271.77, and the subsequent bounce of more than 20% from that low suggests buyers have returned at deeply discounted valuations. Even so, the broader trend over the past year remains clearly downward, and the recovery off the lows has not yet been strong enough to shift the intermediate picture in a more constructive direction.

The moving average picture confirms that caution is still warranted. ELV is currently trading below both its 50-day moving average of $351.77 and its 200-day moving average of $338.30, which means the stock is sitting under two layers of potential overhead resistance. The one modestly encouraging signal is that the 50-day average remains above the 200-day average, a configuration technically described as a golden cross. That relationship reflects the stronger price action from earlier in the 12-month window and does not yet capture the more recent deterioration, so dividend investors should treat it as a lagging data point rather than a forward-looking green light.

Momentum, as measured by the 14-day Relative Strength Index, sits at 42.62. That reading places ELV in oversold-adjacent territory without technically triggering the sub-30 threshold that would signal extreme selling exhaustion. In practical terms, the RSI level indicates that sellers have maintained control but that the pace of the decline has slowed. A sustained move back above 50 on the RSI would be a useful early confirmation that buying pressure is beginning to reassert itself, and income investors watching for a re-entry opportunity should keep that signal on their checklist.

For dividend growth investors, the chart presents a classic tension between valuation opportunity and technical deterioration. The pullback from peak levels has brought ELV into a range that historically attracts long-term capital, and the yield has expanded meaningfully as a result of the price decline. At the same time, the stock needs to reclaim its 200-day moving average near $338 and then push through the 50-day near $352 before the technical backdrop can be described as broadly supportive. Investors building or adding to a position here should be comfortable with the possibility of continued near-term volatility while the fundamental and technical pictures work toward realignment.

Cash Flow Statement

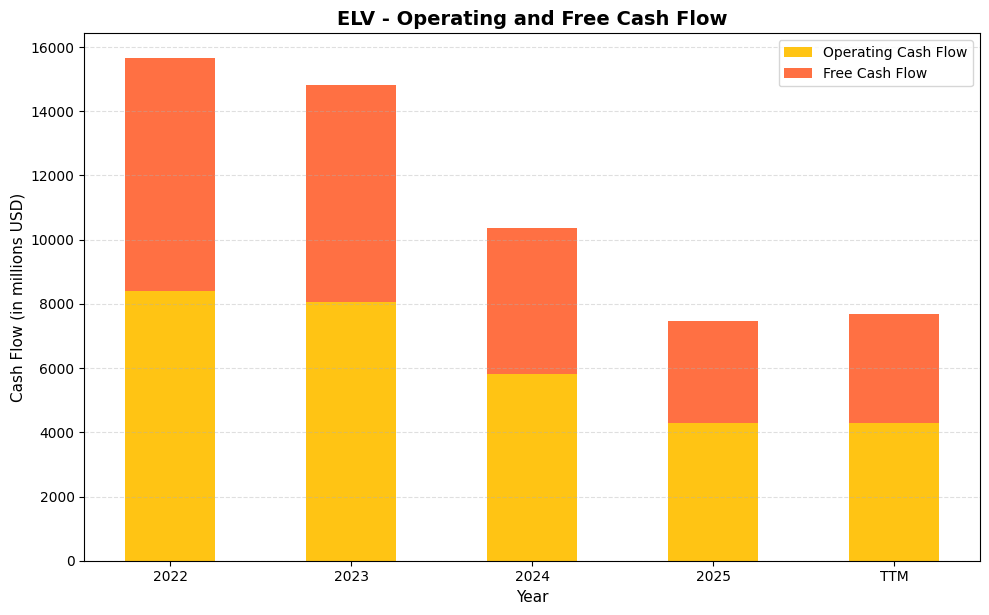

Elevance Health’s cash flow profile has deteriorated meaningfully over the trailing two-year period, and that trend demands attention from any income investor evaluating dividend sustainability. Operating cash flow peaked at $8,399.0 million in 2022 and held relatively firm at $8,061.0 million in 2023, but fell sharply to $5,808.0 million in 2024 and has continued sliding to $4,290.0 million on a TTM basis. Free cash flow tells the same story, dropping from a high of $7,247.0 million in 2022 to $3,399.7 million TTM. Against ELV’s current annual dividend obligation of roughly $1.6 billion, free cash flow coverage remains above 2x at current levels, which keeps the dividend technically sustainable for now, but the shrinking cushion is a genuine concern rather than a trivial footnote.

