Key Takeaways

📈 eBay offers a forward dividend yield of 1.70% with a consistent growth track record, increasing its dividend annually since 2019 and maintaining a low 26% payout ratio.

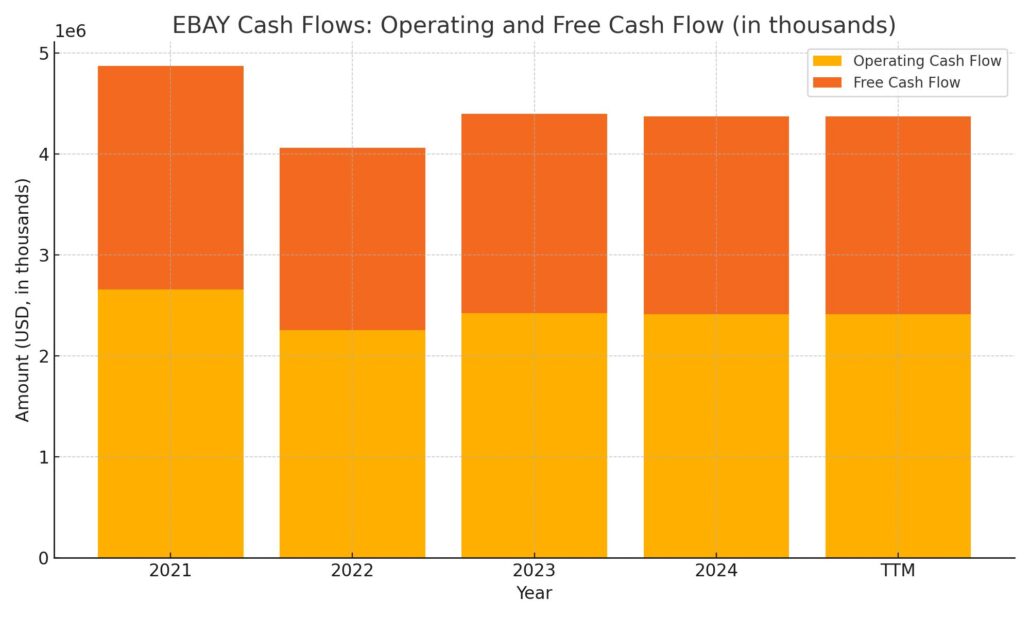

💰 The company generated $2.41 billion in operating cash flow and $1.96 billion in free cash flow over the trailing twelve months, easily covering dividends and buybacks.

🧐 Analyst sentiment is mixed with a consensus price target of $64.83; some firms raised targets based on innovation and cost control, while others lowered expectations due to macro concerns.

📊 Q1 2025 earnings topped forecasts with $2.6 billion in revenue and $1.38 EPS; leadership cited AI enhancements, international growth, and category expansion as key drivers.

Last Update: 5/1/25

eBay has evolved into a disciplined e-commerce business with a strong focus on niche verticals, consistent cash flow, and shareholder returns. With a 34% stock gain over the past year, growing dividends, and strategic stock buybacks, the company has shown it’s capable of delivering solid financial performance while investing in AI-driven tools and platform enhancements. Its operating and free cash flow remain strong, comfortably covering capital returns and reinvestment efforts.

Leadership changes, including the appointment of Peggy Alford as CFO and new roles for key executives, signal a focus on tighter integration and innovation. With steady revenue, healthy margins, and a manageable debt load, eBay continues to position itself as a stable income-oriented investment in the broader tech landscape.

Recent Events

eBay closed out April 2025 at $68.16, not far from its 52-week high of $71.61. That’s a pretty respectable run, up 38% over the past year compared to the broader market’s 10% gain. What’s behind the move? A mix of steady financial performance, conservative spending, and a strong shareholder return story.

Earnings growth has picked up, with EPS rising nearly 15% year over year in the most recent quarter. Margins remain strong too—operating margin is just under 24%, and gross profit is comfortably high. That tells us eBay is still running an efficient operation, even as it fine-tunes its marketplace.

And while the P/E ratio has crept higher (sitting at 17.3 trailing, under 13 forward), the valuation still feels grounded. Especially when you factor in that the company isn’t burning through cash—it’s generating it. Over $2.7 billion in free cash flow over the last twelve months gives them plenty of room to support dividends, buybacks, and balance sheet flexibility.

Key Dividend Metrics

📈 Forward Dividend Yield: 1.70%

💰 Forward Annual Dividend Rate: $1.16

📅 Most Recent Dividend Date: March 28, 2025

🔁 Ex-Dividend Date: March 14, 2025

📊 Payout Ratio: 26.44%

🕰️ 5-Year Average Dividend Yield: 1.64%

🔥 Dividend Growth Rate (TTM): Up nearly 7.5%

🔐 Free Cash Flow Coverage: More than 2x dividend payout

💼 Debt/Equity Ratio: 142% (high, but supported by cash flow)

Dividend Overview

Let’s talk about the dividend itself. eBay isn’t trying to wow anyone with a sky-high yield. At 1.70%, the income might seem modest, but what matters more is the quality behind it. This is a company sitting on nearly $5 billion in cash, generating strong free cash flow, and paying out only a quarter of its earnings as dividends. That’s a smart, measured approach.

It’s easy to gloss over a payout like this when there are flashier yields out there, but a closer look shows that eBay’s dividend is highly sustainable. Free cash flow coverage is strong. The balance sheet, while holding a fair amount of debt, is backed by consistent cash generation. And the payout ratio leaves room for flexibility. In short, the dividend isn’t at risk. In fact, it’s likely got room to grow.

eBay has also been active with buybacks, which reduces share count and supports earnings per share over time. That’s another quiet win for shareholders—especially those reinvesting dividends.

Dividend Growth and Safety

Here’s where things get more interesting for long-term income investors. eBay hasn’t just been consistent—it’s been raising the bar. The dividend has been hiked again this year, now sitting at $1.16 annually, up from $1.08 just last year. That’s nearly a 7.5% increase. Not bad for a company some might still associate with used DVDs and collectibles.

Since initiating its dividend in 2019, eBay has increased the payout every single year. That’s the kind of track record that starts to build real income momentum, especially if you’re holding for the long haul.

What really makes the dividend feel secure is the math behind it. Free cash flow of over $2.7 billion covers the dividend multiple times. The payout ratio at 26% is low by industry standards. And while the debt level is something to monitor—currently at 142% of equity—it’s manageable because of the company’s strong margins and free cash generation.

This isn’t a stretch dividend. It’s not being propped up by short-term cost cutting or financial gymnastics. It’s a byproduct of a mature business that knows its niche and isn’t trying to overextend.

Looking ahead, there’s no reason to think eBay won’t keep delivering moderate, regular dividend increases. The business is stable. The capital return policy is disciplined. And for investors who appreciate predictability and compounding income, that’s a winning combination.

Cash Flow Statement

eBay generated $2.41 billion in operating cash flow over the trailing 12 months, slightly down from the prior year but still reflecting steady operational strength. Free cash flow came in at $1.96 billion, comfortably covering dividend obligations and giving the company flexibility for buybacks and other capital returns. Capital expenditures remained consistent at around $458 million, showing eBay is investing selectively without overextending.

On the financing side, eBay returned a significant amount of capital to shareholders, repurchasing $3.15 billion in stock and paying down $750 million in debt. The company did issue $441 million in new debt but remains net deleveraging. Its cash position has improved to $3.29 billion, up from $2.49 billion a year ago. While investing cash flow is positive due to strategic asset sales or shifts in investments, eBay continues to lean on internally generated cash to fund operations and shareholder returns.

Analyst Ratings

📊 eBay has recently seen a mix of analyst sentiment, with some adjusting their outlooks as the company’s strategy and market dynamics evolve. The general tone among analysts is currently neutral, with most falling into the “Hold” category. This cautious positioning comes as eBay continues to navigate a more selective e-commerce landscape and broader economic uncertainty.