The broader trajectory here reflects the severe margin compression Elevance has experienced in its government-sponsored business segments, particularly Medicaid, where higher-than-anticipated medical cost ratios have eaten directly into operating earnings and cash generation. Capital expenditures have remained relatively stable in the $1.1 billion to $1.2 billion annual range, meaning the free cash flow compression is almost entirely a function of operating deterioration rather than elevated investment spending. That is a nuanced but important distinction: ELV is not sacrificing cash flow to fund growth, it is simply generating less of it from its core operations. For dividend growth investors, the practical implication is that dividend growth is likely to remain modest or pause until management demonstrates a credible path back toward the $7 billion or higher free cash flow levels that defined 2022 and 2023. The company’s ability to re-rate on that front will depend heavily on Medicaid rate rebalancing with state partners and a stabilization of its medical loss ratios over the next several reporting periods.

Analyst Ratings

The analyst community remains broadly constructive on Elevance Health, with a consensus buy rating across 20 covering analysts as of late February 2026. The mean price target sits at $387.85, which represents meaningful upside from the current price of $327.14. The range of targets runs from a low of $332.00 to a high of $474.00, reflecting a fairly wide dispersion that captures both the near-term uncertainty around medical cost trends and the longer-term confidence in Elevance’s positioning as an integrated healthcare platform.

The low end of the target range at $332.00 is only modestly above the current trading price, suggesting that the more cautious analysts see limited near-term upside while the sector works through elevated utilization pressures. The high end at $474.00 implies a recovery scenario in which margins normalize and earnings growth re-accelerates, bringing the stock back toward levels it occupied earlier in its 52-week range. The mean target of $387.85 implies roughly 18.6% upside from current levels, which is a reasonable expectation if the operating environment stabilizes over the course of 2026.

The overall tone from the analyst community appears to acknowledge that the stock’s decline from its 52-week high of $458.75 has created a more interesting risk-reward setup for patient investors, even as the near-term path remains somewhat clouded by cost and regulatory uncertainty. The buy consensus, maintained despite the stock’s underperformance, reflects a view that Elevance’s competitive positioning and cash flow generation make it a durable long-term holding in the managed care space.

Earning Report Summary

Revenue and Membership Growth

Elevance Health closed out its most recently reported fiscal year with trailing revenue of approximately $199.1 billion, a figure that underscores the sheer scale of the company’s operations across its commercial, Medicare, and Medicaid membership base. Revenue growth has been driven by a combination of premium rate adjustments, membership dynamics across government-sponsored programs, and the continued scaling of Carelon’s healthcare services segment. Carelon in particular has been a consistent bright spot, with CarelonRx and care coordination services contributing meaningfully to the top line even as the broader insurance business navigated a more challenging cost environment.

Membership trends have been shaped in part by Medicaid redeterminations, which reshuffled enrollment across the industry following the end of continuous coverage requirements. Elevance has managed this transition with a degree of operational steadiness, though the net effect on membership mix has introduced some variability in per-member revenue and cost dynamics that management has been working to absorb.

Profitability and Spending

On the profitability side, trailing EPS of $25.22 and net income of approximately $5.66 billion reflect the pressure that elevated medical costs have placed on the bottom line relative to the revenue base. The profit margin of 2.84% is consistent with the thin-margin reality of the managed care business, where premium revenue must be carefully managed against claims costs that have been running above historical expectations in several product lines. Operating cash flow of $4.29 billion and free cash flow of $3.40 billion remained solid and provided full coverage of the company’s dividend and capital return commitments.

The quarterly dividend of $1.71 per share has been paid consistently, and the company has continued to execute on share repurchases where capital allocation priorities allow. Return on equity of 13.25% reflects a business that continues to generate value for shareholders even in a more difficult operating period.

Comments from Leadership

CEO Gail Boudreaux has continued to emphasize the company’s long-term transformation strategy, with a focus on integrating care delivery more deeply into the insurance model through Carelon and expanding the use of digital tools to improve member engagement and health outcomes. Her messaging has acknowledged the near-term cost environment candidly while reaffirming confidence in the company’s ability to manage through the cycle and emerge with a stronger and more diversified business. The long-term thesis, as articulated by leadership, centers on becoming a more essential partner in the healthcare ecosystem rather than simply a payer, a direction that has meaningful implications for margin improvement and earnings durability over time.