💡 Citigroup reaffirmed a positive view with a “Buy” rating, nudging its price target slightly lower from $80 to $79. They still see strength in demand trends and consistency in gross merchandise volume. On the more reserved side, Stifel Nicolaus trimmed its target from $63 to $61 while keeping a “Hold” stance, citing concerns about macro pressures and global trade risks that might affect performance.

🔍 Bernstein took a step back, downgrading eBay from “Outperform” to “Market Perform” and lowering their price target from $70 to $65. Their concern centers around slowing momentum and the lack of near-term catalysts. Meanwhile, Needham & Company raised their target to $78 from $72 and maintained a “Buy” rating, pointing to eBay’s disciplined execution and potential in key verticals like refurbished tech and luxury items.

📈 UBS also leaned optimistic, increasing their target from $66 to $72, highlighting solid cost control and stable top-line performance. They see eBay as well-positioned to sustain margin strength.

🎯 The average analyst price target for eBay currently sits around $64.83, with projections ranging between $49 on the low end and $79 on the high end. That spread reflects differing views on the company’s long-term strategy execution but suggests there’s still room for upward movement, especially if market conditions stay supportive.

Earning Report Summary

Solid Start to the Year

eBay kicked off 2025 with a quarter that showed steady progress. Revenue for the first quarter came in at $2.6 billion, a slight increase from the same time last year. Gross merchandise volume, or GMV, also nudged higher to $18.8 billion. While the numbers weren’t explosive, they reflect a company that’s holding its ground in a tough environment and continuing to grow in the areas it’s chosen to focus on.

Profit-wise, eBay delivered. GAAP net income landed at $505 million, or $1.06 per share, while the adjusted earnings per share hit $1.38—coming in ahead of what many were expecting. Operating margins remained healthy, sitting at nearly 24% on a GAAP basis and just shy of 30% on a non-GAAP basis. That efficiency is a key piece of eBay’s story right now, and it’s clear they’re managing costs well without sacrificing growth initiatives.

Leadership’s Take and What’s Next

CEO Jamie Iannone sounded confident during the update. He pointed to several things that are helping push eBay forward—most notably, its investment in AI and category-specific enhancements. Features like the new AI-powered listing tools are already making a noticeable impact, improving the seller experience and helping buyers find what they’re looking for faster. He also noted traction in international markets, especially in Japan where the Authenticity Guarantee program has gained momentum.

One of the more interesting moves this quarter was eBay’s acquisition of Caramel, a company focused on streamlining vehicle transactions. It’s a smart fit for eBay Motors and shows the company is still willing to lean into opportunities where it has a competitive edge.

On the capital return front, eBay remained active. They bought back $625 million worth of stock and handed out $134 million in dividends. At the end of the quarter, they were sitting on $6.2 billion in cash and equivalents, giving them plenty of flexibility moving forward.

Looking Ahead

Guidance for the second quarter was pretty balanced. Revenue is expected to fall between $2.59 billion and $2.66 billion, while adjusted earnings are projected in the range of $1.24 to $1.31 per share. The tone from leadership suggests cautious optimism. They’re focused on delivering consistent performance and doubling down on what’s working—like vertical-specific growth, better user tools, and strategic tech investments.

All in all, it was a quarter that showed eBay continuing to evolve while sticking to its strengths. It’s not chasing headlines, but it is building a business that delivers—both to customers and shareholders.

Earning Report Summary

Solid Start to the Year

eBay kicked off 2025 with a quarter that showed steady progress. Revenue for the first quarter came in at $2.6 billion, a slight increase from the same time last year. Gross merchandise volume, or GMV, also nudged higher to $18.8 billion. While the numbers weren’t explosive, they reflect a company that’s holding its ground in a tough environment and continuing to grow in the areas it’s chosen to focus on.

Profit-wise, eBay delivered. GAAP net income landed at $505 million, or $1.06 per share, while the adjusted earnings per share hit $1.38—coming in ahead of what many were expecting. Operating margins remained healthy, sitting at nearly 24% on a GAAP basis and just shy of 30% on a non-GAAP basis. That efficiency is a key piece of eBay’s story right now, and it’s clear they’re managing costs well without sacrificing growth initiatives.

Leadership’s Take and What’s Next

CEO Jamie Iannone sounded confident during the update. He pointed to several things that are helping push eBay forward—most notably, its investment in AI and category-specific enhancements. Features like the new AI-powered listing tools are already making a noticeable impact, improving the seller experience and helping buyers find what they’re looking for faster. He also noted traction in international markets, especially in Japan where the Authenticity Guarantee program has gained momentum.

One of the more interesting moves this quarter was eBay’s acquisition of Caramel, a company focused on streamlining vehicle transactions. It’s a smart fit for eBay Motors and shows the company is still willing to lean into opportunities where it has a competitive edge.

On the capital return front, eBay remained active. They bought back $625 million worth of stock and handed out $134 million in dividends. At the end of the quarter, they were sitting on $6.2 billion in cash and equivalents, giving them plenty of flexibility moving forward.

Looking Ahead

Guidance for the second quarter was pretty balanced. Revenue is expected to fall between $2.59 billion and $2.66 billion, while adjusted earnings are projected in the range of $1.24 to $1.31 per share. The tone from leadership suggests cautious optimism. They’re focused on delivering consistent performance and doubling down on what’s working—like vertical-specific growth, better user tools, and strategic tech investments.

All in all, it was a quarter that showed eBay continuing to evolve while sticking to its strengths. It’s not chasing headlines, but it is building a business that delivers—both to customers and shareholders.

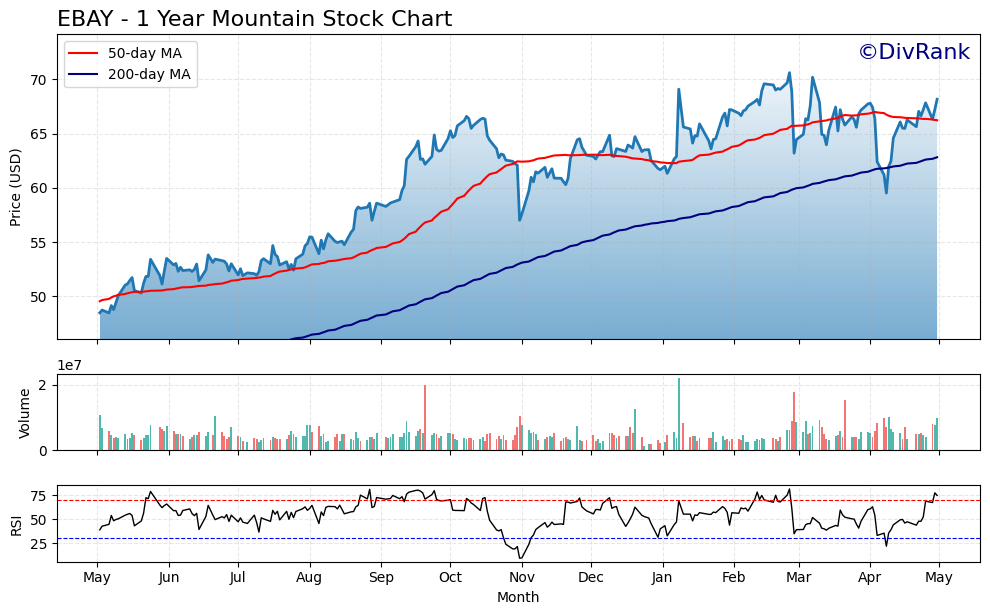

Chart Analysis

Price Action and Moving Averages

The chart for EBAY over the past year shows a clear and consistent uptrend, especially from June through early February. The stock has spent most of the year trading above both its 50-day (red line) and 200-day (blue line) moving averages, which typically reflects strength and underlying momentum. The 50-day average has remained well above the 200-day for most of the period, reinforcing that this isn’t just a short-lived bounce but part of a broader upward move.

There was a noticeable pullback in early March, where price briefly dipped below the 50-day average, but it rebounded quickly and continued to push higher. The most recent activity shows the stock regaining strength and pressing toward its previous highs. The 200-day average continues to slope upward, a sign that longer-term trends remain supportive.