Management Team

Elevance Health is led by CEO Gail Boudreaux, who has guided the company since 2017. Her leadership has been marked by a clear strategy focused on integrating care delivery with insurance services, investing in digital infrastructure, and improving health outcomes. She brings a pragmatic, long-term approach to managing the complexities of a rapidly evolving healthcare landscape, and her consistent communication with investors during a period of sector-wide pressure has reinforced confidence in her steady stewardship of the business.

The broader leadership team brings deep industry experience and operational discipline. Mark Kaye serves as Chief Financial Officer, overseeing capital allocation and financial operations with a focus on sustainable growth. Blair Todt, the Chief Legal Officer, plays a key role in navigating regulatory environments and ensuring compliance. The team’s collective focus on execution has helped Elevance grow steadily while adapting to industry changes, and their track record of maintaining dividend growth through challenging periods speaks to a capital allocation philosophy that prioritizes long-term shareholder returns.

Valuation and Stock Performance

Elevance shares are trading at $327.14 as of February 25, 2026, representing a significant discount to the stock’s 52-week high of $458.75 and placing the price near the lower end of its annual range, which bottomed at $273.71. The current P/E ratio of 12.97 is well below the company’s historical average and compares favorably to most peers in the managed care sector, suggesting that the market has priced in a meaningful amount of near-term pessimism about medical cost trends and earnings trajectory.

The price-to-book ratio of 1.65 against a book value per share of $198.81 further supports the case that the stock is not expensive by historical standards. With a market cap of approximately $72.2 billion and a beta of 0.50, Elevance continues to offer the low-volatility characteristics that income investors tend to value, even as the share price has moved materially lower over the past year.

The mean analyst price target of $387.85 implies roughly 18.6% upside from current levels, and the high-end target of $474.00 would represent a return to territory the stock occupied earlier in its 52-week range. For investors focused on total return, the combination of a 2.04% yield trading above its historical average and a valuation that appears to reflect an overly cautious earnings outlook makes the current setup more interesting than it has been in some time. The stock’s underperformance appears to be driven primarily by sector-wide concerns rather than company-specific deterioration, which is an important distinction for long-term holders.

Risks and Considerations

The most immediate risk facing Elevance is the persistence of elevated medical cost trends, particularly in Medicare Advantage, where utilization has been running above what many insurers modeled when setting premiums. If those trends do not moderate as the year progresses, earnings could continue to face pressure, which would complicate the case for accelerating dividend growth even if the current payout remains secure.

Regulatory risk is a constant feature of the managed care business and deserves serious consideration. Reimbursement rate decisions from CMS on Medicare Advantage, Medicaid contract renewals, and potential changes to the ACA subsidy structure all have the capacity to disrupt revenue and margin assumptions in meaningful ways. Elevance’s significant exposure to government-sponsored programs means that policy shifts in Washington carry direct financial consequences for the company.

Litigation exposure adds another layer of uncertainty. The federal lawsuit against Carelon Behavioral Health, which alleges misrepresentation of the mental health provider network, remains an unresolved overhang. The financial outcome is difficult to predict, but the reputational dimension of the case is relevant at a time when access to behavioral health services is a heightened area of public and regulatory scrutiny.

Finally, the competitive landscape in managed care continues to intensify, with both established players and newer entrants competing aggressively on price and network breadth. Elevance must continue investing in its Carelon platform and digital capabilities to maintain its differentiation, and those investments come with execution risk. If the integration of care delivery and insurance services proves more difficult or more costly than anticipated, the margin improvement thesis that supports the longer-term dividend growth case could take longer to materialize than investors are currently expecting.

Final Thoughts

Elevance Health finds itself at an interesting juncture heading into 2026. The stock has pulled back sharply from its highs, the yield has risen to its most attractive level in years relative to its own history, and the valuation at under 13 times earnings reflects a degree of pessimism that may not be fully warranted given the company’s durable competitive position and strong cash flow generation. The dividend, now at $6.88 annually, is well-covered and backed by a management team that has demonstrated a consistent commitment to growing the payout each year.

The risks are real and should not be minimized. Medical cost pressure, regulatory uncertainty, and litigation exposure all create a more complex near-term picture than Elevance investors have been accustomed to. But for dividend growth investors with a multi-year horizon, the combination of a rising yield, a conservative payout ratio, and a business model that is becoming more integrated and diversified over time presents a case worth taking seriously. Elevance may not deliver immediate fireworks, but for those who value reliability and gradual compounding, the current setup offers more than the share price decline alone might suggest.