Volume Trends

Volume has remained fairly stable, with a few spikes in trading activity, particularly in October and again recently. These bursts in volume tend to align with notable price moves, possibly around earnings or other material news. Despite occasional surges, there’s no sign of sustained selling pressure or panic activity, which adds confidence to the stability in the trend.

RSI and Momentum

The Relative Strength Index (RSI) has spent much of the year above the 50 level, and on several occasions pushed into overbought territory near 70. That doesn’t necessarily mean the stock is overvalued, but it does point to strong buying interest. Recently, the RSI has once again approached the overbought range, suggesting momentum is building as the stock nears resistance levels from previous highs.

There was a brief dip in RSI to oversold territory during the March pullback, but that turned out to be short-lived, and the indicator has recovered quickly since. This kind of behavior typically points to buyers stepping in on weakness, keeping the trend intact.

Overall Structure

The combination of rising moving averages, resilient RSI behavior, and steady volume all point to a stock with solid technical footing. There’s been some volatility, but it’s been orderly—pullbacks have been met with support, and price has responded well. As of the most recent candles, the chart shows renewed strength, suggesting that market participants are still willing to step in at higher levels. The steady uptrend, supported by long-term averages, is a sign of confidence in the name.

Management Team

eBay is making notable changes to its leadership structure, signaling a strategic push toward greater innovation and agility. Steve Priest, the company’s current Chief Financial Officer, will be stepping down, with Peggy Alford taking over the role starting May 12. Alford brings extensive experience, including her time at PayPal, and is expected to strengthen eBay’s financial operations through a more tech-driven lens.

To complement the leadership transition, eBay is also reorganizing its executive team to encourage tighter collaboration across departments. Jordan Sweetnam will now oversee both the Global Markets and Product divisions in his new position as Chief Commercial Officer. On the technology side, Mazen Rawashdeh will lead a unified engineering team as Chief Technology Officer. These shifts are designed to streamline decision-making and enhance innovation, positioning the company to better respond to customer needs and industry shifts.

Valuation and Stock Performance

eBay’s stock performance over the past year has been solid, with a return of nearly 35 percent. At a current share price of $68.16, the company is trading at a price-to-earnings ratio of 16.95. That valuation looks fairly balanced given the company’s earnings growth and capital return strategy. Analyst estimates reflect a range of expectations, with a consensus price target of $64.83. The lowest estimate stands at $49, while the highest reaches $79.

Recent earnings helped support the stock’s momentum. In Q1 2025, eBay reported revenue of $2.6 billion and an adjusted earnings per share of $1.38, beating expectations. Gross merchandise volume edged up 1 percent to $18.8 billion. These results are a reflection of focused execution, particularly in verticals like refurbished electronics and collectibles, and continued investment in AI and platform improvements.

Risks and Considerations

Despite its strengths, eBay faces several risks that investors should factor into their decision-making. Economic slowdowns can impact discretionary spending, which in turn can affect both GMV and revenue. The company has shown in past downturns that it can be sensitive to broader macro trends, and while it has improved efficiency, it’s still vulnerable to shifts in consumer sentiment.

Competition is another key factor. Giants like Amazon and specialized platforms continue to compete for market share, putting pressure on pricing and user retention. eBay’s strategy has been to differentiate through niche categories and personalized experiences, but maintaining that edge requires ongoing innovation and marketing investment.

The transition in the executive suite also adds a layer of uncertainty. While the changes appear well-planned and are aligned with eBay’s broader goals, any leadership turnover can bring about shifts in priorities or short-term disruption as teams adjust to new roles and directions.

Final Thoughts

eBay continues to transform itself with a clear focus on technology, category depth, and a disciplined capital return strategy. The company is not chasing scale for the sake of growth but instead is carving out a space where it can serve both buyers and sellers more effectively. With strong cash flow, regular dividend payouts, and ongoing stock buybacks, eBay is aligning itself closely with shareholder interests.

At the same time, investors should remain aware of the variables that could challenge the current trajectory. From economic headwinds to competitive threats, eBay needs to stay sharp in execution. If management delivers on its strategic plans and continues to leverage its core strengths, the company appears well-positioned to deliver value over time—particularly for those focused on long-term, income-oriented investing.